Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the final part. please help! Winter Company has organized its accounts receivable by customer and how long each receivable has been outstanding. Winter

this is the final part. please help!

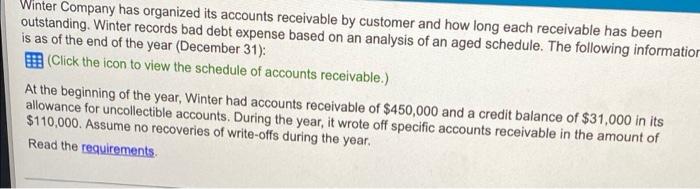

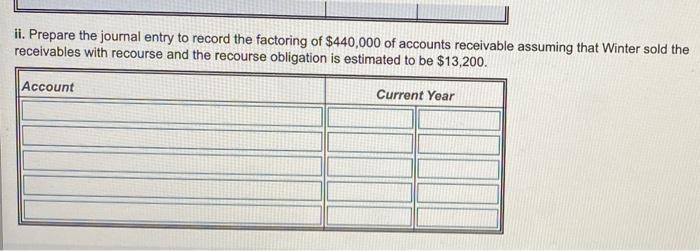

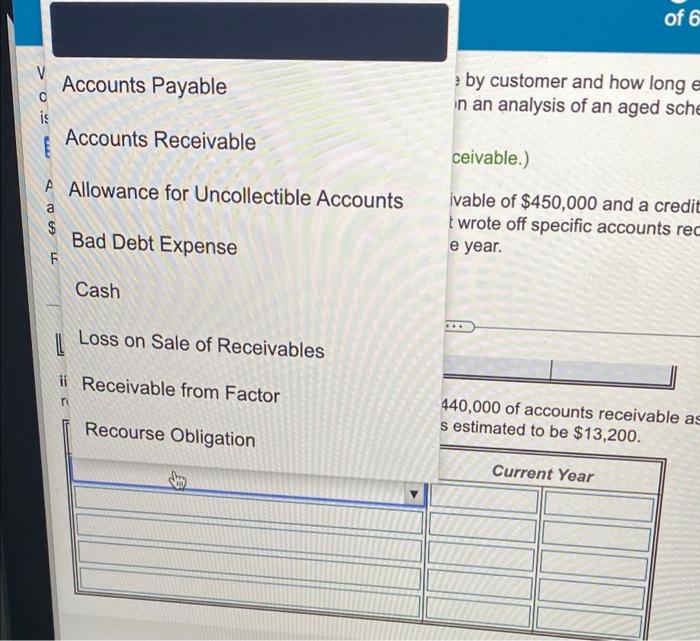

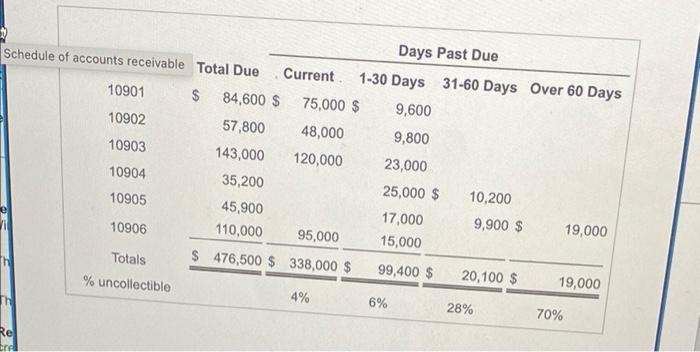

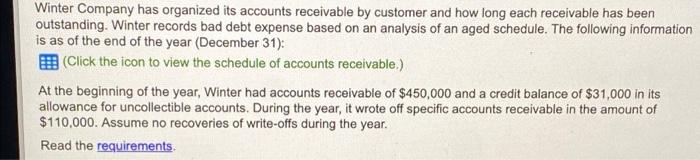

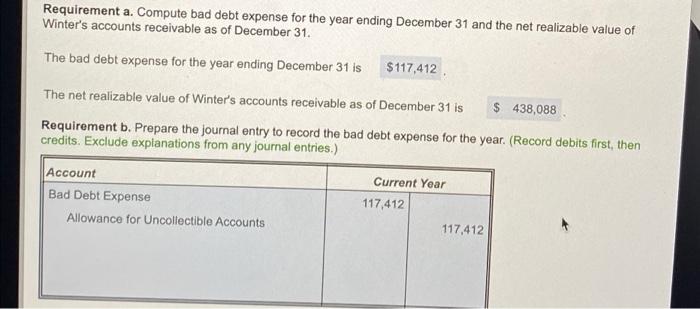

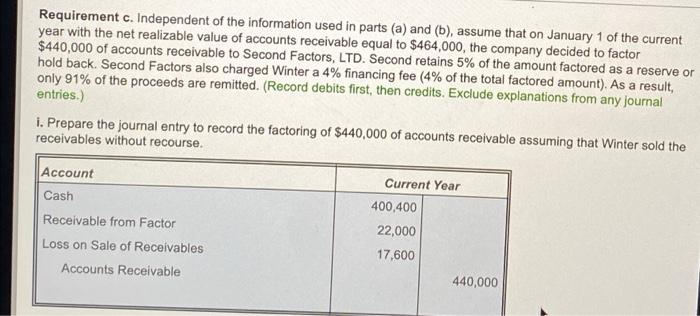

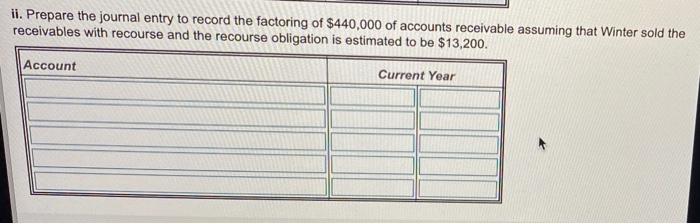

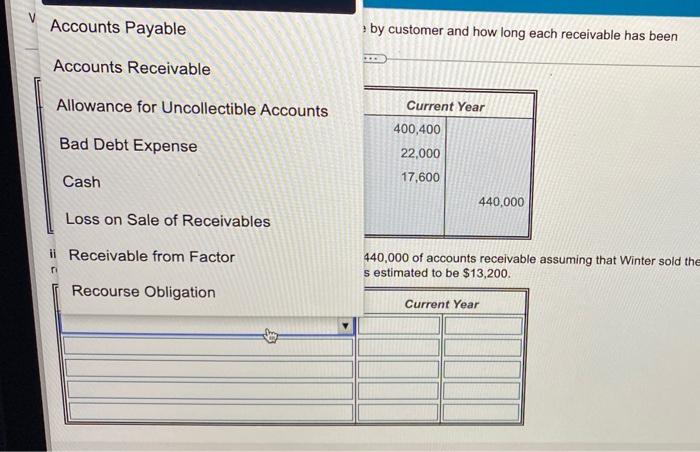

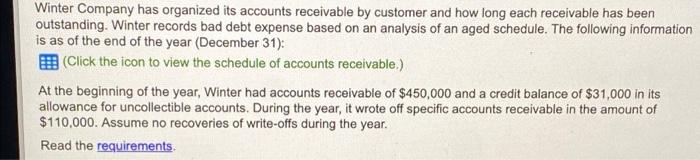

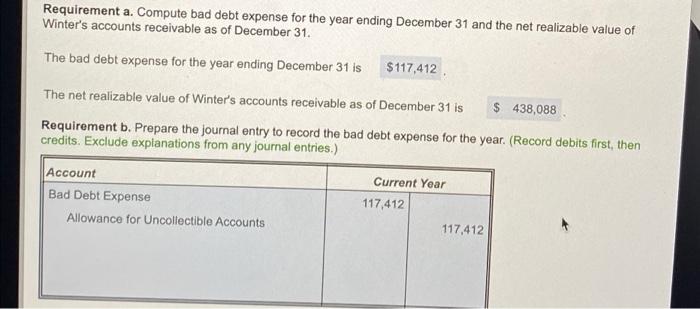

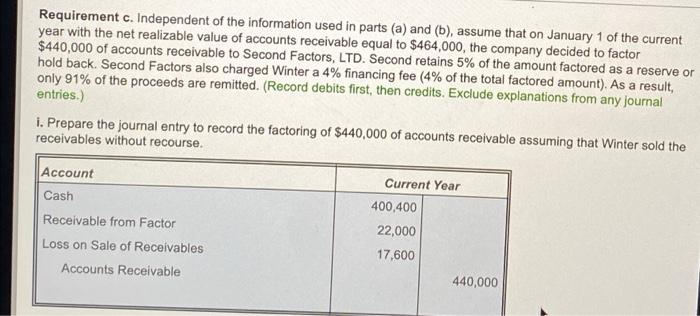

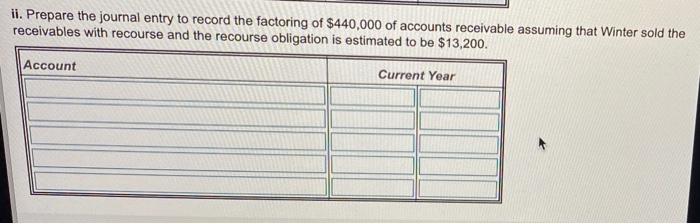

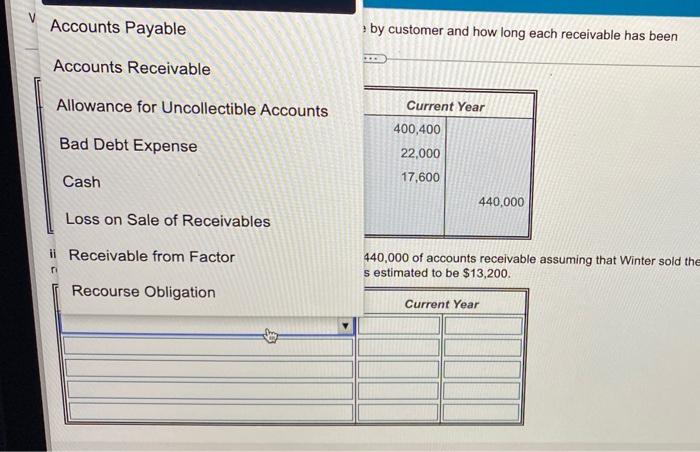

Winter Company has organized its accounts receivable by customer and how long each receivable has been outstanding. Winter records bad debt expense based on an analysis of an aged schedule. The following information is as of the end of the year (December 31): Click the icon to view the schedule of accounts receivable.) At the beginning of the year, Winter had accounts receivable of $450,000 and a credit balance of $31,000 in its allowance for uncollectible accounts. During the year, it wrote off specific accounts receivable in the amount of $110,000. Assume no recoveries of write-offs during the year. Read the requirements. ii. Prepare the journal entry to record the factoring of $440,000 of accounts receivable assuming that Winter sold the receivables with recourse and the recourse obligation is estimated to be $13,200. Account Current Year of 6 Accounts Payable by customer