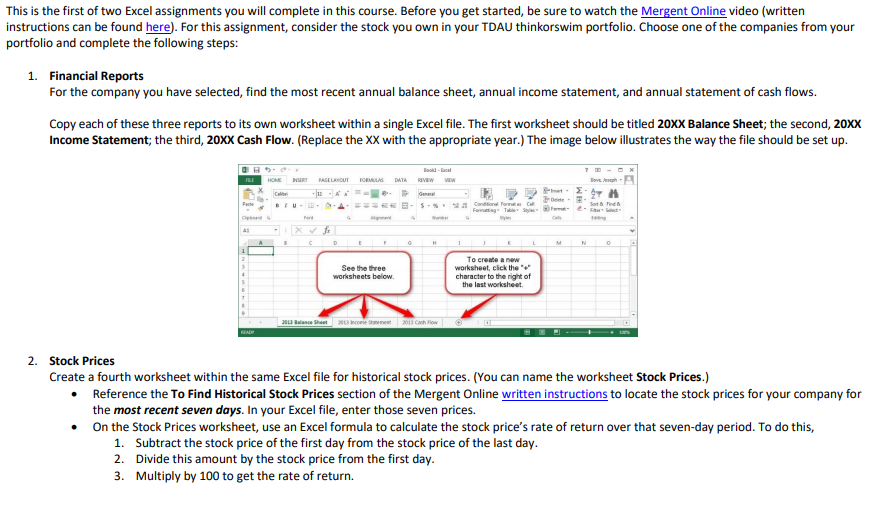

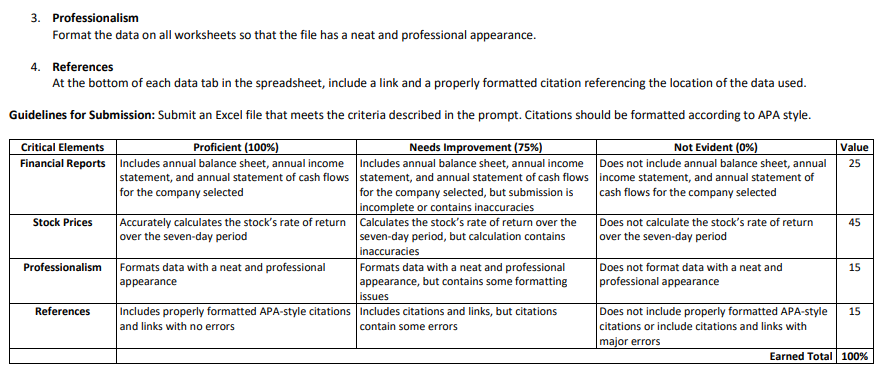

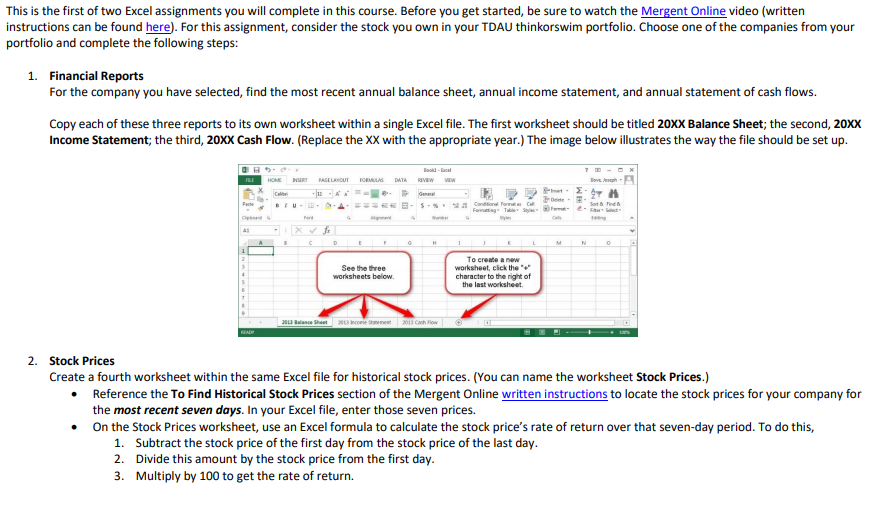

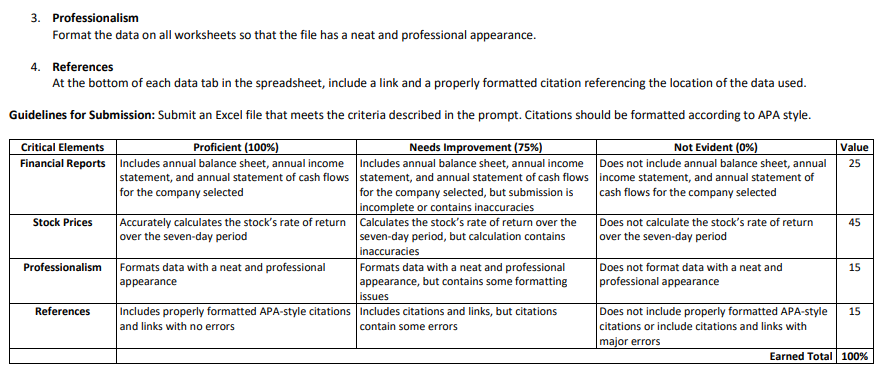

This is the first of two Excel assignments you will complete in this course. Before you get started, be sure to watch the Mergent Online video (written instructions can be found here). For this assignment, consider the stock you own in your TDAU thinkorswim portfolio. Choose one of the companies from your portfolio and complete the following steps: 1. Financial Reports For the company you have selected, find the most recent annual balance sheet, annual income statement, and annual statement of cash flows. Copy each of these three reports to its own worksheet within a single Excel file. The first worksheet should be titled 20XX Balance Sheet; the second, 20XX Income Statement; the third, 20XX Cash Flow. (Replace the XX with the appropriate year.) The image below illustrates the way the file should be set up. RE HOMEN AGELUI FORMAS DIARY WEW AH See the three worksheets below. To create a new worksheet, click the " character to the right of the last worksheet lance Sheet 2013 Carch 2. Stock Prices Create a fourth worksheet within the same Excel file for historical stock prices. (You can name the worksheet Stock Prices.) Reference the To Find Historical Stock Prices section of the Mergent Online written instructions to locate the stock prices for your company for the most recent seven days. In your Excel file, enter those seven prices. On the Stock Prices worksheet, use an Excel formula to calculate the stock price's rate of return over that seven-day period. To do this, 1. Subtract the stock price of the first day from the stock price of the last day. 2. Divide this amount by the stock price from the first day. 3. Multiply by 100 to get the rate of return. 3. Professionalism Format the data on all worksheets so that the file has a neat and professional appearance. 4. References At the bottom of each data tab in the spreadsheet, include a link and a properly formatted citation referencing the location of the data used. Guidelines for Submission: Submit an Excel file that meets the criteria described in the prompt. Citations should be formatted according to APA style. Critical Elements Financial Reports Stock Prices Proficient (100%) Needs Improvement (75%) Not Evident (0%) Value Includes annual balance sheet, annual income Includes annual balance sheet, annual income Does not include annual balance sheet, annual statement, and annual statement of cash flows statement, and annual statement of cash flows income statement, and annual statement of for the company selected the company selected, but submission is cash flows for the company selected incomplete or contains inaccuracies Accurately calculates the stock's rate of return Calculates the stock's rate of return over the Does not calculate the stock's rate of return over the seven-day period seven-day period, but calculation contains over the seven-day period inaccuracies Formats data with a neat and professional Formats data with a neat and professional Does not format data with a neat and appearance appearance, but contains some formatting professional appearance issues Includes properly formatted APA-style citations Includes citations and links, but citations Does not include properly formatted APA-style 15 and links with no errors contain some errors citations or include