this is the information

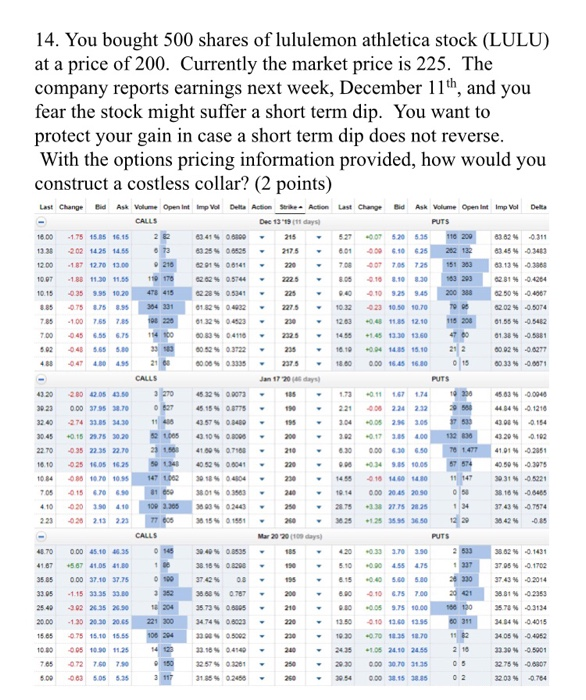

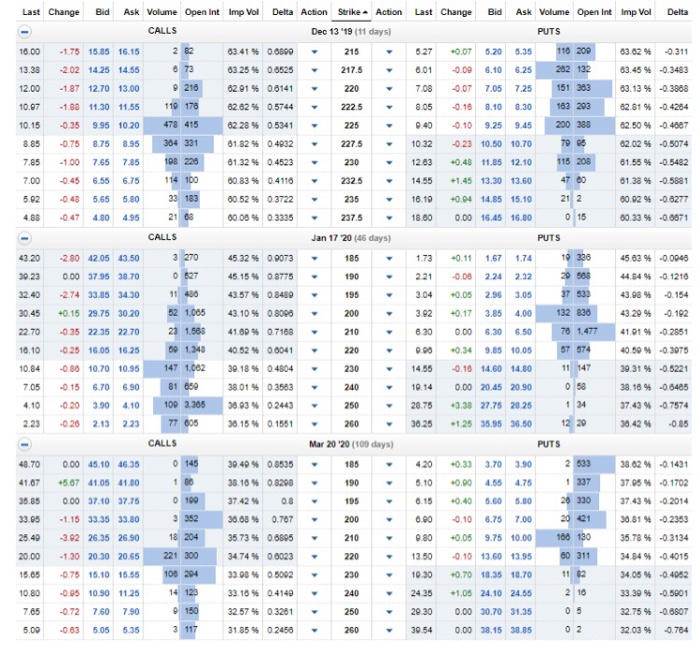

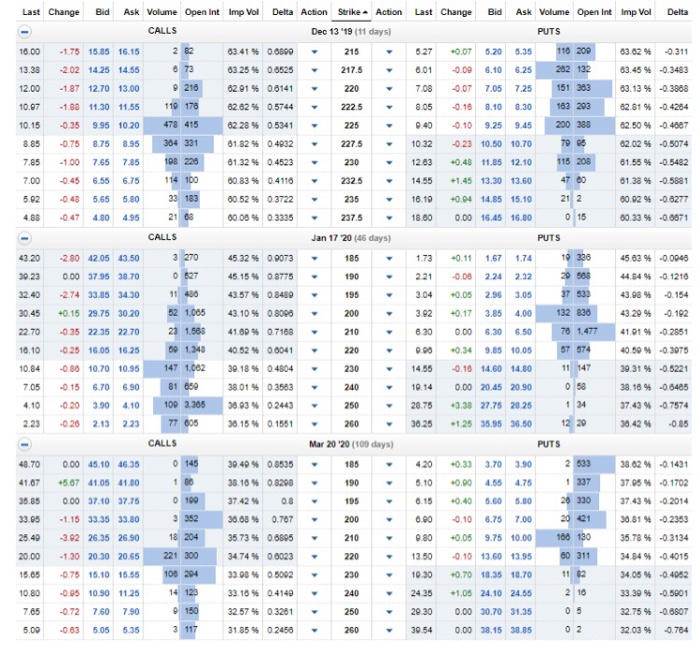

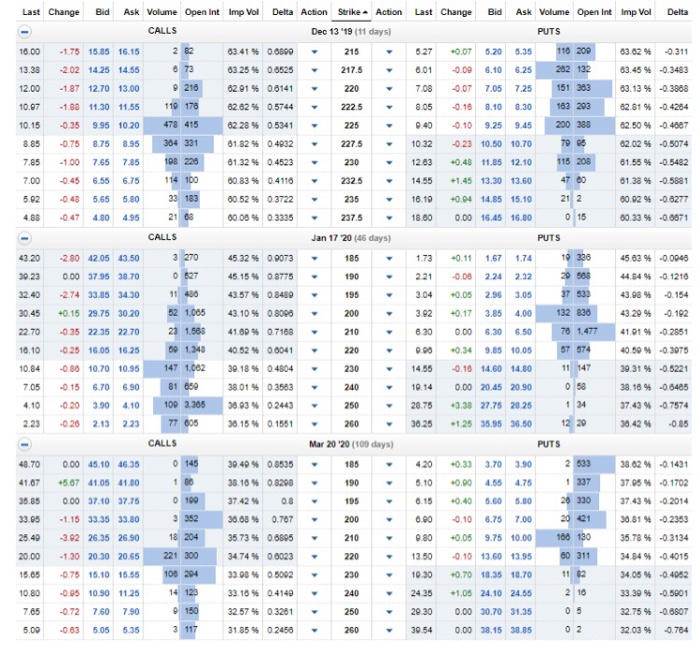

14. You bought 500 shares of lululemon athletica stock (LULU) at a price of 200. Currently the market price is 225. The company reports earnings next week, December 11th, and you fear the stock might suffer a short term dip. You want to protect your gain in case a short term dip does not reverse With the options pricing information provided, how would you construct a costless collar? (2 points Last Change Bid Ask Volume Open Int Imp Vol Delta Action Strike Action Last Change Bid Ask Volume Open Int Imp Vol Dec 13 19 (11 days) Delta CALLS PUTS 2 82 116 209 16.00 -175 15.85 16.15 e341%06800 215 527 0.07 520 535 83 82 0311 275 6325% 06525 282 132 13.38 202 1425 14.55 e01 400 6.10 625 6345% -03483 216 12.00 187 12.70 13.00 6291% 08141 220 708 407 705 725 151 303 6313 % -03868 19 170 2225 183 293 02.81 % -04204 10 07 1.88 11.30 11.55 6262% 05744 8.00 410 8.10 8.30 62 28% 05341 478 415 410 925 200 388 02 50 % -04007 10.15 35 9.95 10.20 225 40 9.45 0182% 04932 304 331 02.02 % -0.5074 885 75 75 8.95 2275 10.32 423 10.50 10.70 01.55 % -05482 198 22 01.32% 04523 048 11.85 12.10 115 208 7.85 -1.00 7.65 7.85 230 12.83 114 100 01.38 % -05881 47 0 +1.45 13.30 13.60 7.00 445 655 675 00 83% 04110 232.5 14.55 33 3 21 68 60 52 0.3722 80 00 0.3335 2 2 004 14.85 15.10 502 048 565 580 235 16.10 80.92 % -00277 015 488 047 480 4.55 2375 18.60 0.00 16.45 16.80 60.33 % -00071 CALLS Jan 17 20 (4 days) PUTS 3 270 27 1140 2 1,005 10 300 43 20 45 32% 09073 15 173 011 1.67 174 4583% 00040 280 42.05 43.50 44 94 %121 45 15% 08775 224 2.32 58 3023 000 3795 38.70 10 221 0 17 533 3240 43 57% 08400 304 4398% 4154 274 33.85 34.30 0.05 256 3.05 43.10% 08000 132 836 43 20 3045 0.15 29.75 30.20 200 32 017 35 4.00 4102 23 1.5 4100%07188 78 1477 22.70 35 22.35 22.70 210 630 0.00 30 650 41.01% 0251 16 10 034 57 574 025 16.05 