This is the question

followup screenshots are relevent for answering the question

followup screenshots are relevent for answering the question

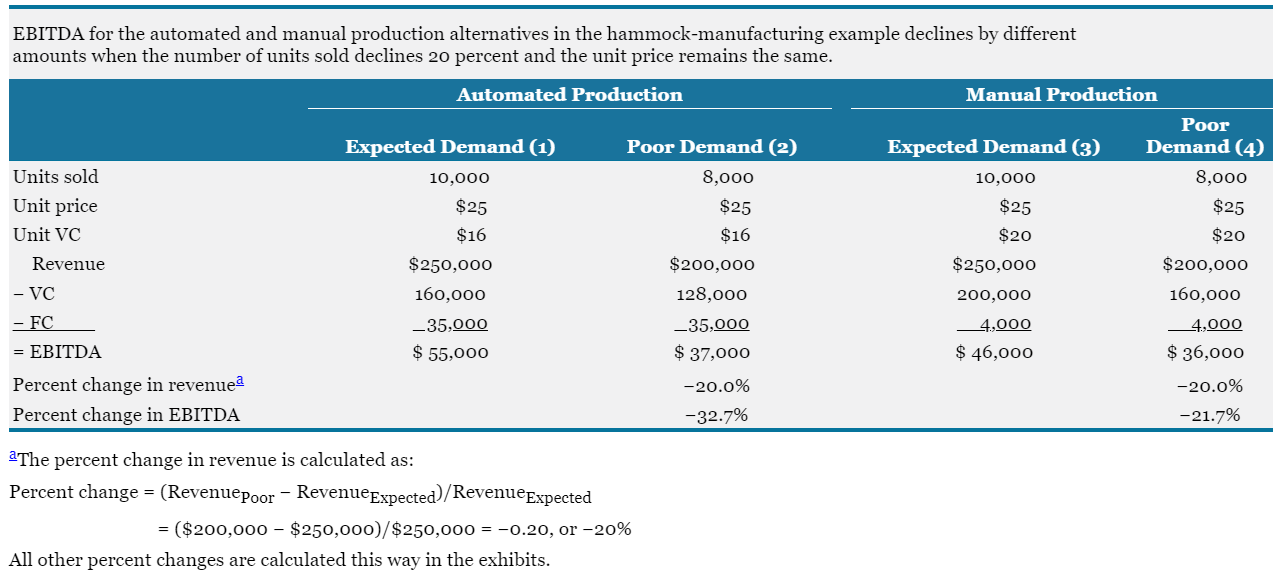

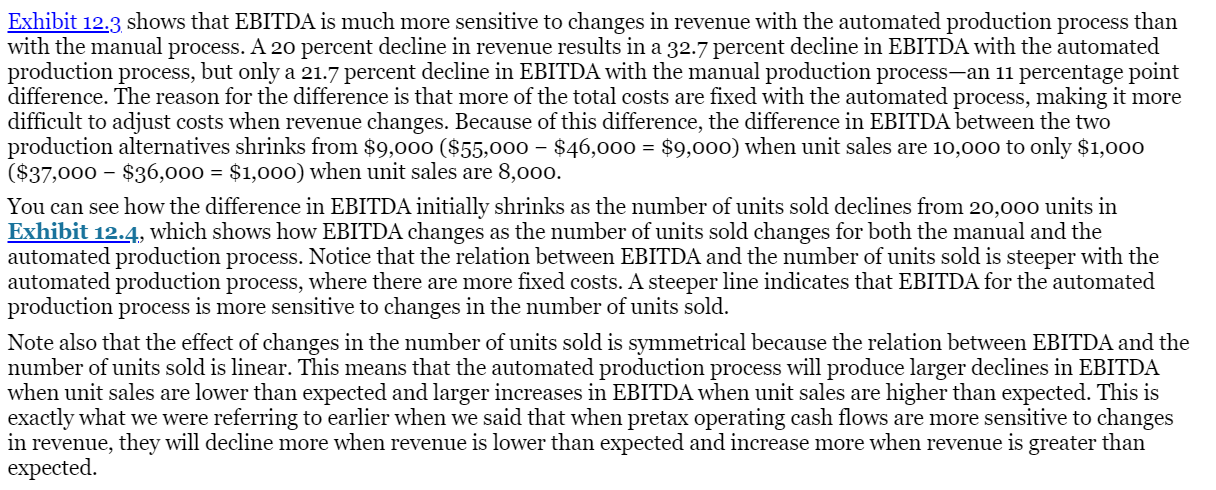

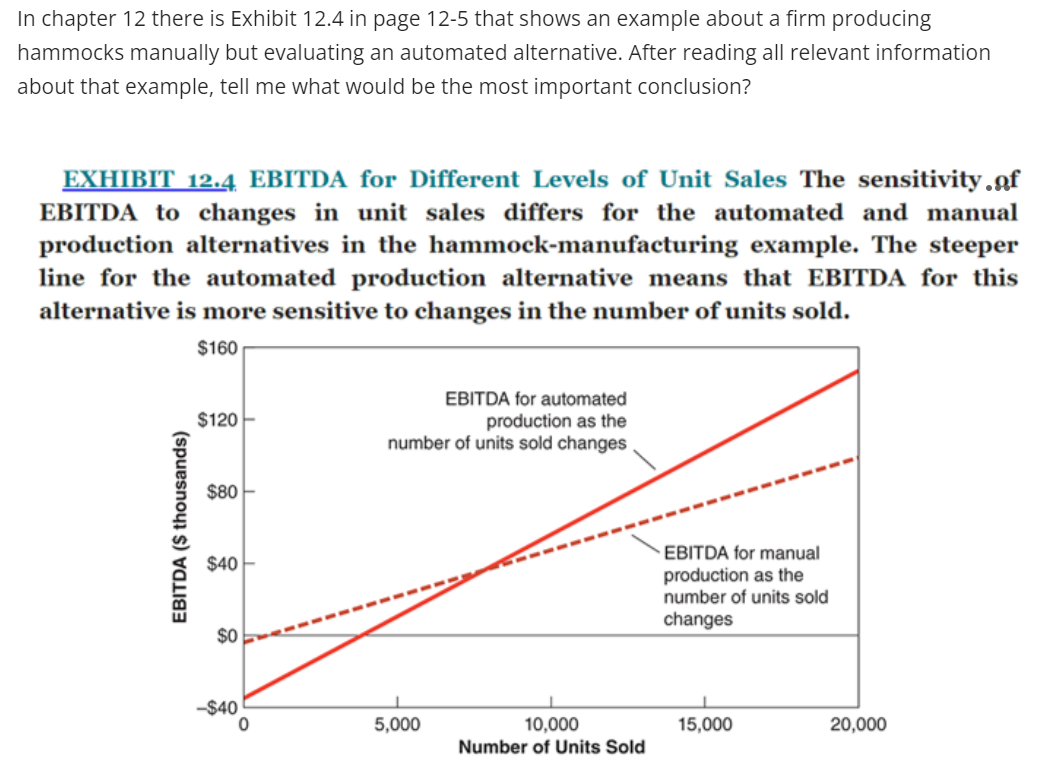

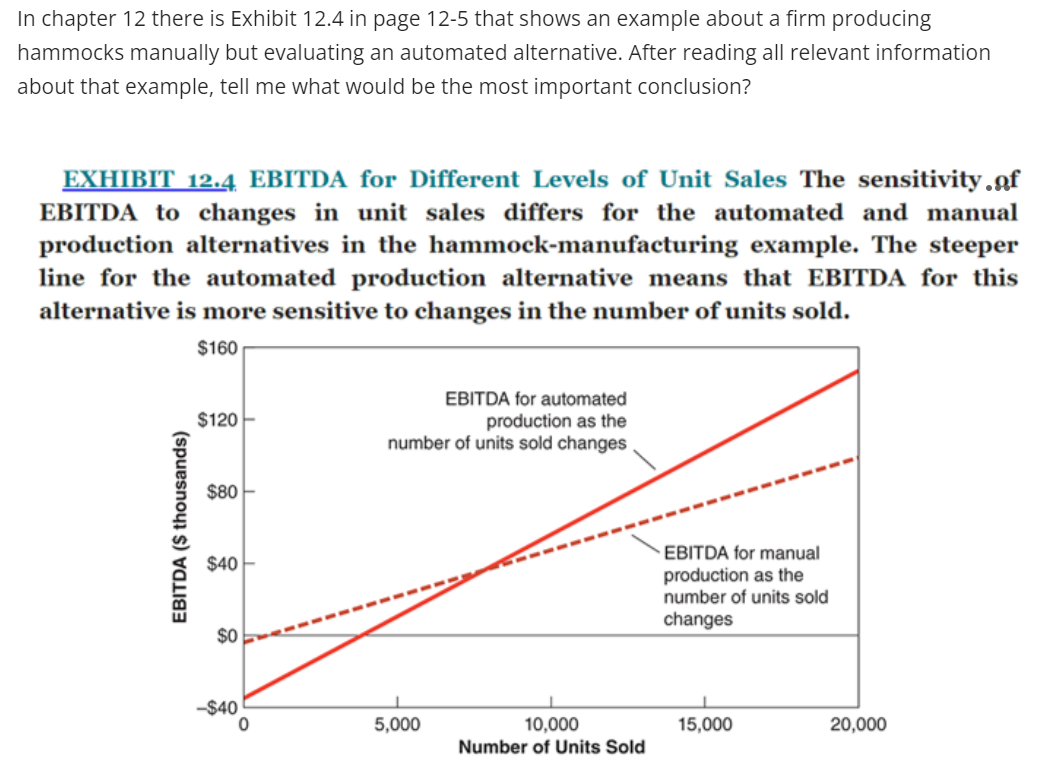

In chapter 12 there is Exhibit 12.4 in page 125 that shows an example about a firm producing hammocks manually but evaluating an automated alternative. After reading all relevant information about that example, tell me what would be the most important conclusion? EXHIBIT 12.4 EBITDA for Different Levels of Unit Sales The sensitivity f EBITDA to changes in unit sales differs for the automated and manual production alternatives in the hammock-manufacturing example. The steeper line for the automated production alternative means that EBITDA for this alternative is more sensitive to changes in the number of units sold. EBITDA for the automated and manual production alternatives in the hammock-manufacturing example declines by different amounts when the number of units sold declines 20 percent and the unit price remains the same. Exhibit 12.3. shows that EBITDA is much more sensitive to changes in revenue with the automated production process than with the manual process. A 20 percent decline in revenue results in a 32.7 percent decline in EBITDA with the automated production process, but only a 21.7 percent decline in EBITDA with the manual production process-an 11 percentage point difference. The reason for the difference is that more of the total costs are fixed with the automated process, making it more difficult to adjust costs when revenue changes. Because of this difference, the difference in EBITDA between the two production alternatives shrinks from $9,000($55,000$46,000=$9,000) when unit sales are 10,000 to only $1,000 ($37,000$36,000=$1,000) when unit sales are 8,000 You can see how the difference in EBITDA initially shrinks as the