Question: this is the figure Do some energy and cost saving analysis if ice storage is to be adopted for Air conditioning purposes for a space

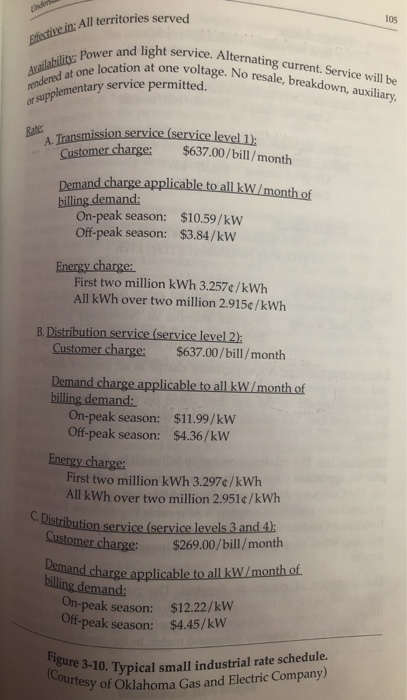

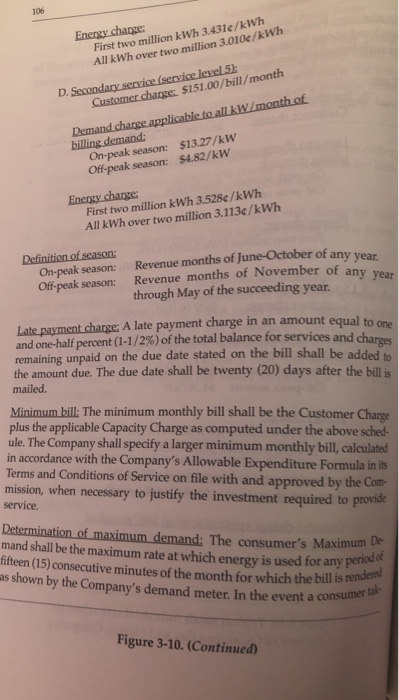

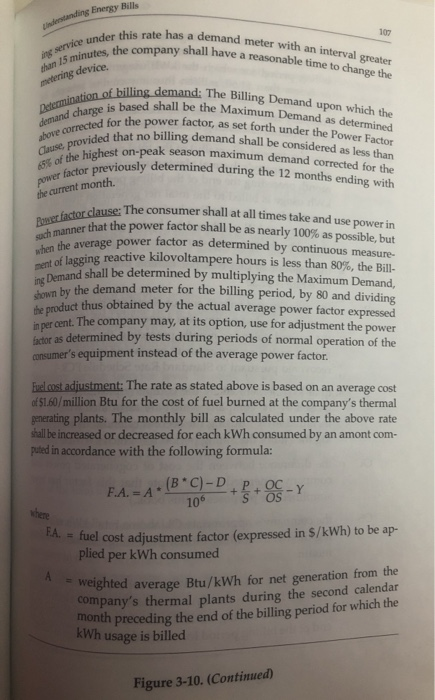

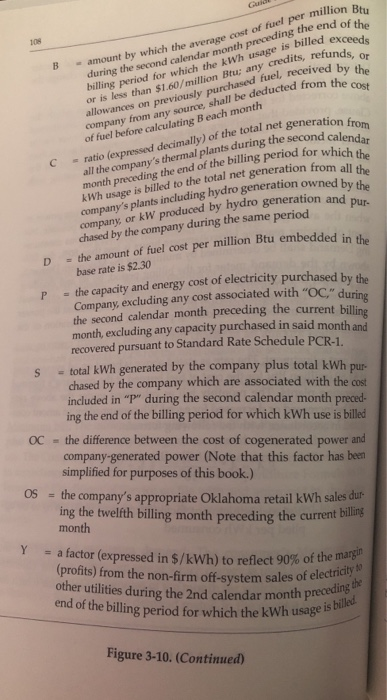

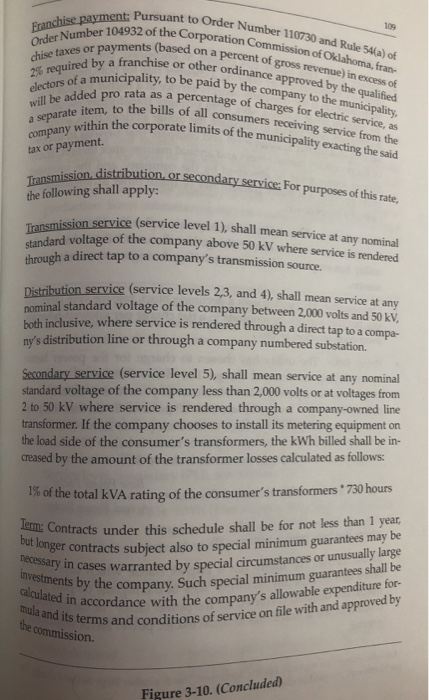

Do some energy and cost saving analysis if ice storage is to be adopted for Air conditioning purposes for a space that has a sensible cooling load of 100 kW and a latent heat load of 12 kW. The system is a CAV system with a design air flow rate of 25 kg/s. Consider outdoor air to be at 30 C and 80%. Indoor is at 24 C and 50%. Consider no air circulation; only air from outdoor enters the space. The HVAC system operates for 6 hours a day for 20 days per month. Make any assumption you feel appropriate. . At which rate heat need to be removed from the supplied air? . Assume that 50% of the cooling is to be realized by ice stored for that purpose. How much ice you need to generate every day? If ice is generated during off-peak times during the night, use Fig. 3-10 level 5 to estimate the saving you achieve by using ice to cool down outdoor air to the desired supply condition. Discuss the problems associated with implementing the ice-making system, whether feasible or not technically!! What would be required! in: All territories served 105 active in: Allt ght service. Alternating current. Service will be cation at one voltage. No resale, breakdown, auxilia sailability Power and light rendered at one locatie or supplementary se olementary service permitted. Transmission service (service level 1): Customer charge: $637.00/bill/month Demand charge applicable to all kW/month of billing demand: On-peak season: $10.59/kW Off-peak season: $3.84/kW Energy charge: First two million kWh 3.257/kWh All kWh over two million 2.915/kWh B. Distribution service (service level 2): Customer charge: $637.00/bill/month Demand charge applicable to all kW/month of billing demand: On-peak season: $11.99/kW Off-peak season: $4.36/kW Energy charge: First two million kWh 3.297/kWh All kWh over two million 2.951/kWh distribution service (service levels 3 and 4): sustomer charge: $269.00/bill/month and charge applicable to all kW/month of billing demand: On-peak season: Off-peak season: $12.22/kW $4.45/kW Figure 3-10. ly! (Courtesy of 3-10. Typical small industrial rate schedule. esy of Oklahoma Gas and Electric Company) Energy charge: First two million kWh 3.431c/kWh All kWh over two million 3.010e/kWh D. Secondary service (service level 5): Customer change: 5151.00/bill/month Demand charge applicable to all kW/month of billing demand: On-peak season: $13.27/kW Off-peak season: $4.82/kW Energy change: First two million kWh 3.528/kWh All kWh over two million 3.113/kWh Definition of season: On-peak season: Off-peak season: s of November of any year Revenue months of June-October of any year Revenue months of November of any through May of the succeeding year. Late payment charge: A late payment charge in an amount equal to one and one-half percent (1-1/2%) of the total balance for services and charos remaining unpaid on the due date stated on the bill shall be added to the amount due. The due date shall be twenty (20) days after the bill is mailed. Minimum bill: The minimum monthly bill shall be the Customer Charge plus the applicable Capacity Charge as computed under the above sched ule. The Company shall specify a larger minimum monthly bill, calculated in accordance with the Company's Allowable Expenditure Formula in is Terms and Conditions of Service on file with and approved by the com mission, when necessary to justify the investment required to provide service. Determination of maximum demand: The consumer's Maximum mand shall be the maximum rate at which energy is used for any per fifteen (15) consecutive minutes of the month for which the bill is as shown by the Company's demand meter. In the event a consum bill is rendered ent a consumer tal Figure 3-10. (Continued) standing Energy Bills 107 rate has a demand meter with an interval greater mpany shall have a reasonable time to change