citations and links with major errors Earned Total 100% Professionalism References This is the first of two Excel assignments you will complete in this course. Before you get started, be sure to watch the Mergent Online video (written instructions can be found here). For this assignment, consider the stock you own in your TDAU thinkorswim portfolio. Choose one of the companies from your portfolio and complete the following steps: 1. Financial Reports For the company you have selected, find the most recent annual balance sheet, annual income statement, and annual statement of cash flows. Copy each of these three reports to its own worksheet within a single Excel file. The first worksheet should be titled 20XX Balance Sheet; the second, 20XX Income Statement; the third, 20XX Cash Flow. (Replace the XX with the appropriate year.) The image below illustrates the way the file should be set up. RE HOMEN AGELUI FORMAS DIARY WEW AH See the three worksheets below. To create a new worksheet, click the " character to the right of the last worksheet lance Sheet 2013 Carch 2. Stock Prices Create a fourth worksheet within the same Excel file for historical stock prices. (You can name the worksheet Stock Prices.) Reference the To Find Historical Stock Prices section of the Mergent Online written instructions to locate the stock prices for your company for the most recent seven days. In your Excel file, enter those seven prices. On the Stock Prices worksheet, use an Excel formula to calculate the stock price's rate of return over that seven-day period. To do this, 1. Subtract the stock price of the first day from the stock price of the last day. 2. Divide this amount by the stock price from the first day. 3. Multiply by 100 to get the rate of return. 3. Professionalism Format the data on all worksheets so that the file has a neat and professional appearance. 4. References At the bottom of each data tab in the spreadsheet, include a link and a properly formatted citation referencing the location of the data used. Guidelines for Submission: Submit an Excel file that meets the criteria described in the prompt. Citations should be formatted according to APA style. Critical Elements Financial Reports Stock Prices Proficient (100%) Needs Improvement (75%) Not Evident (0%) Value Includes annual balance sheet, annual income Includes annual balance sheet, annual income Does not include annual balance sheet, annual statement, and annual statement of cash flows statement, and annual statement of cash flows income statement, and annual statement of for the company selected the company selected, but submission is cash flows for the company selected incomplete or contains inaccuracies Accurately calculates the stock's rate of return Calculates the stock's rate of return over the Does not calculate the stock's rate of return over the seven-day period seven-day period, but calculation contains over the seven-day period inaccuracies Formats data with a neat and professional Formats data with a neat and professional Does not format data with a neat and appearance appearance, but contains some formatting professional appearance issues Includes properly formatted APA-style citations Includes citations and links, but citations Does not include properly formatted APA-style 15 and links with no errors contain some errors citations or include citations and links with major errors Earned Total 100% Professionalism References