and how long e an analysis of an aged sche is Vue Accounts Receivable ceivable.) Allowance for Uncollectible Accounts CU a $ ivable of $450,000 and a credit I wrote off specific accounts rec e year. Bad Debt Expense F Cash Loss on Sale of Receivables ii Receivable from Factor 440,000 of accounts receivable as s estimated to be $13,200. Recourse Obligation Current Year Days Past Due Schedule of accounts receivable Total Due Current 1-30 Days 31-60 Days Over 60 Days 10901 $ 84,600 $ 75,000 $ 9,600 10902 57,800 48,000 9,800 10903 143,000 120,000 23,000 10904 35,200 25,000 $ 10,200 10905 45,900 17,000 9,900 $ 19,000 10906 110,000 95,000 15,000 Totals $ 476,500 $ 338,000 $ 99,400 $ 20,100 $ 19,000 % uncollectible 4% 6% 28% 70% Re Winter Company has organized its accounts receivable by customer and how long each receivable has been outstanding. Winter records bad debt expense based on an analysis of an aged schedule. The following information is as of the end of the year (December 31): Click the icon to view the schedule of accounts receivable.) At the beginning of the year, Winter had accounts receivable of $450,000 and a credit balance of $31,000 in its allowance for uncollectible accounts. During the year, it wrote off specific accounts receivable in the amount of $110,000. Assume no recoveries of write-offs during the year. Read the requirements Requirement a. Compute bad debt expense for the year ending December 31 and the net realizable value of Winter's accounts receivable as of December 31. The bad debt expense for the year ending December 31 is $ 117,412 The net realizable value of Winter's accounts receivable as of December 31 is 438,088 Requirement b. Prepare the journal entry