Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the case study based on personal selling subject can u guys help me in solving this Life, Health, and Disability Insurance Jamie Lee

this is the case study based on personal selling subject can u guys help me in solving this

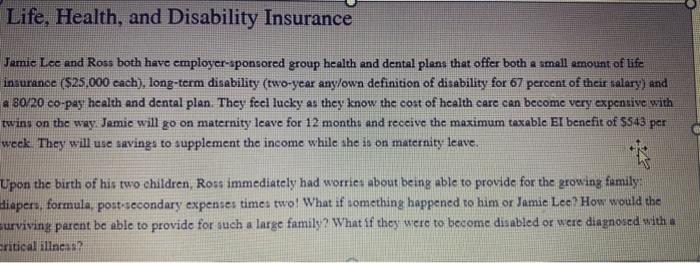

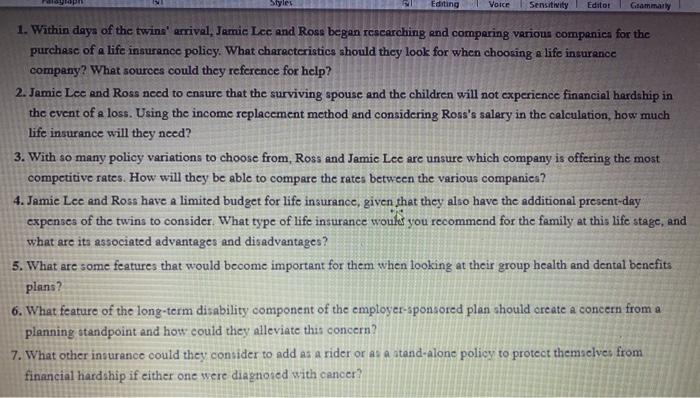

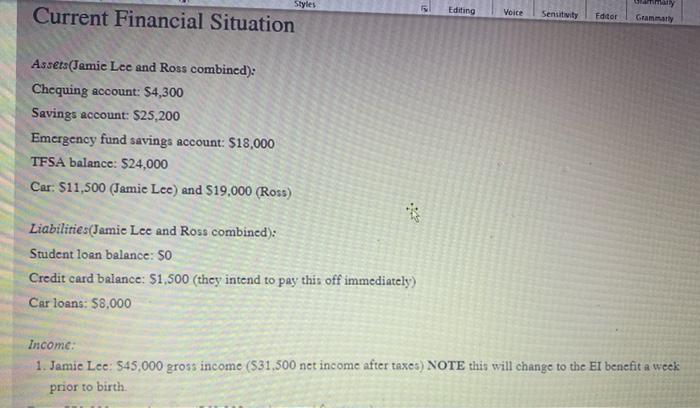

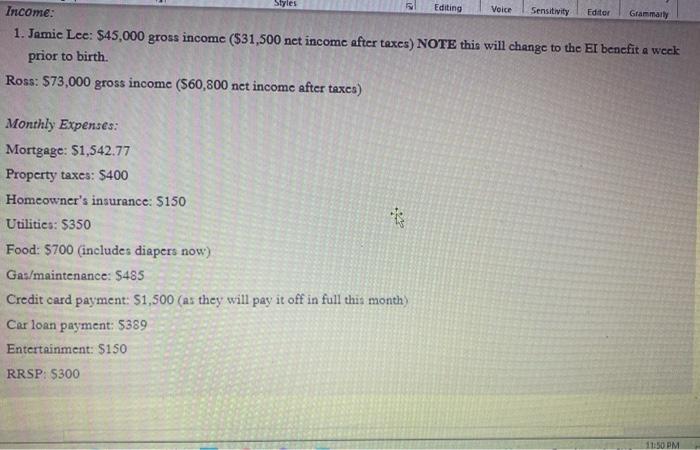

Life, Health, and Disability Insurance Jamie Lee and Ross both have employer-sponsored group health and dental plans that offer both a small emount of life insurance ($25.000 each), long-term disability (two-year any/own definition of disability for 67 percent of their salary) and 4 80/20 co-pay health and dental plan. They feel lucky as they know the cost of health care can become very expensive with twins on the way. Jamie will go on maternity leave for 12 months and receive the maximum taxable El benefit of SS43 per week. They will use savings to supplement the income while she is on maternity leave. Upon the birth of his two children, Ross immediately had worries about being able to provide for the growing family diapers, formula, post-secondary expenses times two! What if something happened to him or Jamie Lee? How would the surviving parent be able to provide for such a large family? What if they were to become disabled or were diagnosed with a critical illness Styles NI Editing Grammy Voice Sensitivity Editor 1. Within days of the twins' arrival, Jamic Lcc and Ross began rescarching and comparing various companica for the purchase of a life insurance policy. What characteristics should they look for when choosing a life insurance company? What sources could they reference for help? 2. Jamie Lee and Ross need to ensure that the surviving spouse and the children will not experience financial hardship in the event of a loss. Using the income replacement method and considering Ross's salary in the calculation, how much life insurance will they need? 3. With so many policy variations to choose from, Ross and Jamic Lee are unsure which company is offering the most competitive rates. How will they be able to compare the rates between the various companica? 4. Jamie Lee and Ross have a limited budget for life insurance, given that they also have the additional present-day expenses of the twins to consider. What type of life insurance would you recommend for the family at this life stage, and what are its associated advantages and disadvantages? 5. What are some features that would become important for them when looking at their group health and dental benefits plans? 6. What feature of the long-term disability component of the employer-sponsored plan should create a concern from a planning standpoint and how could they alleviate this concern? 