Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the full question The following extract of the audited Equity section of the Statement of Financial Position of Bass Industries (Pty) Ltd as

this is the full question

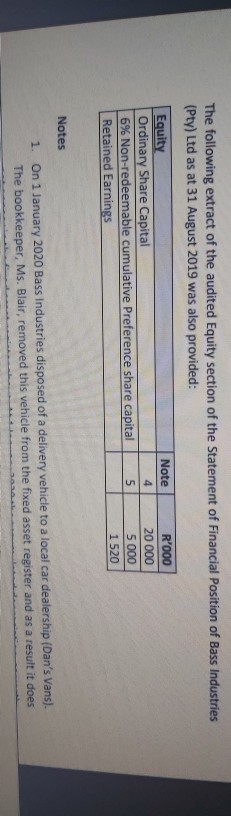

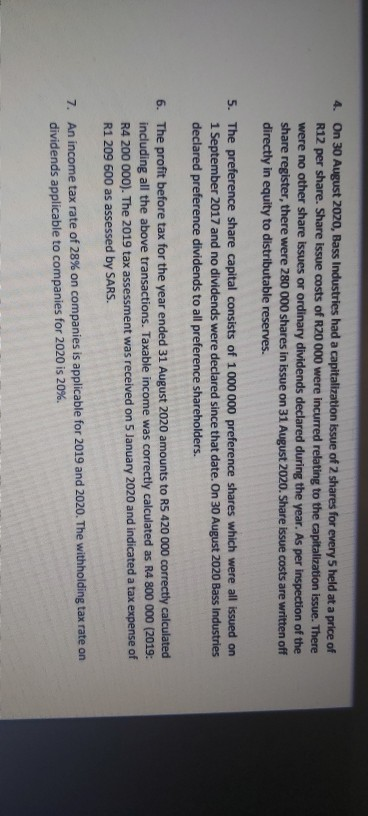

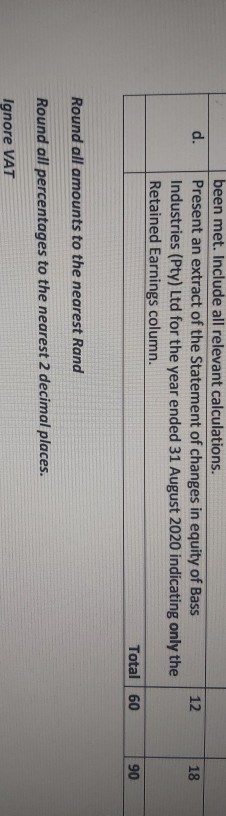

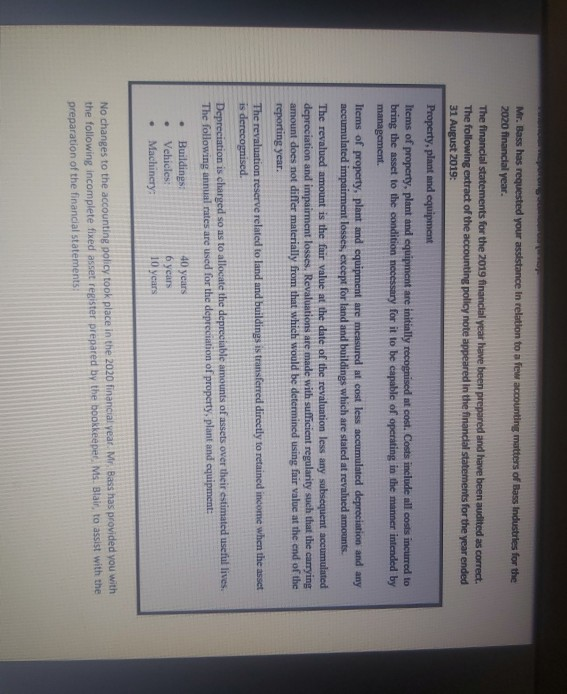

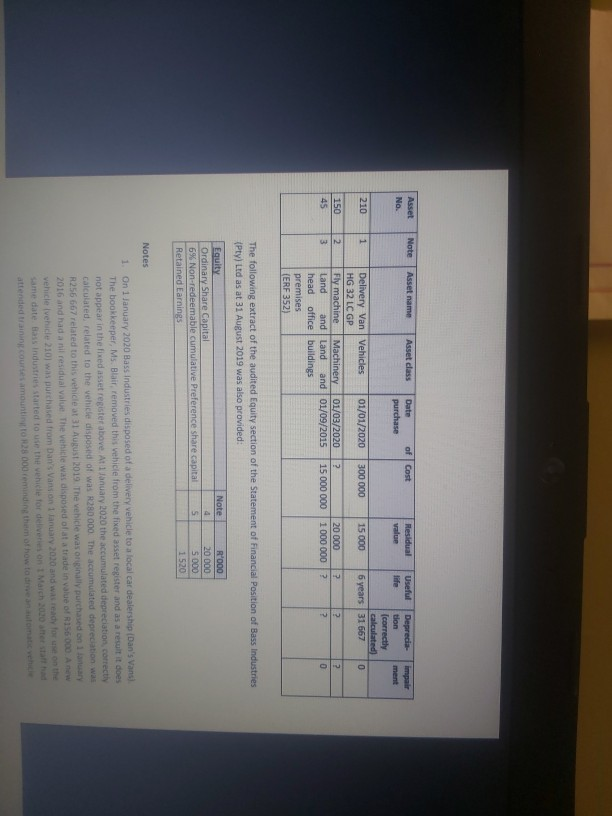

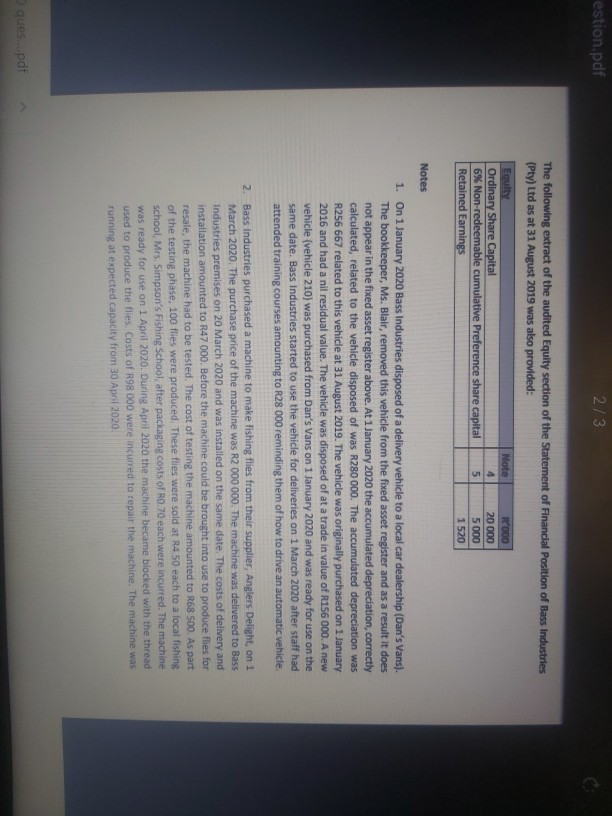

The following extract of the audited Equity section of the Statement of Financial Position of Bass Industries (Pty) Ltd as at 31 August 2019 was also provided: Equity Ordinary Share Capital 6% Non-redeemable cumulative Preference share capital Retained Earnings Note 4 5 R'000 20 000 5 000 1 520 Notes 1. On 1 January 2020 Bass Industries disposed of a delivery vehicle to a local car dealership (Dan's Vans). The bookkeeper, Ms. Blair, removed this vehicle from the fixed asset register and as a result it does 4. On 30 August 2020, Bass Industries had a capitalization issue of 2 shares for every 5 held at a price of R12 per share. Share issue costs of R20 000 were incurred relating to the capitalization issue. There were no other share issues or ordinary dividends declared during the year. As per inspection of the share register, there were 280 000 shares in issue on 31 August 2020. Share issue costs are written off directly in equity to distributable reserves. 5. The preference share capital consists of 1 000 000 preference shares which were all issued on 1 September 2017 and no dividends were declared since that date. On 30 August 2020 Bass Industries declared preference dividends to all preference shareholders. 6. The profit before tax for the year ended 31 August 2020 amounts to R5 420 000 correctly calculated including all the above transactions. Taxable income was correctly calculated as R4 800 000 (2019: R4 200 000). The 2019 tax assessment was received on 5 January 2020 and indicated a tax expense of R1 209 600 as assessed by SARS. 7. An income tax rate of 28% on companies is applicable for 2019 and 2020. The withholding tax rate on dividends applicable to companies for 2020 is 20%. d. 18 been met. Include all relevant calculations. Present an extract of the Statement of changes in equity of Bass 12 Industries (Pty) Ltd for the year ended 31 August 2020 indicating only the Retained Earnings column. Total 60 90 Round all amounts to the nearest Rand Round all percentages to the nearest 2 decimal places. Ignore VAT Mr. Bass has requested your assistance in relation to a few accounting matters of Bass Industries for the 2020 financial year. The financial statements for the 2019 financial year have been prepared and have been audited as correct. The following extract of the accounting policy note appeared in the financial statements for the year ended 31 August 2019: Property, plant and equipment Items of property, plant and equipment are initially recognised at cost. Costs include all costs incurred to bring the asset to the condition necessary for it to be capable of operating in the manner intended by management. Items of property, plant and equipment are measured at cost less accumulated depreciation and any accumulated impairment losses, except for land and buildings which are stated at revalued amounts. The revalued amount is the fair value at the date of the revaluation less any subsequent accumulated depreciation and impairment losses, Revaluations are made with