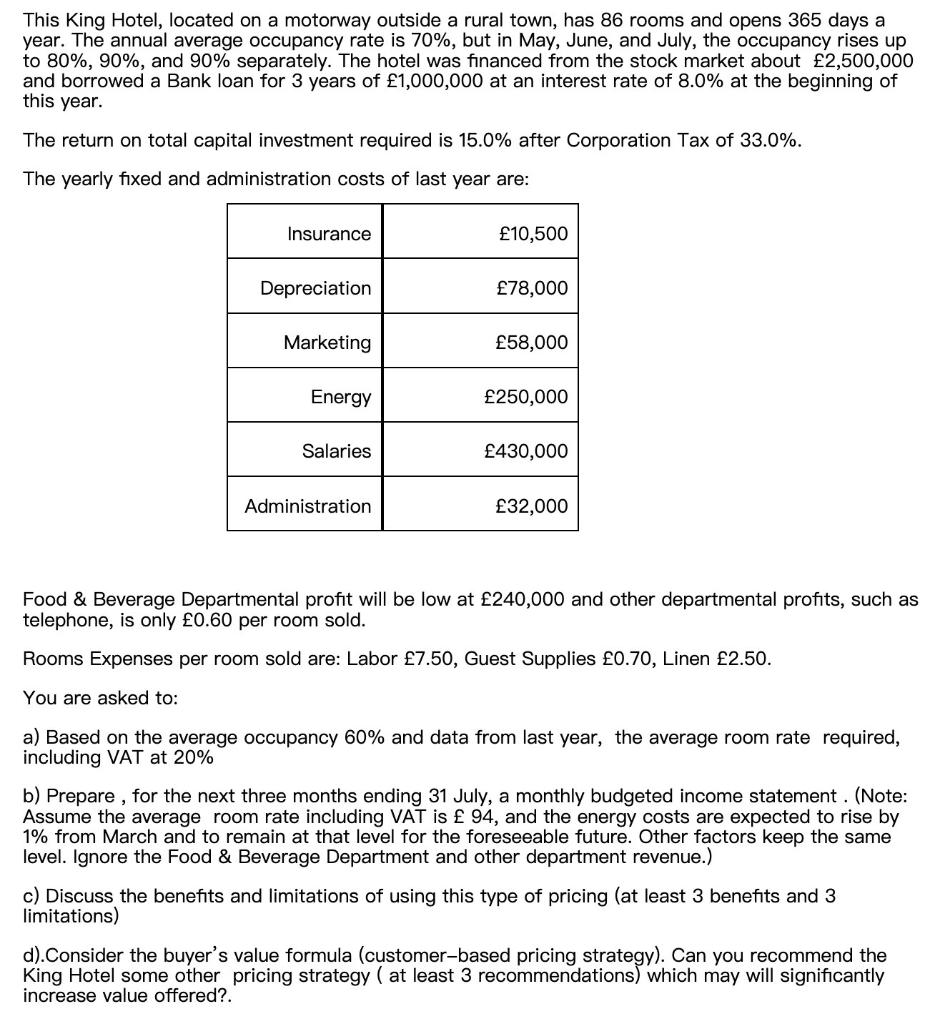

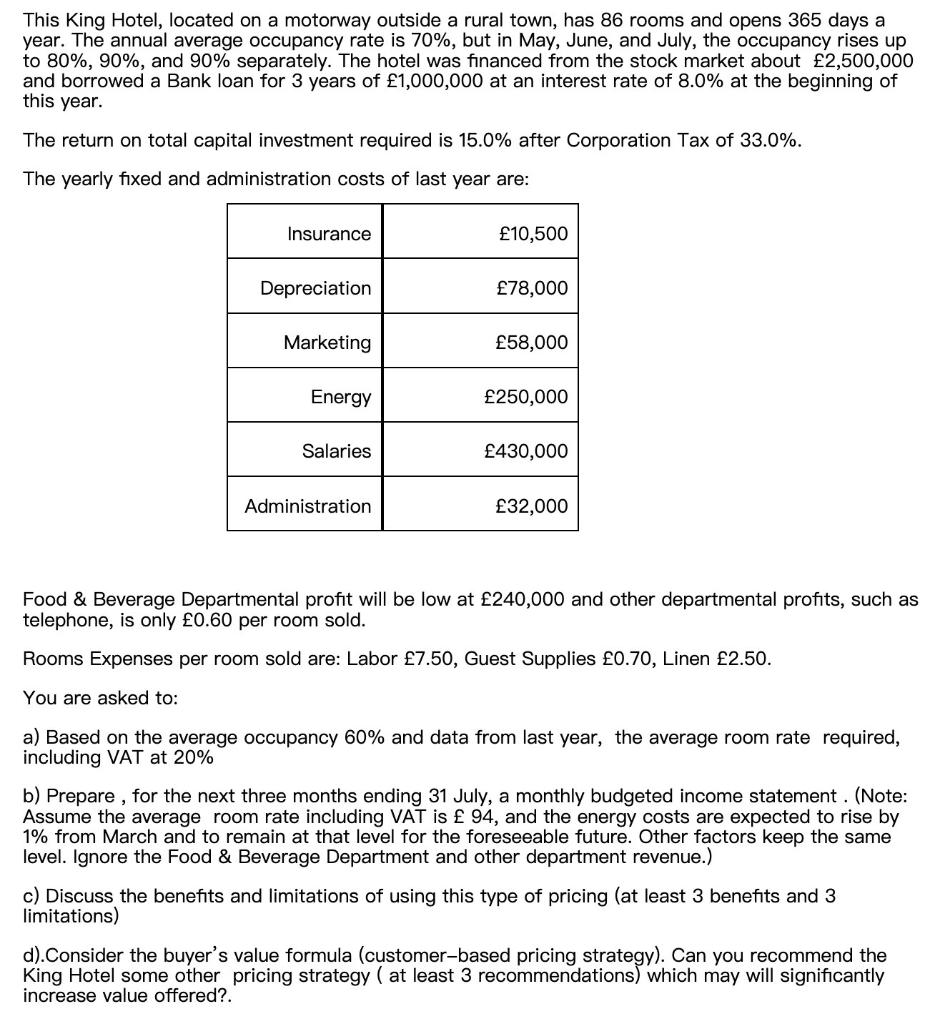

This King Hotel, located on a motorway outside a rural town, has 86 rooms and opens 365 days a year. The annual average occupancy rate is 70%, but in May, June, and July, the occupancy rises up to 80%,90%, and 90% separately. The hotel was financed from the stock market about 2,500,000 and borrowed a Bank loan for 3 years of 1,000,000 at an interest rate of 8.0% at the beginning of this year. The return on total capital investment required is 15.0% after Corporation Tax of 33.0%. The yearly fixed and administration costs of last year are: Food \& Beverage Departmental profit will be low at 240,000 and other departmental profits, such as telephone, is only 0.60 per room sold. Rooms Expenses per room sold are: Labor 7.50, Guest Supplies 0.70, Linen 2.50. You are asked to: a) Based on the average occupancy 60% and data from last year, the average room rate required, including VAT at 20% b) Prepare, for the next three months ending 31 July, a monthly budgeted income statement . (Note: Assume the average room rate including VAT is 94, and the energy costs are expected to rise by 1% from March and to remain at that level for the foreseeable future. Other factors keep the same level. Ignore the Food \& Beverage Department and other department revenue.) c) Discuss the benefits and limitations of using this type of pricing (at least 3 benefits and 3 limitations) d).Consider the buyer's value formula (customer-based pricing strategy). Can you recommend the King Hotel some other pricing strategy ( at least 3 recommendations) which may