Question

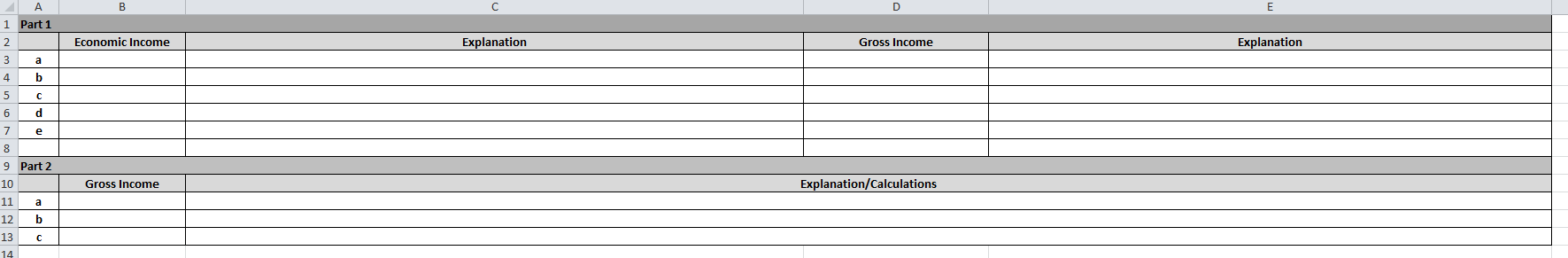

This is the template i was given, please format your answer to be the same, thank you in advance. NO MORE INFORMATION WAS GIVEN FOR

This is the template i was given, please format your answer to be the same, thank you in advance.

NO MORE INFORMATION WAS GIVEN FOR THE QUESTION!

Part 1: Determine the taxpayers current-year (1) economic income and (2) gross income for tax purposes from the following events:

Curtis, age 18, has income as follows: $700 interest from a certificate of deposit and $6,000 from repairing cars.

Mattie, age 18, has income as follows: $600 cash dividends from a stock investment and $4,700 from handling a paper route.

Mel, age 16, has income as follows: $800 interest on a bank savings account and $700 for painting a neighbors fence.

Lucy, age 15, has income as follows: $400 cash dividends from a stock investment and $500 from grooming pets.

Sarah, age 67 and a widow, has income as follows: $500 from a bank savings account and $3,200 from babysitting.

Part 2: or each of the following, determine the amount that should be included in gross income:

a) Peyton was selected the most valuable player in the Super Bowl. In recognition of this, he was awarded an automobile with a value of $60,000. Peyton did not need the automobile, so he asked that the title be put in his parents names.

b) Jacob was awarded the Nobel Peace Prize. When he was presented the check for $1.4 million, Jacob said, I do not need the money. Give it to the United Nations to use toward the goal of world peace.

c) Linda won the Craig County Fair beauty pageant. She received a $10,000 scholarship that paid her $6,000 for tuition and $4,000 for meals and housing for the academic year.

This is the template i was given, please format your answer to be the same, thank you in advance.

NO MORE INFORMATION WAS GIVEN FOR THE QUESTION!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started