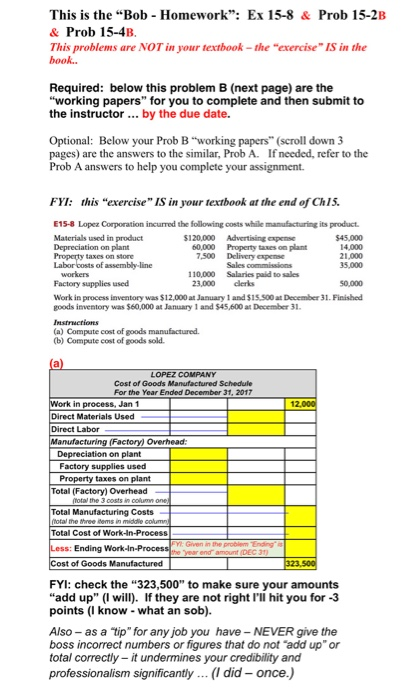

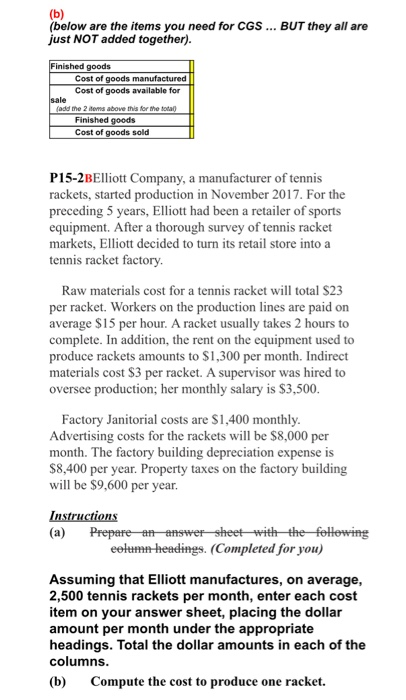

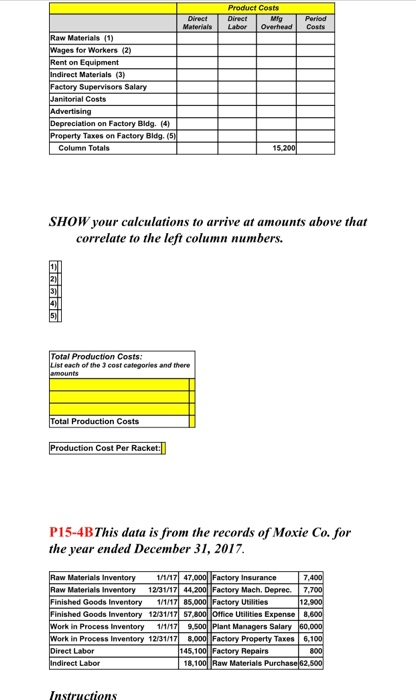

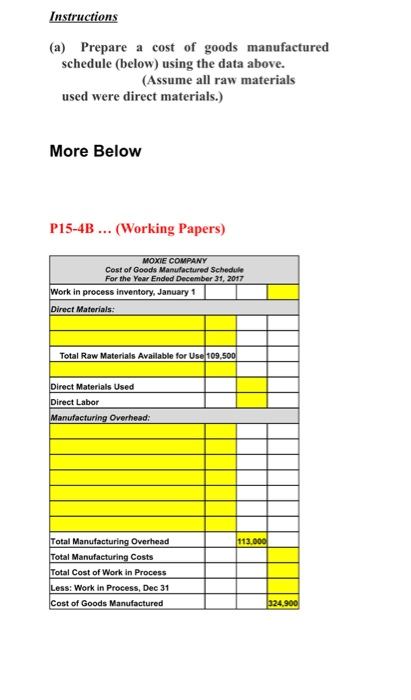

This is the "Bob - Homework": Ex 15-8 & Prob 15-2B & Prob 15-4B This problems are NOT in your textbook -the "exercise" IS in the book.. Required: below this problem B (next page) are the "working papers" for you to complete and then submit to the instructor.. by the due date. Optional: Below your Prob B"working papers" (scroll down 3 pages) are the answers to the similar, Prob A. If needed, refer to the Prob A answers to help you complete your assignment. this "exercise" IS in your textbook at the end of Ch15. FY: E15-8 Lopez Corporation incurred the following costs while manufacturing its product Materials used in product Depreciation on plant Property taxes on store Labor costs of assembly-line workers $120,000 60,000 7,500 Advertising expense Property taxes on plant Delivery expense Sales commissions Salaries paid to sales clerks $45,000 14,000 21,000 35,000 110,000 23,000 Factory supplies used s0,000 Work in process inventory was $12,000 at January 1 and $15,500 at December 31. Finished goods inventory was $60,000 at January 1 and $45,600 at December 31. Instructions (a) Compute cost of goods manufactured. (b) Compute cost of goods sold. LOPEZ COMPANY Cost of Goods Manufactured Schedule For the Year Ended December 31, 2017 Work in process, Jan 1 Direct Materials Used Direct Labor Manufacturing (Factory) Overhead: Depreciation on plant 12,000 Factory supplies used Property taxes on plant Total (Factory) Overhead otal the 3 costs in column ane Total Manufacturing Costs (total the three items in middle column Total Cost of Work-in-Process Less: Ending Work-In-Procese Given in the problem Endingi Cost of Goods Manufactured year end amount (DEC 31) 323,500 FYI: check the "323,500" to make sure your amounts "add up" (I will). If they are not right r hit you for -3 points (I know -what an sob) Also - as a tip" for anyjob you have-NEVER give the boss incorrect numbers or figures that do not "add up" or total correctly-it undermines your credibility and professionalism significantly (I did - once.) (b) (below are the items you need for CGS. BUT they all are just NOT added together). Finished goods Cost of goods manufactured Cost of goods available for sale (add the 2 items above this for the total) Finished goods Cost of goods sold P15-2BEIliott Company, a manufacturer of tennis rackets, started production in November 2017. For the preceding 5 years, Elliott had been a retailer of sports equipment. After a thorough survey of tennis racket markets, Elliott decided to turn its retail store into a tennis