sufficient regularity such that the carrying amount does not differ materially from that which would be determined using fair value at the end of the reporting year. The revaluation reserve related to land and buildings is transferred directly to retained income when the asset is derecognised. Depreciation is charged so as to allocate the depreciable amounts of assets over their estimated useful lives. The following annual rates are used for the depreciation of property, plant and equipment: Buildings Vehicles 6 years Machinery 10 years - 40 years . No changes to the accounting policy took place in the 2020 financial year. Mr. Bass has provided you with the following incomplete fixed asset register prepared by the bookkeeper. Ms. Blair, to assist with the preparation of the financial statements: Financial Accounting 1 August 2020 Test Question 1 (60 marles; 90 minutes) Ignore VAT Bass Industries (Pty) Ltd is a company that manufactures high quality fishing gear for fly fishing and bass fishing. The year end of the company is 31 August 2020. The financial manager, Mr. Bart Bass is currently in the process of preparing the financial statements for the 2020 financial year. Mr. Bass qualified as a CA(SA) many years ago and is struggling to remember some of the accounting standards that he studied at university. Bass Industries prepares their financial statements in accordance with the International Financial Reporting Standards (IFRS). Mr. Bass has requested your assistance in relation to a few accounting matters of Bass Industries for the 2020 financial year. The financial statements for the 2019 financial year have been prepared and have been audited as correct The following extract of the accounting policy note appeared in the financial statements for the year ended 31 August 2019 Note Asset No. Asset name Asset class af Cost Date purchase Residual value impair ment Useful Deprecia life tion (correctly calculated) 6 years 31 667 210 1 300 000 15 000 0 150 45 WIN Delivery Van Vehicles 01/01/2020 HG 32 LC GP Fly machine Machinery 01/03/2020 Land and Land and 01/09/2015 head office buildings premises (ERF352) ? 15 000 000 20 000 ? 1 000 000? 2 2 2 0 The following extract of the audited Equity section of the Statement of Financial Position of Bass Industries (Pty) Ltd as at 31 August 2019 was also provided: Equity Ordinary Share Capital 6% Non-redeemable cumulative Preference share capital Retained Earnings Note 4 5 R'000 20 000 5 000 1520 Notes 1. On 1 January 2020 Bass industries disposed of a delivery vehicle to a local car dealership (Dan's Vans) The bookkeeper, Ms. Blair removed this vehicle from the fixed asset register and as a result it does not appear in the fixed asset register above. At January 2020 the accumulated depreciation correctly calculated, related to the vehicle disposed of was R280 000. The accumulated depreciation was R256 667 related to this vehicle at 31 August 2019 The vehicle was originally purchased on vary 2016 and had a nil residual value the vehicle was disposed of at a trade in value of R156 000. A new vehicle vehicle 210) was purchased from Dan's Vansion 1 January 2010 and was ready for use on the same date and industries started to use the vehicle for deliveries on March 200tet started estion.pdf 2/3 The following extract of the audited Equity section of the Statement of Financial Position of Bass Industries (Pty) Ltd as at 31 August 2019 was also provided: Equity Note R'000 Ordinary Share Capital 4 20 000 