16.25 40 52% 00041 220 9.85 10.05 4050% 03975 147 1.002 11 147 10 84 88 10.70 10.95 30 18% 04804 230 14 55 416 14.60 1480 3031% -05221 58 7.05 415 70 .s0 38.01% 03583 19.14 0.00 20.45 20 50 38.16% 06465 3803% 02443 250 3.38 27.75 28 25 420 390 410 109 3.305 34 410 275 37 43 % 7574 77 0 12 29 85 223 28 2.13 223 38 15% a1551 260 3625 +125 3595 36.50 38 42% CALLS Mar 20 20 (109 days) PUTS 145 2533 4870 000 45.10 46.35 3040% 08535 185 420 0.33 3.70 350 3862% -01431 337 4167 +567 41.05 41.80 38.16% 08298 5.10 0.90 455 4.75 37.05 % -0.1702 2 330 o00 3585 0.00 37.10 37.75 37 42% 08 15 15 0.40 560 5.80 37.43 % -02014 2 421 3 32 3305 -1.15 33.35 33.80 3868% 0787 200 00 410 75 7.00 3881% -02353 1204 100 130 254 302 235 2.50 3573% 0605 210 080 0.05 9.75 10.00 35.78 % -03134 221 300 13 50 60 311 2000 -1.30 2030 20.65 3474%08023 220 410 13.60 13.55 3494 % 04015 11 82 15.65 75 15.10 15.55 100 204 330%05002 230 10 30 070 1.35 1.70 3405%04052 14 123 24.35 100 05 10.90 11.25 32.16% 04140 240 1.05 24.10 24.55 2 10 33.30% 05001 150 7.65 072 7.60 730 2 57% 03201 250 2030 0.00 30.70 31.35 05 275% 00307 463 3 117 600 5.05 535 3185% 02450 260 .00 315 38.s5 02 3203% 4764 3054 Last Change Bid Ask Volume Open Int Imp Vol Delta Action Strike Action Last Change Bid Ask Volume Open Int Imp Vol Delta CALLS Dec 13 '19 (11 days) PUTS 2 82 110 200 10.00 -1.75 15.85 16.15 63.41 % 00800 215 527 0.07 5.20 5.35 03.02 % -0.311 6 73 63 25 % 00525 202 132 13.38 -2.02 14.25 14.55 217.5 6.01 -0.09 6.10 6.25 03.45 % -03483 12.00 9216 220 7.25 151 383 -187 12.70 13.00 62.91% 06141 7.08 -0.07 7.05 63.13 % -0.3868 11 178 183 203 10.97 -1.88 11.30 11.55 6262 % 05744 222.5 8.05 0.16 8.10 62.81 % -0.4284 8.30 62 28% 05341 9.95 10.20 478 415 200 388 10.15 -0.35 225 9.40 0.10 9.25 9.45 82.50 % -04887 62.02 % - 05074 304 331 61.82 % 0.4032 79 5 8.85 0.75 8.75 8.95 227.5 10.32 -023 10.50 10.70 115 208 198 226 7.85 -1.00 7.65 7.85 61.32 % 04523 230 12.63 +0.48 11.85 12.10 61.55 % -0.5482 114 100 47 0 7.00 0.45 6.55 6.75 