Question

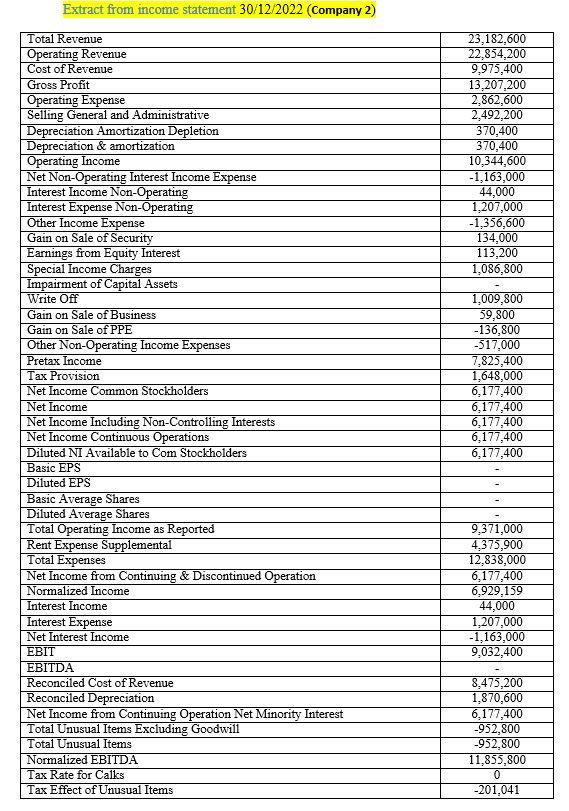

this is the only inofrmation that i had. calculate the following ratios for Company 1 and Company 2 : 1. Any two solvency ratios: (i)Debt

this is the only inofrmation that i had.

calculate the following ratios for Company 1 and Company 2 :

1. Any two solvency ratios:

(i)Debt to Equity ratio

(ii)Total assets to Debt ratio

(iii)Proprietary ratio

(iv)Interest coverage ratio

2. Any two turnover ratios

(i)Inventory turnover ratio

(ii)Trade receivables turnover ratio

(iii)Trade payables turnover ratio

(iv)Working capital turnover ratio

Based on your calculation compare and comment on ratios with proper justification.

----------------------------------------------------------------------------------

