This is what I was given. What kind of information is needed?

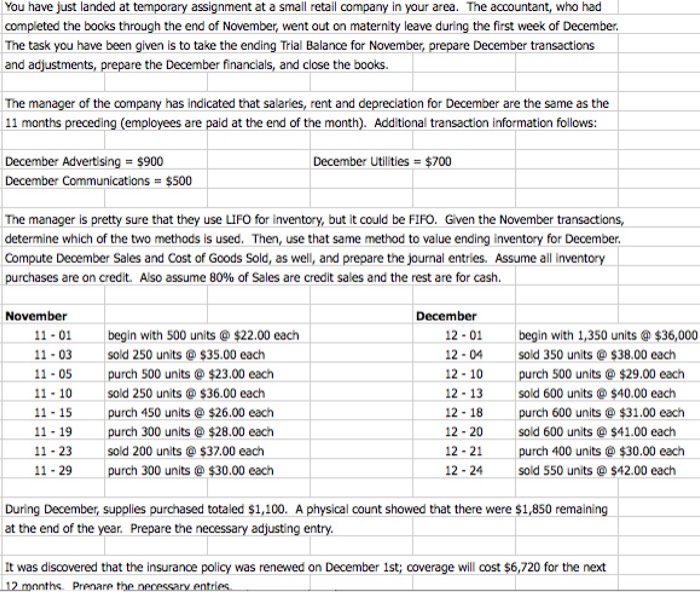

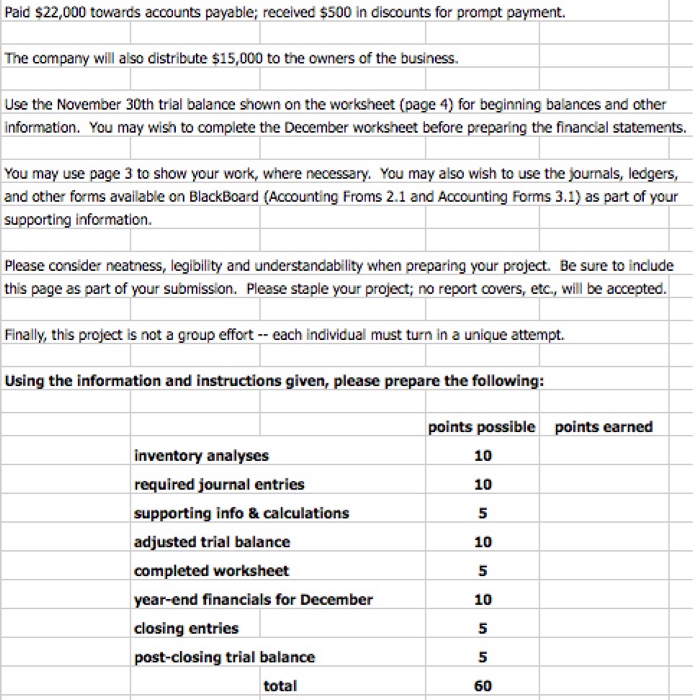

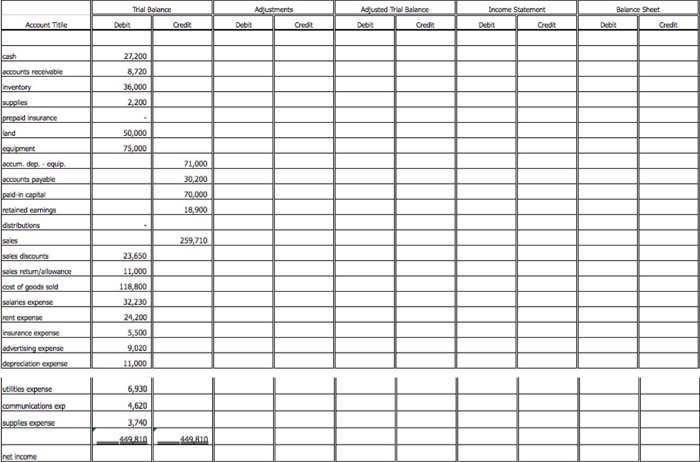

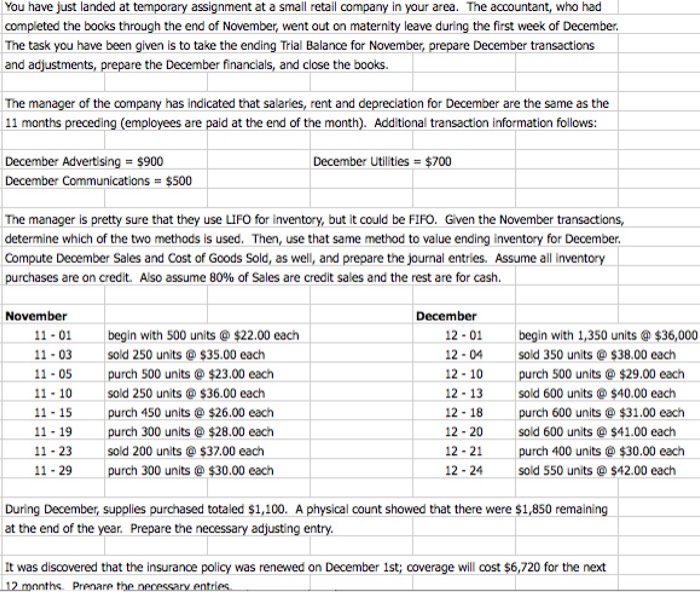

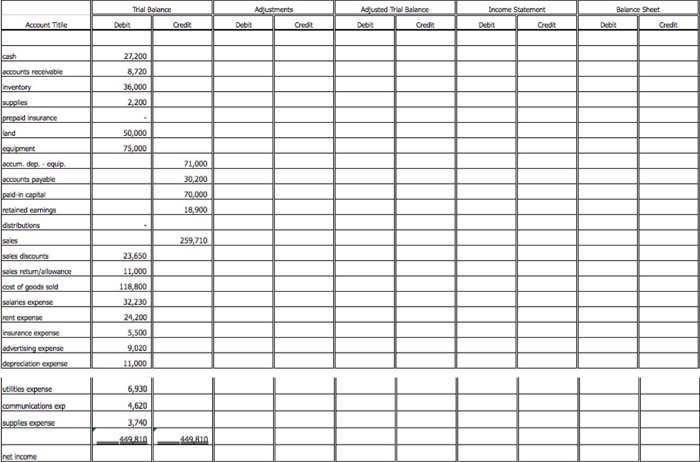

You have just landed at temporary assignment at a small retail company in your area. The accountant, who had completed the books through the end of November, went out on maternity leave during the first week of December. The task you have been given is to take the ending Trial Balance for November, prepare December transactions and adjustments, prepare the December financials, and close the books. The manager of the company has indicated that salaries, rent and depreciation for December are the same as the 11 months preceding (employees are paid at the end of the month). Additional transaction information follows December utilities $700 December Advertising-$900 December Communications = $500 The manager is pretty sure that they use uro for inventory, but it could be FIFOGven the November transactions, determine which of the two methods is used. Then, use that same method to value ending inventory for December. Compute December Sales and Cost of Goods Sold, as well, and prepare the journal entries. Assume all inventory purchases are on credit. Also assume 80% of Sales are credit sales and the rest are for cash. November December 11-01 begin with 500 units $22.00 each 11-03sold 250 units$35.00 each 11-05 purch 500 units $23.00 each 11-10 sold 250 units$36.00 each 11-15 purch 450 units@ $26.00 each 11-19 purch 300 units $28.00 each 11- 23sold 200 units $37.00 each 11-29 purch 300 units$30.00 each 12-01 begin with 1,350 units@$36,000 12-04 sold 350 units@$38.00 each 12-10 purch 500 units $29.00 each 12-13 sold 600 units$40.00 each 12-18 purch 600 units@ $31.00 each 12- 20 sold 600 units$41.00 each 12- 21 purch 400 units $30.00 each 12-24sold 550 units$42.00 each During December, supplies purchased totaled $1,100. A physical count showed that there were $1,850 remaining at the end of the year. Prepare the necessary adjusting entry. It was discovered