60.83% 0.4118 232.5 14.55 +1.45 13.30 13.60 81.38 % -0.5881 21 2 60.52 % | 0.3722 33 183 60.02 % -06277 5.92 0.48 5.65 5.80 235 16.10 +0.04 14.85 15.10 21 68 0 15 4.88 -047 4.80 495 60.00 % 0.3335 237.5 18.00 0.00 16.45 16.80 00.33 % -00071 CALLS Jan 17 20 (46 days) PUTS 10 336 45.63 %-0.0046 3 270 1.73 1.67 1.74 43.20 -2.80 42.05 43.50 45.32 % 09073 185 +0.11 0 627 45.15 % 08775 2 508 44.04 % -01210 30.23 0.00 37.95 38.70 190 221 0.00 2.24 2.32 3.04 37 533 32.40 2.74 33.85 34.30 11 400 43.57 % 08489 195 +0.05 2.96 43.98 % -0.154 3.05 52 1.005 132 838 30.45 +0.15 29.75 30.20 43.10% 0.8096 200 3.92 +0.17 3.85 4.00 43.29 % 0.192 23 1.56 76 1.477 22.70 0.35 22.35 22.70 41.60 % 07168 210 6.30 0.00 6.30 6.50 41.01 % -02851 50 1.340 220 0.34 9.85 10.05 57 574 10.10 0 25 16.05 16.25 40.52 % 00041 9.00 40.50 % -0.3075 10.84 147 1.062 -0.80 10.70 10.95 30.18 % 0.4804 230 14.55 -0.16 14.60 14.80 11 147 30.31 % -0.5221 0 58 81 650 7.05 6.90 38.01 % 0.3563 19.14 0.00 20.45 20.90 38.18 % -08485 0.15 6.70 240 100 3.385 134 4.10 020 3.90 4.10 3893 % 02443 250 20.75 +3.38 27.75 20.25 37.43 % -07574 77 605 12 29 36.15% 0.1551 30 25 2.23 0 20 2.13 2.23 260 +1.25 35.95 36.50 30.42 % 0.85 CALLS Mar 20 '20 (109 days) PUTS 2 533 38.62 % -0.1431 0 145 0.00 45.10 46.35 420 0.33 3.70 48.70 30 40% 0.8535 185 3.90 337 37.05 % -0.1702 38.10% 08200 41.67 +587 41.05 41.80 190 6.10 0.00 4.55 4.75 0 100 26 330 0.00 37.10 37.75 37.42 % 5.80 37.43 % -02014 35.85 195 6.15 0.40 5.60 20 421 3 352 30.08 % 0.10 33.05 1.15 3335 33.80 0.767 200 6.00 6.75 7.00 30.81 % -02353 -3.92 26.35 26.90 18 204 166 130 35.78 % -03134 25.40 35.73 % 06895 210 9.80 +0.05 9.75 10.00 80 311 221 300 13.50 34.84 % -04015 20.00 1.30 20.30 20.65 34.74 % 06023 220 0.10 13.60 13.95 106 294 11 2 15.05 0.75 15.10 15.55 33.08 % 05002 230 10.30 0.70 18.35 18.70 34.05 % -04052 14 123 2 16 10.80 0.95 10.90 11.25 33.16 % 0.4149 240 24.35 +1.05 24.10 24.55 33.39 % -0.5001 9150 0 5 7.85 0.72 7.60 7.90 32.57 % 0.3261 250 29.30 0.00 30.70 31.35 