6% Non-redeemable cumulative Preference share capital 5 000 Retained Earnings 1520 5 Notes 1. On 1 January 2020 Bass Industries disposed of a delivery vehicle to a local car dealership (Dan's Vans). The bookkeeper, Ms. Blair, removed this vehicle from the fixed asset register and as a result it does not appear in the fixed asset register above. At 1 January 2020 the accumulated depreciation, correctly calculated, related to the vehicle disposed of was R280 000. The accumulated depreciation was R256 667 related to this vehicle at 31 August 2019. The vehicle was originally purchased on 1 January 2016 and had a nil residual value. The vehicle was disposed of at a trade in value of R156 000. A new vehicle (vehicle 210) was purchased from Dan's Vans on 1 January 2020 and was ready for use on the same date. Bass Industries started to use the vehicle for deliveries on 1 March 2020 after staff had attended training courses amounting to R28 000 reminding them of how to drive an automatic vehicle 2. Bass Industries purchased a machine to make fishing flies from their supplier, Anglers Delight, on 1 March 2020. The purchase price of the machine was R2 000 000. The machine was delivered to Bass Industries premises on 20 March 2020 and was installed on the same date. The costs of delivery and installation amounted to R47 000. Before the machine could be brought into use to produce flies for resale, the machine had to be tested. The cost of testing the machine amounted to R68 500. As part of the testing phase, 100 fles were produced. These flies were sold at R4 50 each to a local fishing school, Mrs. Simpson's Fishing School, after packaging costs of R0.70 each were incurred. The machine was ready for use on 1 April 2020. During April 2020 the machine became blocked with the thread used to produce the flies Costs of R98 000 were incurred to repair the machine. The machine was running at expected capacity from 30 April 2020. ques....pdf The following extract of the audited Equity section of the Statement of Financial Position of Bass Industries (Pty) Ltd as at 31 August 2019 was also provided: Equity Ordinary Share Capital 6% Non-redeemable cumulative Preference share capital Retained Earnings Note 4 5 R'000 20 000 5 000 1 520 Notes 1. On 1 January 2020 Bass Industries disposed of a delivery vehicle to a local car dealership (Dan's Vans). The bookkeeper, Ms. Blair, removed this vehicle from the fixed asset register and as a result it does 4. On 30 August 2020, Bass Industries had a capitalization issue of 2 shares for every 5 held at a price of R12 per share. Share issue costs of R20 000 were incurred relating to the capitalization issue. There were no other share issues or ordinary dividends declared during the year. As per inspection of the share register, there were 280 000 shares in issue on 31 August 2020. Share issue costs are written off directly in equity to distributable reserves. 5. The preference share capital consists of 1 000 000 preference shares which were all issued on 1 September 2017 and no dividends were declared since that date. On 30 August 2020 Bass Industries declared preference dividends to all preference shareholders. 