the service under this ral 15 minutes, the com metering device. Determination of billine demand charge is based above corrected for the Clause, provided that 656 of the highest on power factor previo the current month. ling demand: The Billing Demand upon which the based shall be the Maximum Demand as determined for the power factor, as set forth under the Power Factor d that no billing demand shall be considered as less than best on-peak season maximum demand corrected for the reviously determined during the 12 months ending with Power factor clause: T such manner that the pe When the average power fa ment of lagging rea ing Demand shall use: The consumer shall at all times take and use power in or that the power factor shall be as nearly 100% as possible, but erage power factor as determined by continuous measure- Lagging reactive kilovoltampere hours is less than 80%, the Bill- and shall be determined by multiplying the Maximum Demand, by the demand meter for the billing period, by 80 and dividing duct thus obtained by the actual average power factor expressed percent. The company may, at its option, use for adjustment the power e as determined by tests during periods of normal operation of the consumer's equipment instead of the average power factor. Fuel cost adjustment: The rate as stated above is based on an average cost of $1.60/million Btu for the cost of fuel burned at the company's thermal generating plants. The monthly bill as calculated under the above rate shall be increased or decreased for each kWh consumed by an amont com puted in accordance with the following formula: (BC)-D POCY F.A. = A* 106 $+ os - Y * fuel cost adjustment factor (expressed in $/kWh) to be ap- plied per kWh consumed weighted average Btu/kWh for net generation from the company's thermal plants during the second calendar month preceding the end of the billing period for which the kWh usage is billed Figure 3-10. (Continued) of paint bi the end of the dits, refunds, or received by the d from the cost amount by which the average cost of fuel per million R during the second calendar month preceding the end of billing period for which the kWh usage is billed excee or is less than $160/million Btu; any credits, refund allowances on previously purchased fuel, received bu company from any source, shall be deducted from a of fuel before calculating B each month generation from second calendar C -ratio company's thermal probe billing period for which the beration from all the neration owned by the generation and pur- ratio (expressed decimally) of the total net generatio all the company's thermal plants during the second month preceding the end of the billing period for wh kWh usage is billed to the total net generation from company's plants including hydro generation owned company or kW produced by hydro generation chased by the company during the same period - the amount of fuel cost per million Btu embedded base rate is $2.30 P - the capacity and energy cost of electricity purchased Company, excluding any cost associated with "OC," during the second calendar month preceding the current billine month, excluding any capacity purchased in said month and recovered pursuant to Standard Rate Schedule PCR-1. = total kWh generated by the company plus total kWh pur- chased by the company which are associated with the cost included in "T" during the second calendar month preced- ing the end of the billing period for which kWh use is billed OC - the difference between the cost of cogenerated power and company-generated power (Note that this factor has been simplified for purposes of this book.) Os - the company's appropriate Oklahoma retail kWh sales dur ing the twelfth billing month preceding the current line month - a factor (expressed in $/kWh) to reflect 90% of the profits) from the non-firm off-system sales of elecu other utilities during the 2nd calendar month pre of the billing period for which the kWh usage is 90% of the margin sales of electricity to nth preceding the usage is billed Figure 3-10. (Continued) Franchise payment: Pursuant to er Number 104932 of the Corpora chise taxes or payments (b Cruired by a franchise or other