THIS IS WHAT I HAVE WRONG:

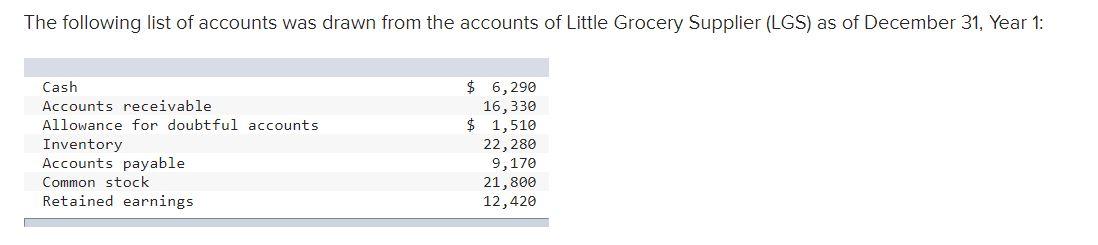

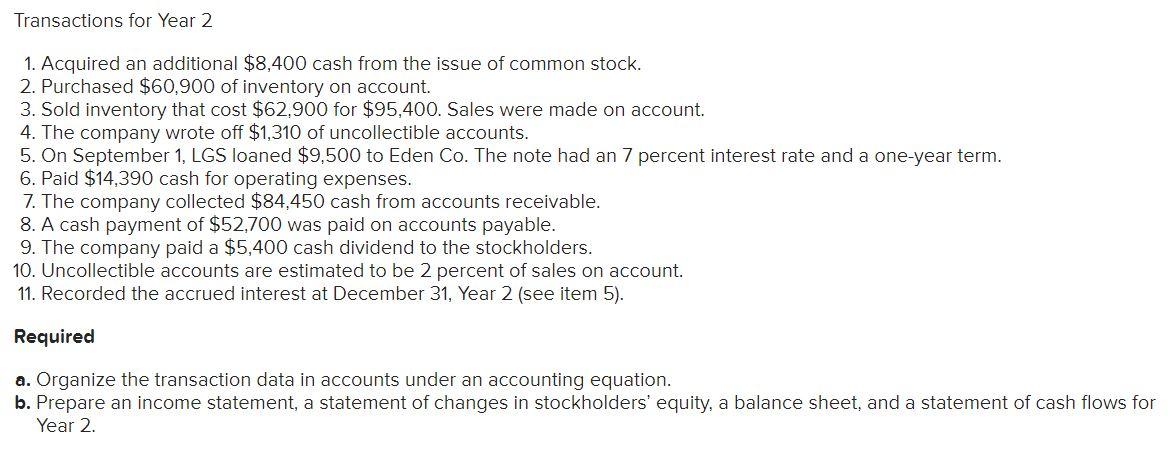

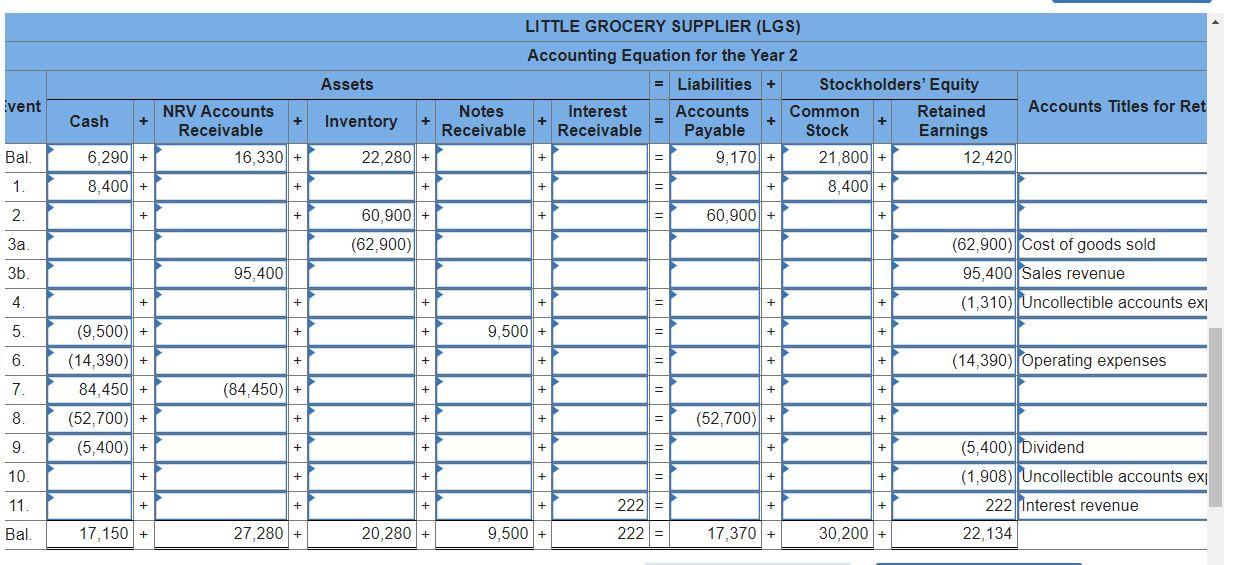

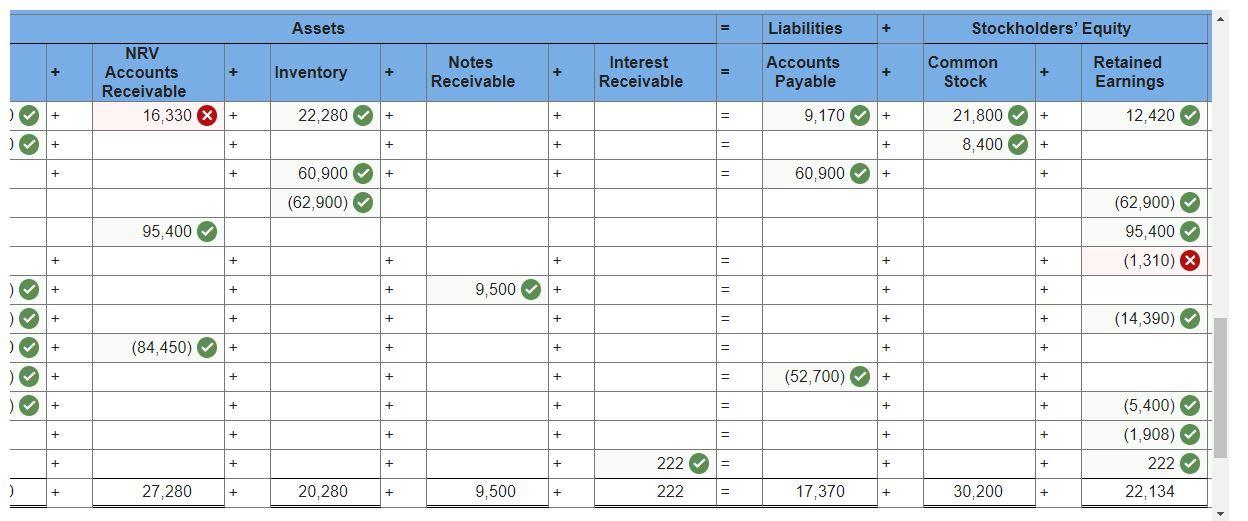

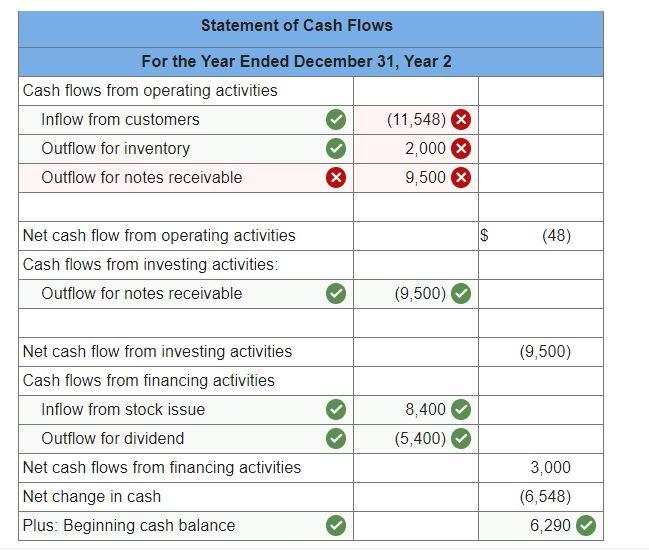

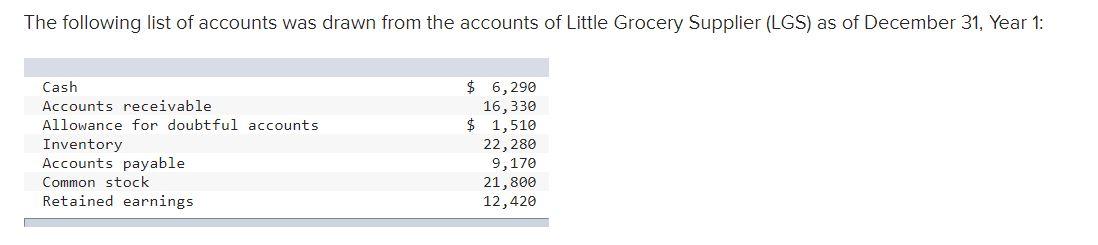

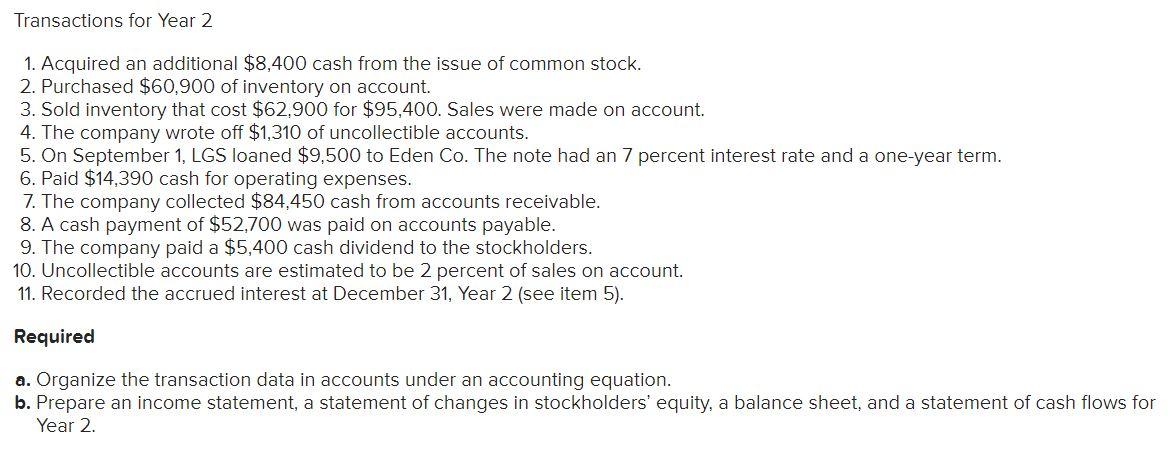

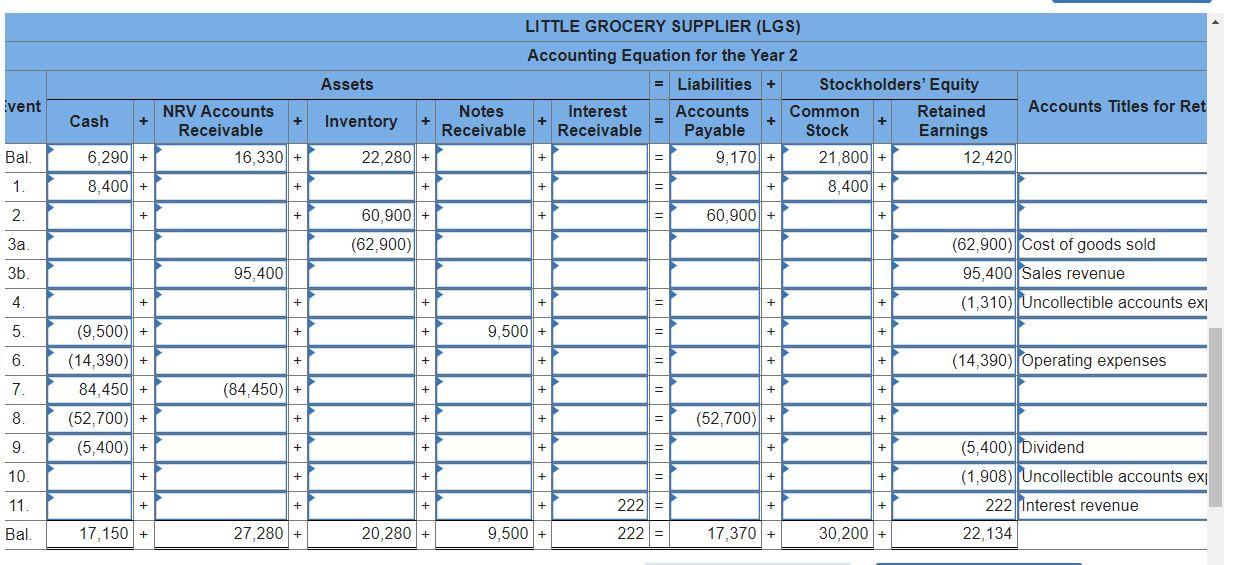

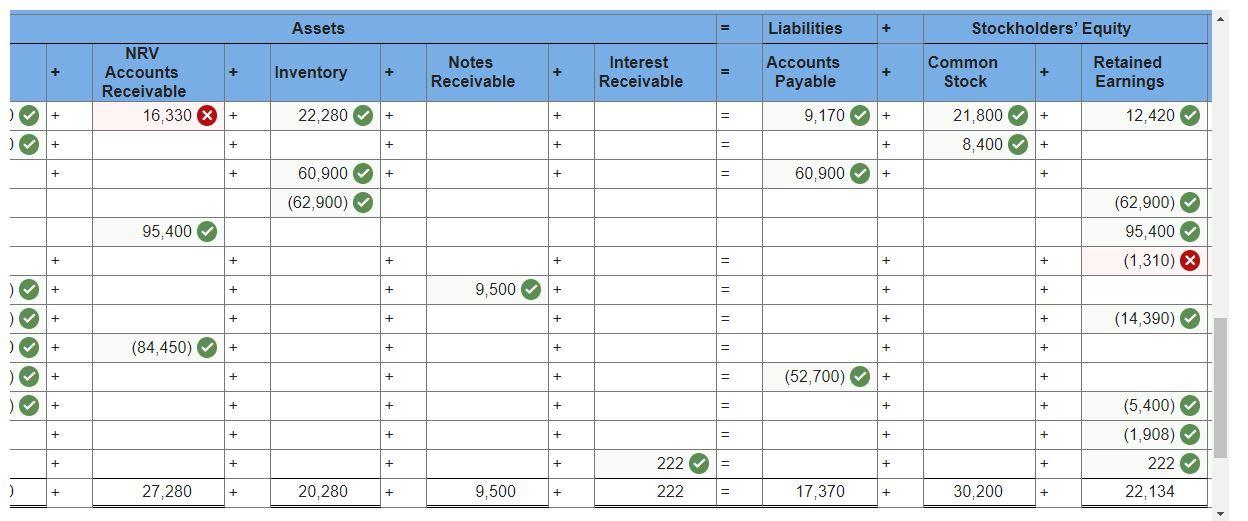

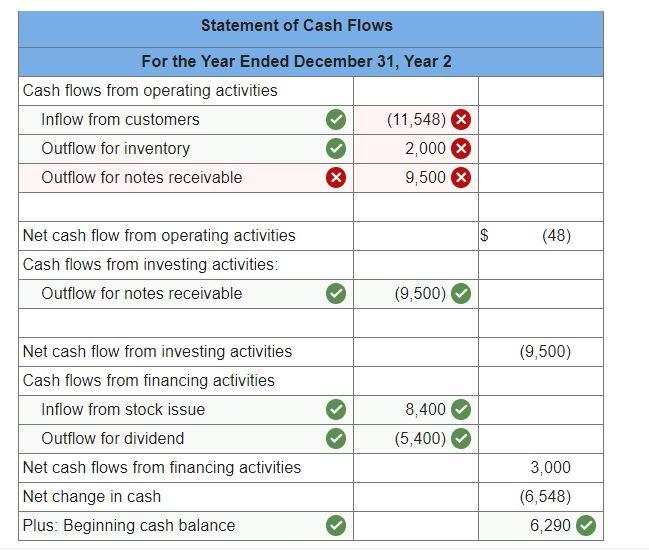

The following list of accounts was drawn from the accounts of Little Grocery Supplier (LGS) as of December 31, Year 1: Cash Accounts receivable Allowance for doubtful accounts Inventory Accounts payable Common stock Retained earnings $ 6,290 16,330 $ 1,510 22,280 9,170 21,800 12,420 Transactions for Year 2 1. Acquired an additional $8,400 cash from the issue of common stock. 2. Purchased $60,900 of inventory on account. 3. Sold inventory that cost $62,900 for $95,400. Sales were made on account. 4. The company wrote off $1,310 of uncollectible accounts. 5. On September 1, LGS loaned $9,500 to Eden Co. The note had an 7 percent interest rate and a one-year term. 6. Paid $14,390 cash for operating expenses. 