This is the Solution to Depreciation!

Consider the following two scenarios. A taxpayer acquires a rental property in April 2019 for $1 million (the same case as the depreciation assignment; $800,000 assigned to building; 27.5year depreciation) and sells it for $1.5 million either on:

(a) December 31, 2019 or on

(b) December 31, 2020

1. What is the gain on sale? Remember to add back the value of the land when calculating the gain. Show calculations. You will need the correct solutions to the Depreciation1 assignment (please see posted solution under Course Documents available after you submit Depreciation1).

Scenario 1: sale on 12/31/19

Scenario 2: sale on 12/31/20

2. What kind of gain is this? Ordinary or Capital? Explain why

Scenario 1

Scenario 2

3. Based on your answers above, calculate the tax owed on the gain.

Scenario 1

Scenario 2

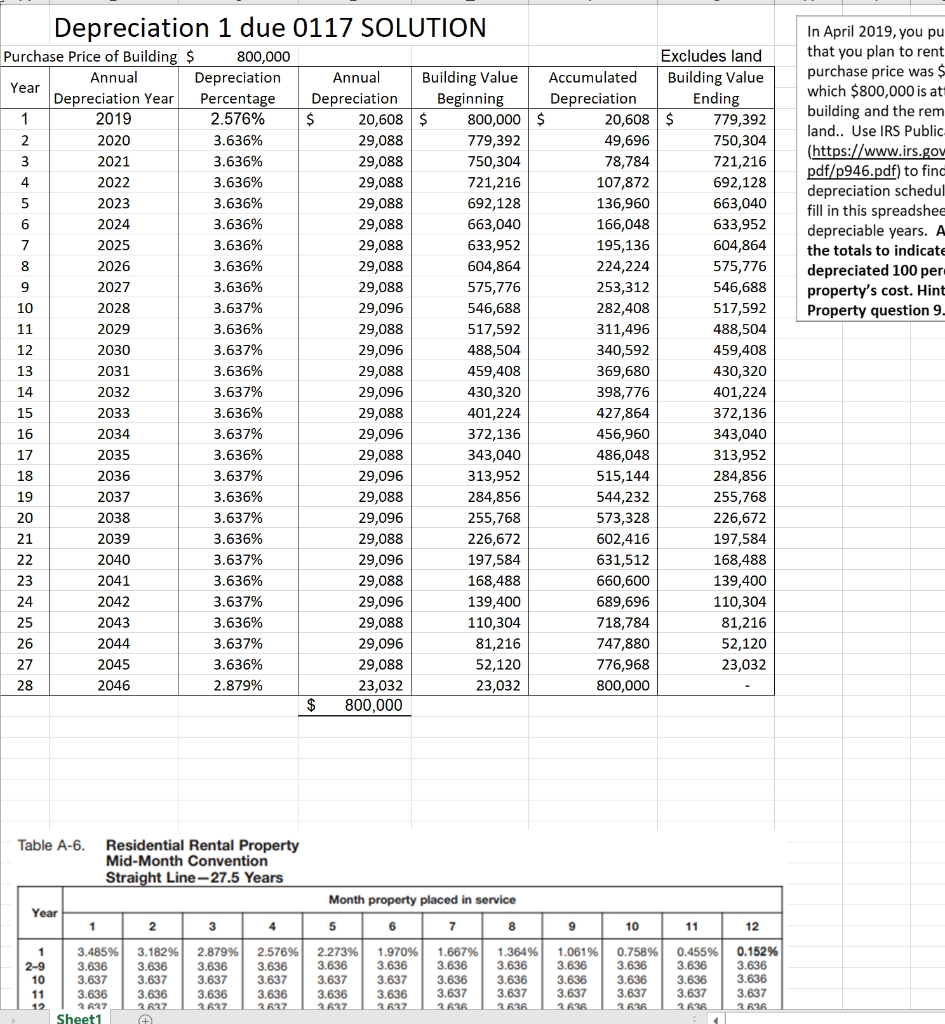

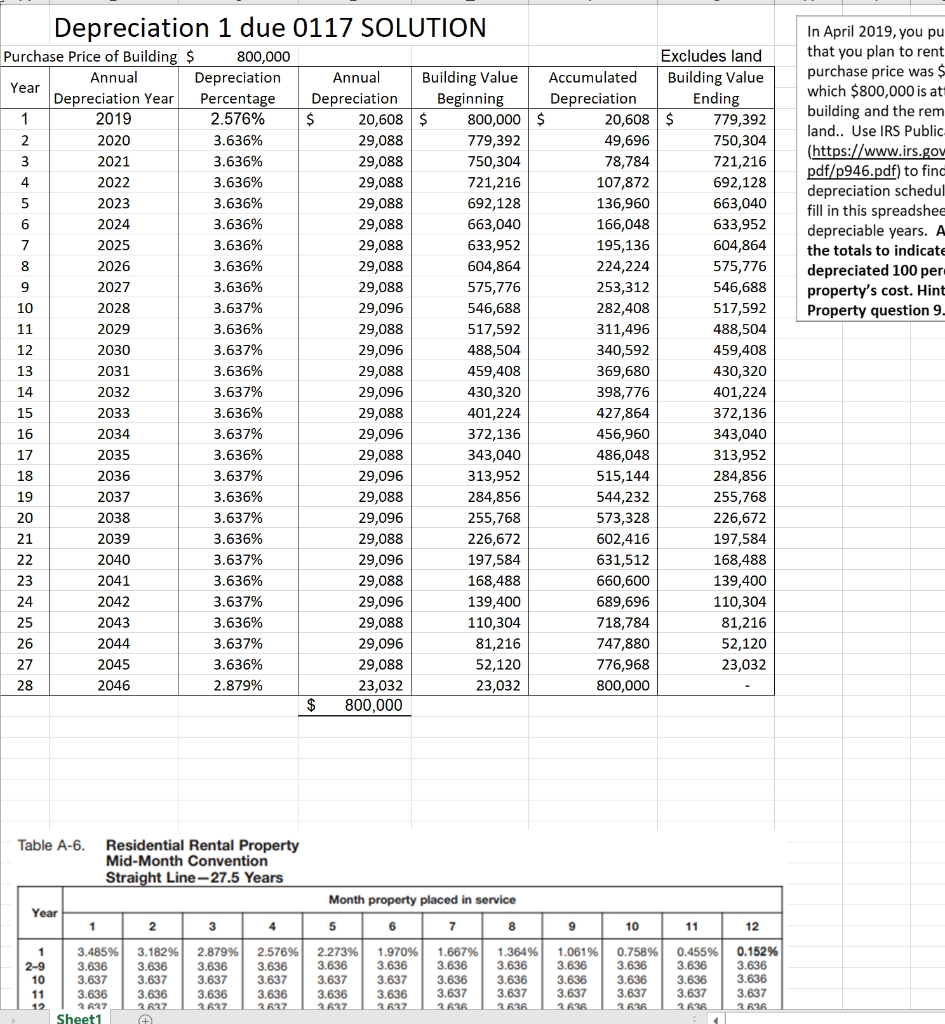

Depreciation 1 due 0117 SOLUTION In April 2019, you pu that you plan to rent purchase price was $ which $800,000 is at Excludes land Purchase Price of Building $ 800,000 Building Value Beginning 800,000 $ 779,392 Building Value Ending 779,392 Annual Depreciation Annual Accumulated Year Depreciation Year 2019 Depreciation 24 Depreciation 20,608 $ Percentage 2.576% building and the rem land.. Use IRS Public- 20,608 $ 2020 3.636% 29,088 49,696 750,304 (https://www.irs.gov pdf/p946.pdf) to find depreciation schedul fill in this spreadshee depreciable years. A 78,784 2021 3.636% 29,088 750,304 721,216 721,216 4 2022 3.636% 29,088 107,872 692,128 2023 3.636% 29,088 692,128 