Answered step by step

Verified Expert Solution

Question

1 Approved Answer

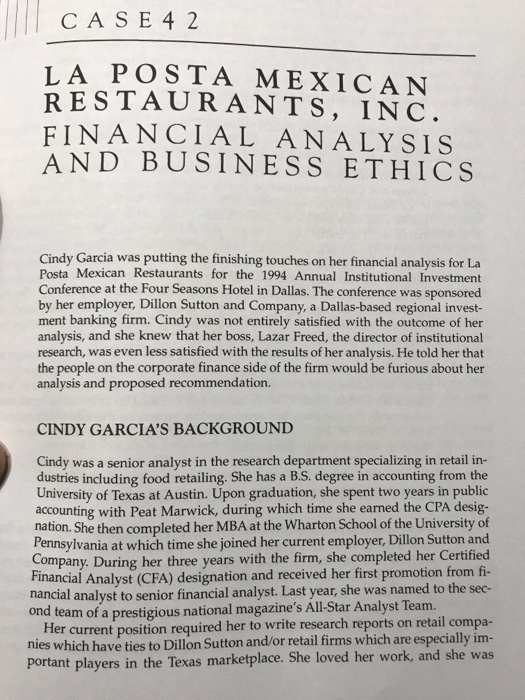

This is the last case of the course and it deals with a financial analyst, her duties and ethical responsibilities to her firm, her clients,

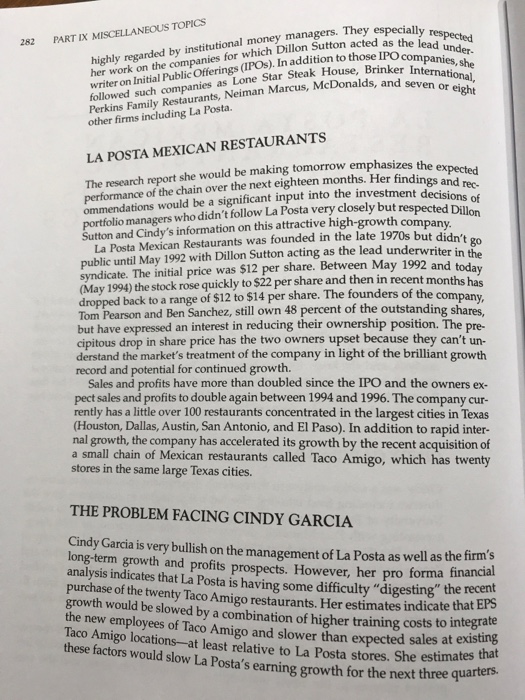

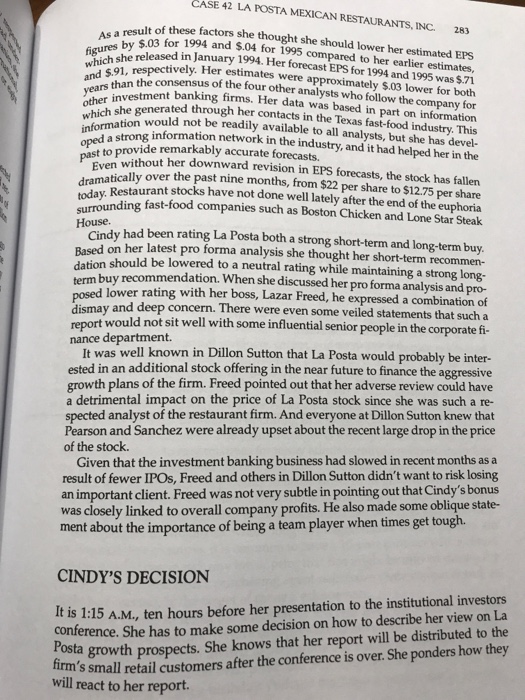

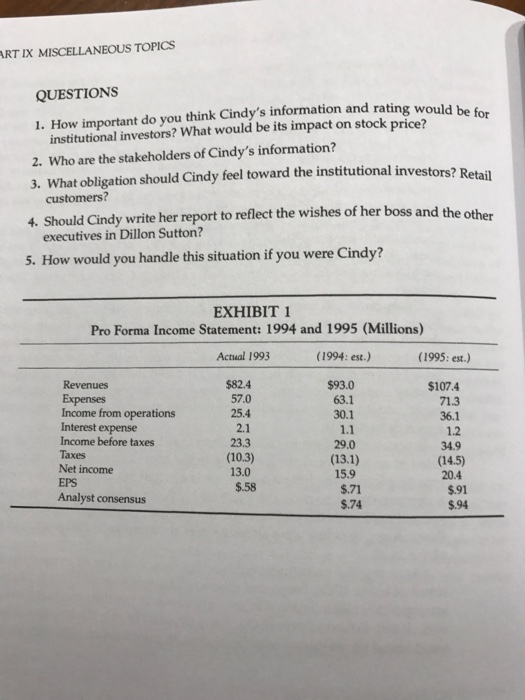

This is the last case of the course and it deals with a financial analyst, her duties and ethical responsibilities to her firm, her clients, and her profession. Cindy Garcia is a Chartered Financial Analyst (CFA), one of the highest professional certifications a financial analyst can aspire to. It is extremely challenging to qualify as a CFA, as it requires a candidate to successfully pass three separate exams covering a wide range of financial, accounting, and economics topics. Moreover, CFAs are expected, indeed required, to maintain very high ethical standards in their work. If they fail to do so, they can lose their certification.

It is not always easy in work (or in life for that matter) to do the 'right thing'. We often face competing demands from a variety of agents and conflicts of interest can easily arise. Maintaining your sense of professional ethics and personal integrity can be difficult under such circumstances, but it is essential to do so if you are going to be seen as a credible and trusted expert in your field.

In this week's case, you will be asked to consider the analyst's role in evaluating and reporting on financial information that may have a significant impact on a number of different company stakeholders. You will have to weigh the analyst's responsibilities to the different stakeholders and decide on an appropriate professional and ethical approach to the situation.

Please have a read and then answer Questions 1, 2, 4, 5 on page 284.

Again, these are qualitative questions requiring thoughtful qualitative answers of about 200-300 words each.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started