This is the data from 4-3A

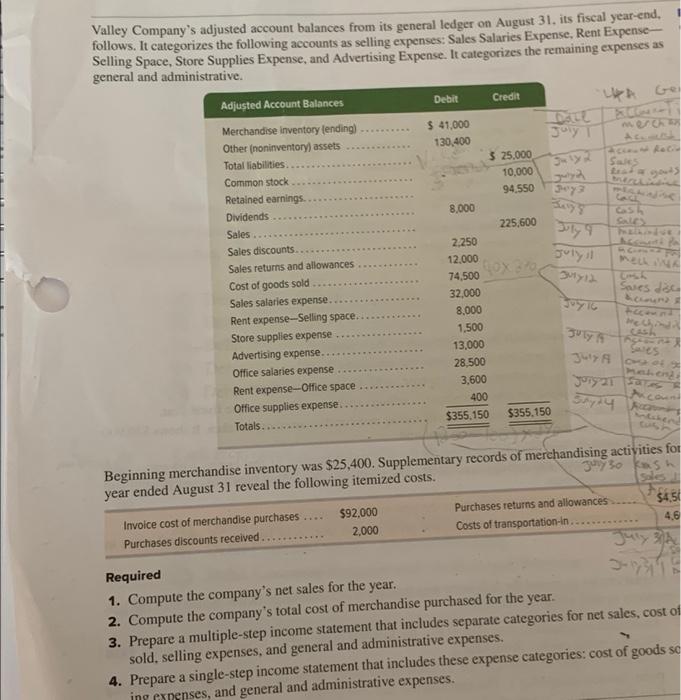

Use the data for Valley Company in Problem 4-3A to complete the following requirement. Required Prepare closing entries as of August 31 (the perpetual inventory system is used). Problem 4-4A Preparing closing entries and interpreting information about discounts and returns C1 P3 193 Chapter 4 Accounting for Merchandising Operations 20 Sold merchandise that cost $1.450 to Tamer Co. for $2,800 under credit terms of 2/15. n/60, May 17, C. Cash, 89.900 FOB shipping point, invoice dated May 20. 22 Gave a price reduction (allowance) of $300 to Tamer Co. for merchandise sold on May 20 and credited Tamer's accounts receivable for that amount 25 Paid Duke Co. the balance due, net of the discount. 30 Received the balance due from Tamer Co. for the invoice dated May 20, net of discount and allowance. 31 Sold merchandise that cost $3,600 to Rath Co. for $7.200 under credit terms of 2/10, n/60. FOB shipping point, invoice dated May 31. May 30, Di Cash $2,450 Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: Sales Salaries Expense, Rent Expense- Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Debit Credit Dace July con Rob Sales tas Jey Bys Cash Adjusted Account Balances Merchandise inventory lending) Other (noninventory) assets Total liabilities Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold .. Sales salaries expense. Rent expense-Selling space. Store supplies expense Advertising expense.. Office salaries expense Rent expense-Office space Office supplies expense. Totals $ 41,000 130,400 $ 25,000 10.000 94.550 8.000 225,600 2.250 12.000 LOX 74,500 32,000 8,000 1.500 13,000 28,500 3.600 400 $355.150 $355,150 July 9 July Sares disc La JoyG Mc July 37810 yorgara Skyny $4,50 4 Beginning merchandise inventory was $25,400. Supplementary records of merchandising activities for guryso kash year ended August 31 reveal the following itemized costs. sales Invoice cost of merchandise purchases $92,000 Purchases returns and allowances 2,000 Purchases discounts received .. 4,6 Costs of transportation-in. July in Required 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods se ine expenses, and general and administrative expenses