Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the continuation of the four questions already posted. Problems 1 through 7 - Tables are in the Appendix of the text When asked

this is the continuation of the four questions already posted.

Problems 1 through 7 - Tables are in the Appendix of the text When asked for future value use future value tables and when asked for present value use the present value tables.

4. Assume a $1,000 face value bond has a coupon rate of 8.5 percent, pays interest semi-annually, and has an eight-year life. If investors are willing to accept a 10 percent rate of return on bonds of similar quality, what is the present value or worth of this bond?

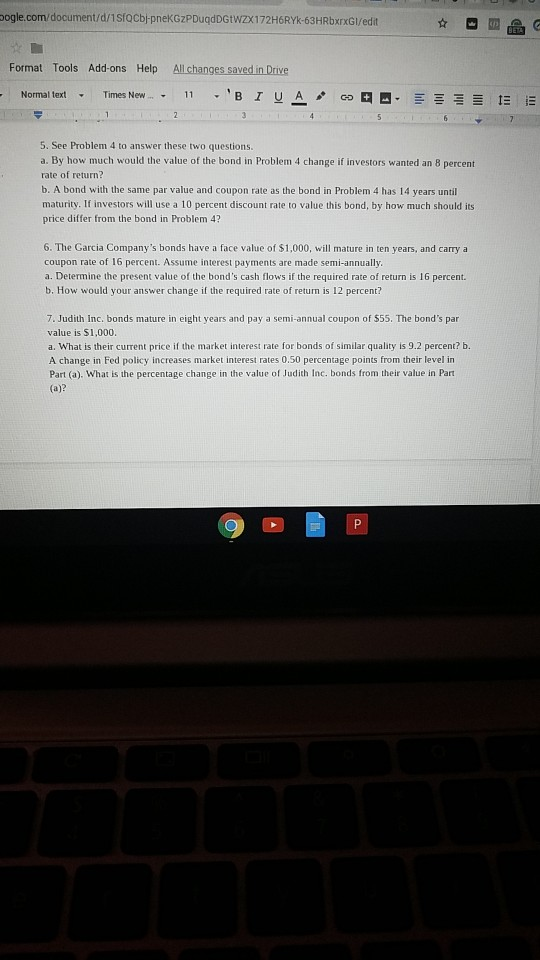

ogle.com/document/d/1sfOCbj-pneKGzPDuqdDGtWZX172H6RYk-63HRbxrxGI/edit Format Tools Add-ons Help All changes saved in Drive i Normal text . Times New 11 .'BIYA, cog8: 5. See Problem 4 to answer these two questions. a. By how much would the value of the bond in Problem 4 change if investors wanted an 8 percent rate of return? b. A bond with the same par value and coupon rate as the bond in Problem 4 has 14 years until maturity. If investors will use a 10 percent discount rate to value this bond, by how much should its price differ from the bond in Problem 4? 6. The Garcia Company's bonds have a face value of $1,000, will mature in ten years, and carry a coupon rate of 16 percent. Assume interest payments are made semi-annually a. Determine the present value of the bond's cash flows if the required rate of return is 16 percent. b. How would your answer change if the required rate of return is 12 percent? 7. Judith Inc. bonds mature in eight years and pay a semi-annual coupon of $55. The bond's par value is S1,000 a. What is their current price if the market interest rate for bonds of similar quality is 9.2 percent? b. A change in Fed policy increases market interest rates 0.50 percentage points from their level in Part (a). What is the percentage change in the value of Judith Inc. bonds from their value in Part (a)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started