Answered step by step

Verified Expert Solution

Question

1 Approved Answer

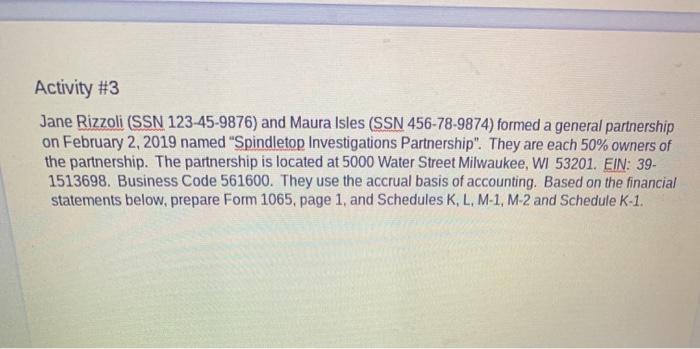

this is the problem and the information Activity #3 Jane Rizzoli (SSN 123-45-9876) and Maura Isles (SSN 456-78-9874) formed a general partnership on February 2,

this is the problem and the information

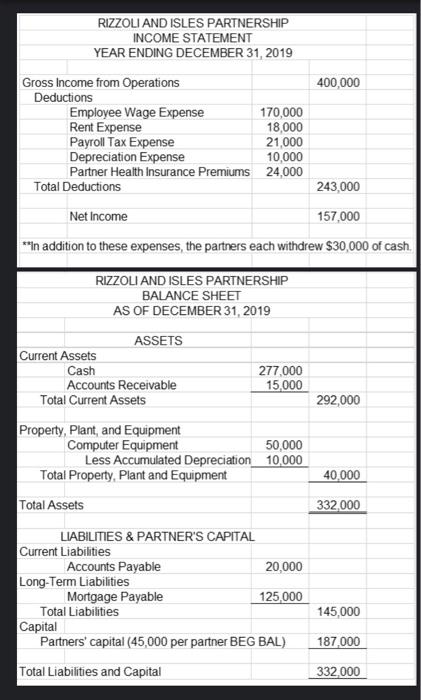

Activity #3 Jane Rizzoli (SSN 123-45-9876) and Maura Isles (SSN 456-78-9874) formed a general partnership on February 2, 2019 named "Spindletop Investigations Partnership". They are each 50% owners of the partnership. The partnership is located at 5000 Water Street Milwaukee, WI 53201. EIN: 39- 1513698. Business Code 561600. They use the accrual basis of accounting. Based on the financial statements below, prepare Form 1065, page 1. and Schedules K, L, M-1, M-2 and Schedule K-1. RIZZOLI AND ISLES PARTNERSHIP INCOME STATEMENT YEAR ENDING DECEMBER 31, 2019 Gross Income from Operations 400,000 Deductions Employee Wage Expense 170,000 Rent Expense 18,000 Payroll Tax Expense 21,000 Depreciation Expense 10,000 Partner Health Insurance Premiums 24,000 Total Deductions 243,000 Net Income 157,000 **In addition to these expenses, the partners each withdrew $30,000 of cash. RIZZOLI AND ISLES PARTNERSHIP BALANCE SHEET AS OF DECEMBER 31, 2019 ASSETS Current Assets Cash 277,000 Accounts Receivable 15.000 Total Current Assets 292,000 Property, Plant, and Equipment Computer Equipment 50,000 Less Accumulated Depreciation 10,000 Total Property. Plant and Equipment 40.000 Total Assets 332,000 LIABILITIES & PARTNER'S CAPITAL Current Liabilities Accounts Payable 20,000 Long-Term Liabilities Mortgage Payable 125,000 Total Liabilities 145,000 Capital Partners' capital (45,000 per partner BEG BAL) 187,000 Total Liabilities and Capital 332000 Activity #3 Jane Rizzoli (SSN 123-45-9876) and Maura Isles (SSN 456-78-9874) formed a general partnership on February 2, 2019 named "Spindletop Investigations Partnership". They are each 50% owners of the partnership. The partnership is located at 5000 Water Street Milwaukee, WI 53201. EIN: 39- 1513698. Business Code 561600. They use the accrual basis of accounting. Based on the financial statements below, prepare Form 1065, page 1. and Schedules K, L, M-1, M-2 and Schedule K-1. RIZZOLI AND ISLES PARTNERSHIP INCOME STATEMENT YEAR ENDING DECEMBER 31, 2019 Gross Income from Operations 400,000 Deductions Employee Wage Expense 170,000 Rent Expense 18,000 Payroll Tax Expense 21,000 Depreciation Expense 10,000 Partner Health Insurance Premiums 24,000 Total Deductions 243,000 Net Income 157,000 **In addition to these expenses, the partners each withdrew $30,000 of cash. RIZZOLI AND ISLES PARTNERSHIP BALANCE SHEET AS OF DECEMBER 31, 2019 ASSETS Current Assets Cash 277,000 Accounts Receivable 15.000 Total Current Assets 292,000 Property, Plant, and Equipment Computer Equipment 50,000 Less Accumulated Depreciation 10,000 Total Property. Plant and Equipment 40.000 Total Assets 332,000 LIABILITIES & PARTNER'S CAPITAL Current Liabilities Accounts Payable 20,000 Long-Term Liabilities Mortgage Payable 125,000 Total Liabilities 145,000 Capital Partners' capital (45,000 per partner BEG BAL) 187,000 Total Liabilities and Capital 332000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started