7. What other insurance could they consider to add as a rider or as a stand-alone policy to protect themselves from financial hardship if either one were diagnosed with cancer? Styles Editing Current Financial Situation Voice Sensitivity Editor Grammar Assets(Jamie Lee and Ross combined): Chequing account: $4,300 Savings account: $25,200 Emergency fund savings account: $18,000 TFSA balance: $24,000 Car: 11,500 (Jamie Lee) and 519,000 (Ross) Liabilities(Jamie Lee and Ross combined): Student loan balance: 50 Credit card balance: $1,500 (they intend to pay this off immediately) Car loans: 58,000 income: 1. Jamie Lee: $45.000 gross income (531,500 net income after taxes) NOTE this will change to the El benefit a week prior to birth Styles Voice Sensitivity Editor Grammarly Editing Income: 1. Jamie Lee: $45,000 gross income ($31,500 net income after texes) NOTE this will change to the El benefit a week prior to birth. Ross: $73,000 gross income (560,800 net income after taxes) Monthly Expenses: Mortgage: $1,542.77 Property taxes: $400 Homeowner's insurance: $150 Utilities: $350 Food: $700 (includes diapers now) Gas/maintenance: $485 Credit card payment: $1,500 (as they will pay it off in full this month) Car loan payment: 5389 Entertainment: $150 RRSP: $300 11:50 PM Life, Health, and Disability Insurance Jamie Lee and Ross both have employer-sponsored group health and dental plans that offer both a small amount of life insurance ($25.000 cach), long-term disability (two-year any/own definition of disability for 67 percent of their talary) and a 80/20 co-pay health and dental plan. They feel lucky as they know the cost of health care can become very expensive with twins on the way. Jamie will go on maternity leave for 12 months and receive the maximum taxable El benefit of SS43 per week They will use savings to supplement the income while she is on maternity leave. Upon the birth of his two children, Ross immediately had worries about being able to provide for the growing family diapers, formula, post-secondary expenses times two! What if something happened to him or Jamie Lee? How would the surviving parent be able to provide for such a large family? What if they were to become disabled or were diagnosed with a Critical illncas? Life, Health, and Disability Insurance Jamie Lee and Ross both have employer-sponsored group health and dental plans that offer both a small emount of life insurance ($25.000 each), long-term disability (two-year any/own definition of disability for 67 percent of their salary) and 4 80/20 co-pay health and dental plan. They feel lucky as they know the cost of health care can become very expensive with twins on the way. Jamie will go on maternity leave for 12 months and receive the maximum taxable El benefit of SS43 per week. They will use savings to supplement the income while she is on maternity leave. Upon the birth of his two children, Ross immediately had worries about being able to provide for the growing family diapers, formula, post-secondary expenses times two! What if something happened to him or Jamie Lee? How would the surviving parent be able to provide for such a large family? What if they were to become disabled or were diagnosed with a critical illness Styles NI Editing Grammy Voice Sensitivity Editor 1. Within days of the twins' arrival, Jamic Lcc and Ross began rescarching and comparing various companica for the purchase of a life insurance policy. What characteristics should they look for when choosing a life insurance company? What sources could they reference for help? 2. Jamie Lee and Ross need to ensure that the surviving spouse and the children will not experience financial hardship in the event of a loss. Using the income replacement method and considering Ross's salary in the calculation, how much life insurance will they need? 3. With so many policy variations to choose from, Ross and Jamic Lee are unsure which company is offering the most competitive rates. How will they be able to compare the rates between the various companica? 