This is the accouting cybertext assignment. I can not get pass the last few items on the general format.. the first three photos are the transactions and the last photo is the general journal format.

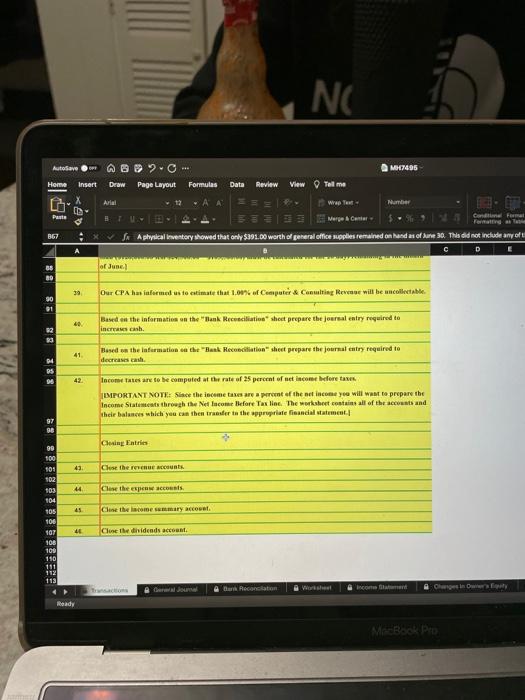

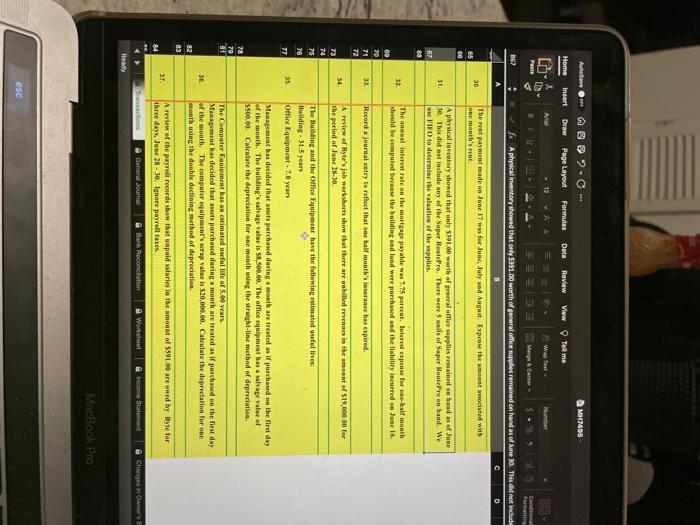

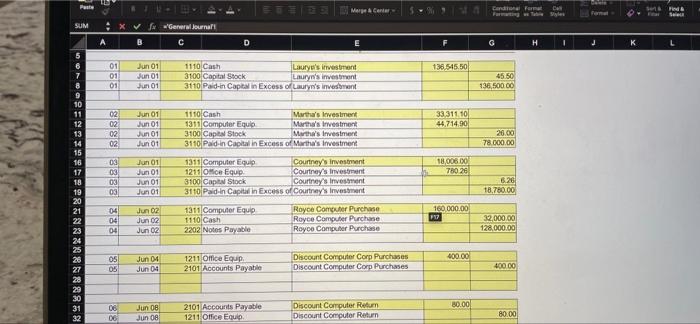

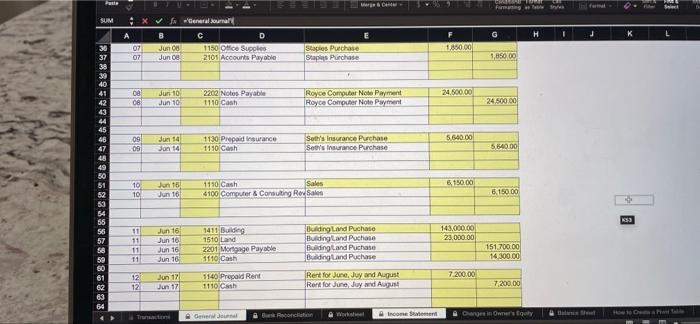

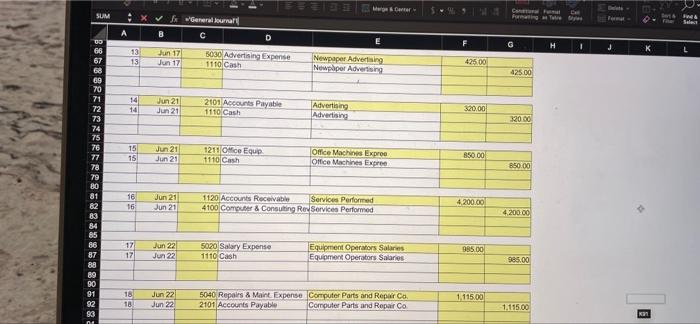

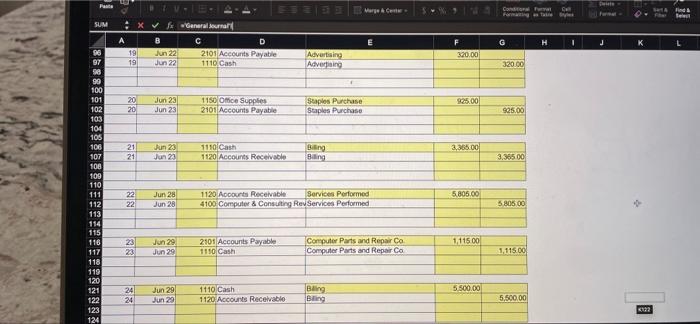

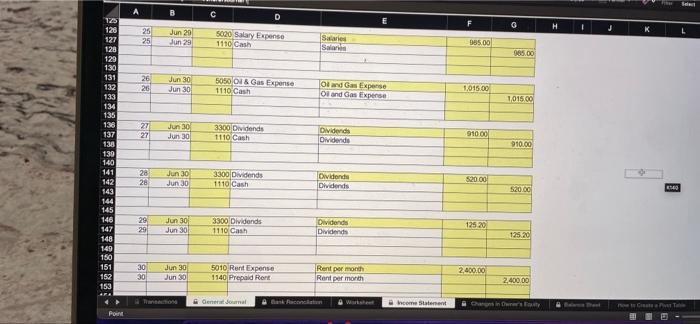

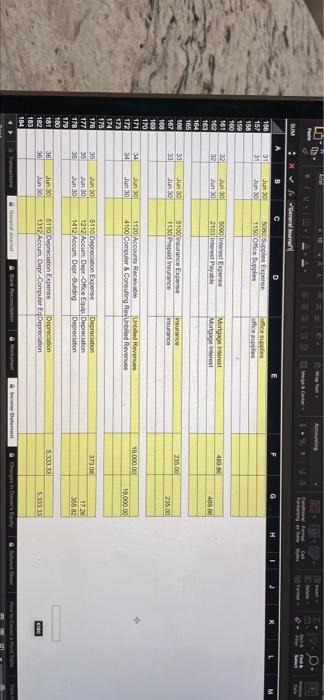

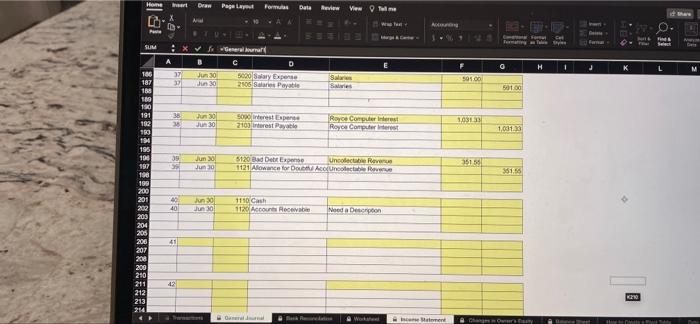

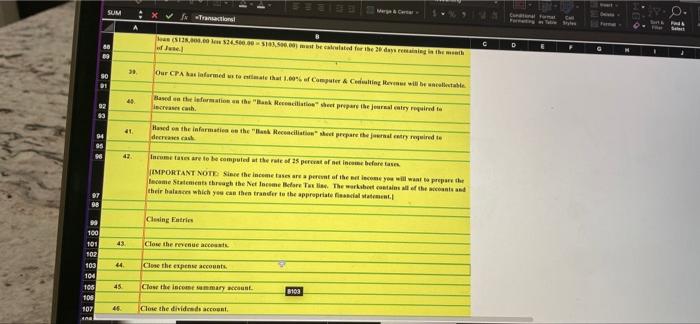

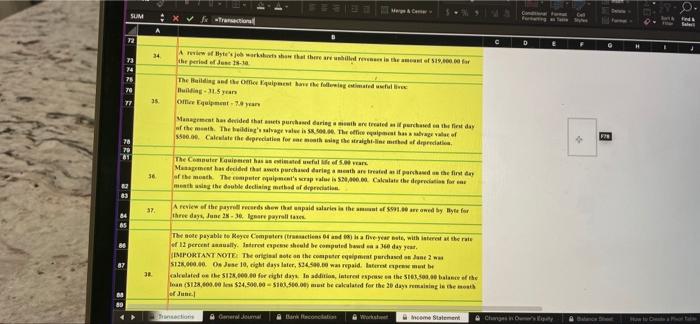

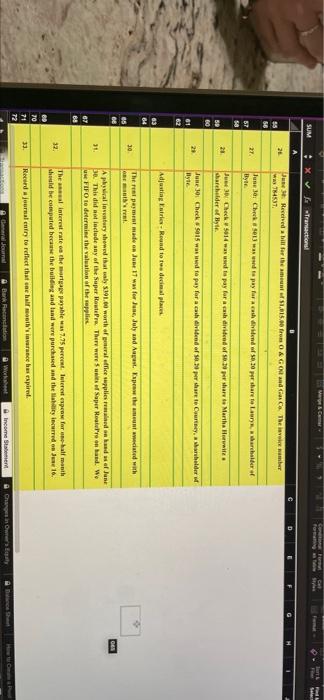

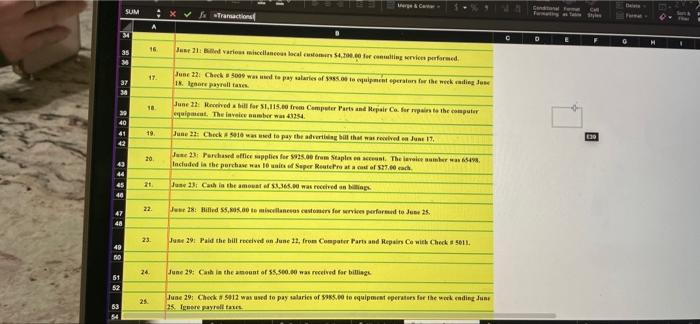

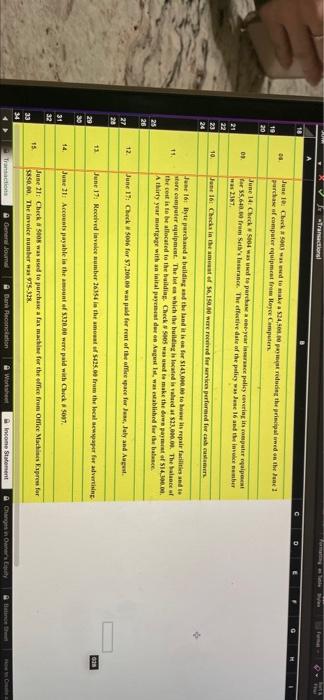

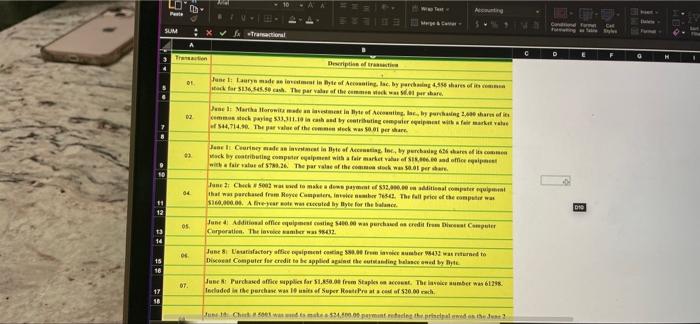

NO AutoSave 2.C... MH7495 Home Insert Draw Page Layout Formulas Data Review View Tell me X Arial A A Number BT Merge & Centr Con Formal x Aphysical Inventory showed that only $391.00 worth of general office supplies remained on hand as of June 30. This did not include any of t A C D E of June.) Our CPA has informed us to estimate that 1.09% of Computer & Consulting Revenue will be uncollectable 40 Based on the information on the "Bank Reconciliation sheet prepare the journal entry required to increases cash. Based on the information on the "Bank Reconciliation sheet prepare the journal entry required to 41. decreases cash. 42 Income Taxes are to be computed at the rate of 25 percent of net income before taxes IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement. * Closing Entries Close the revenue accounts. Close the expense accounts. Close the income summary account. Close the dividends account. Income Statement Q. Pat 867 68 85 882 97 99 100 101 102 103 104 105 106 107 106 109 110 111 112 113 I 44 45 44 Ready General Journal Bank Reconciation Changes in Owner's Equity MacBook Pro 67 68 MH7495 AutoSave A 2-0 Home Insert Draw X Page Layout Formulas Data Review View Tell me Arial Number B Was Text Merge & Center - Past Conditional Formatting A physical inventory showed that only $391.00 worth of general office supplies remained on hand as of June 30. This did not include D 30 The rent payment made on June 17 was for June, July and August. Expense the amount asociated with one month's rent. 31. A physical inventory showed that only $391.00 worth of general office supplies remained on hand as of June 30. This did not include any of the Super RoutePro. There were 5 units of Super RoutePre on hand. We use FIFO to determine the valuation of the supplies. 32. The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16, 33. Record a journal entry to reflect that one half month's insurance has expired. 34 A review of Byte's job worksheets show that there are unbilled revenues in the amount of $19,000.00 for the period of June 28-30. The Building and the Office Equipment have the following estimated useful lives: Building-31.5 years Office Equipment-7.0 years Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's salvage value is $8,508.00. The office equipment has a salvage value of $500.00. Calculate the depreciation for one month using the straight-line method of depreciation. The Computer Equipment has an estimated useful life of 5.00 years. 36. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The computer equipment's scrap value is $20,000.00. Calculate the depreciation for one month using the double declining method of depreciation. 37. A review of the payroll records show that unpaid salaries in the amount of $591.00 are owed by Byte for three days, June 28-30. Ignore payroll taxes. Transactions General Journal Bank Reconciation Worksheet Income Statement SREE 067 71 78 79 72 73 74 75 76 77 81 82 3 3: Ready AG 35. esc Changes in Owner's E MacBook Pro Pat SUM 5 6 7 8 9 10 11 12 13 14 15 16 17 12PRINAX 18 19 20 22 23 24 25 26 27 28 29 30 31 32 TE A 02 555 8888 8888 333 88 88 03 04 05 RTL- Xx B Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 02 Jun 02 Jun 02 Jun 04 Jun 04 Jun 08 Jun 08 General Journal C Merge & Centr 1110 Cash Laury's investment Lauryn's investment 3100 Capital Stock 3110 Paid-in Capital in Excess of Lauryn's investment 1110 Cash Martha's Investment 1311 Computer Equip Martha's Investment 3100 Capital Stock Martha's Investment 3110 Paid-in Capital in Excess of Martha's Investment 1311 Computer Equip Courtney's Investment 1211 Office Equip Courtney's Investment 3100 Capital Stock Courtney's Investment 3110 Paid-in