32.75 % -06807 3 117 0 2 32.03 % 5.00 0.63 5.05 5.35 31.85% 024568 260 3054 0.00 38.15 38.85 -0.764 14. You bought 500 shares of lululemon athletica stock (LULU) at a price of 200. Currently the market price is 225. The company reports earnings next week, December 11th, and you fear the stock might suffer a short term dip. You want to protect your gain in case a short term dip does not reverse With the options pricing information provided, how would you construct a costless collar? (2 points Last Change Bid Ask Volume Open Int Imp Vol Delta Action Strike Action Last Change Bid Ask Volume Open Int Imp Vol Dec 13 19 (11 days) Delta CALLS PUTS 2 82 116 209 16.00 -175 15.85 16.15 e341%06800 215 527 0.07 520 535 83 82 0311 275 6325% 06525 282 132 13.38 202 1425 14.55 e01 400 6.10 625 6345% -03483 216 12.00 187 12.70 13.00 6291% 08141 220 708 407 705 725 151 303 6313 % -03868 19 170 2225 183 293 02.81 % -04204 10 07 1.88 11.30 11.55 6262% 05744 8.00 410 8.10 8.30 62 28% 05341 478 415 410 925 200 388 02 50 % -04007 10.15 35 9.95 10.20 225 40 9.45 0182% 04932 304 331 02.02 % -0.5074 885 75 75 8.95 2275 10.32 423 10.50 10.70 01.55 % -05482 198 22 01.32% 04523 048 11.85 12.10 115 208 7.85 -1.00 7.65 7.85 230 12.83 114 100 01.38 % -05881 47 0 +1.45 13.30 13.60 7.00 445 655 675 00 83% 04110 232.5 14.55 33 3 21 68 60 52 0.3722 80 00 0.3335 2 2 004 14.85 15.10 502 048 565 580 235 16.10 80.92 % -00277 015 488 047 480 4.55 2375 18.60 0.00 16.45 16.80 60.33 % -00071 CALLS Jan 17 20 (4 days) PUTS 3 270 27 1140 2 1,005 10 300 43 20 45 32% 09073 15 173 011 1.67 174 4583% 00040 280 42.05 43.50 44 94 %121 45 15% 08775 224 2.32 58 3023 000 3795 38.70 10 221 0 17 533 3240 43 57% 08400 304 4398% 4154 274 33.85 34.30 0.05 256 3.05 43.10% 08000 132 836 43 20 3045 0.15 29.75 30.20 200 32 017 35 4.00 4102 23 1.5 4100%07188 78 1477 22.70 35 22.35 22.70 210 630 0.00 30 650 41.01% 0251 16 10 034 57 574 025 16.05 16.25 40 52% 00041 220 9.85 10.05 4050% 03975 147 1.002 11 147 10 84 88 10.70 10.95 30 18% 04804 