racket factory Raw materials cost for a tennis racket will total S23 per racket. Workers on the production lines are paid on average $15 per hour. A racket usually takes 2 hours to complete. In addition, the rent on the equipment used to produce rackets amounts to $1,300 per month. Indirect materials cost $3 per racket. A supervisor was hired to oversee production; her monthly salary is $3,500 Factory Janitorial costs are S1,400 monthly Advertising costs for the rackets will be $8,000 per month. The factory building depreciation expense is $8,400 per year. Property taxes on the factory building will be $9,600 per year. Instructions (a) Prepare anenswer sheet with the following eelumnheadings. (Completed for you) Assuming that Elliott manufactures, on average, 2,500 tennis rackets per month, enter each cost item on your answer sheet, placing the dollar amount per month under the appropriate headings. Total the dollar amounts in each of the columns. Compute the cost to produce one racket (b) Product Costs Direct Direct Mig Overhead Period Materials Labor Costs Raw Materials (1) Wages for Workers (2) Rent on Equipment Indirect Materials (3) Factory Supervisors Salary Janitorial Costs Advertising Depreciation on Factory Bldg. (4) Property Taxes on Factory Bldg. (5) 15,200 Column Totals SHOW your calculations to arrive at amounts above that correlate to the left column numbers Total Production Costs: List each of the 3 cost categories and there amounts Total Production Costs Production Cost Per Racket: P15-4BThis data is from the records of Moxie Co. for the year ended December 31, 2017 Raw Materials Inventory 11/17 47,000 Factory Insurance 7,400 Raw Materials Inventory 12/31/17 44,200 Factory Mach. Deprec. 7,700 |12.900 Finished Goods Inventory 12/31/17 57,800 Office Utilities Expense 8,600 9,500 Plant Managers Salary 60,000 8,000 Factory Property Taxes 6,100 800 Finished Goods Inventory 1/1/17 85,000 Factory Utilities Work in Process Inventory Work in Process Inventory 12/31/17 Direct Labor Indirect Labor 1/1/17 145,100 Factory Repairs 18,100 Raw Materials Purchase 62,500 Instructions Instructions (a) Prepare a cost of goods manufactured schedule (below) using the data above. (Assume all raw materials used were direct materials.) More Below PI5-4B.. (Working Papers) MOXIE COMPANY Cost of Goods Manufactured Schedule For the Year Ended December 31, 2017 Work in process inventory, January 1 Direct Materials: Total Raw Materials Available for Use 109,500 Direct Materials Used Direct Labor Manufacturing Overhead: Total Manufacturing Overhead 113,000 Total Manufacturing Costs Total Cost of Work in Process Less: Work in Process, Dec 31 Cost of Goods Manufactured 324,900