Capital in Excess of Courtney's Investment 1311 Computer Equip 1110 Cash Royce Computer Purchase Royce Computer Purchase Royce Computer Purchase 2202 Notes Payable 1211 Office Equip 2101 Accounts Payable Discount Computer Corp Purchases Discount Computer Corp Purchases 2101 Accounts Payable 1211 Office Equip. Discount Computer Retur Discount Computer Return 136.545.50 33.311.10 44,714.90 18,006 00 760 26 160.000.00 400.00 80.00 F17 Cantonal Format 45.50 136,500.00 26.00 78.000.00 6.26 18,780.00 32,000.00 128,000.00 400.00 80.00 Call deeln K $616 Find & S SUM 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 283288 60 61 62 63 64 Y A X f B Jun 08 Jun ce 07 08 Jun 10 08 Jun 10 09 Jun 14 09 Jun 14 10 Jun 15 10 Jun 16 Jun 16 Jun 16 Jun 16 Jun 16 Jun 17 Jun 17 07 BEEF 127 12 Transactions M&Y General Journal C D 1150 Office Supplies 2101 Accounts Payable Staples Purchase Staples Purchase 2202 Notes Payable 1110 Cash Royce Computer Note Payment Royce Computer Note Payment 1130 Prepaid Insurance Seth's Insurance Purchase Seth's Insurance Purchase 1110 Cash 1110 Cash Sales 4100 Computer & Consulting ReSales 1411 Building 1510 Land Building Land Puchase BuildingLand Puchase Building and Puchase Building and Puchase 2201 Mortgage Payable 1110 Cash 1140 Prepaid Rent 1110 Cash Rent for June, Juy and August Rent for June, Juy and August General Journal Bank Reconciliation Income Statement CRAMART For M forming G 1,850 00 24.500.00 5,640.00 6,150.00 151.700.00 14.300.00 7,200.00 Changes in Owner's Equity F 1,850.00 24,500.00 5.640.00 6,150.00 143,000.00 23.000 00 7,200.00 Informat St Select L K KS3 How to Ows Phot Tale SUM B86882EFEE 00 66 67 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 28828885 89 90 91 92 93 A 13 13 x x General Journal B C D Jun 17 Jun 17 5030 Advertising Expense 1110 Cash Newpaper Advertising Newpaper Advertising Jun 21 2101 Accounts Payable Advertising Advertising Jun 21 1110 Cash Office Machines Expres Jun 21 Jun 21 1211 Office Equip 1110 Cash Office Machines Expree 1120 Accounts Receivable Services Performed Jun 21 Jun 21 4100 Computer & Consulting RevServices Performed 17 Jun 22 17 Jun 22 5020 Salary Expense 1110 Cash Jun 22 Jun 22 5040 Repairs & Maint. Expense 2101 Accounts Payable 14 14 15 15 29 EE 98 16 16 18 Mage & Car 18 Equipment Operators Salaries Equipment Operators Salaries Computer Parts and Repair Co Computer Parts and Repair Co 425.00 320.00 850.00 4.200.00 985.00 1.115.00 Cal C Forming T G H 425.00 320.00 850.00 4,200.00 985.00 1.115.00 Delets Form J B F 4 Fre Select L Past SUM 96 97 98 99 100 101 102 103 104 105 106 107 106 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 10 A 19 19 20 20 21 21 NN 28 ** x fx B Jun 22 Jun 22 Jun 23 Jun 23 Jun 23 Jun 23 Jun 28 Jun 28 Jun 29 Jun 29 Jun 29 Jun 29 22 Marge & Centr General Journal C D 2101 Accounts Payable 1110 Cash Advertising Advertising 1150 Office Supples 2101 Accounts Payable Staples Purchase Staples Purchase 1110 Cash Billing Billing 1120 Accounts Receivable 1120 Accounts Receivable Services Performed 4100 Computer & Consulting RevServices Performed 2101 Accounts Payable 1110 Cash 1110 Cash 1120 Accounts Receivable Computer Parts and Repair Co Computer Parts and Repair Co Baing Baling 320.00 925.00 3,365.00 5,805.00 1.115.00 5.500.00 Con Formating Ta G 320.00 925.00 3.365.00 5.805.00 1,115.00 5.500.00 C Dist SHA Find & 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 AFA Point 22 55 28 28 25 26 26 27 27 29 29 30 30 B Jun 29 Jun 29 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 C D 5020 Salary Expense 1110 Cash 5050 O & Gas Expense 1110 Cash 3300 Dividends 1110 Cash 3300 Dividends 1110 Cash 3300 Dividends 1110 Cash 5010 Rent Expense 1140 Prepaid Rent General Journal Salaries Salans Ol and Gas Expense Oil and Gas Expense Dividends Dividends Dividends Dividends Dividends Dividends Rent per month Rent per month Income Statement F 965.00 1,015.00 910.00 520.00 125.20 2.400.00 G 965.00 1,015.00 910.00 520.00 125.20 2.400.00 Changes in Owner's H K Create 440 S 31 SUM 156 157 158 159 160 161 162 163 164 165 166 167 168 160 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 A 31 31 32 32 33 33 34 34 35 35 35 22 36 36 .. x B Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Transactions 10 - AA FURIDE Wapen General Journa C D 5080 Supplies Expense 1150 Office Supplies office supplies office supplies 5090 Interest Expense 2103 Interest Payable Mortgage Interest Mortgage Interest 5100 insurance Expense insurance insurance 1130 Prepaid insurance 1120 Accounts