This is the followup question about my last 5 questions. and this have additional information that you have asked.

And this is basically the template in which he wants answer. so i have to follow this template please.

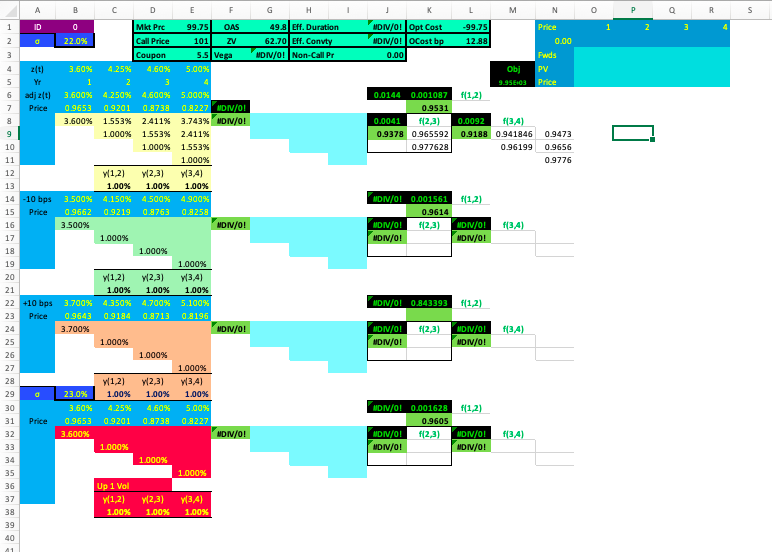

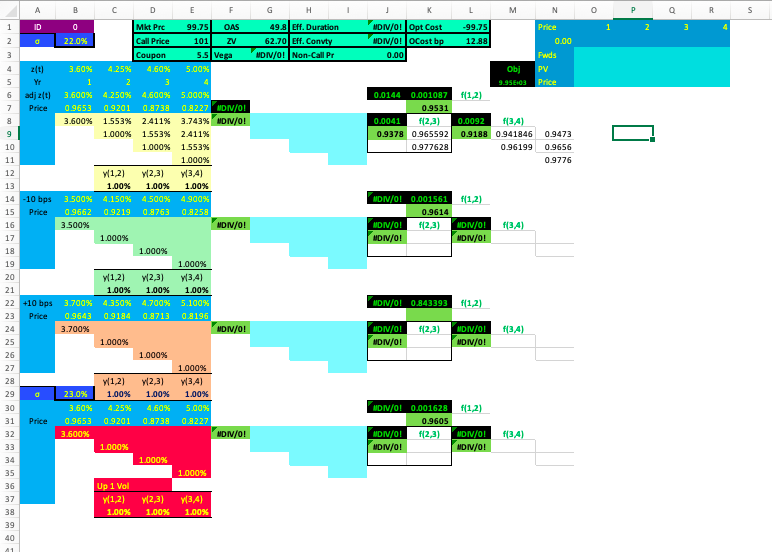

In cell E1 you see the market price - $99.75. That's the price for the bond we observe in the market and OAS tells us how much extra spread we are earning when taking into account that the bond is callable. You use volatility to calibrate the one-step forward rates such that they are consistent with the zero coupon bond prices given in cells B-E row 6. Time horizon is 4 years (project is 7 years). Not sure what you mean by risk free rate.