onder of gross revernoma, fran- Sectors of a municipality, to be paid by thence approved behin excess of nt to Order Number 110730 and Rule 54(a) of be Corporation Commission of Oklahoma, fran- ents (based on a percent of gross revenue) in excess of or other ordinance approved by the qualified ipality, to be paid by the company to the municipality, rata as a percentage of charges for electric service, as be bills of all consumers receiving service from the hin the corporate limits of the municipality exacting the said will be added pro rata as a separate item, to the bill company within the tax or payment onsumers for electric nicipality distribution, or secondary service: For purposes of this rate. Tansmission, distributio the following shall apply: Transmission service sion service (service level 1), shall mean service at any nominal nd voltage of the company above 50 kV where service is rendered through a direct tap to a company's transmission source. Distribution service (service levels 2,3, and 4), shall mean service at any nominal standard voltage of the company between 2,000 volts and 50 KV, both inclusive, where service is rendered through a direct tap to a compa- ny's distribution line or through a company numbered substation. Secondary service (service level 5), shall mean service at any nominal standard voltage of the company less than 2,000 volts or at voltages from 2 to 50 kV where service is rendered through a company-owned line transformer. If the company chooses to install its metering equipment on the load side of the consumer's transformers, the kWh billed shall be in- creased by the amount of the transformer losses calculated as follows: 1% of the total kVA rating of the consumer's transformers 730 hours but longer contrac investments by the compa calculated in accordan mula and its terms ar the commission. Contracts under this schedule shall be for not less than 1 year, ger contracts subiect also to special minimum guarantees may be sary in cases warranted by special circumstances or unus the company. Such special minimum guarantees shall be accordance with the company's allowable expenditure for- erms and conditions of service on file with and approved by Figure 3-10. (Concluded) Do some energy and cost saving analysis if ice storage is to be adopted for Air conditioning purposes for a space that has a sensible cooling load of 100 kW and a latent heat load of 12 kW. The system is a CAV system with a design air flow rate of 25 kg/s. Consider outdoor air to be at 30 C and 80%. Indoor is at 24 C and 50%. Consider no air circulation; only air from outdoor enters the space. The HVAC system operates for 6 hours a day for 20 days per month. Make any assumption you feel appropriate. . At which rate heat need to be removed from the supplied air? . Assume that 50% of the cooling is to be realized by ice stored for that purpose. How much ice you need to generate every day? If ice is generated during off-peak times during the night, use Fig. 3-10 level 5 to estimate the saving you achieve by using ice to cool down outdoor air to the desired supply condition. Discuss the problems associated with implementing the ice-making system, whether feasible or not technically!! What would be required! in: All territories served 105 active in: Allt ght service. Alternating current. Service will be cation at one voltage. No resale, breakdown, auxilia sailability Power and light rendered at one locatie or supplementary se olementary service permitted. Transmission service (service level 1): Customer charge: $637.00/bill/month Demand charge applicable to all kW/month of billing demand: On-peak season: $10.59/kW Off-peak season: $3.84/kW Energy charge: First two million kWh 3.257/kWh All kWh over two million 2.915/kWh B. Distribution service (service level 2): Customer charge: $637.00/bill/month Demand charge applicable to all kW/month of billing demand: On-peak season: $11.99/kW Off-peak season: $4.36/kW Energy charge: First two million kWh 3.297/kWh All kWh over two million 2.951/kWh distribution service (service levels 3 and 4): sustomer charge: $269.00/bill/month and charge applicable to all kW/month of