this is the question complete it on T1

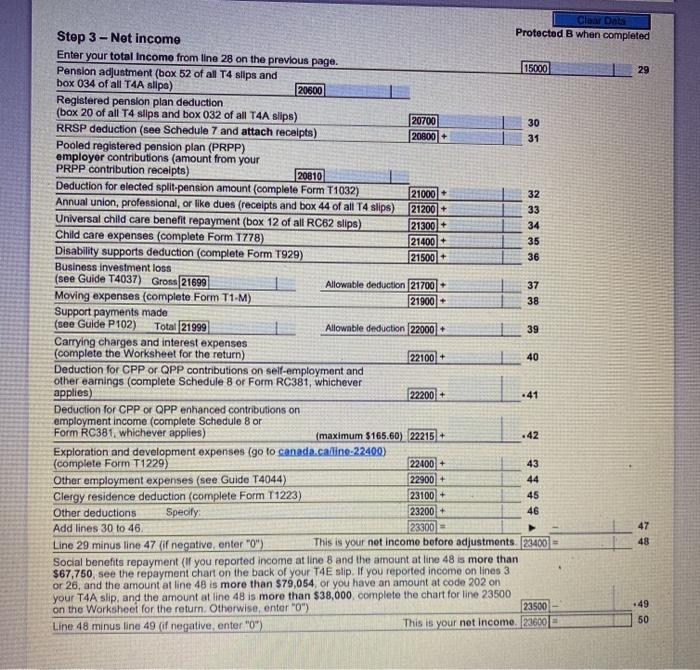

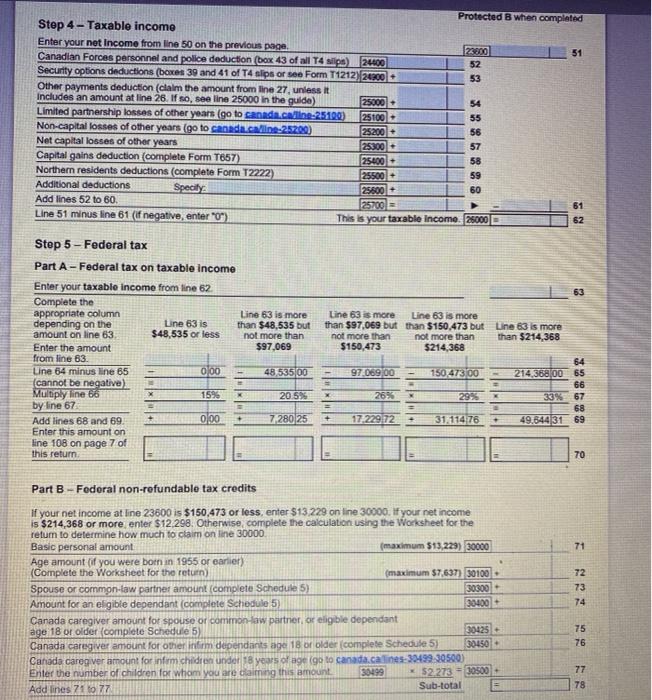

given below is the T1 forms on which it should be completed

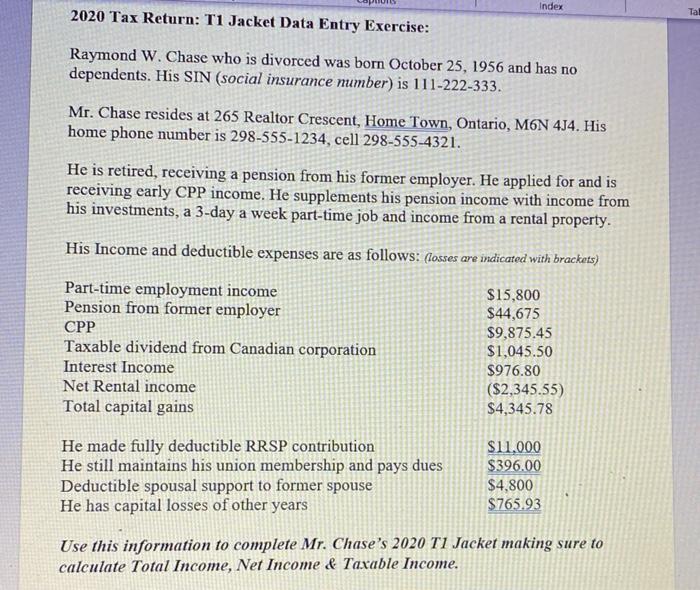

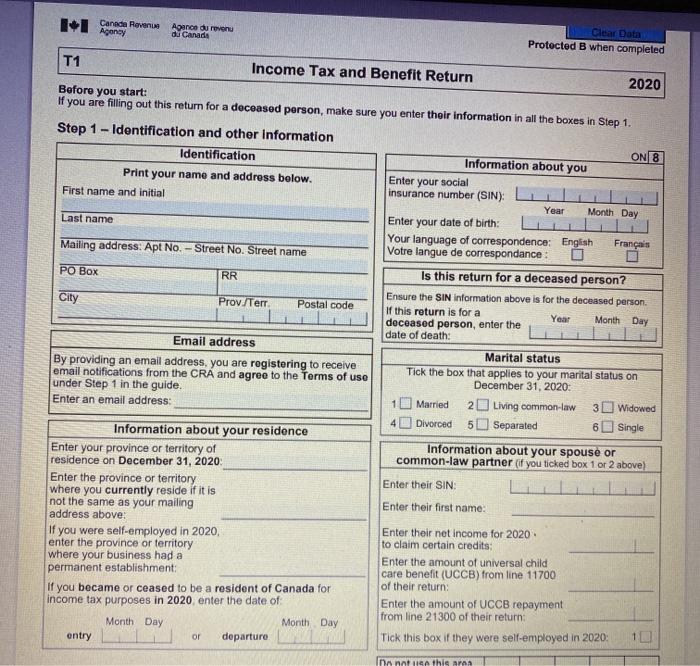

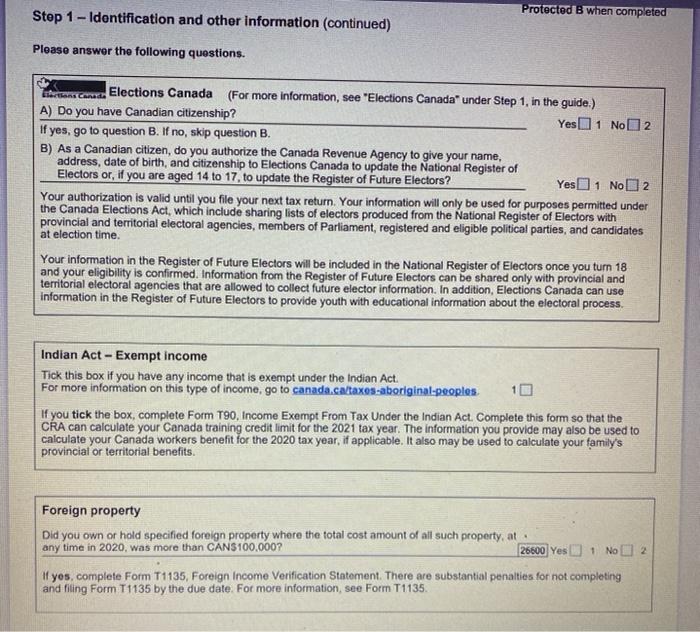

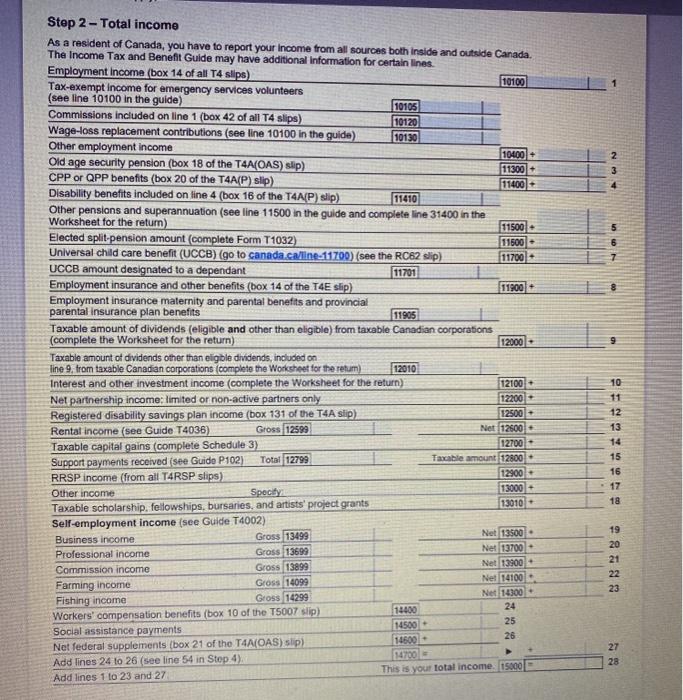

Index 2020 Tax Return: T1 Jacket Data Entry Exercise: Raymond W. Chase who is divorced was born October 25, 1956 and has no dependents. His SIN (social insurance number) is 111-222-333. Mr. Chase resides at 265 Realtor Crescent, Home Town, Ontario, MON 4J4. His home phone number is 298-555-1234, cell 298-555-4321. He is retired, receiving a pension from his former employer. He applied for and is receiving early CPP income. He supplements his pension income with income from his investments, a 3-day a week part-time job and income from a rental property. His Income and deductible expenses are as follows: (losses are indicated with brackets) Part-time employment income $15,800 Pension from former employer $44,675 CPP $9,875.45 Taxable dividend from Canadian corporation $1,045.50 Interest Income $976.80 Net Rental income ($2,345.55) Total capital gains $4,345.78 He made fully deductible RRSP contribution He still maintains his union membership and pays dues Deductible spousal support to former spouse He has capital losses of other years $11.000 $396.00 $4,800 $765.93 Use this information to complete Mr. Chase's 2020 T1 Jacket making sure to calculate Total Income, Net Income Taxable income. Il Canada Rowe Agence du revenu du Canads Clear Data Protected B when completed City Year T1 Income Tax and Benefit Return 2020 Before you start: If you are filling out this return for a deceased person, make sure you enter their information in all the boxes in Step 1. Step 1 - Identification and other Information ON 8 Identification Information about you Print your name and address below. Enter your social First name and initial insurance number (SIN) Year Month Day Last name Enter your date of birth: Your language of correspondence: English Franais Mailing address: Apt No. - Street No. Street name Votre langue de correspondance : PO Box RR Is this return for a deceased person? Ensure the SIN Information above is for the deceased person Prov./Terr Postal code If this return is for a Month Day deceased person, enter the date of death: Email address Marital status By providing an email address, you are registering to receive email notifications from the CRA and agree to the Terms of use Tick the box that applies to your marital status on December 31, 2020: under Step 1 in the guide. Enter an email address: Married 2 Living common-law 3 Widowed 4 Divorced 