Question

This is the General Ledger of Trendz Traders on 28 February 2022before the year end adjustments were considered: These are the adjustments that need to

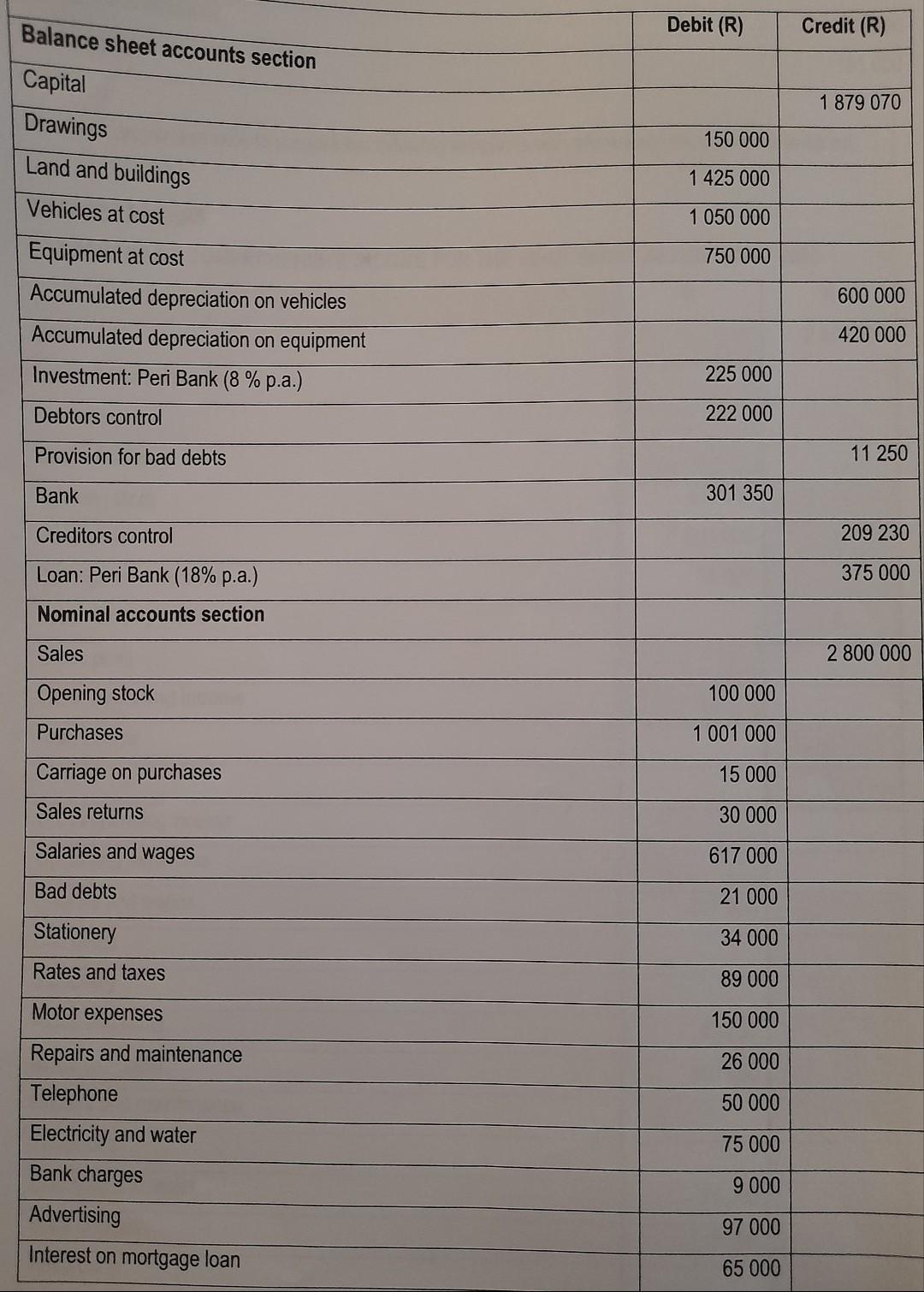

This is the General Ledger of Trendz Traders on 28 February 2022before the year end adjustments were considered:

These are the adjustments that need to be made: the bookkeeper made the following list of adjustments that he intended using to prepare the financial statements: Stocktaking revealed the value of unsold goods amounted to R120 000. Stationery, R3 000, was purchased for use in the next accounting period. No entry was made to record an invoice received to replace a broken door, R1 000. An advertising contract at a cost of R2 500 per month for the period 01 December 2021 to 31 May 2022 was paid in full (for the stated period) on 01 December 2021. A debtor who was declared insolvent paid R2 100, which represented 60% of the amount owed. The amount that was received was recorded but the rest of his account must now be written off. The provision for bad debts must be adjusted to R10 250. Interest was still outstanding on the investment at Peri Bank which was made on 01 February 2021 and which matures on 30 June 2023. Interest on investment is not capitalised. The interest on loan from Peri Bank was accurately calculated at R72 000 for the financial year ended 28 February 2022. Interest on loan is not capitalised. Rent, which increased by 10% with effect from 01 September 2021, was received for the period 01 March 2021 to 31 March 2022. The telephone account for February 2022, R5 000, was due to be paid on 02 March 2022. Depreciation must be calculated on vehicles at 20% p.a. on the reducing (diminishing) balance whilst depreciation on equipment must be calculated at 10% p.a. on cost.

kindly assist with showing the calculations for these adjustments, so this can be added to the Statement of Comprehensive Income.

I need to understand how to calculate these adjustments.