Receivable Unbiled Revenues 4100 Computer & Consulting ReUnbiled Revenues 5110 Depreciation Expense Depreciation 1212 Accum Depr-Office Equip 1412 Accum Depr Building Depreciation Depreciation 5110 Depreciation Expense Depreciation 1312 Accum Depr-Computer EqDepreciation Works Accounting come Statement 40980 235.00 19,000.00 373.00 5.333.33 A Ce Ca G H 489 235.00 19,000.00 17.26 355 82 5.333.33 Changes in Or D J - O. THE S L C M Home P SUM 106 187 188 100 190 191 192 193 194 1965 196 197 196 199 200 201 202 203 204 205 206 207 208 200 210 211 212 213 214 A 37 37 38 38 Dran Page Lay General C D 5020 Salary Expense 2105 Salaries Payable 5000 interest Expense 2103 Interest Payable 5120 Bad Debit Expense 1121 Alowance for Doue 1110 Cash 1120 Accounts Receivable 39 B Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 39 Jun 30 40 Jun 30 40 Jun 301 41 A X Formulas Geral Ja Data Review View T Wa &1 Salas Salvies Royce Computer Interest Royce Computer Interest Uncolectable Revenue AccUncolectable Revenue Need a Descripton Work Ang Statement 501.00 1,031 33 351.55 Fo Fermating an a H 0 501.00 1,031.33 351.55 Change O CH 1 D J Theat K MILL Fie Select L 20 Fler Tite M 881 88 28 01 92 95 99 100 101 102 103 104 105 106 107 Ana 96 97 98 SUM 43. 44. 45 46 Merge & Certal : x Transactions! Joan (S128,000.00 low 524,500.00-5181,500.00 must be calculated for the 20 days remaining in the mouth of June 39. Our CPA has lafarmed us to estimate that 1.00% of Computer & Coding Revens will be able 40 Based on the information on the "Bank Reconciliation sheet prepare the journal entry required to increases cash. 41. Based on the information on the "Bank Reconciliation sheet prepare the journal entry required to decreases cask 42. Income taxes are to be computed at the rate of 25 percent of net income before tases. IMPORTANT NOTE: Since the income tases are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement. Closing Entries Close the revenue accesst Close the expense accounts. Close the income summary account. 8103 Close the dividends account. Cantonalm D E CHI 1! ail SUM 72 RZERE 78 79 81 28 32 Merge & Car xix Traction A 34 A review of Byte's job workshorts show that there are unbilled revesses in the amount of $19,000.00 the period of Juse 18-10 The Building and the Office Equipment have the following estimated fl Building-31.5 years 35 Office Equipment-7 year Management has decided that amets purchased during a month are treated as if purchased on the first day of the month. The building's salvage value is 58,500.00. The office equipment has a salvage val of $500.00. Calculate the depreciation for one month using the straight-line method of depreciation The Computer Equipment has an estimated useful life of 5.00 Years 36. Management has decided that assets purchased during a month are treated as if parchased on the first day of the month. The computer equipment's scrap value is $20,000.00 Calculate the depreciation for one month using the double declising method of depreciation 37. A review of the payroll records show that unpaid salaries is the amount of $991.00 are owed by Byte for three days, June 28-30. Ignare payroll taxes The note payable to Reyce Computers (transactions 04 and 98) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed bawd on a 360 day year. IMPORTANT NOTE: The original note on the computer equipment purchased on Jane 2 was $128,000.00. Os Jese 10, cight days later, $24.500.00 was repaid. Interest expensement be 38. calculated on the $128,000.00 for eight days. In addition, interest expense on the 5103,500,00 balance of the loan (3128,600.00 less $24,500.00-5103,500.00) must be calculated for the 20 days remaining in the moth of June. Income Statement Changes General Journal C Ce 28 4 & Babence d find Sal 59 53 33 38 BREN SUM 89 70 71 72 X Transactions June 3. Received a bill for the amount of $1,015.00 from O&GO and Gas Co. The invoice number 26 was 784537 27. June 30: Check #5013 was used to pay for a cash dividend of 50,20 per share to Laurys, a shareholder of 28 June 30 Check 5014 was used to pay for a cash dividend of 50.20 per share to Martha Horwit shareholder of Byte. 29 June 30: Check 5015 was used to pay for a cash dividend of 50.29 per share to Courtney, a sharsholder of Byte Adjusting Entries Round to tus decimal places 30. The rent payment made on June 17 was for June, July and Aagast. Expense the amount asociated with one month's rent. 31. A physical inventory showed that only $391.00 worth of general office supplies remained on