number of units sold declines from 20,0oo units in Exhibit 12.4, which shows how EBITDA changes as the number of units sold changes for both the manual and the automated production process. Notice that the relation between EBITDA and the number of units sold is steeper with the automated production process, where there are more fixed costs. A steeper line indicates that EBITDA for the automated production process is more sensitive to changes in the number of units sold. Note also that the effect of changes in the number of units sold is symmetrical because the relation between EBITDA and the number of units sold is linear. This means that the automated production process will produce larger declines in EBITDA when unit sales are lower than expected and larger increases in EBITDA when unit sales are higher than expected. This is exactly what we were referring to earlier when we said that when pretax operating cash flows are more sensitive to changes in revenue, they will decline more when revenue is lower than expected and increase more when revenue is greater than expected. In chapter 12 there is Exhibit 12.4 in page 125 that shows an example about a firm producing hammocks manually but evaluating an automated alternative. After reading all relevant information about that example, tell me what would be the most important conclusion? EXHIBIT 12.4 EBITDA for Different Levels of Unit Sales The sensitivity f EBITDA to changes in unit sales differs for the automated and manual production alternatives in the hammock-manufacturing example. The steeper line for the automated production alternative means that EBITDA for this alternative is more sensitive to changes in the number of units sold. EBITDA for the automated and manual production alternatives in the hammock-manufacturing example declines by different amounts when the number of units sold declines 20 percent and the unit price remains the same. Exhibit 12.3. shows that EBITDA is much more sensitive to