Answered step by step

Verified Expert Solution

Question

1 Approved Answer

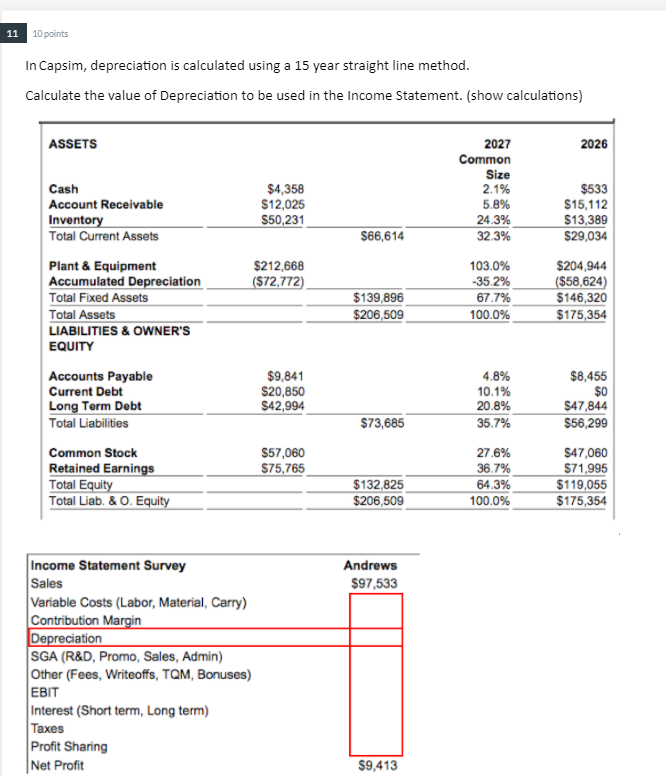

This is the entire question, there is no other information. Provided you all. 11 10 points In Capsim, depreciation is calculated using a 15 year

This is the entire question, there is no other information. Provided you all.

11 10 points In Capsim, depreciation is calculated using a 15 year straight line method. Calculate the value of Depreciation to be used in the Income Statement. (show calculations) ASSETS 2026 2027 Common Size 2.1% 5.8% 24.3% Cash Account Receivable Inventory Total Current Assets $4,358 $12,025 $50,231 $533 $15,112 $13,389 $29,034 $66,614 32.3% $212,668 103.0% -35.2% ($72,772) Plant & Equipment Accumulated Depreciation Total Fixed Assets Total Assets 67.7% $139,896 $206,509 $204,944 ($58,624) $146,320 $175,354 100.0% LIABILITIES & OWNER'S EQUITY Accounts Payable Current Debt Long Term Debt Total Liabilities $9,841 $20,850 542,994 4.8% 10.1% 20.8% 35.7% $8,455 $0 S47,844 $56,299 $73,685 Common Stock $57,060 $75,765 Retained Earnings Total Equity Total Liab. &0. Equity 27.6% 36.7% 64.3% 100.0% S47,060 $71,995 $119,055 $175,354 $132,825 $206,509 Andrews $97,533 Income Statement Survey Sales Variable Costs (Labor, Material, Carry) Contribution Margin Depreciation SGA (R&D, Promo, Sales, Admin) Other (Fees, Writeoffs, TQM, Bonuses) EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit $9,413 11 10 points In Capsim, depreciation is calculated using a 15 year straight line method. Calculate the value of Depreciation to be used in the Income Statement. (show calculations) ASSETS 2026 2027 Common Size 2.1% 5.8% 24.3% Cash Account Receivable Inventory Total Current Assets $4,358 $12,025 $50,231 $533 $15,112 $13,389 $29,034 $66,614 32.3% $212,668 103.0% -35.2% ($72,772) Plant & Equipment Accumulated Depreciation Total Fixed Assets Total Assets 67.7% $139,896 $206,509 $204,944 ($58,624) $146,320 $175,354 100.0% LIABILITIES & OWNER'S EQUITY Accounts Payable Current Debt Long Term Debt Total Liabilities $9,841 $20,850 542,994 4.8% 10.1% 20.8% 35.7% $8,455 $0 S47,844 $56,299 $73,685 Common Stock $57,060 $75,765 Retained Earnings Total Equity Total Liab. &0. Equity 27.6% 36.7% 64.3% 100.0% S47,060 $71,995 $119,055 $175,354 $132,825 $206,509 Andrews $97,533 Income Statement Survey Sales Variable Costs (Labor, Material, Carry) Contribution Margin Depreciation SGA (R&D, Promo, Sales, Admin) Other (Fees, Writeoffs, TQM, Bonuses) EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit $9,413Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started