5Separated Single Information about your residence Enter your province or territory of Information about your spouse or residence on December 31, 2020 common-law partner if you ticked box 1 or 2 above) Enter the province or territory Enter their SIN: where you currently reside if it is not the same as your mailing Enter their first name: address above If you were self-employed in 2020, Enter their net income for 2020 enter the province or territory to claim certain credits: where your business had a Enter the amount of universal child permanent establishment care benefit (UCCB) from line 11700 of their return if you became or ceased to be a resident of Canada for income tax purposes in 2020 enter the date of Enter the amount of UCCB repayment from line 21300 of their return Month Day Month Day entry departure Tick this box if they were self-employed in 2020 In nathis this area or Step 1 - Identification and other information (continued) Protected B when completed Please answer the following questions. Franco. Elections Canada (For more information, see "Elections Canada" under Step 1, in the guide.) A) Do you have Canadian citizenship? Yes 1 No2 If yes, go to question B. If no, skip question B. B) As a Canadian citizen, do you authorize the Canada Revenue Agency to give your name, address, date of birth, and citizenship to Elections Canada to update the National Register of Electors or, if you are aged 14 to 17. to update the Register of Future Electors? Yes 1 No2 Your authorization is valid until you file your next tax return. Your information will only be used for purposes permitted under the Canada Elections Act, which include sharing lists of electors produced from the National Register of Electors with provincial and territorial electoral agencies, members of Parliament, registered and eligible political parties, and candidates at election time. Your information in the Register of Future Electors will be included in the National Register of Electors once you turn 18 and your eligibility is confirmed. Information from the Register of Future Electors can be shared only with provincial and territorial electoral agencies that are allowed to collect future elector information. In addition, Elections Canada can use information in the Register of Future Electors to provide youth with educational information about the electoral process. Indian Act - Exempt income Tick this box if you have any income that is exempt under the Indian Act. For more information on this type of income, go to canada.ca/taxes-aboriginal-peoples If you tick the box, complete Form T90, Income Exempt From Tax Under the Indian Act. Complete this form so that the CRA can calculate your Canada training credit limit for the 2021 tax year. The information you provide may also be used to calculate your Canada workers benefit for the 2020 tax year, if applicable. It also may be used to calculate your family's provincial or territorial benefits. Foreign property Did you own or hold specified foreign property where the total cost amount of all such property, at any time in 2020, was more than CANS100.000? 