hand as of Jane 30. This did not include any of the Super Routefra. There were 5 units of Super Rosteroon band. We use FIFO to determine the valuation of the supplies 32. The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 33. Record a journal entry to reflect that one half month's inverance has expired. General Journal Bank Reconciation Income Statement Contine For Changes in Owner's Ey Ca F Fama G J I For Salac 34 37 R SUM 3585 40 41 45 47 48 49 50 51 52 53 x Transactions C 16 June 21: Billed various miscellaneous local customers $4,200.00 for consulting services performed 17. June 22: Check 5009 was used to pay salaries of 1985.08 to equipment operators for the week ending Jose 18. Ignore payroll taxes. 18. June 21: Received a bill for $1,115.00 from Computer Parts and Repair Co. for repairs to the computer equipment. The invece number was 43254. June 21: Check # 5910 was used to pay the advertising bill that was received on June 17, June 23: Parchased office supplies for $925.00 from Staples en account. The invoice number was 65498 20 Included in the purchase was 10 units of Super RoutePro at a cost of $27.00 each 21. June 23: Cash in the amount of $3,365.00 was received on billings 22. June 28: Billed 55,805.00 to miscellaneous customers for services performed to June 25. 23. June 29: Paid the bill received on June 12, from Computer Parts and Repairs Co with Check # 5011. 24. June 29: Cash in the amount of $5,500.00 was received for billings 25. June 29: Check # 5812 was used to pay salaries of 5985.00 to equipment operators for the week ending June 25 Ignere payroll taxes Cantonal Form D CHI De 28 2 29 30 31 32 33 34 JAUME 21 22 23 24 2 28 X Transactions C 26. June 18: Check #5003 was used to make a $24,500.00 paytroducing the principal owed on the June purchase of computer equipment from Royce Computers 09. June 14: Check # 5004 was used to purchase a one-year insurance policy covering its computer equipment for 55,640.00 from Seth's fasurance. The effective date of the policy was Jene 16 and the invoice member was 2387, 10. June 16: Checks in the amount of 56,150.00 were received for services performed for cash customers 11. June 16: Byte purchased a building and the land it is on for $143,000.00 to house its repair facilities and to store computer equipment. The let en which the building is located is valued at $23,000.00. The balance of the cost is to be allocated to the building. Check # 5005 was used to make the down payment of 514,300.00. A thirty year mortgage with an inital payement der on August 1st, was established for the balance. 12. June 17: Check & 5006 for $7,200.00 was paid for rent of the office space for June, July and Augest 13 June 17: Received invoice number 26354 in the amount of $425.00 from the local newspaper for advertising 14. June 21: Accounts payable in the amount of $320.00 were paid with Check # 5007. 15 June 21: Check 8 5008 was used to purchase a fax machine for the office from Office Machines Express for $$50.00. The invoice number was 975-328. Transactions General Journal Bank Reconciation Worksheet Income Statement D E Changes in Owner's Ey F G Batince then Fur I 028 How Ca 13 14 15 16 17 18 LO AA SUM WT Accounting 7 U Marge & Car fx Transactional C Transaction Description of transaction 01 June 1: Lauryn made an investment in Byte of Accounting, lac, by parchasing 4,556 shares of its commen tack for $136.545.50 cash. The par valar of the common stock was $8.01 per share 02 June 1: Martha Horowitz made an investment in Byte of Accounting, ls, by purchasing 1,000 shares of t common stock paying 533,311.10 in cash and by contributing compuier equipment with a fair market val of 544,714.90. The par value of the common stock was $0.01 per share. 03 Jane I: Courtney made an investment in Byte of Accounting, Inc, by purchasing 626 shares of its commen Mock by contributing computer equipment with a fair market value of $18,406.00 and office equipment with a fair value of $788.26. The par valse of the common stock was 50.01 per share 04 June 2: Check #5002 was used to make a down payment of $32,000.00 in additional computer equipment that was parchased from Royce Computers, invoice number 765-42. The fall price of the computer was $160,000.00. A five-year note was executed by Byte for the balance. 05 June 4 Additional office equipment costing $400.00 was purchased on credit from Discount Computer Corporation. The invoice samber was 98432. 