this is the question:

this is the answer booklet, please layout the answer similar to this, many thanks

any help would be very much appreciated thank you!

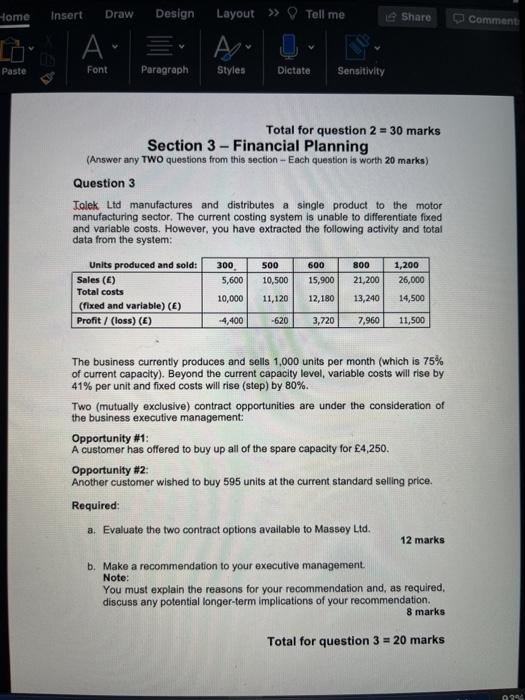

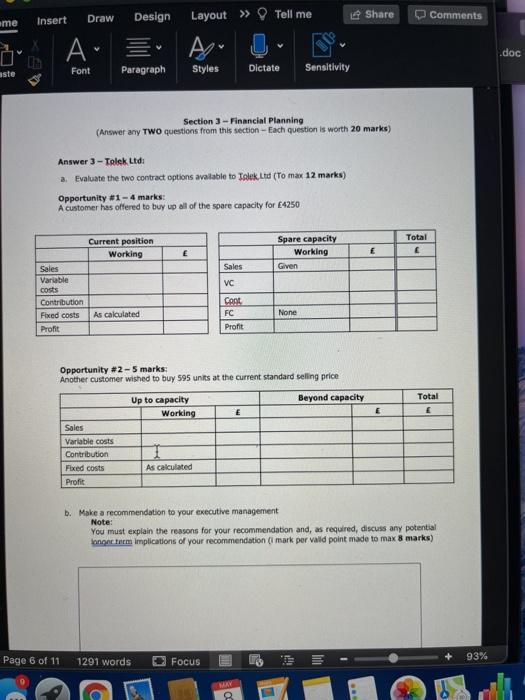

Home Insert Draw Design Layout Tell me Share Comment A Paste Font Paragraph Styles Dictate. Sensitivity Total for question 2 = 30 marks Section 3 - Financial Planning (Answer any TWO questions from this section - Each question is worth 20 marks) Question 3 Tolek Ltd manufactures and distributes a single product to the motor manufacturing sector. The current costing system is unable to differentiate fixed and variable costs. However, you have extracted the following activity and total data from the system: 300 600 800 5,600 Units produced and sold: Sales (6) Total costs (fixed and variable)(E) Profit/ (loss) (E) 500 10,500 11,120 15,900 21,200 13,240 1,200 26,000 14,500 10,000 12,180 -4,400 -620 3,720 7,960 11,500 The business currently produces and sells 1,000 units per month (which is 75% of current capacity). Beyond the current capacity level, variable costs will rise by 41% per unit and fixed costs will riso (step) by 80%. Two (mutually exclusive) contract opportunities are under the consideration of the business executive management Opportunity #1: A customer has offered to buy up all of the spare capacity for 4,250. Opportunity #2: Another customer wished to buy 595 units at the current standard selling price. Required: a. Evaluate the two contract options available to Massey Ltd. 12 marks b. Make a recommendation to your executive management. Note: You must explain the reasons for your recommendation and, as required, discuss any potential longer-term Implications of your recommendation 8 marks Total for question 3 = 20 marks 03 Draw Design Share Insert Comments ame A Layout Tell me Styles Dictate Sensitivity .doc aste Font Paragraph Section 3 - Financial Planning (Answer any TWO questions from this section - Each question is worth 20 marks) Answer 3-Telek Ltd a. Evaluate the two contract options available to Talek. Ltd (To max 12 marks) Opportunity #1 - 4 marks: A customer has offered to buy up all of the spare capacity for 4250 Total Current position Working E Spare capacity Working Given E Sales VC Sales Variable costs Contribution Fixed costs Profit As calculated Cont FC Profit None Opportunity #2-5 marks: Another customer wished to buy 595 units at the current standard selling price Beyond capacity Up to capacity Working Total E E E Sales Variable costs Contribution Fixed costs Profit As calculated b. Make a recommendation to your executive management Note: You must explain the reasons for your recommendation and, as required, discuss any potential lange term implications of your recommendation mark per vald point made to max 8 marks) Page 6 of 11 1291 words Focus 93% MY 8