changes in revenue with the automated production process than with the manual process. A 20 percent decline in revenue results in a 32.7 percent decline in EBITDA with the automated production process, but only a 21.7 percent decline in EBITDA with the manual production process-an 11 percentage point difference. The reason for the difference is that more of the total costs are fixed with the automated process, making it more difficult to adjust costs when revenue changes. Because of this difference, the difference in EBITDA between the two production alternatives shrinks from $9,000($55,000$46,000=$9,000) when unit sales are 10,000 to only $1,000 ($37,000$36,000=$1,000) when unit sales are 8,000 You can see how the difference in EBITDA initially shrinks as the number of units sold declines from 20,0oo units in Exhibit 12.4, which shows how EBITDA changes as the number of units sold changes for both the manual and the automated production process. Notice that the relation between EBITDA and the number of units sold is steeper with the automated production process, where there are more fixed costs. A steeper line indicates that EBITDA for the automated production process is more sensitive to changes in the number of units sold. Note also that the effect of changes in the number of units sold is symmetrical because the relation between EBITDA and the number of units sold is linear. This means that the automated production process will produce larger declines in EBITDA when unit sales are lower than expected and larger increases in EBITDA when unit sales are higher than expected. This is exactly what we were referring to earlier when we said that when pretax operating cash flows are more sensitive to changes in revenue, they will decline more when revenue is lower than expected and increase more when revenue is greater than expected

followup screenshots are relevent for answering the question

followup screenshots are relevent for answering the question