136,960 663,040 2024 633,952 3.636% 29,088 663,040 166,048 3.636% 29,088 2025 633,952 195,136 604,864 the totals to indicate 3.636% 2026 29,088 604,864 224,224 575,776 depreciated 100 per property's cost. Hint 253,312 3.636% 2027 29,088 575,776 546,688 3.637% 10 2028 29,096 546,688 282,408 517,592 Property question 9. 3.636% 2029 11 29,088 517,592 311,496 488,504 12 2030 3.637% 29,096 488,504 340,592 459,408 3.636% 13 2031 29,088 459,408 369,680 430,320 3.637% 14 2032 29,096 430,320 398,776 401,224 3.636% 401,224 15 2033 29,088 427,864 372,136 3.637% 29,096 343,040 16 2034 372,136 456,960 486,048 3.636% 29,088 343,040 313,952 17 2035 2036 3.637% 313,952 18 29,096 515,144 284,856 3.636% 29,088 255,768 19 2037 284,856 544,232 3.637% 20 2038 29,096 255,768 573,328 226,672 21 3.636% 226,672 197,584 2039 29,088 602,416 197,584 22 2040 3.637% 29,096 631,512 168,488 3.636% 23 2041 29,088 168,488 660,600 139,400 24 2042 3.637% 29,096 139,400 689,696 110,304 3.636% 29,088 81,216 25 2043 110,304 718,784 747,880 26 2044 3.637% 29,096 81,216 52,120 776,968 29,088 27 2045 3.636% 52.120 23,032 2046 2.879% 23,032 28 23,032 800,000 800,000 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years Table A-6. Month property placed in service Year 3 6 10 11 12 0.152% 3.636 3.485% 3.182% 2.879% 2.576% 2.273% 0.758% 1.970% 3.636 1.667% 3.636 3.636 3.637 1.364% 3.636 1.061% 0.455% 3.636 3.636 3.636 3.637 3.636 3.636 2-9 10 3.636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.637 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 11 3.636 3.636 3.636 3.636 12 3637 3637 3637 3637 3637 3636 3636 Sheet1