Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the Accounting information system Question 2 Seattle Paper Products (SPP) is modifying its sales department payroll system to change the way it calculates

this is the Accounting information system

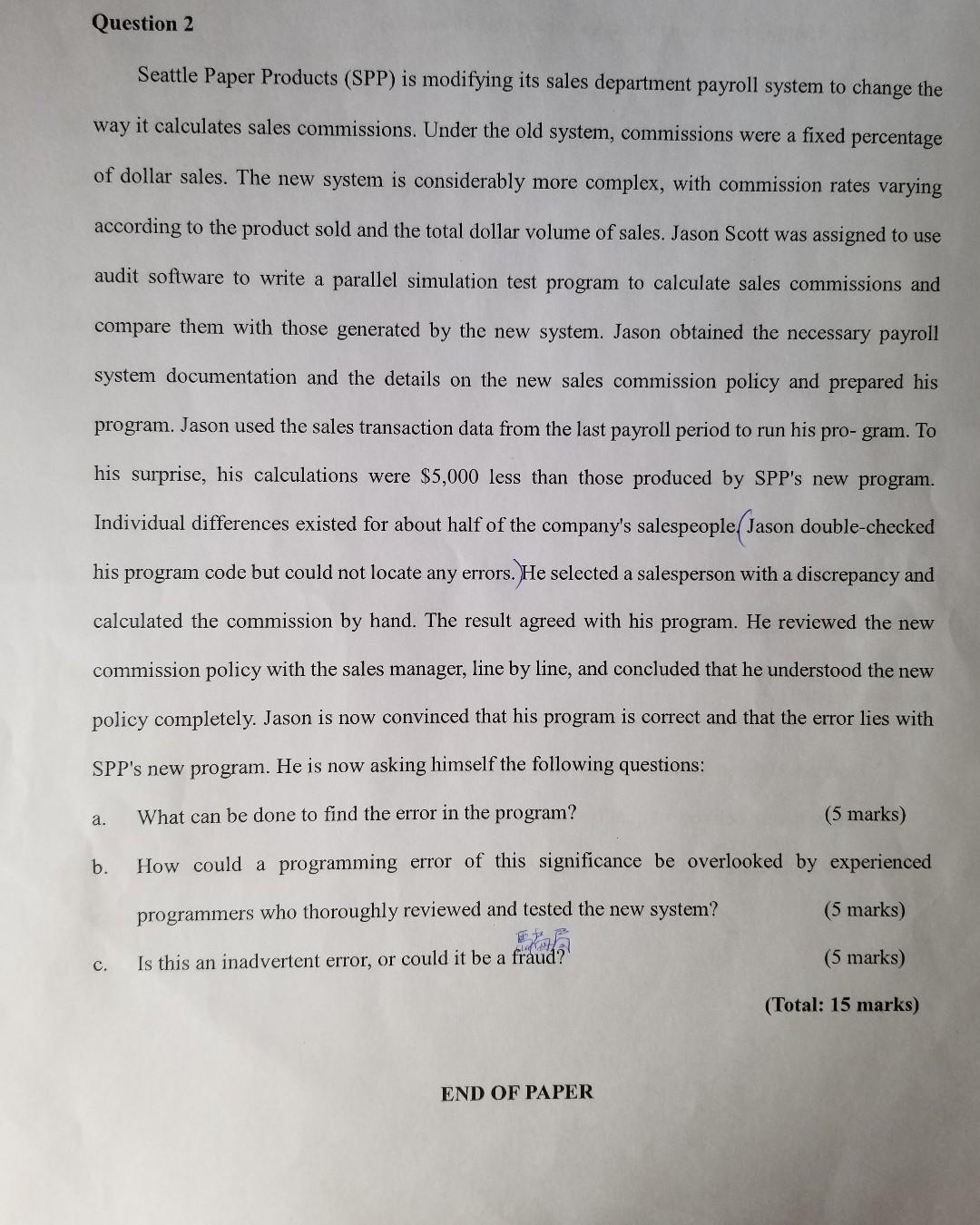

Question 2 Seattle Paper Products (SPP) is modifying its sales department payroll system to change the way it calculates sales commissions. Under the old system, commissions were a fixed percentage of dollar sales. The new system is considerably more complex, with commission rates varying according to the product sold and the total dollar volume of sales. Jason Scott was assigned to use audit software to write a parallel simulation test program to calculate sales commissions and compare them with those generated by the new system. Jason obtained the necessary payroll system documentation and the details on the new sales commission policy and prepared his program. Jason used the sales transaction data from the last payroll period to run his pro- gram. To his surprise, his calculations were $5,000 less than those produced by SPP's new program. Individual differences existed for about half of the company's salespeople Jason double-checked his program code but could not locate any errors. He selected a salesperson with a discrepancy and calculated the commission by hand. The result agreed with his program. He reviewed the new commission policy with the sales manager, line by line, and concluded that he understood the new policy completely. Jason is now convinced that his program is correct and that the error lies with SPP's new program. He is now asking himself the following questions: a. What can be done to find the error in the program? (5 marks) b. How could a programming error of this significance be overlooked by experienced (5 marks) programmers who thoroughly reviewed and tested the new system? Is this an inadvertent error, or could it be a fraud? c. (5 marks) (Total: 15 marks) END OF PAPERStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started