04 June 8: Lasatisfactory office opsipment costing 580.00 from invoice number 98432 was returned to Discoeat Computer for credit to be applied againd the outstanding balance owed by Byte 07. June 8: Purchased office supplies for $1.850.00 from Staples on account. The invoice sumber was 61298. Included in the purchase was 10 units of Super RoutePro at a cost of $20.00 each tune Chick 5003 was make 524.500.00 perminteleg the principalmed on the June 2 Con D E CA F NO AutoSave 2.C... MH7495 Home Insert Draw Page Layout Formulas Data Review View Tell me X Arial A A Number BT Merge & Centr Con Formal x Aphysical Inventory showed that only $391.00 worth of general office supplies remained on hand as of June 30. This did not include any of t A C D E of June.) Our CPA has informed us to estimate that 1.09% of Computer & Consulting Revenue will be uncollectable 40 Based on the information on the "Bank Reconciliation sheet prepare the journal entry required to increases cash. Based on the information on the "Bank Reconciliation sheet prepare the journal entry required to 41. decreases cash. 42 Income Taxes are to be computed at the rate of 25 percent of net income before taxes IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement. * Closing Entries Close the revenue accounts. Close the expense accounts. Close the income summary account. Close the dividends account. Income Statement Q. Pat 867 68 85 882 97 99 100 101 102 103 104 105 106 107 106 109 110 111 112 113 I 44 45 44 Ready General Journal Bank Reconciation Changes in Owner's Equity MacBook Pro 67 68 MH7495 AutoSave A 2-0 Home Insert Draw X Page Layout Formulas Data Review View Tell me Arial Number B Was Text Merge & Center - Past Conditional Formatting A physical inventory showed that only $391.00 worth of general office supplies remained on hand as of June 30. This did not include D 30 The rent payment made on June 17 was for June, July and August. Expense the amount asociated with one month's rent. 31. A physical inventory showed that only $391.00 worth of general office supplies remained on hand as of June 30. This did not include any of the Super RoutePro. There were 5 units of Super RoutePre on hand. We use FIFO to determine the valuation of the supplies. 32. The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16, 33. Record a journal entry to reflect that one half month's insurance has expired. 34 A review of Byte's job worksheets show that there are unbilled revenues in the amount of $19,000.00 for the period of June 28-30. The Building and the Office Equipment have the following estimated useful lives: Building-31.5 years Office Equipment-7.0 years Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's salvage value is $8,508.00. The office equipment has a salvage value of $500.00. Calculate the depreciation for one month using the straight-line method of depreciation. The Computer Equipment has an estimated useful life of 5.00 years. 36. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The computer equipment's scrap value is $20,000.00. Calculate the depreciation for one month using the double declining method of depreciation. 37. A review of the payroll records show that unpaid salaries in the amount of $591.00 are owed by Byte for three days, June 28-30. Ignore payroll taxes. Transactions General Journal Bank Reconciation Worksheet Income Statement SREE 067 71 78 79 72 73 74 75 76 77 81 82 3 3: Ready AG 35. esc Changes in Owner's E MacBook Pro Pat SUM 5 6 7 8 9 10 11 12 13 14 15 16 17 12PRINAX 18 19 20 22 23 24 25 26 27 28 29 30 31 32 TE A 02 555 8888 8888 333 88 88 03 04 05 RTL- Xx B Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 02 Jun 02 Jun 02 Jun 04 Jun 04 Jun 08 Jun 08 General Journal C Merge & Centr 1110 Cash Laury's investment Lauryn's investment 3100 Capital Stock 3110 Paid-in Capital in Excess of Lauryn's investment 1110 Cash Martha's Investment 1311 Computer Equip Martha's Investment 3100 Capital Stock Martha's Investment 3110 Paid-in Capital in Excess of Martha's Investment 1311 Computer Equip Courtney's Investment 1211 Office Equip Courtney's Investment 3100 Capital Stock Courtney's Investment 3110 Paid-in Capital in Excess of Courtney's Investment 1311 Computer Equip 1110 Cash Royce Computer Purchase Royce Computer Purchase Royce Computer Purchase 2202 Notes Payable 1211 Office Equip 2101 Accounts Payable Discount Computer Corp Purchases Discount Computer Corp Purchases 2101 Accounts Payable 1211 Office Equip. Discount Computer Retur Discount Computer Return 136.545.50 33.311.10 44,714.90 18,006 00 760 26 160.000.00 400.00 80.00 F17 Cantonal