this is the only information i was given

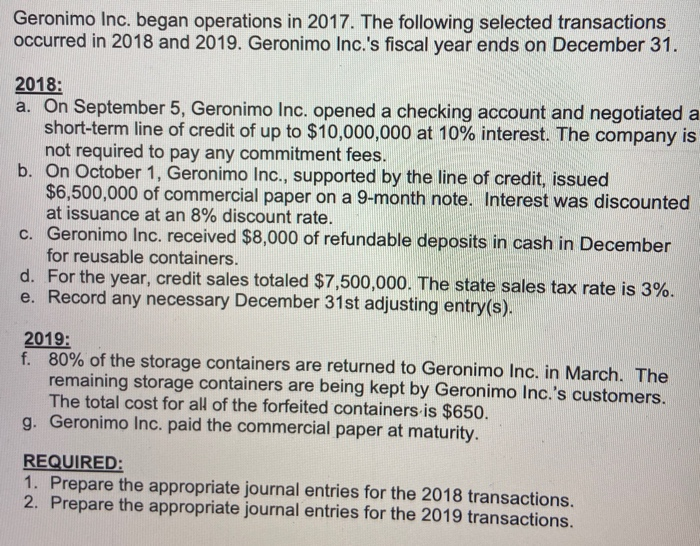

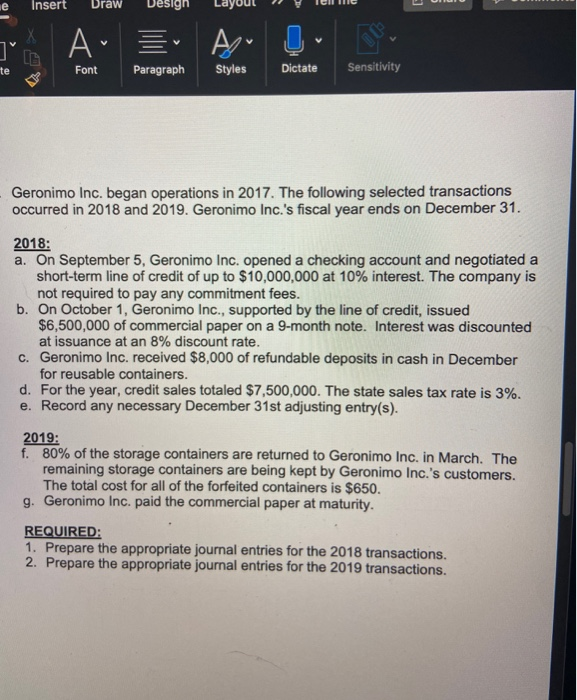

Geronimo Inc. began operations in 2017. The following selected transactions occurred in 2018 and 2019. Geronimo Inc.'s fiscal year ends on December 31. 2018: a. On September 5, Geronimo Inc. opened a checking account and negotiated a short-term line of credit of up to $10,000,000 at 10% interest. The company is not required to pay any commitment fees. b. On October 1, Geronimo Inc., supported by the line of credit, issued $6,500,000 of commercial paper on a 9-month note. Interest was discounted at issuance at an 8% discount rate. c. Geronimo Inc. received $8,000 of refundable deposits in cash in December for reusable containers. d. For the year, credit sales totaled $7,500,000. The state sales tax rate is 3%. e. Record any necessary December 31st adjusting entry(s). 2019: f. 80% of the storage containers are returned to Geronimo Inc. in March. The remaining storage containers are being kept by Geronimo Inc.'s customers. The total cost for all of the forfeited containers is $650. g. Geronimo Inc. paid the commercial paper at maturity. REQUIRED: 1. Prepare the appropriate journal entries for the 2018 transactions. 2. Prepare the appropriate journal entries for the 2019 transactions. e Insert Draw Design x Au te Font Paragraph Styles Dictate Sensitivity Geronimo Inc. began operations in 2017. The following selected transactions occurred in 2018 and 2019. Geronimo Inc.'s fiscal year ends on December 31. 2018: a. On September 5, Geronimo Inc. opened a checking account and negotiated a short-term line of credit of up to $10,000,000 at 10% interest. The company is not required to pay any commitment fees. b. On October 1, Geronimo Inc., supported by the line of credit, issued $6,500,000 of commercial paper on a 9-month note. Interest was discounted at issuance at an 8% discount rate. C. Geronimo Inc. received $8,000 of refundable deposits in cash in December for reusable containers. d. For the year, credit sales totaled $7,500,000. The state sales tax rate is 3%. e. Record any necessary December 31st adjusting entry(s). 2019: f. 80% of the storage containers are returned to Geronimo Inc. in March. The remaining storage containers are being kept by Geronimo Inc.'s customers. The total cost for all of the forfeited containers is $650. g. Geronimo Inc. paid the commercial paper at maturity. REQUIRED: 1. Prepare the appropriate journal entries for the 2018 transactions. 2. Prepare the appropriate journal entries for the 2019 transactions