7. The company collected $84,450 cash from accounts receivable. 8. A cash payment of $52,700 was paid on accounts payable. 9. The company paid a $5,400 cash dividend to the stockholders. 10. Uncollectible accounts are estimated to be 2 percent of sales on account. 11. Recorded the accrued interest at December 31, Year 2 (see item 5). Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 2. Assets vent Cash + Inventory + NRV Accounts Receivable 16,330 + Bal. 22.280 + 1 6,290 + 8,400 + 1. + + + + LITTLE GROCERY SUPPLIER (LGS) Accounting Equation for the Year 2 = Liabilities + Stockholders' Equity Notes Interest Accounts Common Retained Accounts Titles for Ret Receivable Receivable Payable Stock Earnings 9,170 + 21,800 + 12,420 8,400 + 60,900 + (62,900) Cost of goods sold 95,400 Sales revenue (1,310) Uncollectible accounts exi 9,500 + + (14,390) Operating expenses 2. + + + 60,900 + (62,900) . 3b. 95,400 4. + + + - + + 5. + + + + + 6. + + + + + + + 7. (9,500) + (14,390) + 84,450 + (52,700) + (5,400) + (84,450) + + + + + 8. + + + - (52,700) + + 9. + + + + + 10. + + + + + + (5,400) Dividend (1,908) Uncollectible accounts exi 222 Interest revenue 22,134 11. + + + + 222 = + + Bal. 17,150 + 27,280 + 20,280 + 9,500 + 222 = 17,370 + 30,200 + Assets Liabilities + Stockholders' Equity + Inventory + Notes Receivable + Interest Receivable II NRV Accounts Receivable 16,330 X + Accounts Payable + Common Stock + Retained Earnings ) + 22,280 > + + 9,170 + + 12,420 21,800 8,400 ) + + + + = + + + + + + 60.900 + + 60,900 (62,900) 95,400 (62,900) 95,400 (1,310) X + + + + + + + + + 9,500 + - + + + + + + + + (14 390) ) + (84,450) + + + + + + + + + - (52,700) > + + + + + + = + + + (5,400) (1,908) + + + + + + + + + + + 222 - + + 222 ) + 27,280 + 20,280 + 9,500 + 222 17,370 + + 30,200 + 22.134 Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities Inflow from customers (11,548) Outflow for inventory 2,000 Outflow for notes receivable X 9,500 $ (48) Net cash flow from operating activities Cash flows from investing activities: Outflow for notes receivable (9,500) (9,500) Net cash flow from