Answered step by step

Verified Expert Solution

Question

1 Approved Answer

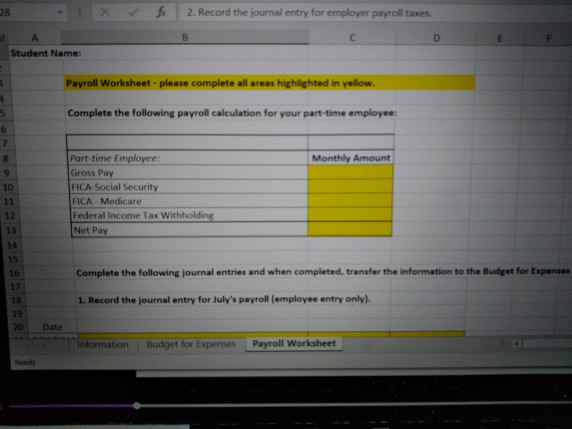

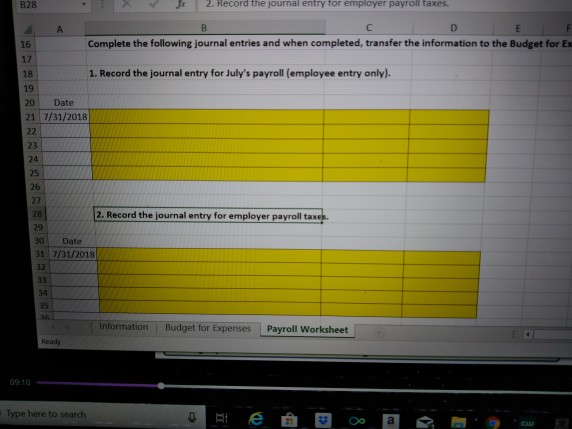

this is the payroll worksheet for the second part of my question from the previous question need help doing g this for my accounting principles

this is the payroll worksheet for the second part of my question from the previous question

need help doing g this for my accounting principles class

28 1Xf2. Record the journal entry for employer payroll taxes Student Name: Payroll Worksheet please complete all areas highlighted in yellow. Complete the following payroll calculation for your part-time employee: Part time Employee: Gross Pay FICA-Social Security FICA Medicare Federal Income Tax Withholding Net Pay Monthly Amount 10 12 13 14 15 16 Complete the following journal entries and when completed, transfer the information to the Budget for Expenses 18 19 1. Record the journal entry for July's payroll (employee entry only). Date ormation Budget for Expenses Payroll Worksheet 28 1Xf2. Record the journal entry for employer payroll taxes Student Name: Payroll Worksheet please complete all areas highlighted in yellow. Complete the following payroll calculation for your part-time employee: Part time Employee: Gross Pay FICA-Social Security FICA Medicare Federal Income Tax Withholding Net Pay Monthly Amount 10 12 13 14 15 16 Complete the following journal entries and when completed, transfer the information to the Budget for Expenses 18 19 1. Record the journal entry for July's payroll (employee entry only). Date ormation Budget for Expenses Payroll WorksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started