4. Jamie Lee and Ross have a limited budget for life insurance, given that they also have the additional present-day expenses of the twins to consider. What type of life insurance would you recommend for the family at this life stage, and what are its associated advantages and disadvantages? 5. What are some features that would become important for them when looking at their group health and dental benefits plans? 6. What feature of the long-term disability component of the employer-sponsored plan should create a concern from a planning standpoint and how could they alleviate this concern? 7. What other insurance could they consider to add as a rider or as a stand-alone policy to protect themselves from financial hardship if either one were diagnosed with cancer? Styles Editing Current Financial Situation Voice Sensitivity Editor Grammar Assets(Jamie Lee and Ross combined): Chequing account: $4,300 Savings account: $25,200 Emergency fund savings account: $18,000 TFSA balance: $24,000 Car: 11,500 (Jamie Lee) and 519,000 (Ross) Liabilities(Jamie Lee and Ross combined): Student loan balance: 50 Credit card balance: $1,500 (they intend to pay this off immediately) Car loans: 58,000 income: 1. Jamie Lee: $45.000 gross income (531,500 net income after taxes) NOTE this will change to the El benefit a week prior to birth Styles Voice Sensitivity Editor Grammarly Editing Income: 1. Jamie Lee: $45,000 gross income ($31,500 net income after texes) NOTE this will change to the El benefit a week prior to birth. Ross: $73,000 gross income (560,800 net income after taxes) Monthly Expenses: Mortgage: $1,542.77 Property taxes: $400 Homeowner's insurance: $150 Utilities: $350 Food: $700 (includes diapers now) Gas/maintenance: $485 Credit card payment: $1,500 (as they will pay it off in full this month) Car loan payment: 5389 Entertainment: $150 RRSP: $300 11:50 PM Life, Health, and Disability Insurance Jamie Lee and Ross both have employer-sponsored group health and dental plans that offer both a small amount of life insurance ($25.000 cach), long-term disability (two-year any/own definition of disability for 67 percent of their talary) and a 80/20 co-pay health and dental plan. They feel lucky as they know the cost of health care can become very expensive with twins on the way. Jamie will go on maternity leave for 12 months and receive the maximum taxable El benefit of SS43 per week They will use savings to supplement the income while she is on maternity leave. Upon the birth of his two children, Ross immediately had worries about being able to provide for the growing family diapers, formula, post-secondary expenses times two! What if something happened to him or Jamie Lee? How would the surviving parent be able to provide for such a large family? What if they were to become disabled or were diagnosed with a Critical illncas Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started