This is the same question, but it is just in two pictures so you can see the entire problem. Please fill in all the blue bordered boxed with the correct values, thanks.

This is the same question, but it is just in two pictures so you can see the entire problem. Please fill in all the blue bordered boxed with the correct values, thanks.

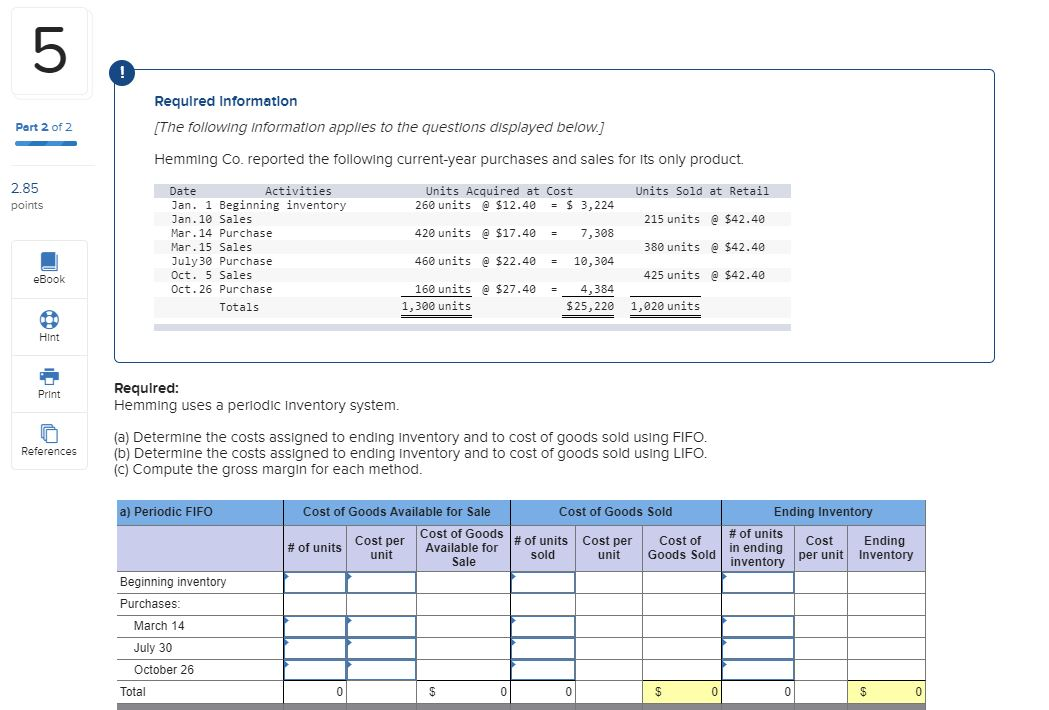

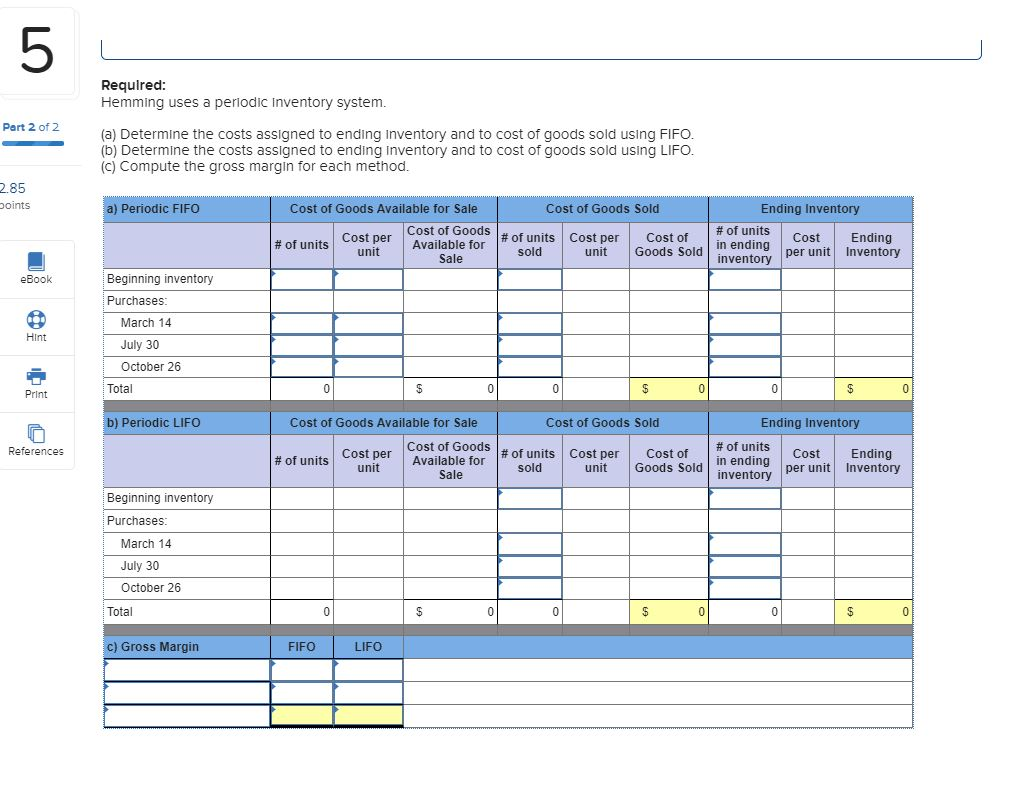

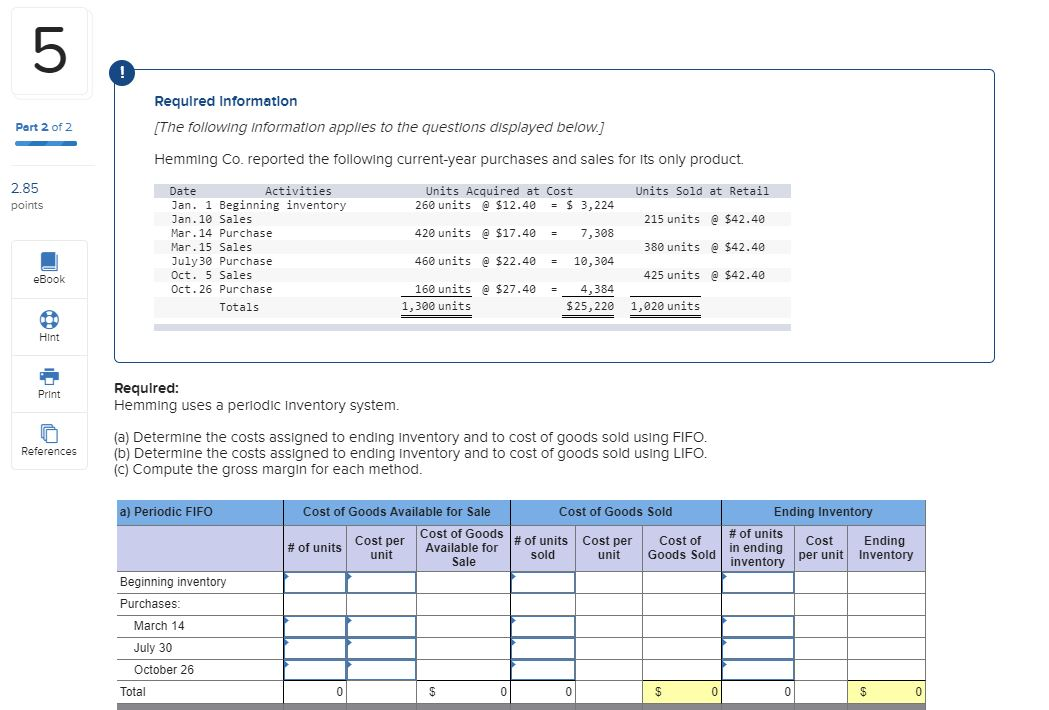

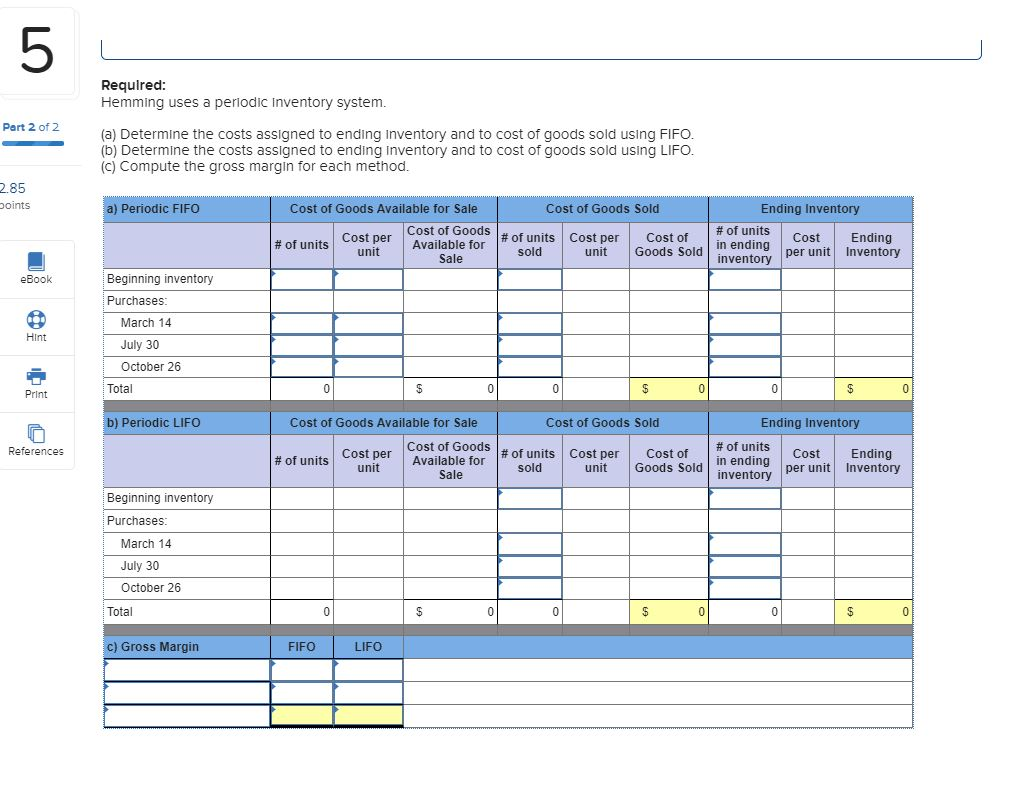

Required Information [The following information applies to the questions displayed below.] Part 2 of 2 Hemming Co. reported the following current-year purchases and sales for its only product 2.85 points Units Acquired at Cost 260 units @ $12.40 = $ 3,224 Units Sold at Retail 215 units @ $42.40 Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Mar. 14 Purchase Mar. 15 Sales July 30 Purchase Oct. 5 Sales Oct. 26 Purchase Totals 420 units @ $17.40 460 units @ $22.40 = = 7,308 10,304 380 units @ $42.40 425 units @ $42.40 eBook = 160 units @ $27.40 1,300 units 4,384 $ 25, 220 1,020 units Hint Print Required: Hemming uses a periodic Inventory system. References (a) Determine the costs assigned to ending Inventory and to cost of goods sold using FIFO. (b) Determine the costs assigned to ending Inventory and to cost of goods sold using LIFO. (c) Compute the gross margin for each method. a) Periodic FIFO Cost of Goods Available for Sale Cost of Goods Cost per # of units Available for unit Sale Cost of Goods Sold # of units Cost per of unit Cost of sold unit Goods Sold Ending Inventory # of units Cost Ending in ending inventory per unit Inventory Beginning inventory Purchases: March 14 July 30 October 26 Total $ 0 0 01 $ 0 Required: Hemming uses a periodic Inventory system. Part 2 of 2 (a) Determine the costs assigned to ending Inventory and to cost of goods sold using FIFO. (b) Determine the costs assigned to ending Inventory and to cost of goods sold using LIFO. (c) Compute the gross margin for each method. 2.85 points a) Periodic FIFO Cost of Goods Available for Sale Cost of Goods Sold # of units Cost per Cost of sold unit Goods Sold Ending Inventory # of units Cost Ending in ending inventory per unit Inventory # of units Cost per Cost of Goods unit Available for Sale eBook ot Hint Beginning inventory Purchases: March 14 July 30 October 26 Total Print $ 0 0 $ 0 $ 0 b) Periodic LIFO References Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Goods # of units Cost per | # of units Cost of Cost Available for Ending unit Sale | sold unit in ending Goods Sold inventory per unit Inventory # of units Cost per Beginning inventory Purchases: March 14 July 30 October 26 Total $ 0 0 $ 0 0 $ 0 c) Gross Margin FIFO LIFO

This is the same question, but it is just in two pictures so you can see the entire problem. Please fill in all the blue bordered boxed with the correct values, thanks.

This is the same question, but it is just in two pictures so you can see the entire problem. Please fill in all the blue bordered boxed with the correct values, thanks.