This is the question

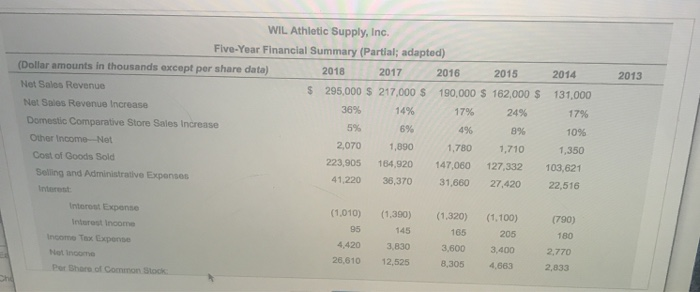

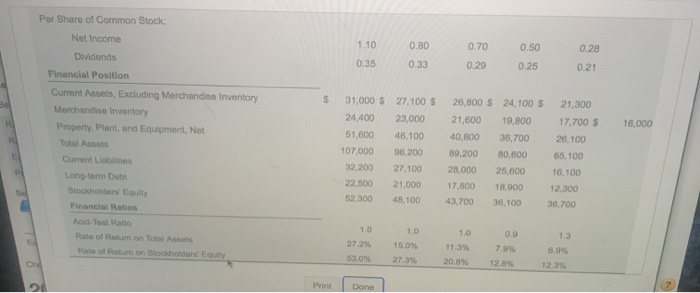

This is the Financial Summary

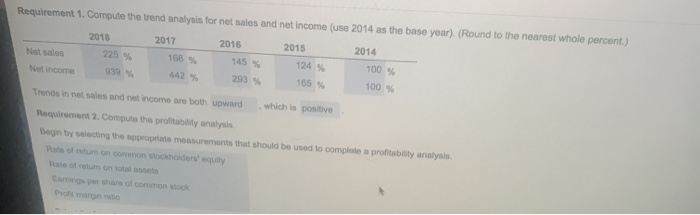

These are the previously 2 questions asked

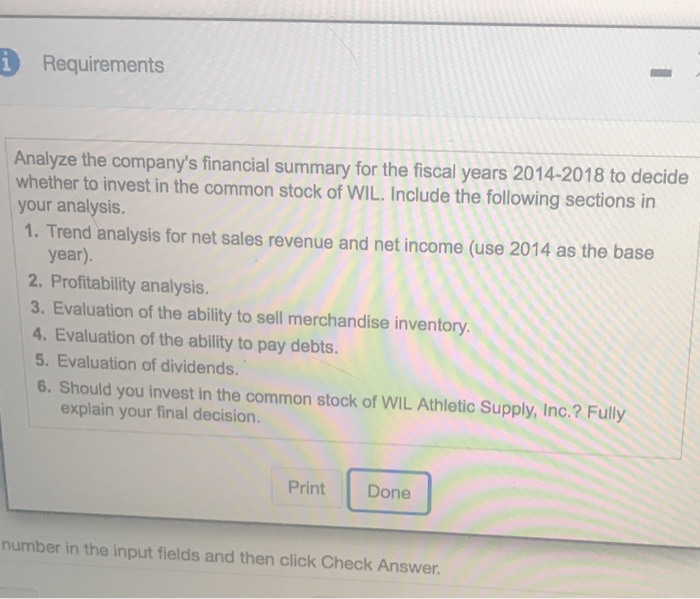

These are the requiremnets (other asked questions) in this whole problem

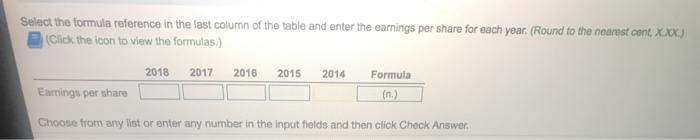

Select the formula reference in the last column of the table and enter the earnings per share for each year. (Round to the nearest cont, XXX) (Click the icon to view the formulas.) 2018 2017 2016 2015 2014 Formula Earnings per share Choose from any list or enter any number in the input fields and then click Check Answer. 2013 WIL Athletic Supply, Inc. Five-Year Financial Summary (Partial; adapted) (Dollar amounts in thousands except per share data) 2018 2017 2016 2015 Not Sales Revenue $ 295,000 $ 217,000 $ 190,000 $ 162,000 $ Net Sales Revenue Increase 36% 14% 17% 24% Domestic Comparative Store Sales Increase 5% 6% 8% Other Income-Net 2,070 1,890 1,780 1,710 Cost of Goods Sold 223,905 184,920 147,060 127,332 Selling and Administrative Expenses 41.220 36,370 31,660 27,420 2014 131,000 17% 10% 1,350 103,621 22,516 (1,010) (1,320) 165 Interest Expense Interest income Income Tax Expense et income Per Share of Common Stock (1,390) 145 3,830 12,525 4,420 (1.100) 205 3,400 4.663 (790) 180 2.770 2,833 26,610 8,305 0.28 1.10 0.35 0.80 0.33 0.70 0.29 0.50 0.25 0.21 Per Share of Common Stock: Net Income Dividends Financial Position Current Assets, Excluding Merchandise Inventory Merchandise Inventory Property. Plant, and Equipment, Not Total Assets Current Liabilities Long-term Debt stockholders' Equity Financial Ratios 16,000 31,000 $ 24,400 51,600 107.000 32.200 22.500 52,300 27,100 $ 23,000 46,100 96.200 27,100 21.000 48,100 26,800 $ 24,100 $ 21,600 19,800 40.800 36,700 89,200 30.600 20,000 25.600 17,500 18,900 43.700 36,00 21,300 17.700 $ 26.100 65,100 10,100 12,300 36,700 Add-Test Ratio Rate of Return on Total Assets Rate of Return on Stockholders 1.0 27.2% 53.0% 1.0 15.0% 27.3% 1.0 11.3% 20.8% 0.9 7.9% 12.8% 6.9% 12 396 Print Done Requirement 1. Compute the trend analysis for net sales and net income (use 2014 as the base year). (Round to the nearest whole percent.) 2018 2017 2016 2015 2014 Not sales 225 % 166 % 145 % 124 % 100 % Net income 830 % 442 % 293 % 165 %. 100% Trends in net sales and net income are both upward which is positive Requirement 2. Compute the probly analysis Begin by acting the proper mesurements that should be used to complete a profitability analysis to mon common holders equity E g et har o common stock Requirements Analyze the company's financial summary for the fiscal years 2014-2018 to decide whether to invest in the common stock of WIL. Include the following sections in your analysis 1. Trend analysis for net sales revenue and net income (use 2014 as the base year). 2. Profitability analysis. 3. Evaluation of the ability to sell merchandise inventory. 4. Evaluation of the ability to pay debts. 5. Evaluation of dividends. 6. Should you invest in the common stock of WIL Athletic Supply, Inc.? explain your final decision. Print Done number in the input fields and then click Check