6. The profit before tax for the year ended 31 August 2020 amounts to R5 420 000 correctly calculated including all the above transactions. Taxable income was correctly calculated as R4 800 000 (2019: R4 200 000). The 2019 tax assessment was received on 5 January 2020 and indicated a tax expense of R1 209 600 as assessed by SARS. 7. An income tax rate of 28% on companies is applicable for 2019 and 2020. The withholding tax rate on dividends applicable to companies for 2020 is 20%. d. 18 been met. Include all relevant calculations. Present an extract of the Statement of changes in equity of Bass 12 Industries (Pty) Ltd for the year ended 31 August 2020 indicating only the Retained Earnings column. Total 60 90 Round all amounts to the nearest Rand Round all percentages to the nearest 2 decimal places. Ignore VAT Mr. Bass has requested your assistance in relation to a few accounting matters of Bass Industries for the 2020 financial year. The financial statements for the 2019 financial year have been prepared and have been audited as correct. The following extract of the accounting policy note appeared in the financial statements for the year ended 31 August 2019: Property, plant and equipment Items of property, plant and equipment are initially recognised at cost. Costs include all costs incurred to bring the asset to the condition necessary for it to be capable of operating in the manner intended by management. Items of property, plant and equipment are measured at cost less accumulated depreciation and any accumulated impairment losses, except for land and buildings which are stated at revalued amounts. The revalued amount is the fair value at the date of the revaluation less any subsequent accumulated depreciation and impairment losses, Revaluations are made with sufficient regularity such that the carrying amount does not differ materially from that which would be determined using fair value at the end of the reporting year. The revaluation reserve related to land and buildings is transferred directly to retained income when the asset is derecognised. Depreciation is charged so as to allocate the depreciable amounts of assets over their estimated useful lives. The following annual rates are used for the depreciation of property, plant and equipment: Buildings Vehicles 6 years Machinery 10 years - 40 years . No changes to the accounting policy took place in the 2020 financial year. Mr. Bass has provided you with the following incomplete fixed asset register prepared by the bookkeeper. Ms. Blair, to assist with the preparation of the financial statements: Financial Accounting 1 August 2020 Test Question 1 (60 marles; 90 minutes) Ignore VAT Bass Industries (Pty) Ltd is a company that manufactures high quality fishing gear for fly fishing and bass fishing. The year end of the company is 31 August 2020. The financial manager, Mr. Bart Bass is currently in the process of preparing the financial statements for the 2020 financial year. Mr. Bass qualified as a CA(SA) many years ago and is struggling to remember some of the accounting standards that he studied at university. Bass Industries prepares their financial statements in accordance with the International Financial Reporting Standards (IFRS). Mr. Bass has requested your assistance in relation to a few accounting matters of Bass Industries for the 2020 financial year. The financial statements for the 2019 financial year have been prepared and have been audited as correct The following extract of the accounting policy note appeared in the financial statements for the year ended 31 August 2019 Note Asset No. Asset name Asset class af Cost Date purchase Residual value impair ment Useful Deprecia life tion (correctly calculated) 6 years 31 667 210 1 300 000 15 000 0 150 45 WIN Delivery Van Vehicles 01/01/2020 HG 32 LC GP Fly machine Machinery 01/03/2020 Land and Land and 01/09/2015 head office buildings premises (ERF352) ? 