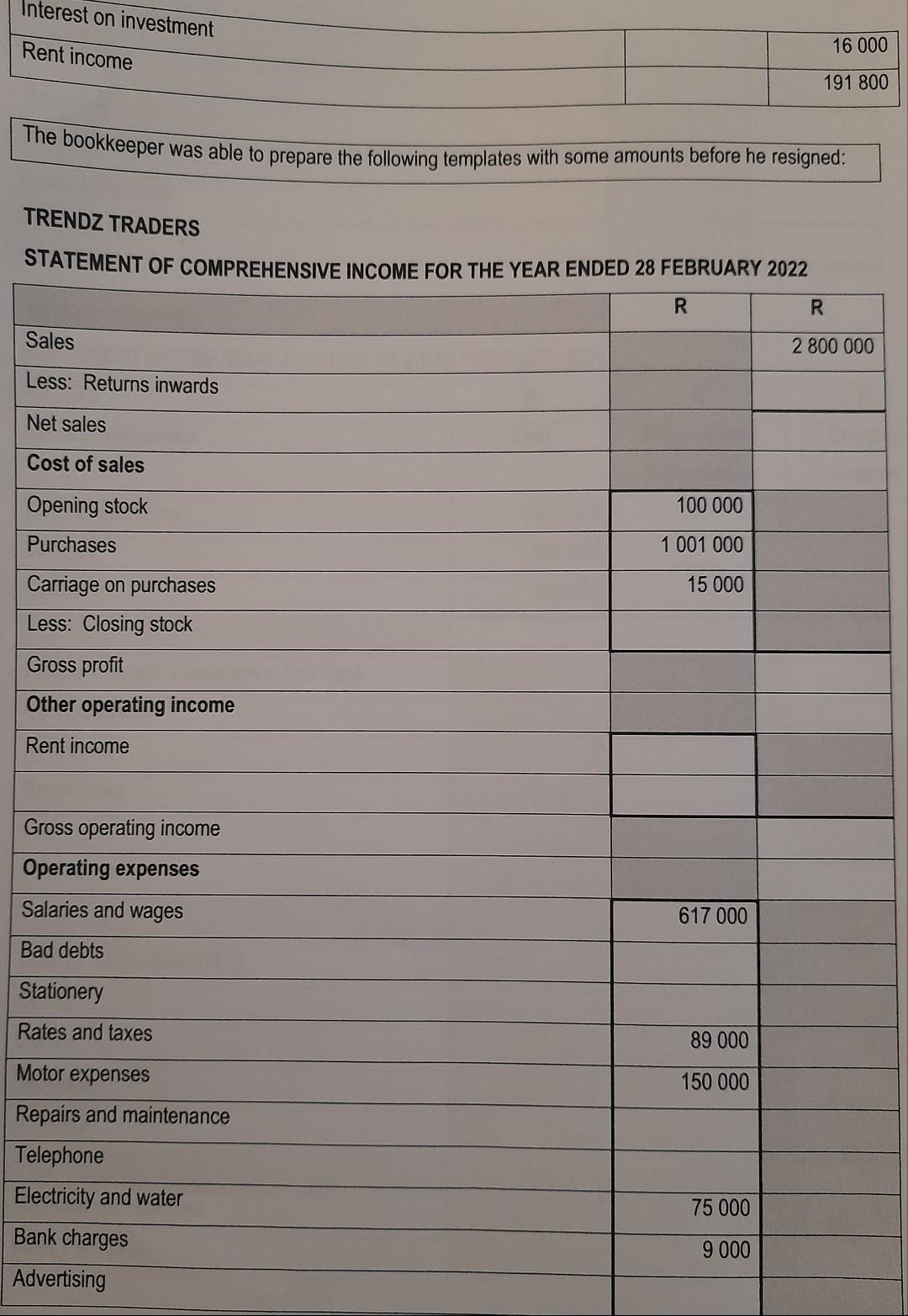

Balance sheet accounts section Debit (R) Credit (R) 1 879 070 Capital Drawings Land and buildings 150 000 1 425 000 Vehicles at cost 1 050 000 750 000 600 000 Equipment at cost Accumulated depreciation on vehicles Accumulated depreciation on equipment Investment: Peri Bank (8 % p.a.) 420 000 225 000 Debtors control 222 000 Provision for bad debts 11 250 Bank 301 350 Creditors control 209 230 Loan: Peri Bank (18% p.a.) 375 000 Nominal accounts section Sales 2 800 000 Opening stock 100 000 Purchases 1 001 000 Carriage on purchases 15 000 Sales returns 30 000 Salaries and wages 617 000 Bad debts 21 000 Stationery 34 000 Rates and taxes 89 000 Motor expenses 150 000 26 000 50 000 Repairs and maintenance Telephone Electricity and water Bank charges Advertising Interest on mortgage loan 75 000 9 000 97 000 65 000 Interest on investment Rent income 16 000 191 800 The bookkeeper was able to prepare the following templates with some amounts before he resigned: TRENDZ TRADERS STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 28 FEBRUARY 2022 R R Sales 2 800 000 Less: Returns inwards Net sales Cost of sales Opening stock 100 000 Purchases 1 001 000 15 000 Carriage on purchases Less: Closing stock Gross profit Other operating income Rent income Gross operating income Operating expenses Salaries and wages 617 000 Bad debts Stationery Rates and taxes 89 000 Motor expenses 150 000 Repairs and maintenance Telephone Electricity and water Bank charges Advertising 75 000 9 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started