Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is year 2024. You have survived Corona epidemic and life has returned to normal. After successfully graduating from LUMS, you and your best friend

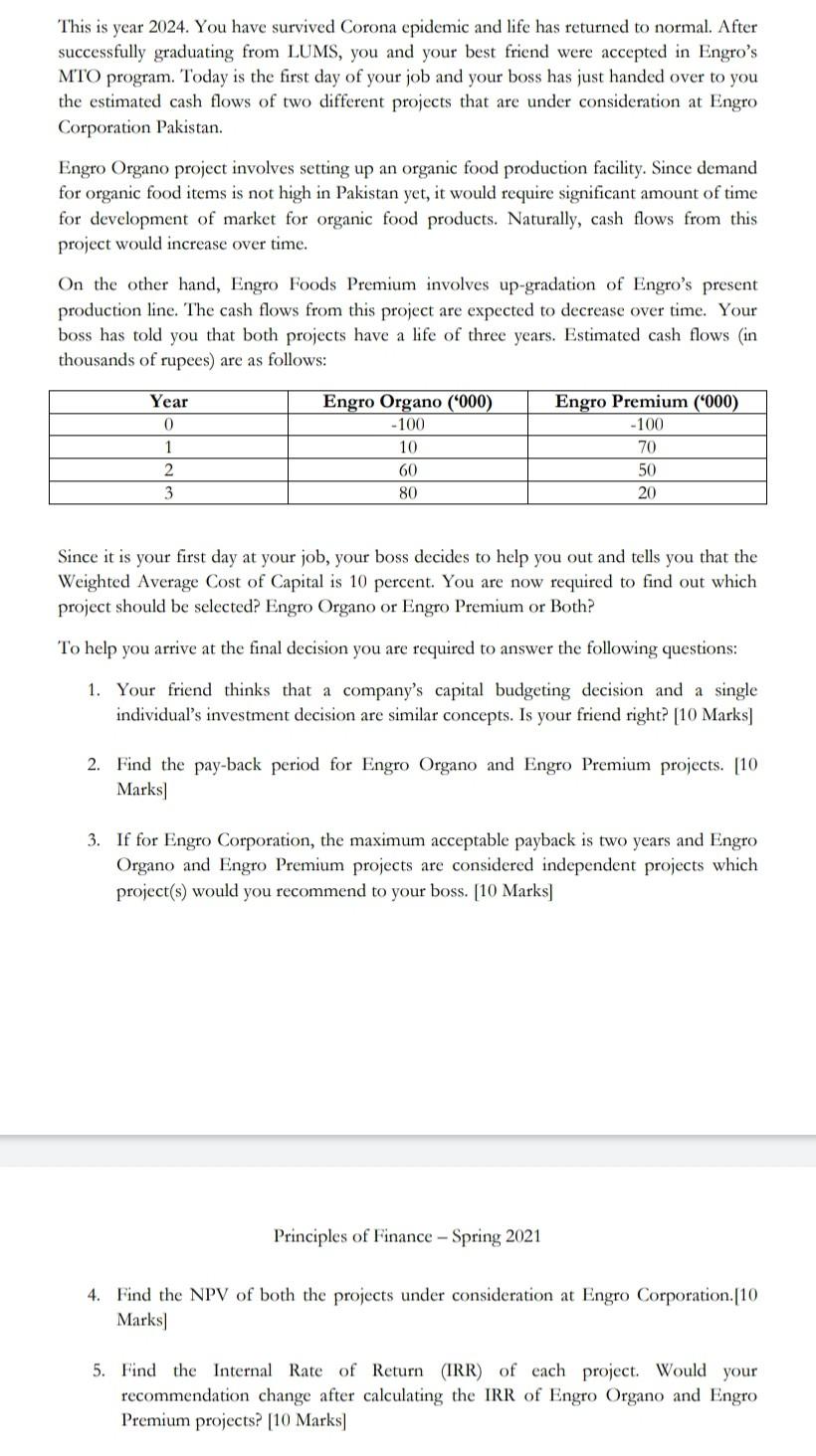

This is year 2024. You have survived Corona epidemic and life has returned to normal. After successfully graduating from LUMS, you and your best friend were accepted in Engro's MTO program. Today is the first day of your job and your boss has just handed over to you the estimated cash flows of two different projects that are under consideration at Engro Corporation Pakistan. Engro Organo project involves setting up an organic food production facility. Since demand for organic food items is not high in Pakistan yet, it would require significant amount of time for development of market for organic food products. Naturally, cash flows from this project would increase over time. On the other hand, Engro Foods Premium involves up-gradation of Engro's present production line. The cash flows from this project are expected to decrease over time. Your boss has told you that both projects have a life of three years. Estimated cash flows (in thousands of rupees) are as follows: Year 0 1 2 3 Engro Organo ('000) -100 10 60 Engro Premium (*000) -100 70 50 20 80 Since it is your first day at your job, your boss decides to help you out and tells you that the Weighted Average Cost of Capital is 10 percent. You are now required to find out which project should be selected? Engro Organo or Engro Premium or Both? To help you arrive at the final decision you are required to answer the following questions: 1. Your friend thinks that a company's capital budgeting decision and a single individual's investment decision are similar concepts. Is your friend right? [10 Marks/ 2. Find the pay-back period for Engro Organo and Engro Premium projects. [10 Marks 3. If for Engro Corporation, the maximum acceptable payback is two years and Engro Organo and Engro Premium projects are considered independent projects which project(s) would you recommend to your boss. [10 Marks Principles of Finance - Spring 2021 4. Find the NPV of both the projects under consideration at Engro Corporation.[10 Marks 5. Find the Internal Rate of Return (IRR) of each project. Would your recommendation change after calculating the IRR of Engro Organo and Engro Premium projects? [10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started