26600 Yes I 1 No If yes, complete Form T1135, Foreign Income Verification Statement. There are substantial penalties for not completing and filing Form T1135 by the due date. For more information, see Form T1135 2 9 Step 2 - Total income As a resident of Canada, you have to report your Income from all sources both inside and outside Canada. The Income Tax and Benefit Guide may have additional Information for certain lines. Employment Income (box 14 of all T4 slips) Tax-exempt Income for emergency services volunteers 10100 (see line 10100 in the guide) 10105 Commissions included on line 1 (box 42 of all T4 slips) 10120 Wage-loss replacement contributions (see line 10100 in the guide) 10130 Other employment income 10400 + Old age security pension (box 18 of the T4A(OAS) slip) 11300 CPP or QPP benefits (box 20 of the T4A(P) slip) 11400 Disability benefits included on line 4 (box 16 of the T4A(P) slip) 11410 Other pensions and superannuation (see line 11500 in the guide and complete line 31400 in the Worksheet for the retum) 11500 Elected split-pension amount (complete Form T1032) 11500 - Universal child care benefit (UCCB) (go to canada.ca/line 11700) (see the RC62 slip) 11700 UCCB amount designated to a dependant 11701 Employment insurance and other benefits (box 14 of the T4E slip) 11900 Employment insurance maternity and parental benefits and provincial parental insurance plan benefits 11905 Taxable amount of dividends (eligible and other than eligible) from taxable Canadian corporations (complete the Worksheet for the return) 12000 Taxable amount of dividends other than eligble dividends, included on line 9, trom taxable Canadian corporations (complete the Worksheet for the retum) 12010 Interest and other investment income (complete the Worksheet for the return) 12100 Net partnership income: limited or non-active partners only 12200 Registered disability savings plan income (box 131 of the T4A slip) 12500 Rental income (see Guide T4036) Gross 12599 Net 12600 - Taxable capital gains (complete Schedule 3) 12700 Support payments received (see Guide P102) Total 12799 Taxable amount 12800 129001 RRSP income (from all TARSP slips) Other income Specify 13000+ Taxable scholarship, fellowships, bursaries, and artists' project grants 13010 Self-employment income (see Guide T4002) Business income Gross 13499 Net 13500 Professional income Gross. 