15 000 000 20 000 ? 1 000 000? 2 2 2 0 The following extract of the audited Equity section of the Statement of Financial Position of Bass Industries (Pty) Ltd as at 31 August 2019 was also provided: Equity Ordinary Share Capital 6% Non-redeemable cumulative Preference share capital Retained Earnings Note 4 5 R'000 20 000 5 000 1520 Notes 1. On 1 January 2020 Bass industries disposed of a delivery vehicle to a local car dealership (Dan's Vans) The bookkeeper, Ms. Blair removed this vehicle from the fixed asset register and as a result it does not appear in the fixed asset register above. At January 2020 the accumulated depreciation correctly calculated, related to the vehicle disposed of was R280 000. The accumulated depreciation was R256 667 related to this vehicle at 31 August 2019 The vehicle was originally purchased on vary 2016 and had a nil residual value the vehicle was disposed of at a trade in value of R156 000. A new vehicle vehicle 210) was purchased from Dan's Vansion 1 January 2010 and was ready for use on the same date and industries started to use the vehicle for deliveries on March 200tet started estion.pdf 2/3 The following extract of the audited Equity section of the Statement of Financial Position of Bass Industries (Pty) Ltd as at 31 August 2019 was also provided: Equity Note R'000 Ordinary Share Capital 4 20 000 6% Non-redeemable cumulative Preference share capital 5 000 Retained Earnings 1520 5 Notes 1. On 1 January 2020 Bass Industries disposed of a delivery vehicle to a local car dealership (Dan's Vans). The bookkeeper, Ms. Blair, removed this vehicle from the fixed asset register and as a result it does not appear in the fixed asset register above. At 1 January 2020 the accumulated depreciation, correctly calculated, related to the vehicle disposed of was R280 000. The accumulated depreciation was R256 667 related to this vehicle at 31 August 2019. The vehicle was originally purchased on 1 January 2016 and had a nil residual value. The vehicle was disposed of at a trade in value of R156 000. A new vehicle (vehicle 210) was purchased from Dan's Vans on 1 January 2020 and was ready for use on the same date. Bass Industries started to use the vehicle for deliveries on 1 March 2020 after staff had attended training courses amounting to R28 000 reminding them of how to drive an automatic vehicle 2. Bass Industries purchased a machine to make fishing flies from their supplier, Anglers Delight, on 1 March 2020. The purchase price of the machine was R2 000 000. The machine was delivered to Bass Industries premises on 20 March 2020 and was installed on the same date. The costs of delivery and installation amounted to R47 000. Before the machine could be brought into use to produce flies for resale, the machine had to be tested. The cost of testing the machine amounted to R68 500. As part of the testing phase, 100 fles were produced. These flies were sold at R4 50 each to a local fishing school, Mrs. Simpson's Fishing School, after packaging costs of R0.70 each were incurred. The machine was ready for use on 1 April 2020. During April 2020 the machine became blocked with the thread used to produce the flies Costs of R98 000 were incurred to repair the machine. The machine was running at expected capacity from 30 April 2020. ques....pdf

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started