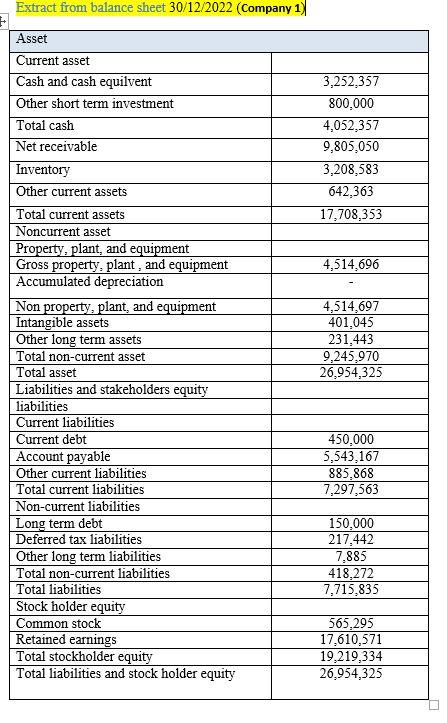

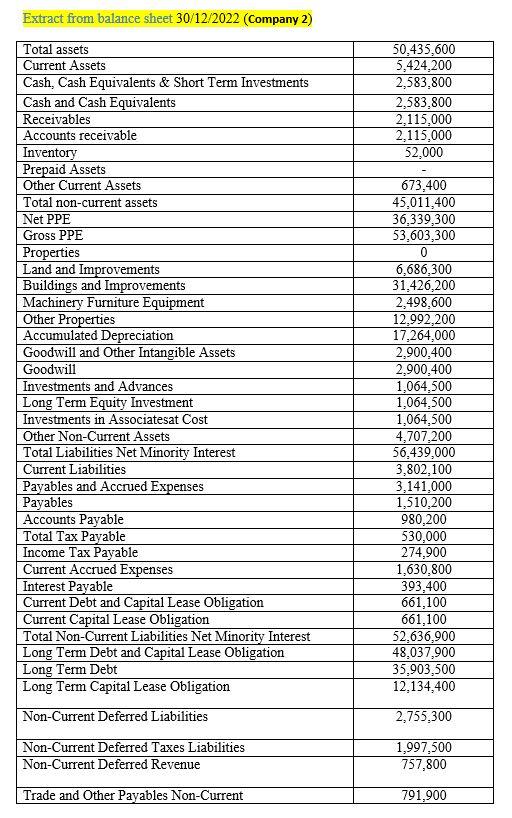

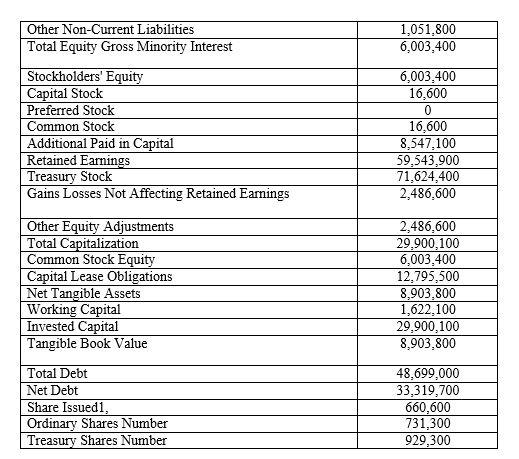

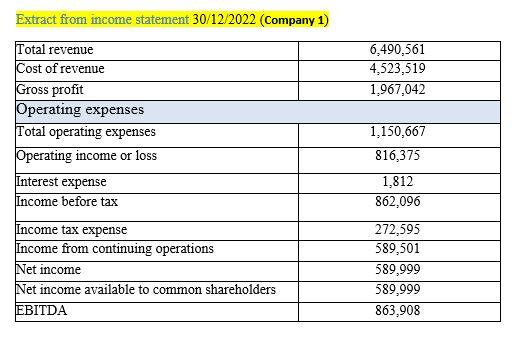

Extract from balance sheet 30/12/2022 (Company 1) Extract from balance sheet 30/12/2022 (Company 2) \begin{tabular}{|l|c|} \hline Total assets & 50,435,600 \\ \hline Current Assets & 5,424,200 \\ \hline Cash, Cash Equivalents \& Short Term Investments & 2,583,800 \\ \hline Cash and Cash Equivalents & 2,583,800 \\ \hline Receivables & 2,115,000 \\ \hline Accounts receivable & 2,115,000 \\ \hline Inventory & 52,000 \\ \hline Prepaid Assets & - \\ \hline Other Current Assets & 673,400 \\ \hline Total non-current assets & 45,011,400 \\ \hline Net PPE & 36,339,300 \\ \hline Gross PPE & 53,603,300 \\ \hline Properties & 0 \\ \hline Land and Improvements & 6,686,300 \\ \hline Buildings and Improvements & 31,426,200 \\ \hline Machinery Furniture Equipment & 2,498,600 \\ \hline Other Properties & 12,992,200 \\ \hline Accumulated Depreciation & 17,264,000 \\ \hline Goodwill and Other Intangible Assets & 2,900,5,500,300 \\ \hline Goodwill & 7,800 \\ \hline Investments and Advances & 2,900 \\ \hline Long Term Equity Investment & 2,900,400 \\ \hline Investments in Associatesat Cost & 1,064,500 \\ \hline Other Non-Current Assets & 1,064,500 \\ \hline Total Liabilities Net Minority Interest & 1,064,500 \\ \hline Current Liabilities & 4,707,200 \\ \hline Payables and Accrued Expenses & 56,439,000 \\ \hline Payables & 3,802,100 \\ \hline Accounts Payable & 3,141,000 \\ \hline Total Tax Payable & 1,510,200 \\ \hline Income Tax Payable & 980,200 \\ \hline Current Accrued Expenses & 530,000 \\ \hline Interest Payable & 274,900 \\ \hline Current Debt and Capital Lease Obligation & 1,630,800 \\ \hline Current Capital Lease Obligation & 393,400 \\ \hline Total Non-Current Liabilities Net Minority Interest & 661,100 \\ \hline Long Term Debt and Capital Lease Obligation & 661,100 \\ \hline Long Term Debt & 52,636,900 \\ \hline Long Term Capital Lease Obligation Non-Current & 48,037,900 \\ \hline \end{tabular} \begin{tabular}{|l|c|} \hline Other Non-Current Liabilities & 1,051,800 \\ \hline Total Equity Gross Minority Interest & 6,003,400 \\ \hline Stockholders' Equity & 6,003,400 \\ \hline Capital Stock & 16,600 \\ \hline Preferred Stock & 0 \\ \hline Common Stock & 16,600 \\ \hline Additional Paid in Capital & 8,547,100 \\ \hline Retained Earnings & 59,543,900 \\ \hline Treasury Stock & 71,624,400 \\ \hline Gains Losses Not Affecting Retained Earnings & 2,486,600 \\ \hline Other Equity Adjustments & \\ \hline Total Capitalization & 2,486,600 \\ \hline Common Stock Equity & 29,900,100 \\ \hline Capital Lease Obligations & 6,003,400 \\ \hline Net Tangible Assets & 12,795,500 \\ \hline Working Capital & 8,903,800 \\ \hline Invested Capital & 1,622,100 \\ \hline Tangible Book Value & 29,900,100 \\ \hline Total Debt & 8,903,800 \\ \hline Net Debt & \\ \hline Share Issued1, & 48,699,000 \\ \hline Ordinary Shares Number & 33,319,700 \\ \hline Treasury Shares Number & 660,600 \\ \hline \end{tabular} Extract from income statement 30/12/2022 (Company 1) Extract from income statement 30/12/2022 (Company 2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started