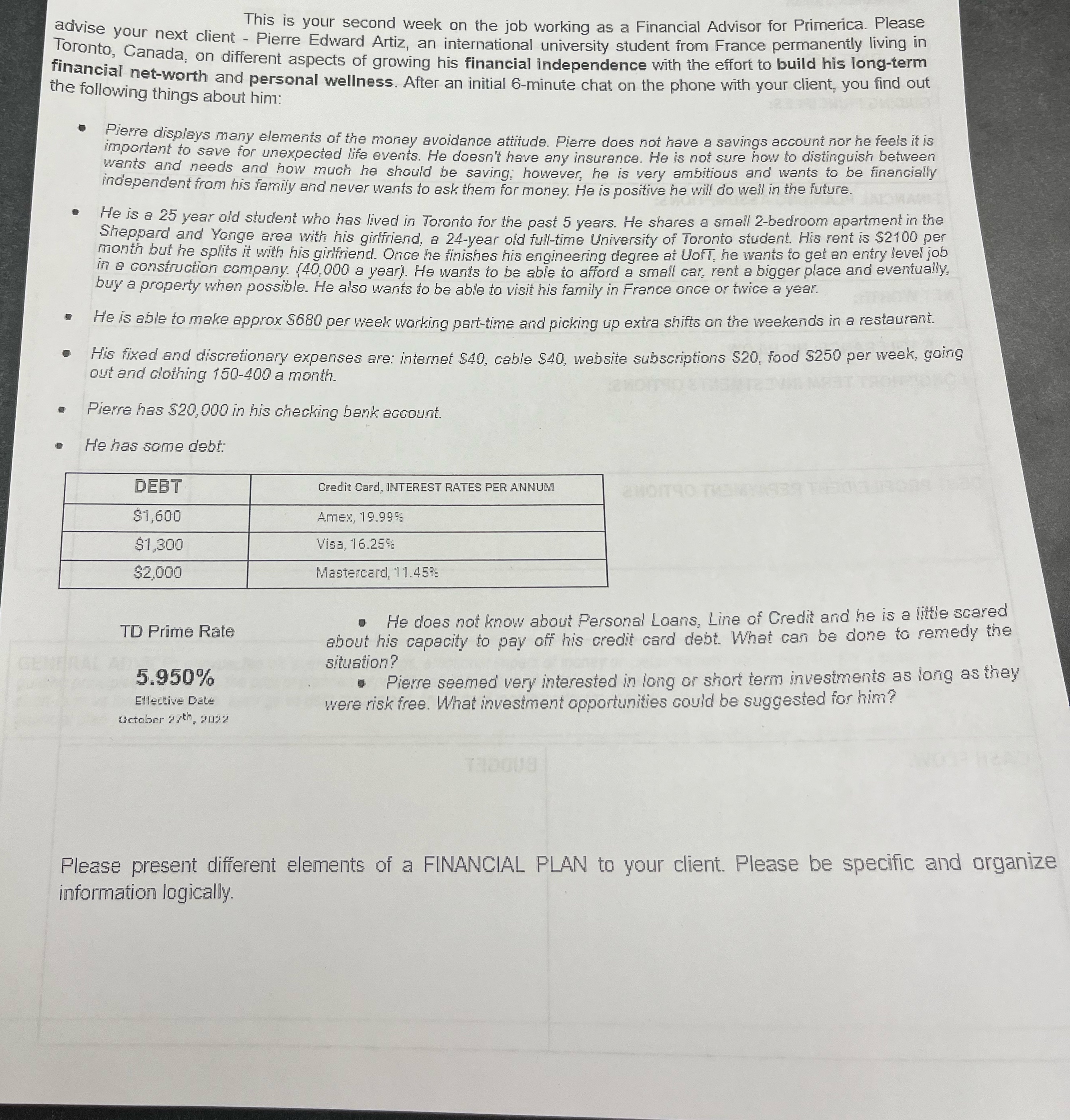

This is your second week on the job working as a Financial Advisor for Primerica. Please advise your next client - Pierre Edward Artiz, an international university student from France permanently living in Toronto, Canada, on different aspects of growing his financial independence with the effort to build his long-term financial net-worth and personal wellness. After an initial 6-minute chat on the phone with your client, you find out the following things about him: Pierre displays many elements of the money avoidance attitude. Pierre does not have a savings account nor he feels it is important to save for unexpected life events. He doesn't have any insurance. He is not sure how to distinguish between wants and needs and how much he should be saving; however, he is very ambitious and wants to be financially independent from his family and never wants to ask them for money. He is positive he will do well in the future. He is a 25 year old student who has lived in Toronto for the past 5 years. He shares a small 2-bedroom apartment in the Sheppard and Yonge area with his girlfriend, a 24-year old full-time University of Toronto student. His rent is $2100 per month but he splits it with his girlfriend. Once he finishes his engineering degree at Uoff, he wants to get an entry level job in a construction company. (40.000 a year). He wants to be able to afford a small car, rent a bigger place and eventually, buy a property when possible. He also wants to be able to visit his family in France once or twice a year. He is able to make approx $680 per week working part-time and picking up extra shifts on the weekends in a restaurant. His fixed and discretionary expenses are: internet $40, cable $40, website subscriptions $20, food $250 per week, going out and clothing 150-400 a month. Pierre has $20,000 in his checking bank account. He has some debt: DEBT Credit Card, INTEREST RATES PER ANNUM $1,600 Amex, 19.99% $1,300 Visa, 16.25% $2,000 Mastercard, 11.45% . He does not know about Personal Loans, Line of Credit and he is a little scared TD Prime Rate about his capacity to pay off his credit card debt. What can be done to remedy the situation? 5.950% . Pierre seemed very interested in long or short term investments as long as they Ellective Date were risk free. What investment opportunities could be suggested for him? October 2 7th, 2032 radova Please present different elements of a FINANCIAL PLAN to your client. Please be specific and organize information logically