to record the bad debt expense for the year. (Record debits first, then credits. Exclude explanations from any journal entries.) Current Year Account Bad Debt Expense Allowance for Uncollectible Accounts 117,412 117,412 Requirement c. Independent of the information used in parts (a) and (b), assume that on January 1 of the current year with the net realizable value of accounts receivable equal to $464,000, the company decided to factor $440,000 of accounts receivable to Second Factors, LTD. Second retains 5% of the amount factored as a reserve or hold back. Second Factors also charged Winter a 4% financing fee (4% of the total factored amount). As a result, only 91% of the proceeds are remitted. (Record debits first, then credits. Exclude explanations from any journal entries.) I. Prepare the journal entry to record the factoring of $440,000 of accounts receivable assuming that Winter sold the receivables without recourse. Account Cash Receivable from Factor Loss on Sale of Receivables Accounts Receivable Current Year 400,400 22,000 17,600 440,000 ii. Prepare the journal entry to record the factoring of $440,000 of accounts receivable assuming that Winter sold the receivables with recourse and the recourse obligation is estimated to be $13,200. Account Current Year by customer and how long each receivable has been Accounts Payable Accounts Receivable Allowance for Uncollectible Accounts Current Year 400,400 22.000 Bad Debt Expense Cash 17,600 440,000 Loss on Sale of Receivables ii Receivable from Factor 440,000 of accounts receivable assuming that Winter sold the s estimated to be $13,200. Recourse Obligation Current Year they

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started