this is the hong kong taxation assignment. it's to calculate profits tax, i have no idea how to solve this

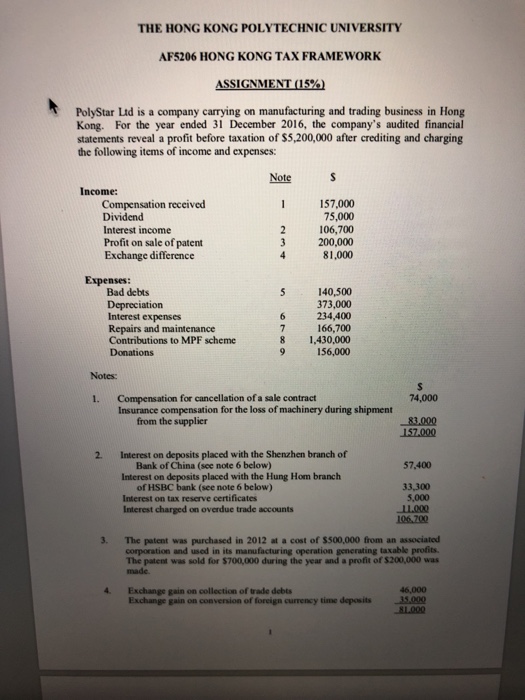

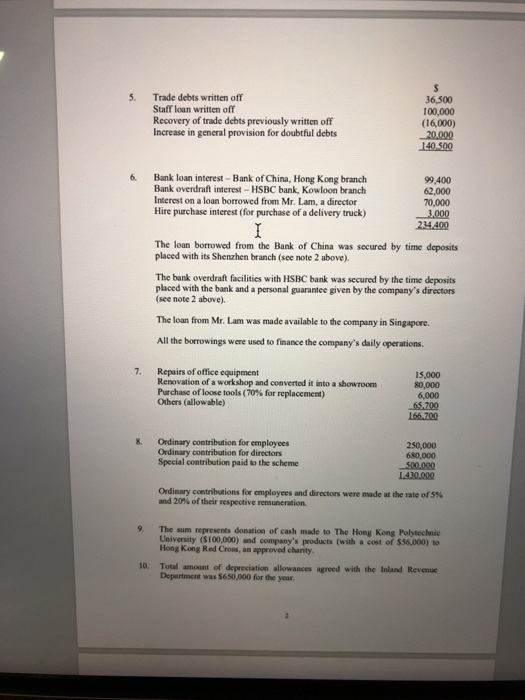

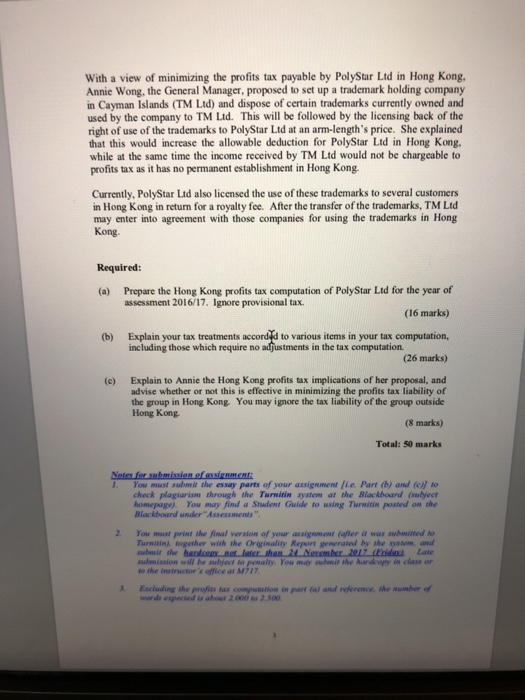

THE HONG KONG POLYTECHNIC UNIVERSITY AFS206 HONG KONG TAX FRAMEWORK ASSIGNMENT(15%) PolyStar Ltd is a company carrying on manufacturing and trading business in Hong Kong. For the year ended 31 December 2016, the company's audited financial statements reveal a profit before taxation of $5,200,000 after crediting and charging the following items of income and expenses: Notes Income: Compensation received Dividend Interest income Profit on sale of patent Exchange difference 1 157,000 75,000 2 106,700 3 200,000 81,000 Expenses Bad debts Depreciation Interest expenses Repairs and maintenance Contributions to MPF scheme Donations 5140,500 373,000 6 234,400 166,700 8 1,430,000 9 156,000 Notes: Compensation for cancellation of a sale contract Insurance compensation for the loss of machinery during shipment 1. 74,000 from the supplier 157.000 2. Interest on deposits placed with the Shenzhen branch of 57.400 Bank of China (see note 6 below) Interest on deposits placed with the Hung Hom branch of HSBC bank (see note 6 below) Interest on tax reserve certificates Interest charged on overdue trade accounts 33.300 5,000 3. The patent was purchased in 2012 at a cost of $500,000 from an associated corporation and used in its manufacturing operation generating taxable profits The patent was sold for $700,000 during the year and a profit of $200,000 was 4. Exchange gain on collection of trade debts Exchange gain on conversion of foreign currency time 35,000 THE HONG KONG POLYTECHNIC UNIVERSITY AFS206 HONG KONG TAX FRAMEWORK ASSIGNMENT(15%) PolyStar Ltd is a company carrying on manufacturing and trading business in Hong Kong. For the year ended 31 December 2016, the company's audited financial statements reveal a profit before taxation of $5,200,000 after crediting and charging the following items of income and expenses: Notes Income: Compensation received Dividend Interest income Profit on sale of patent Exchange difference 1 157,000 75,000 2 106,700 3 200,000 81,000 Expenses Bad debts Depreciation Interest expenses Repairs and maintenance Contributions to MPF scheme Donations 5140,500 373,000 6 234,400 166,700 8 1,430,000 9 156,000 Notes: Compensation for cancellation of a sale contract Insurance compensation for the loss of machinery during shipment 1. 74,000 from the supplier 157.000 2. Interest on deposits placed with the Shenzhen branch of 57.400 Bank of China (see note 6 below) Interest on deposits placed with the Hung Hom branch of HSBC bank (see note 6 below) Interest on tax reserve certificates Interest charged on overdue trade accounts 33.300 5,000 3. The patent was purchased in 2012 at a cost of $500,000 from an associated corporation and used in its manufacturing operation generating taxable profits The patent was sold for $700,000 during the year and a profit of $200,000 was 4. Exchange gain on collection of trade debts Exchange gain on conversion of foreign currency time 35,000