that the insurance policy was renewed on December 1st; coverage will cost $6,720 for the next 12 months Prenare the necessary entries You have just landed at temporary assignment at a small retail company in your area. The accountant, who had completed the books through the end of November, went out on maternity leave during the first week of December. The task you have been given is to take the ending Trial Balance for November, prepare December transactions and adjustments, prepare the December financials, and close the books. The manager of the company has indicated that salaries, rent and depreciation for December are the same as the 11 months preceding (employees are paid at the end of the month). Additional transaction information follows December utilities $700 December Advertising-$900 December Communications = $500 The manager is pretty sure that they use uro for inventory, but it could be FIFOGven the November transactions, determine which of the two methods is used. Then, use that same method to value ending inventory for December. Compute December Sales and Cost of Goods Sold, as well, and prepare the journal entries. Assume all inventory purchases are on credit. Also assume 80% of Sales are credit sales and the rest are for cash. November December 11-01 begin with 500 units $22.00 each 11-03sold 250 units$35.00 each 11-05 purch 500 units $23.00 each 11-10 sold 250 units$36.00 each 11-15 purch 450 units@ $26.00 each 11-19 purch 300 units $28.00 each 11- 23sold 200 units $37.00 each 11-29 purch 300 units$30.00 each 12-01 begin with 1,350 units@$36,000 12-04 sold 350 units@$38.00 each 12-10 purch 500 units $29.00 each 12-13 sold 600 units$40.00 each 12-18 purch 600 units@ $31.00 each 12- 20 sold 600 units$41.00 each 12- 21 purch 400 units $30.00 each 12-24sold 550 units$42.00 each During December, supplies purchased totaled $1,100. A physical count showed that there were $1,850 remaining at the end of the year. Prepare the necessary adjusting entry. It was discovered that the insurance policy was renewed on December 1st; coverage will cost $6,720 for the next 12 months Prenare the necessary entries