This is the direction given on the assignment ... Use Excel functions, formulas (mathematical operations), or both to duplicate the answers provided.

so the answers to each question has already been given to me but now I need to find out the formulas, functions, and/or equations that were used to get to the answer.

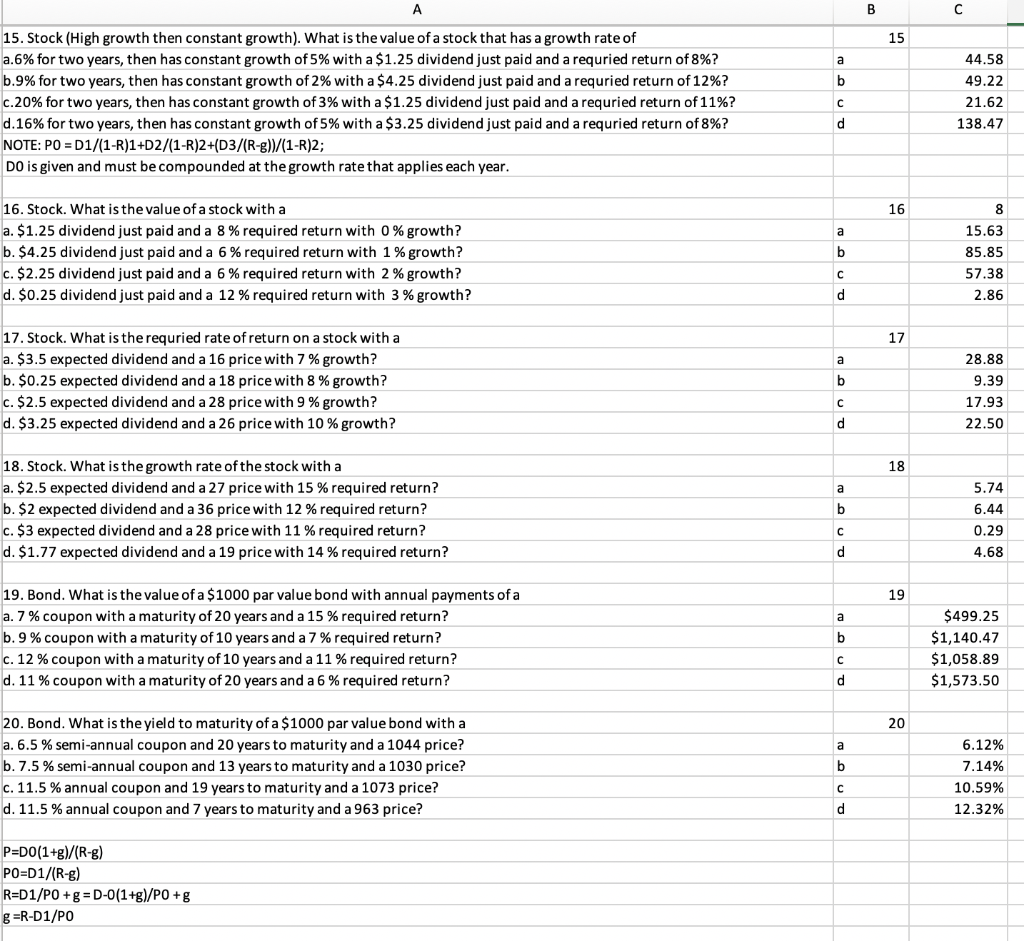

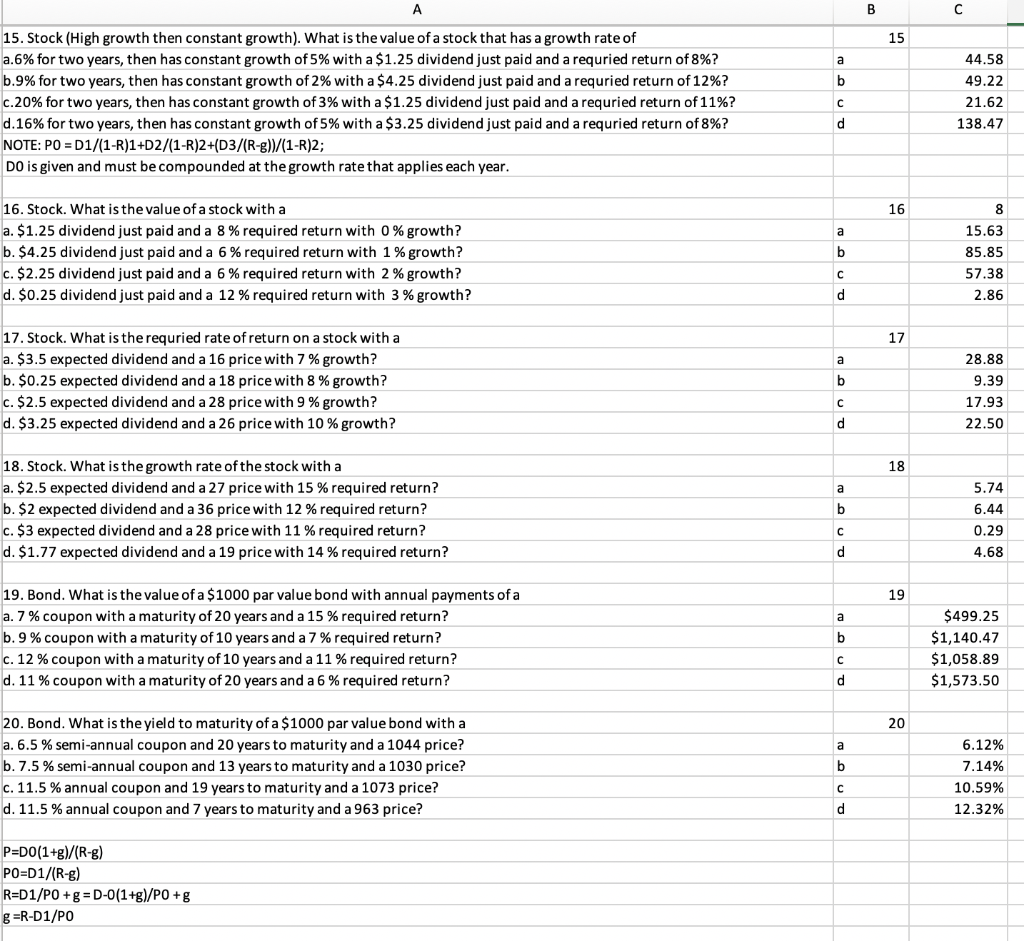

15. Stock (High growth then constant growth). What is the value of a stock that has a growth rate of a.6% for two years, then has constant growth of 5% with a $1.25 dividend just paid and a requried return of 8%? b.9% for two years, then has constant growth of 2% with a $4.25 dividend just paid and a requried return of 12%? c.20% for two years, then has constant growth of 3% with a $1.25 dividend just paid and a requried return of 11%? d, 16% for two years, then has constant growth of 5% with a $3.25 dividend just paid and a requried return of 8%? NOTE: P0 D1/(1-R)1+D2/(1-R)2+(D3/(R-g)/(1-R)2; DO is given and must be compounded at the growth rate that applies each year 15 44.58 49.22 21.62 138.47 16. Stock. What is the value of a stock with a a. $1.25 dividend just paid and a 8 % required return with 0 % growth? b. $4.25 dividend just paid and a 6 % required return with 1 % growth? c. $2.25 dividend just paid and a 6 % required return with 2 % growth? d. $0.25 dividend just paid and a 12 % required return with 3 % growth? 