Format 45.50 136,500.00 26.00 78.000.00 6.26 18,780.00 32,000.00 128,000.00 400.00 80.00 Call deeln K $616 Find & S SUM 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 283288 60 61 62 63 64 Y A X f B Jun 08 Jun ce 07 08 Jun 10 08 Jun 10 09 Jun 14 09 Jun 14 10 Jun 15 10 Jun 16 Jun 16 Jun 16 Jun 16 Jun 16 Jun 17 Jun 17 07 BEEF 127 12 Transactions M&Y General Journal C D 1150 Office Supplies 2101 Accounts Payable Staples Purchase Staples Purchase 2202 Notes Payable 1110 Cash Royce Computer Note Payment Royce Computer Note Payment 1130 Prepaid Insurance Seth's Insurance Purchase Seth's Insurance Purchase 1110 Cash 1110 Cash Sales 4100 Computer & Consulting ReSales 1411 Building 1510 Land Building Land Puchase BuildingLand Puchase Building and Puchase Building and Puchase 2201 Mortgage Payable 1110 Cash 1140 Prepaid Rent 1110 Cash Rent for June, Juy and August Rent for June, Juy and August General Journal Bank Reconciliation Income Statement CRAMART For M forming G 1,850 00 24.500.00 5,640.00 6,150.00 151.700.00 14.300.00 7,200.00 Changes in Owner's Equity F 1,850.00 24,500.00 5.640.00 6,150.00 143,000.00 23.000 00 7,200.00 Informat St Select L K KS3 How to Ows Phot Tale SUM B86882EFEE 00 66 67 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 28828885 89 90 91 92 93 A 13 13 x x General Journal B C D Jun 17 Jun 17 5030 Advertising Expense 1110 Cash Newpaper Advertising Newpaper Advertising Jun 21 2101 Accounts Payable Advertising Advertising Jun 21 1110 Cash Office Machines Expres Jun 21 Jun 21 1211 Office Equip 1110 Cash Office Machines Expree 1120 Accounts Receivable Services Performed Jun 21 Jun 21 4100 Computer & Consulting RevServices Performed 17 Jun 22 17 Jun 22 5020 Salary Expense 1110 Cash Jun 22 Jun 22 5040 Repairs & Maint. Expense 2101 Accounts Payable 14 14 15 15 29 EE 98 16 16 18 Mage & Car 18 Equipment Operators Salaries Equipment Operators Salaries Computer Parts and Repair Co Computer Parts and Repair Co 425.00 320.00 850.00 4.200.00 985.00 1.115.00 Cal C Forming T G H 425.00 320.00 850.00 4,200.00 985.00 1.115.00 Delets Form J B F 4 Fre Select L Past SUM 96 97 98 99 100 101 102 103 104 105 106 107 106 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 10 A 19 19 20 20 21 21 NN 28 ** x fx B Jun 22 Jun 22 Jun 23 Jun 23 Jun 23 Jun 23 Jun 28 Jun 28 Jun 29 Jun 29 Jun 29 Jun 29 22 Marge & Centr General Journal C D 2101 Accounts Payable 1110 Cash Advertising Advertising 1150 Office Supples 2101 Accounts Payable Staples Purchase Staples Purchase 1110 Cash Billing Billing 1120 Accounts Receivable 1120 Accounts Receivable Services Performed 4100 Computer & Consulting RevServices Performed 2101 Accounts Payable 1110 Cash 1110 Cash 1120 Accounts Receivable Computer Parts and Repair Co Computer Parts and Repair Co Baing Baling 320.00 925.00 3,365.00 5,805.00 1.115.00 5.500.00 Con Formating Ta G 320.00 925.00 3.365.00 5.805.00 1,115.00 5.500.00 C Dist SHA Find & 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 AFA Point 22 55 28 28 25 26 26 27 27 29 29 30 30 B Jun 29 Jun 29 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 C D 5020 Salary Expense 1110 Cash 5050 O & Gas Expense 1110 Cash 3300 Dividends 1110 Cash 3300 Dividends 1110 Cash 3300 Dividends 1110 Cash 5010 Rent Expense 1140 Prepaid Rent General Journal Salaries Salans Ol and Gas Expense Oil and Gas Expense Dividends Dividends Dividends Dividends Dividends Dividends Rent per month Rent per month Income Statement F 965.00 1,015.00 910.00 520.00 125.20 2.400.00 G 965.00 1,015.00 910.00 520.00 125.20 2.400.00 Changes in Owner's H K Create 440 S 31 SUM 156 157 158 159 160 161 162 163 164 165 166 167 168 160 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 A 31 31 32 32 33 33 34 34 35 35 35 22 36 36 .. x B Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Transactions 10 - AA FURIDE Wapen General Journa C D 5080 Supplies Expense 1150 Office Supplies office supplies office supplies 5090 Interest Expense 2103 Interest Payable Mortgage Interest Mortgage Interest 5100 insurance Expense insurance insurance 1130 Prepaid insurance 1120 Accounts Receivable Unbiled Revenues 4100 Computer & Consulting ReUnbiled Revenues 5110 Depreciation Expense Depreciation 1212 Accum Depr-Office Equip 1412 Accum Depr Building Depreciation Depreciation 5110 Depreciation Expense Depreciation 1312 Accum Depr-Computer EqDepreciation Works Accounting come Statement 40980 235.00 19,000.00 373.00 5.333.33 A Ce Ca G H 489 235.00 19,000.00 17.26 355 82 5.333.33 Changes in Or D J - O. THE S L C M Home P SUM 