investing activities Cash flows from financing activities Inflow from stock issue Outflow for dividend Net cash flows from financing activities Net change in cash Plus: Beginning cash balance 8,400 (5,400) 3,000 (6,548) 6,290 The following list of accounts was drawn from the accounts of Little Grocery Supplier (LGS) as of December 31, Year 1: Cash Accounts receivable Allowance for doubtful accounts Inventory Accounts payable Common stock Retained earnings $ 6,290 16,330 $ 1,510 22,280 9,170 21,800 12,420 Transactions for Year 2 1. Acquired an additional $8,400 cash from the issue of common stock. 2. Purchased $60,900 of inventory on account. 3. Sold inventory that cost $62,900 for $95,400. Sales were made on account. 4. The company wrote off $1,310 of uncollectible accounts. 5. On September 1, LGS loaned $9,500 to Eden Co. The note had an 7 percent interest rate and a one-year term. 6. Paid $14,390 cash for operating expenses. 7. The company collected $84,450 cash from accounts receivable. 8. A cash payment of $52,700 was paid on accounts payable. 9. The company paid a $5,400 cash dividend to the stockholders. 10. Uncollectible accounts are estimated to be 2 percent of sales on account. 11. Recorded the accrued interest at December 31, Year 2 (see item 5). Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 2. Assets vent Cash + Inventory + NRV Accounts Receivable 16,330 + Bal. 22.280 + 1 6,290 + 8,400 + 1. + + + + LITTLE GROCERY SUPPLIER (LGS) Accounting Equation for the Year 2 = Liabilities + Stockholders' Equity Notes Interest Accounts Common Retained Accounts Titles for Ret Receivable Receivable Payable Stock Earnings 9,170 + 21,800 + 12,420 8,400 + 60,900 + (62,900) Cost of goods sold 95,400 Sales revenue (1,310) Uncollectible accounts exi 9,500 + + (14,390) Operating expenses 2. + + + 60,900 + (62,900) . 3b. 95,400 4. + + + - + + 5. + + + + + 6. + + + + + + + 7. (9,500) + (14,390) + 84,450 + (52,700) + (5,400) + (84,450) + + + + + 8. + + + - (52,700) + + 9. + + + + + 10. + + + + + + (5,400) Dividend (1,908) Uncollectible accounts exi 222 Interest revenue 22,134 11. + + + + 222 = + + Bal. 17,150 + 27,280 + 20,280 + 9,500 + 222 = 17,370 + 30,200 + Assets Liabilities + Stockholders' Equity + Inventory + Notes Receivable + Interest Receivable II NRV Accounts Receivable 16,330 X + Accounts Payable + Common Stock + Retained Earnings ) + 22,280 > + + 9,170 + + 12,420 21,800 8,400 ) + + + + = + + + + + + 60.900 + + 60,900 (62,900) 95,400 (62,900) 95,400 (1,310) X + + + + + + + + + 9,500 + - + + + + + + + + (14 390) ) + (84,450) + + + + + + + + + - (52,700) > + + + + + + = + + + (5,400) (1,908) + + + + + + + + + + + 222 - + + 222 ) + 27,280 + 20,280 + 9,500 + 222 17,370 + + 30,200 + 22.134 Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities Inflow from customers (11,548) Outflow for inventory 2,000 Outflow for notes receivable X 9,500 $ (48) Net cash flow from operating activities Cash flows from investing activities: Outflow for notes receivable (9,500) (9,500) Net cash flow from investing activities Cash flows from financing activities Inflow from stock issue Outflow for dividend Net cash flows from financing activities Net change in cash Plus: Beginning cash balance 8,400 (5,400) 3,000 (6,548) 6,290