A B C G H 49.8 Eff. Duration 62.70 Eff. Convty NDIV/0! Non-Call Pr 1 2 -99.75 12.88 3 4 D Mkt Pre Call Price Coupon 4.60% 2 E F 99.75 OAS 101 V 5.Vega 5.00% 22.0% NDIV/0! Opt Cost DIV/0! Cost bp 0 .00 Price 0.00 Pwds Py Price z(t) 3.60% 4.25% obj 9.95103 f(1.2) adiz/t) Price 3.600% 0.9653 3.600% 4.250% 0.9201 1553% 1.000% 4.600% 0.8738 2.411% 1553% 1.000% 0.0144 0.001087 0.9531 0.0041 f/2,3) 0.9378 0.965592 0.977628 0.0092 f(34) 0.9188 0.941846 0.96199 5.0009 0.8227 DIV/0! 3.743% NDIV/0! 2.411% 1553% 1.000% 3.4) 1.00% 4.900% 0.3258 DIV/0! 0.9473 0.9656 0.9776 723) 1.00% 4.500% 0.8763 f(12) 14 -10 bps 15 Price 91,2) 1.00% 3.500% 4.150% 0.96620.9219 3.500% 1.000% DIV/0! 0.001561 0.9614 DIV/0! f/2,3) MDIV/0! f/3.4) UDIV/! DIV/0! 1.000% 72,3) 100% 4.700% 0.8713 1.000% 3.4) 1.00% 5.100% 0.8196 DIV/0! 0.843393 91,2) 1.00% 3.700% 4.350% 0.9643 09184 3.700% 1.000% F(1,2) 22 +10 bps 23 Price DIVO! DIV/0! MDIV/0! f/2,3) DIV/0! NDIV/0! f(34) 1.000% 23.0% 3.60% 0.9653 3.60094 91,2) 1.00% 4.25% 0.9201 72,3) 100% 4.60% 0.8738 1.000% 3,4) 100% 5.00% 0.8227 f(1,2) Price DIV/0! 0.001628 0.9605 ADIV/0! f(2,3) MDIV/0! MDIV/0! f(3.4) UDIV/0! NDIV/0! 1.000% 1.000% 1.000% Up 1 Vol (1,2) 1.00% 12,3) 1.00% (3.4) 1.00% A B C G H 49.8 Eff. Duration 62.70 Eff. Convty NDIV/0! Non-Call Pr 1 2 -99.75 12.88 3 4 D Mkt Pre Call Price Coupon 4.60% 2 E F 99.75 OAS 101 V 5.Vega 5.00% 22.0% NDIV/0! Opt Cost DIV/0! Cost bp 0 .00 Price 0.00 Pwds Py Price z(t) 3.60% 4.25% obj 9.95103 f(1.2) adiz/t) Price 3.600% 0.9653 3.600% 4.250% 0.9201 1553% 1.000% 4.600% 0.8738 2.411% 1553% 1.000% 0.0144 0.001087 0.9531 0.0041 f/2,3) 0.9378 0.965592 0.977628 0.0092 f(34) 0.9188 0.941846 0.96199 5.0009 0.8227 DIV/0! 3.743% NDIV/0! 2.411% 1553% 1.000% 3.4) 1.00% 4.900% 0.3258 DIV/0! 0.9473 0.9656 0.9776 723) 1.00% 4.500% 0.8763 f(12) 14 -10 bps 15 Price 91,2) 1.00% 3.500% 4.150% 0.96620.9219 3.500% 1.000% DIV/0! 0.001561 0.9614 DIV/0! f/2,3) MDIV/0! f/3.4) UDIV/! DIV/0! 1.000% 72,3) 100% 4.700% 0.8713 1.000% 3.4) 1.00% 5.100% 0.8196 DIV/0! 0.843393 91,2) 1.00% 3.700% 4.350% 0.9643 09184 3.700% 1.000% F(1,2) 22 +10 bps 23 Price DIVO! DIV/0! MDIV/0! f/2,3) DIV/0! NDIV/0! f(34) 1.000% 23.0% 3.60% 0.9653 3.60094 91,2) 1.00% 4.25% 0.9201 72,3) 100% 4.60% 0.8738 1.000% 3,4) 100% 5.00% 0.8227 f(1,2) Price DIV/0! 0.001628 0.9605 ADIV/0! f(2,3) MDIV/0! MDIV/0! f(3.4) UDIV/0! NDIV/0! 1.000% 1.000% 1.000% Up 1 Vol (1,2) 1.00% 12,3) 1.00% (3.4) 1.00%