106 187 188 100 190 191 192 193 194 1965 196 197 196 199 200 201 202 203 204 205 206 207 208 200 210 211 212 213 214 A 37 37 38 38 Dran Page Lay General C D 5020 Salary Expense 2105 Salaries Payable 5000 interest Expense 2103 Interest Payable 5120 Bad Debit Expense 1121 Alowance for Doue 1110 Cash 1120 Accounts Receivable 39 B Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 39 Jun 30 40 Jun 30 40 Jun 301 41 A X Formulas Geral Ja Data Review View T Wa &1 Salas Salvies Royce Computer Interest Royce Computer Interest Uncolectable Revenue AccUncolectable Revenue Need a Descripton Work Ang Statement 501.00 1,031 33 351.55 Fo Fermating an a H 0 501.00 1,031.33 351.55 Change O CH 1 D J Theat K MILL Fie Select L 20 Fler Tite M 881 88 28 01 92 95 99 100 101 102 103 104 105 106 107 Ana 96 97 98 SUM 43. 44. 45 46 Merge & Certal : x Transactions! Joan (S128,000.00 low 524,500.00-5181,500.00 must be calculated for the 20 days remaining in the mouth of June 39. Our CPA has lafarmed us to estimate that 1.00% of Computer & Coding Revens will be able 40 Based on the information on the "Bank Reconciliation sheet prepare the journal entry required to increases cash. 41. Based on the information on the "Bank Reconciliation sheet prepare the journal entry required to decreases cask 42. Income taxes are to be computed at the rate of 25 percent of net income before tases. IMPORTANT NOTE: Since the income tases are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement. Closing Entries Close the revenue accesst Close the expense accounts. Close the income summary account. 8103 Close the dividends account. Cantonalm D E CHI 1! ail SUM 72 RZERE 78 79 81 28 32 Merge & Car xix Traction A 34 A review of Byte's job workshorts show that there are unbilled revesses in the amount of $19,000.00 the period of Juse 18-10 The Building and the Office Equipment have the following estimated fl Building-31.5 years 35 Office Equipment-7 year Management has decided that amets purchased during a month are treated as if purchased on the first day of the month. The building's salvage value is 58,500.00. The office equipment has a salvage val of $500.00. Calculate the depreciation for one month using the straight-line method of depreciation The Computer Equipment has an estimated useful life of 5.00 Years 36. Management has decided that assets purchased during a month are treated as if parchased on the first day of the month. The computer equipment's scrap value is $20,000.00 Calculate the depreciation for one month using the double declising method of depreciation 37. A review of the payroll records show that unpaid salaries is the amount of $991.00 are owed by Byte for three days, June 28-30. Ignare payroll taxes The note payable to Reyce Computers (transactions 04 and 98) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed bawd on a 360 day year. IMPORTANT NOTE: The original note on the computer equipment purchased on Jane 2 was $128,000.00. Os Jese 10, cight days later, $24.500.00 was repaid. Interest expensement be 38. calculated on the $128,000.00 for eight days. In addition, interest expense on the 5103,500,00 balance of the loan (3128,600.00 less $24,500.00-5103,500.00) must be calculated for the 20 days remaining in the moth of June. Income Statement Changes General Journal C Ce 28 4 & Babence d find Sal 59 53 33 38 BREN SUM 89 70 71 72 X Transactions June 3. Received a bill for the amount of $1,015.00 from O&GO and Gas Co. The invoice number 26 was 784537 27. June 30: Check #5013 was used to pay for a cash dividend of 50,20 per share to Laurys, a shareholder of 28 June 30 Check 5014 was used to pay for a cash dividend of 50.20 per share to Martha Horwit shareholder of Byte. 29 June 30: Check 5015 was used to pay for a cash dividend of 50.29 per share to Courtney, a sharsholder of Byte Adjusting Entries Round to tus decimal places 30. The rent payment made on June 17 was for June, July and Aagast. Expense the amount asociated with one month's rent. 31. A physical inventory showed that only $391.00 worth of general office supplies remained on hand as of Jane 30. This did not include any of the Super Routefra. There were 5 units of Super Rosteroon band. We use FIFO to determine the valuation of the supplies 32. The annual interest rate on the mortgage payable was 7.75 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 33. Record a journal entry to reflect that one half month's inverance has expired. General Journal Bank Reconciation Income Statement Contine For Changes in Owner's Ey Ca F Fama G J I For Salac 34 37 R SUM 3585 40 41 45 47 48 49 50 51 52 53 x Transactions C 16 June 21: Billed various miscellaneous local customers $4,200.00 for consulting services performed 17. June 22: Check 5009 was used to pay salaries of 1985.08 to equipment operators for the week ending Jose 18. Ignore payroll taxes. 