16 15.63 85.85 57.38 2.86 17. Stock. What is the requried rate of return on a stock with a a. $3.5 expected dividend and a 16 price with 7 % growth? b. $0.25 expected dividend and a 18 price with 8 % growth? c. $2.5 expected dividend and a 28 price with 9 % growth? d. $3.25 expected dividend and a 26 price with 10 % growth? 17 28.88 9.39 17.93 22.50 18. Stock. What is the growth rate of the stock with a a. $2.5 expected dividend and a 27 price with 15 % required return? b, $2 expected dividend and a 36 price with 12 % required return? c. $3 expected dividend and a 28 price with 11 % required return? d, $1.77 expected dividend and a 19 price with 14 % required return? 18 5.74 6.44 0.29 4.68 19. Bond. What is the value of a $1000 par value bond with annual payments of a a. 7 % coupon with a maturity of 20 years and a 15 % required return? b, 9 % coupon with a maturity of 10 years and a 7 % required return? c.12 % coupon with a maturity of 10 years and a 11 % required return? d, 11 % coupon with a maturity of 20 years and a 6 % required return? 19 499.25 $1,140.47 $1,058.89 $1,573.50 20. Bond. What is the yield to maturity of a $1000 par value bond witha a. 6.5 % semi-annual coupon and 20 years to maturity and a 1044 price? b. 7.5 % semi-annual coupon and 13 years to maturity and a 1030 price? c. 11.5 % annual coupon and 19 years to maturity and a 1073 price? d. 11.5 % annual coupon and 7 years to maturity and a 963 price? 20 6.12% 7.14% 10.59% 12.32% P-DO(1+g)/(R-g) Po-D1/(R-g) R-D1/POg D-0(1+g)/PO +g g R-D1/PO