This is the main question. The second picture is helping data.

This is the main question. The second picture is helping data.

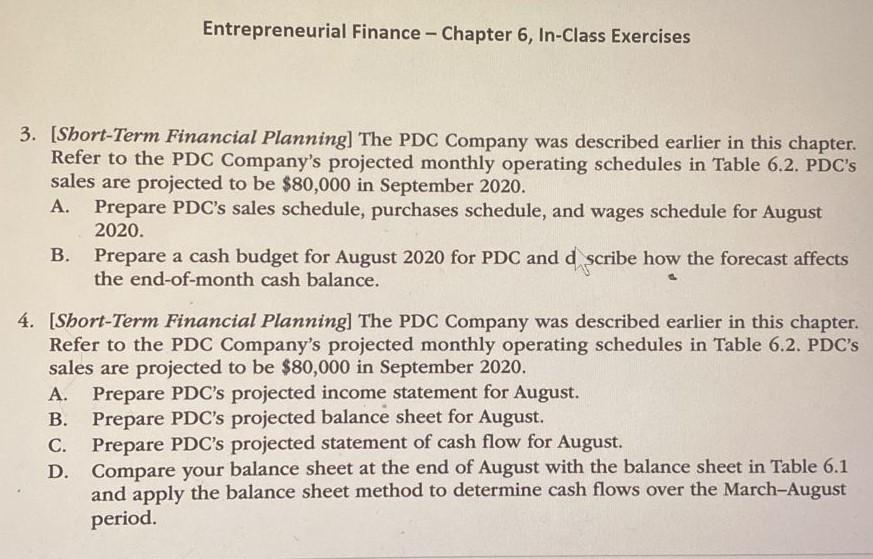

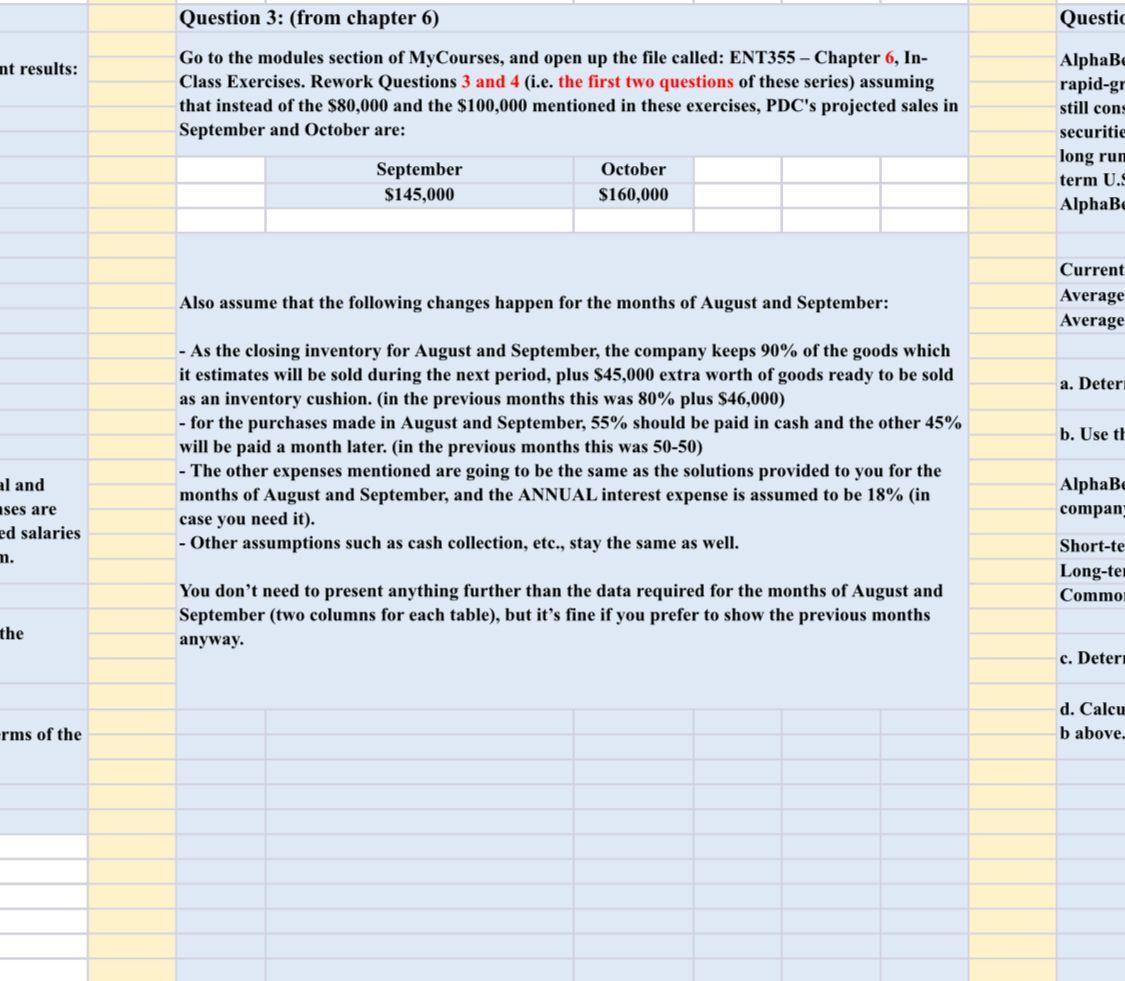

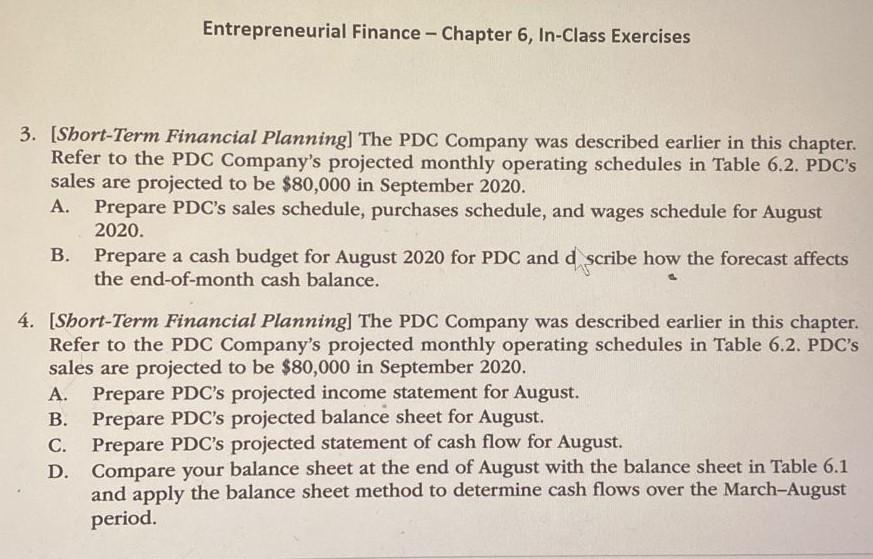

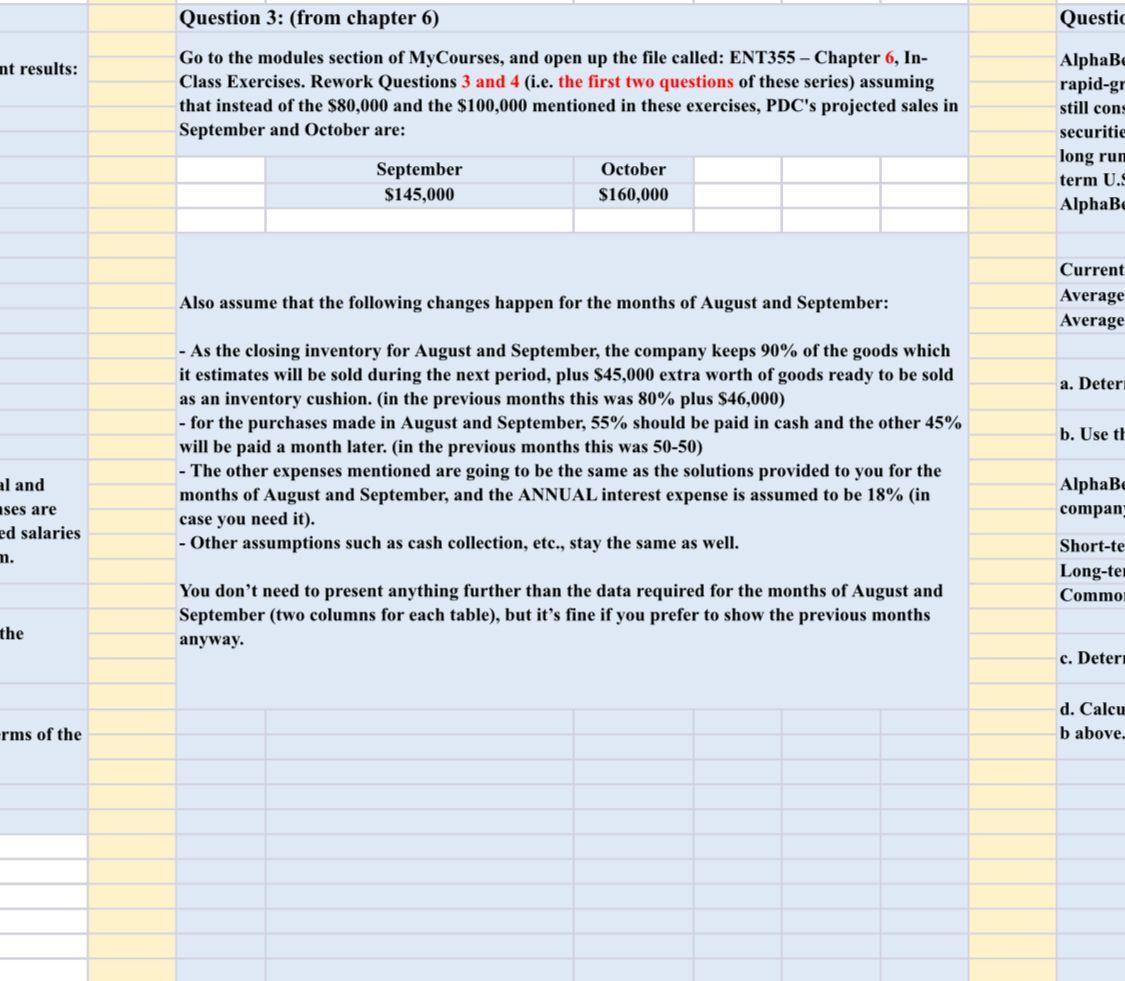

Question 3: (from chapter 6) Questic nt results: Go to the modules section of MyCourses, and open up the file called: ENT355 - Chapter 6, In- Class Exercises. Rework Questions 3 and 4 (i.e. the first two questions of these series) assuming that instead of the $80,000 and the $100,000 mentioned in these exercises, PDC's projected sales in September and October are: AlphaBc rapid-gr still cons securitie long run term U.S AlphaB September $145,000 October $160,000 Also assume that the following changes happen for the months of August and September: Current Average Average a. Deter b. Use th - As the closing inventory for August and September, the company keeps 90% of the goods which it estimates will be sold during the next period, plus $45,000 extra worth of goods ready to be sold as an inventory cushion. (in the previous months this was 80% plus $46,000) - for the purchases made in August and September, 55% should be paid in cash and the other 45% will be paid a month later. (in the previous months this was 50-50) - The other expenses mentioned are going to be the same as the solutions provided to you for the months of August and September, and the ANNUAL interest expense is assumed to be 18% (in case you need it). - Other assumptions such as cash collection, etc., stay the same as well. al and ises are ed salaries AlphaBe compan m. Short-te Long-te Commo You don't need to present anything further than the data required for the months of August and September (two columns for each table), but it's fine if you prefer to show the previous months anyway. the c. Deter: d. Calcu b above -rms of the Entrepreneurial Finance - Chapter 6, In-Class Exercises - 3. [Short-Term Financial Planning] The PDC Company was described earlier in this chapter. Refer to the PDC Company's projected monthly operating schedules in Table 6.2. PDC's sales are projected to be $80,000 in September 2020. A. Prepare PDC's sales schedule, purchases schedule, and wages schedule for August 2020. B. Prepare a cash budget for August 2020 for PDC and d scribe how the forecast affects the end-of-month cash balance. 4. [Short-Term Financial Planning] The PDC Company was described earlier in this chapter. Refer to the PDC Company's projected monthly operating schedules in Table 6.2. PDC's sales are projected to be $80,000 in September 2020. A. Prepare PDC's projected income statement for August. B. Prepare PDC's projected balance sheet for August. C. Prepare PDC's projected statement of cash flow for August. D. Compare your balance sheet at the end of August with the balance sheet in Table 6.1 and apply the balance sheet method to determine cash flows over the March-August period

This is the main question. The second picture is helping data.

This is the main question. The second picture is helping data.