13699 Net 13700 Commission income Gross 13899 Net 13900 Farming income Gross 14099 Net 14100 Fishing income Gross 14299 Net 14300 - 18400 24 Workers' compensation benefits (box 10 of the T5007 slip) 25 Social assistance payments 14500 26 Net federal supplements (box 21 of the T4A(OAS) slip) 14600 - Add lines 24 to 26 (see line 54 in Step 4), This is your total income. 15000 Add lines 1 to 23 and 27 10 11 12 13 14 15 16 17 18 19 20 21 22 23 14700 27 28 Clear Data Protected B when completed Step 3 - Net income Enter your total income from line 28 on the previous page. 15000 29 Pension adjustment (box 52 of all T4 slips and box 034 of all T4A slipe) 20600 Registered pension plan deduction (box 20 of all T4 slips and box 032 of all T4A slips) 20700 30 RRSP deduction (see Schedule 7 and attach receipts) 20800 + 31 Pooled registered pension plan (PRPP) employer contributions (amount from your PRPP contribution receipts) 20810 Deduction for elected split pension amount (complete Form T1032) 121000 32 Annual union, professional, or like dues (receipts and box 44 of all T4 slips) 21200+ 33 Universal child care benefit repayment (box 12 of all RC62 slips) 21300 + 34 Child care expenses (complete Form 1778) 21400 + 35 Disability supports deduction (complete Form T929) 21500+ 36 Business investment loss (see Guide T4037) Gross 21699 Allowable deduction 21700 + 37 Moving expenses (complete Form T1-M) 21900- 38 Support payments made (see Guide P102) Total 21999 Allowable deduction 22000 39 Carrying charges and interest expenses (complete the Worksheet for the return) 22100 + 40 Deduction for CPP or QPP contributions on self-employment and other earnings (complete Schedule 8 or Form RC381, whichever applies) 22200+ .41 Deduction for CPP Or QPP enhanced contributions on employment income (complete Schedule 8 or Form RC381, whichever applies) (maximum $165.60) 22215 + .42 Exploration and development expenses (go to canada.calline-22400) (complete Form T1229) 22400 + 43 Other employment expenses (see Guide T4044) 22900 + 44 Clergy residence deduction (complete Form T1223) 23100 + 45 Other deductions 46 Specify 23200+ Add lines 30 to 46 23300 47 48 Line 29 minus line 47 (if negative, enter "0") This is your net income before adjustments 23400 = Social benefits repayment (If you reported income at line 8 and the amount at line 48 is more than $67,760, see the repayment chart on the back of your T4E slip. If you reported income on line 3 or 26, and the amount at line 48 is more than 579,054, or you have an amount at code 202 on your T4A slip, and the amount at line 48 is more than $38,000, complete the chart for line 23500 23500 49 on the Worksheet for the return. Otherwise, enter "0") 50 Line 48 minus line 49. (if negative, enter "O) This is your net incomo. 