18. June 21: Received a bill for $1,115.00 from Computer Parts and Repair Co. for repairs to the computer equipment. The invece number was 43254. June 21: Check # 5910 was used to pay the advertising bill that was received on June 17, June 23: Parchased office supplies for $925.00 from Staples en account. The invoice number was 65498 20 Included in the purchase was 10 units of Super RoutePro at a cost of $27.00 each 21. June 23: Cash in the amount of $3,365.00 was received on billings 22. June 28: Billed 55,805.00 to miscellaneous customers for services performed to June 25. 23. June 29: Paid the bill received on June 12, from Computer Parts and Repairs Co with Check # 5011. 24. June 29: Cash in the amount of $5,500.00 was received for billings 25. June 29: Check # 5812 was used to pay salaries of 5985.00 to equipment operators for the week ending June 25 Ignere payroll taxes Cantonal Form D CHI De 28 2 29 30 31 32 33 34 JAUME 21 22 23 24 2 28 X Transactions C 26. June 18: Check #5003 was used to make a $24,500.00 paytroducing the principal owed on the June purchase of computer equipment from Royce Computers 09. June 14: Check # 5004 was used to purchase a one-year insurance policy covering its computer equipment for 55,640.00 from Seth's fasurance. The effective date of the policy was Jene 16 and the invoice member was 2387, 10. June 16: Checks in the amount of 56,150.00 were received for services performed for cash customers 11. June 16: Byte purchased a building and the land it is on for $143,000.00 to house its repair facilities and to store computer equipment. The let en which the building is located is valued at $23,000.00. The balance of the cost is to be allocated to the building. Check # 5005 was used to make the down payment of 514,300.00. A thirty year mortgage with an inital payement der on August 1st, was established for the balance. 12. June 17: Check & 5006 for $7,200.00 was paid for rent of the office space for June, July and Augest 13 June 17: Received invoice number 26354 in the amount of $425.00 from the local newspaper for advertising 14. June 21: Accounts payable in the amount of $320.00 were paid with Check # 5007. 15 June 21: Check 8 5008 was used to purchase a fax machine for the office from Office Machines Express for $$50.00. The invoice number was 975-328. Transactions General Journal Bank Reconciation Worksheet Income Statement D E Changes in Owner's Ey F G Batince then Fur I 028 How Ca 13 14 15 16 17 18 LO AA SUM WT Accounting 7 U Marge & Car fx Transactional C Transaction Description of transaction 01 June 1: Lauryn made an investment in Byte of Accounting, lac, by parchasing 4,556 shares of its commen tack for $136.545.50 cash. The par valar of the common stock was $8.01 per share 02 June 1: Martha Horowitz made an investment in Byte of Accounting, ls, by purchasing 1,000 shares of t common stock paying 533,311.10 in cash and by contributing compuier equipment with a fair market val of 544,714.90. The par value of the common stock was $0.01 per share. 03 Jane I: Courtney made an investment in Byte of Accounting, Inc, by purchasing 626 shares of its commen Mock by contributing computer equipment with a fair market value of $18,406.00 and office equipment with a fair value of $788.26. The par valse of the common stock was 50.01 per share 04 June 2: Check #5002 was used to make a down payment of $32,000.00 in additional computer equipment that was parchased from Royce Computers, invoice number 765-42. The fall price of the computer was $160,000.00. A five-year note was executed by Byte for the balance. 05 June 4 Additional office equipment costing $400.00 was purchased on credit from Discount Computer Corporation. The invoice samber was 98432. 04 June 8: Lasatisfactory office opsipment costing 580.00 from invoice number 98432 was returned to Discoeat Computer for credit to be applied againd the outstanding balance owed by Byte 07. June 8: Purchased office supplies for $1.850.00 from Staples on account. The invoice sumber was 61298. Included in the purchase was 10 units of Super RoutePro at a cost of $20.00 each tune Chick 5003 was make 524.500.00 perminteleg the principalmed on the June 2 Con D E CA F