will significantly increase value offered?. This King Hotel, located on a motorway outside a rural town, has 86 rooms and opens 365 days a year. The annual average occupancy rate is 70%, but in May, June, and July, the occupancy rises up to 80%,90%, and 90% separately. The hotel was financed from the stock market about 2,500,000 and borrowed a Bank loan for 3 years of 1,000,000 at an interest rate of 8.0% at the beginning of this year. The return on total capital investment required is 15.0% after Corporation Tax of 33.0%. The yearly fixed and administration costs of last year are: Food \& Beverage Departmental profit will be low at 240,000 and other departmental profits, such as telephone, is only 0.60 per room sold. Rooms Expenses per room sold are: Labor 7.50, Guest Supplies 0.70, Linen 2.50. You are asked to: a) Based on the average occupancy 60% and data from last year, the average room rate required, including VAT at 20% b) Prepare, for the next three months ending 31 July, a monthly budgeted income statement . (Note: Assume the average room rate including VAT is 94, and the energy costs are expected to rise by 1% from March and to remain at that level for the foreseeable future. Other factors keep the same level. Ignore the Food \& Beverage Department and other department revenue.) c) Discuss the benefits and limitations of using this type of pricing (at least 3 benefits and 3 limitations) d).Consider the buyer's value formula (customer-based pricing strategy). Can you recommend the King Hotel some other pricing strategy ( at least 3 recommendations) which may will significantly increase value offered