Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the only question they have provided i just need the answer of question 1. Tina Taxpayer is a 39-year old resident of Richmond

this is the only question they have provided i just need the answer of question

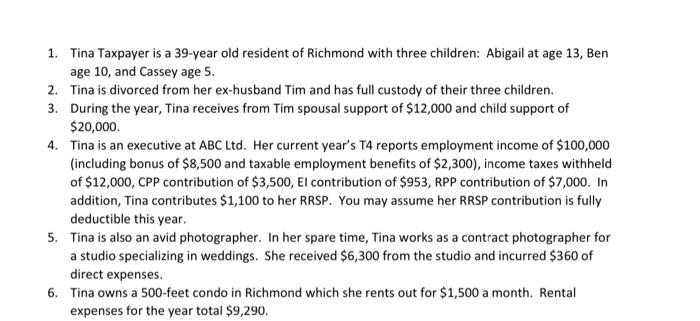

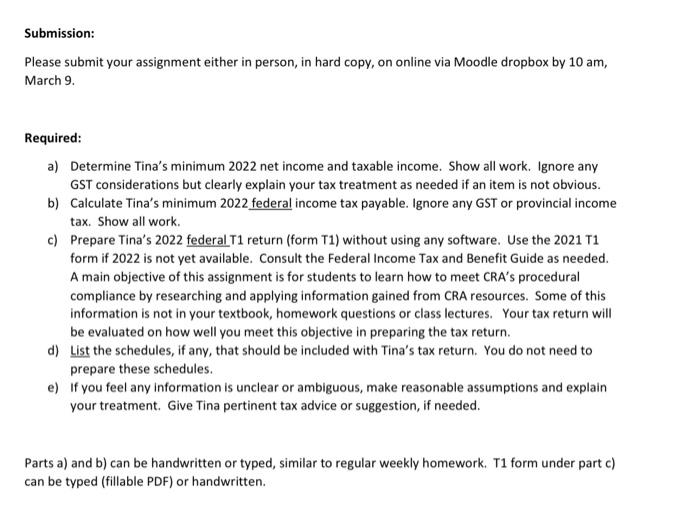

1. Tina Taxpayer is a 39-year old resident of Richmond with three children: Abigail at age 13, Ben age 10 , and Cassey age 5. 2. Tina is divorced from her ex-husband Tim and has full custody of their three children. 3. During the year, Tina receives from Tim spousal support of $12,000 and child support of $20,000. 4. Tina is an executive at ABCL Ld. Her current year's T4 reports employment income of $100,000 (including bonus of $8,500 and taxable employment benefits of $2,300 ), income taxes withheld of $12,000, CPP contribution of $3,500, El contribution of $953, RPP contribution of $7,000. In addition, Tina contributes $1,100 to her RRSP. You may assume her RRSP contribution is fully deductible this year. 5. Tina is also an avid photographer. In her spare time, Tina works as a contract photographer for a studio specializing in weddings. She received $6,300 from the studio and incurred $360 of direct expenses. 6. Tina owns a 500-feet condo in Richmond which she rents out for $1,500 a month. Rental expenses for the year total $9,290. Submission: Please submit your assignment either in person, in hard copy, on online via Moodle dropbox by 10 am, March 9. Required: a) Determine Tina's minimum 2022 net income and taxable income. Show all work. Ignore any GST considerations but clearly explain your tax treatment as needed if an item is not obvious. b) Calculate Tina's minimum 2022 federal income tax payable. Ignore any GST or provincial income tax. Show all work. c) Prepare Tina's 2022 federal T1 return (form T1) without using any software. Use the 2021 T1 form if 2022 is not yet available. Consult the Federal Income Tax and Benefit Guide as needed. A main objective of this assignment is for students to learn how to meet CRA's procedural compliance by researching and applying information gained from CRA resources. Some of this information is not in your textbook, homework questions or class lectures. Your tax return will be evaluated on how well you meet this objective in preparing the tax return. d) List the schedules, if any, that should be included with Tina's tax return. You do not need to prepare these schedules. e) If you feel any information is unclear or ambiguous, make reasonable assumptions and explain your treatment. Give Tina pertinent tax advice or suggestion, if needed. Parts a) and b) can be handwritten or typed, similar to regular weekly homework. T1 form under part c) can be typed (fillable PDF) or handwritten Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started