23600 Protected B when completed Step 4-Taxable income Enter your net Income from line 50 on the previous page 22800 51 Canadian Forces personnel and police deduction (box 43 of all T4 sils) 24400 52 Security options deductions (boxes 39 and 41 of T4 slips or see Form T1212) 24300 53 Other payments deduction (claim the amount from line 27, unless it Includes an amount at line 26. If so, see line 25000 in the guide) 25000 + 54 Limited partnership losses of other years (go to Canada.ca/line-25100) 25100 55 Non-capital losses of other years (go to canada.ca/line-25200) 25200+ 56 Net capital losses of other years 25300 57 Capital gains deduction (complete Form T857) 25400 + 58 Northern residents deductions (complete Form T2222) 25500 59 Additional deductions Specity 25600+ 60 Add lines 52 to 60 125700 61 Line 51 minus line 61 (if negative, enter"0") This is your taxable income. 26000 62 $3 Step 5 - Federal tax Part A - Federal tax on taxable income Enter your taxable income from line 62 Complete the appropriate column Line 63 is more depending on the Line 63 is than $48,535 but amount on line 63 $48,535 or less not more than Enter the amount $97.069 from line 63 Line 64 minus line 65 0 00 48,53500 (cannot be negative Multiply line 66 X 15% 20.596 by line 67 Add lines 68 and 69. + 000 7,280 25 Enter this amount on line 108 on page 7 of this return Line 63 is more Line 63 is more than $97,069 but than $150,473 but Line 63 is more not more than not more than than $214,368 $150,473 $214,368 64 97.069,00 150 47300 214,3680065 66 26% 29% 33% 67 68 17.229.72 31,11476 49.644 31 69 + 70 Part B - Federal non-refundable tax credits 71 If your net income at line 23600 is $150,473 or less, enter $13229 on line 30000. If your net income is $214,368 or more onter $12,298. Otherwise, complete the calculation using the Worksheet for the return to determine how much to claim on line 30000 Basic personal amount maximum 513,229) 30000 Age amount (if you were born in 1955 or earlier) (Complete the Worksheet for the return) (maximum $7,637) 30100 Spouse or common-law partner amount (complete Schedule 5) 30300 Amount for an eligible dependant (complete Schedule 5) 30400 + Canada caregiver amount for spouse or common-law partner, or eligible dependant age 18 or older complete Schedule 5) 30425- Canada caregiver amount for other infim dependants age 18 or older complete Schedule 5) 30450 Canada caregiver amount for inform children under 18 years of age (go to canada.calines: 30499-30500) Enter the number of children for whom you are claiming this amount 30499 * 52.273 - 30500 Add lines 71 to 77 Sub-total 72 73 74 75 76 77 78