billing demand: On-peak season: Off-peak season: $12.22/kW $4.45/kW Figure 3-10. ly! (Courtesy of 3-10. Typical small industrial rate schedule. esy of Oklahoma Gas and Electric Company) Energy charge: First two million kWh 3.431c/kWh All kWh over two million 3.010e/kWh D. Secondary service (service level 5): Customer change: 5151.00/bill/month Demand charge applicable to all kW/month of billing demand: On-peak season: $13.27/kW Off-peak season: $4.82/kW Energy change: First two million kWh 3.528/kWh All kWh over two million 3.113/kWh Definition of season: On-peak season: Off-peak season: s of November of any year Revenue months of June-October of any year Revenue months of November of any through May of the succeeding year. Late payment charge: A late payment charge in an amount equal to one and one-half percent (1-1/2%) of the total balance for services and charos remaining unpaid on the due date stated on the bill shall be added to the amount due. The due date shall be twenty (20) days after the bill is mailed. Minimum bill: The minimum monthly bill shall be the Customer Charge plus the applicable Capacity Charge as computed under the above sched ule. The Company shall specify a larger minimum monthly bill, calculated in accordance with the Company's Allowable Expenditure Formula in is Terms and Conditions of Service on file with and approved by the com mission, when necessary to justify the investment required to provide service. Determination of maximum demand: The consumer's Maximum mand shall be the maximum rate at which energy is used for any per fifteen (15) consecutive minutes of the month for which the bill is as shown by the Company's demand meter. In the event a consum bill is rendered ent a consumer tal Figure 3-10. (Continued) standing Energy Bills 107 rate has a demand meter with an interval greater mpany shall have a reasonable time to change the service under this ral 15 minutes, the com metering device. Determination of billine demand charge is based above corrected for the Clause, provided that 656 of the highest on power factor previo the current month. ling demand: The Billing Demand upon which the based shall be the Maximum Demand as determined for the power factor, as set forth under the Power Factor d that no billing demand shall be considered as less than best on-peak season maximum demand corrected for the reviously determined during the 12 months ending with Power factor clause: T such manner that the pe When the average power fa ment of lagging rea ing Demand shall use: The consumer shall at all times take and use power in or that the power factor shall be as nearly 100% as possible, but erage power factor as determined by continuous measure- Lagging reactive kilovoltampere hours is less than 80%, the Bill- and shall be determined by multiplying the Maximum Demand, by the demand meter for the billing period, by 80 and dividing duct thus obtained by the actual average power factor expressed percent. The company may, at its option, use for adjustment the power e as determined by tests during periods of normal operation of the consumer's equipment instead of the average power factor. Fuel cost adjustment: The rate as stated above is based on an average cost of $1.60/million Btu for the cost of fuel burned at the company's thermal generating plants. The monthly bill as calculated under the above rate shall be increased or decreased for each kWh consumed by an amont com puted in accordance with the following formula: (BC)-D POCY F.A. = A* 106 $+ os - Y * fuel cost adjustment factor (expressed in $/kWh) to be ap- plied per kWh consumed weighted average Btu/kWh for net generation from the company's thermal plants during the second calendar month preceding the end of the billing period for which the kWh usage is billed Figure 3-10. (Continued) of paint bi the end of the dits, refunds, or received by the d from the cost amount by which the average cost of fuel per million R during the second calendar month preceding the end of billing period for which the kWh usage is billed excee or is less than $160/million Btu; any credits, refund allowances on previously purchased fuel, received bu