230 14 55 416 14.60 1480 3031% -05221 58 7.05 415 70 .s0 38.01% 03583 19.14 0.00 20.45 20 50 38.16% 06465 3803% 02443 250 3.38 27.75 28 25 420 390 410 109 3.305 34 410 275 37 43 % 7574 77 0 12 29 85 223 28 2.13 223 38 15% a1551 260 3625 +125 3595 36.50 38 42% CALLS Mar 20 20 (109 days) PUTS 145 2533 4870 000 45.10 46.35 3040% 08535 185 420 0.33 3.70 350 3862% -01431 337 4167 +567 41.05 41.80 38.16% 08298 5.10 0.90 455 4.75 37.05 % -0.1702 2 330 o00 3585 0.00 37.10 37.75 37 42% 08 15 15 0.40 560 5.80 37.43 % -02014 2 421 3 32 3305 -1.15 33.35 33.80 3868% 0787 200 00 410 75 7.00 3881% -02353 1204 100 130 254 302 235 2.50 3573% 0605 210 080 0.05 9.75 10.00 35.78 % -03134 221 300 13 50 60 311 2000 -1.30 2030 20.65 3474%08023 220 410 13.60 13.55 3494 % 04015 11 82 15.65 75 15.10 15.55 100 204 330%05002 230 10 30 070 1.35 1.70 3405%04052 14 123 24.35 100 05 10.90 11.25 32.16% 04140 240 1.05 24.10 24.55 2 10 33.30% 05001 150 7.65 072 7.60 730 2 57% 03201 250 2030 0.00 30.70 31.35 05 275% 00307 463 3 117 600 5.05 535 3185% 02450 260 .00 315 38.s5 02 3203% 4764 3054 Last Change Bid Ask Volume Open Int Imp Vol Delta Action Strike Action Last Change Bid Ask Volume Open Int Imp Vol Delta CALLS Dec 13 '19 (11 days) PUTS 2 82 110 200 10.00 -1.75 15.85 16.15 63.41 % 00800 215 527 0.07 5.20 5.35 03.02 % -0.311 6 73 63 25 % 00525 202 132 13.38 -2.02 14.25 14.55 217.5 6.01 -0.09 6.10 6.25 03.45 % -03483 12.00 9216 220 7.25 151 383 -187 12.70 13.00 62.91% 06141 7.08 -0.07 7.05 63.13 % -0.3868 11 178 183 203 10.97 -1.88 11.30 11.55 6262 % 05744 222.5 8.05 0.16 8.10 62.81 % -0.4284 8.30 62 28% 05341 9.95 10.20 478 415 200 388 10.15 -0.35 225 9.40 0.10 9.25 9.45 82.50 % -04887 62.02 % - 05074 304 331 61.82 % 0.4032 79 5 8.85 0.75 8.75 8.95 227.5 10.32 -023 10.50 10.70 115 208 198 226 7.85 -1.00 7.65 7.85 61.32 % 04523 230 12.63 +0.48 11.85 12.10 61.55 % -0.5482 114 100 47 0 7.00 0.45 6.55 6.75 60.83% 0.4118 232.5 14.55 +1.45 13.30 13.60 81.38 % -0.5881 21 2 60.52 % | 0.3722 33 183 60.02 % -06277 5.92 0.48 5.65 5.80 235 16.10 +0.04 14.85 15.10 21 68 0 15 4.88 -047 4.80 495 60.00 % 0.3335 237.5 18.00 0.00 16.45 16.80 00.33 % -00071 CALLS Jan 17 20 (46 days) PUTS 10 336 45.63 %-0.0046 3 270 1.73 1.67 1.74 43.20 -2.80 42.05 43.50 45.32 % 09073 185 +0.11 0 627 45.15 % 08775 2 508 44.04 % -01210 30.23 0.00 37.95 38.70 190 221 0.00 2.24 2.32 3.04 37 533 32.40 2.74 33.85 34.30 11 400 43.57 % 08489 195 +0.05 2.96 43.98 % -0.154 3.05 52 1.005 132 838 30.45 +0.15 29.75 30.20 43.10% 0.8096 200 3.92 +0.17 3.85 4.00 43.29 % 0.192 23 1.56 76 1.477 22.70 0.35 22.35 22.70 41.60 % 07168 210 6.30 0.00 6.30 6.50 41.01 % -02851 50 1.340 220 0.34 9.85 10.05 57 574 10.10 0 25 16.05 16.25 40.52 % 00041 9.00 40.50 % -0.3075 10.84 147 1.062 -0.80 10.70 10.95 30.18 % 0.4804 230 14.55 -0.16 14.60 14.80 11 147 30.31 % -0.5221 0 58 81 650 7.05 6.90 38.01 % 0.3563 19.14 0.00 20.45 20.90 38.18 % -08485 0.15 6.70 240 100 3.385 134 4.10 020 3.90 4.10 3893 % 02443 250 20.75 +3.38 27.75 20.25 37.43 % -07574 77 605 12 29 36.15% 0.1551 30 25 2.23 0 20 2.13 2.23 260 +1.25 35.95 36.50 30.42 % 0.85 CALLS Mar 20 '20 (109 days) PUTS 2 533 38.62 % -0.1431 0 145 0.00 45.10 46.35 420 0.33 3.70 48.70 30 40% 0.8535 185 3.90 337 37.05 % -0.1702 38.10% 08200 41.67 +587 41.05 41.80 190 6.10 0.00 4.55 4.75 0 100 26 330 0.00 37.10 37.75 37.42 % 5.80 37.43 % -02014 35.85 195 6.15 0.40 5.60 20 421 3 352 30.08 % 0.10 33.05 1.15 3335 33.80 0.767 200 6.00 6.75 7.00 30.81 % -02353 -3.92 26.35 26.90 18 204 166 130 35.78 % -03134 25.40 35.73 % 06895 210 9.80 +0.05 9.75 10.00 80 311 221 300 13.50 34.84 % -04015 20.00 1.30 20.30 20.65 34.74 % 06023 220 0.10 13.60 13.95 106 294 11 2 15.05 0.75 15.10 15.55 33.08 % 05002 230 10.30 0.70 18.35 18.70 34.05 % -04052 14 123 2 16 10.80 0.95 10.90 11.25 33.16 % 0.4149 240 24.35 +1.05 24.10 24.55 33.39 % -0.5001 9150 0 5 7.85 0.72 7.60 7.90 32.57 % 0.3261 250 29.30 0.00 30.70 31.35 32.75 % -06807 3 117 0 2 32.03 % 5.00 0.63 5.05 5.35 31.85% 024568 260 3054 0.00 38.15 38.85 -0.764