Answered step by step

Verified Expert Solution

Question

1 Approved Answer

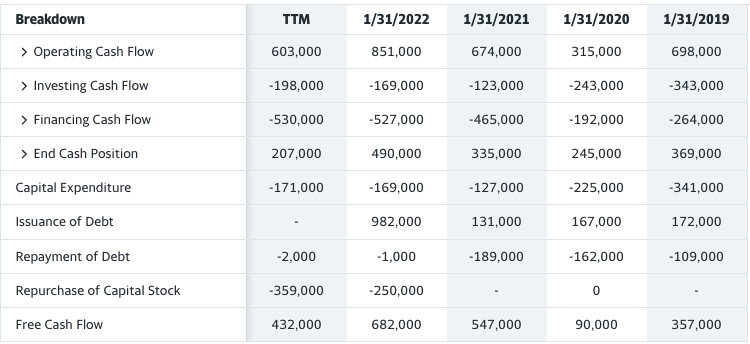

This is Victoria's Secret & Co. cash flow. What can you tell me about the financial health of the company? Explain concepts, discuss increases and

This is Victoria's Secret & Co. cash flow. What can you tell me about the financial health of the company? Explain concepts, discuss increases and decreases. Please keep your answer from 1-2 paragraphs.

\begin{tabular}{|l|c|c|c|c|c|} \hline Breakdown & TTM & 1/31/2022 & 1/31/2021 & 1/31/2020 & 1/31/2019 \\ \hline> Operating Cash Flow & 603,000 & 851,000 & 674,000 & 315,000 & 698,000 \\ \hline> Investing Cash Flow & 198,000 & 169,000 & 123,000 & 243,000 & 343,000 \\ \hline> Financing Cash Flow & 530,000 & 527,000 & 465,000 & 192,000 & 264,000 \\ \hline Pend Cash Position & 207,000 & 490,000 & 335,000 & 245,000 & 369,000 \\ \hline Capital Expenditure & 171,000 & 169,000 & 127,000 & 225,000 & 341,000 \\ \hline Issuance of Debt & & 982,000 & 131,000 & 167,000 & 172,000 \\ \hline Repayment of Debt & 2,000 & 1,000 & 189,000 & 162,000 & 109,000 \\ \hline Repurchase of Capital Stock & 359,000 & 250,000 & & 0 \\ \hline Free Cash Flow & 432,000 & 682,000 & 547,000 & 90,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|} \hline Breakdown & TTM & 1/31/2022 & 1/31/2021 & 1/31/2020 & 1/31/2019 \\ \hline> Operating Cash Flow & 603,000 & 851,000 & 674,000 & 315,000 & 698,000 \\ \hline> Investing Cash Flow & 198,000 & 169,000 & 123,000 & 243,000 & 343,000 \\ \hline> Financing Cash Flow & 530,000 & 527,000 & 465,000 & 192,000 & 264,000 \\ \hline Pend Cash Position & 207,000 & 490,000 & 335,000 & 245,000 & 369,000 \\ \hline Capital Expenditure & 171,000 & 169,000 & 127,000 & 225,000 & 341,000 \\ \hline Issuance of Debt & & 982,000 & 131,000 & 167,000 & 172,000 \\ \hline Repayment of Debt & 2,000 & 1,000 & 189,000 & 162,000 & 109,000 \\ \hline Repurchase of Capital Stock & 359,000 & 250,000 & & 0 \\ \hline Free Cash Flow & 432,000 & 682,000 & 547,000 & 90,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started