company from any source, shall be deducted from a of fuel before calculating B each month generation from second calendar C -ratio company's thermal probe billing period for which the beration from all the neration owned by the generation and pur- ratio (expressed decimally) of the total net generatio all the company's thermal plants during the second month preceding the end of the billing period for wh kWh usage is billed to the total net generation from company's plants including hydro generation owned company or kW produced by hydro generation chased by the company during the same period - the amount of fuel cost per million Btu embedded base rate is $2.30 P - the capacity and energy cost of electricity purchased Company, excluding any cost associated with "OC," during the second calendar month preceding the current billine month, excluding any capacity purchased in said month and recovered pursuant to Standard Rate Schedule PCR-1. = total kWh generated by the company plus total kWh pur- chased by the company which are associated with the cost included in "T" during the second calendar month preced- ing the end of the billing period for which kWh use is billed OC - the difference between the cost of cogenerated power and company-generated power (Note that this factor has been simplified for purposes of this book.) Os - the company's appropriate Oklahoma retail kWh sales dur ing the twelfth billing month preceding the current line month - a factor (expressed in $/kWh) to reflect 90% of the profits) from the non-firm off-system sales of elecu other utilities during the 2nd calendar month pre of the billing period for which the kWh usage is 90% of the margin sales of electricity to nth preceding the usage is billed Figure 3-10. (Continued) Franchise payment: Pursuant to er Number 104932 of the Corpora chise taxes or payments (b Cruired by a franchise or other onder of gross revernoma, fran- Sectors of a municipality, to be paid by thence approved behin excess of nt to Order Number 110730 and Rule 54(a) of be Corporation Commission of Oklahoma, fran- ents (based on a percent of gross revenue) in excess of or other ordinance approved by the qualified ipality, to be paid by the company to the municipality, rata as a percentage of charges for electric service, as be bills of all consumers receiving service from the hin the corporate limits of the municipality exacting the said will be added pro rata as a separate item, to the bill company within the tax or payment onsumers for electric nicipality distribution, or secondary service: For purposes of this rate. Tansmission, distributio the following shall apply: Transmission service sion service (service level 1), shall mean service at any nominal nd voltage of the company above 50 kV where service is rendered through a direct tap to a company's transmission source. Distribution service (service levels 2,3, and 4), shall mean service at any nominal standard voltage of the company between 2,000 volts and 50 KV, both inclusive, where service is rendered through a direct tap to a compa- ny's distribution line or through a company numbered substation. Secondary service (service level 5), shall mean service at any nominal standard voltage of the company less than 2,000 volts or at voltages from 2 to 50 kV where service is rendered through a company-owned line transformer. If the company chooses to install its metering equipment on the load side of the consumer's transformers, the kWh billed shall be in- creased by the amount of the transformer losses calculated as follows: 1% of the total kVA rating of the consumer's transformers 730 hours but longer contrac investments by the compa calculated in accordan mula and its terms ar the commission. Contracts under this schedule shall be for not less than 1 year, ger contracts subiect also to special minimum guarantees may be sary in cases warranted by special circumstances or unus the company. Such special minimum guarantees shall be accordance with the company's allowable expenditure for- erms and conditions of service on file with and approved by Figure 3-10. (Concluded)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts