Answered step by step

Verified Expert Solution

Question

1 Approved Answer

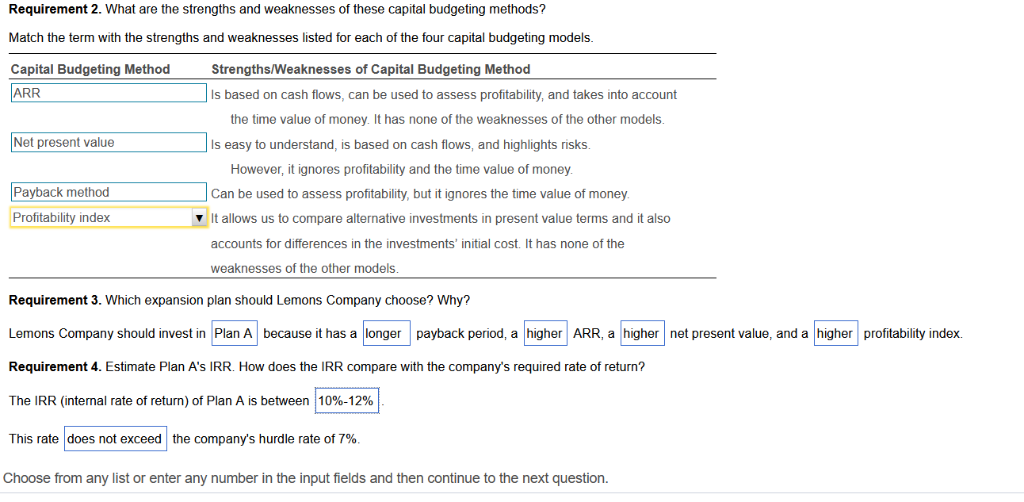

This last section are two choice selections. I.E, Plan A/ Plan B, Longer/Shorter, Higher/Lower, Exceed/Does not exceed, etc etc VIII WIERCURESTRES p ar WAWA 200

This last section are two choice selections. I.E, Plan A/ Plan B, Longer/Shorter, Higher/Lower, Exceed/Does not exceed, etc etc

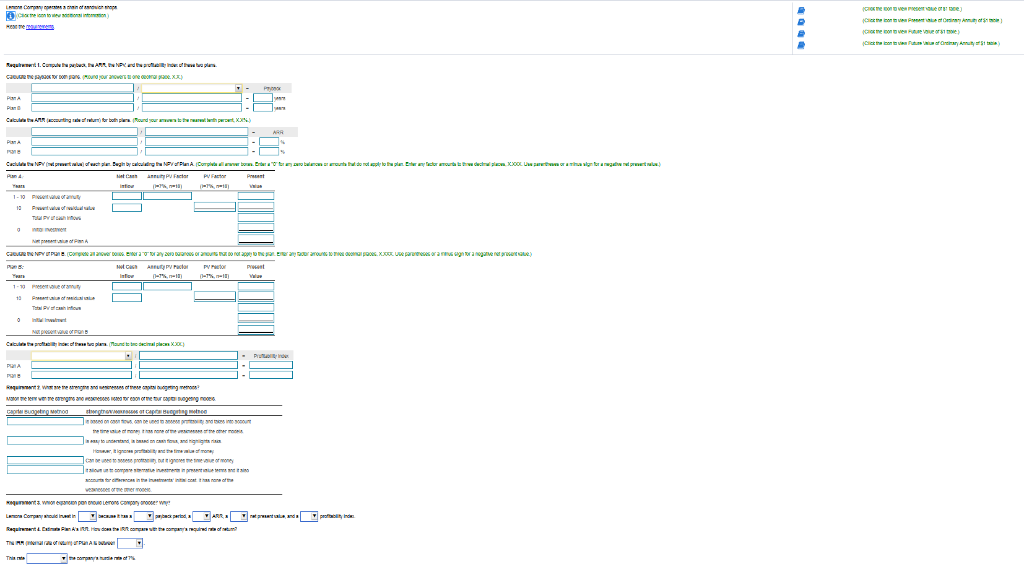

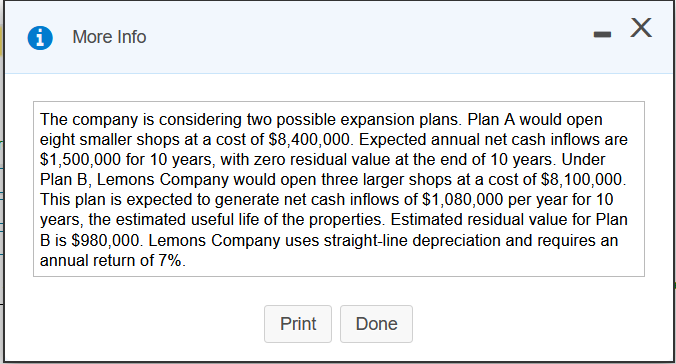

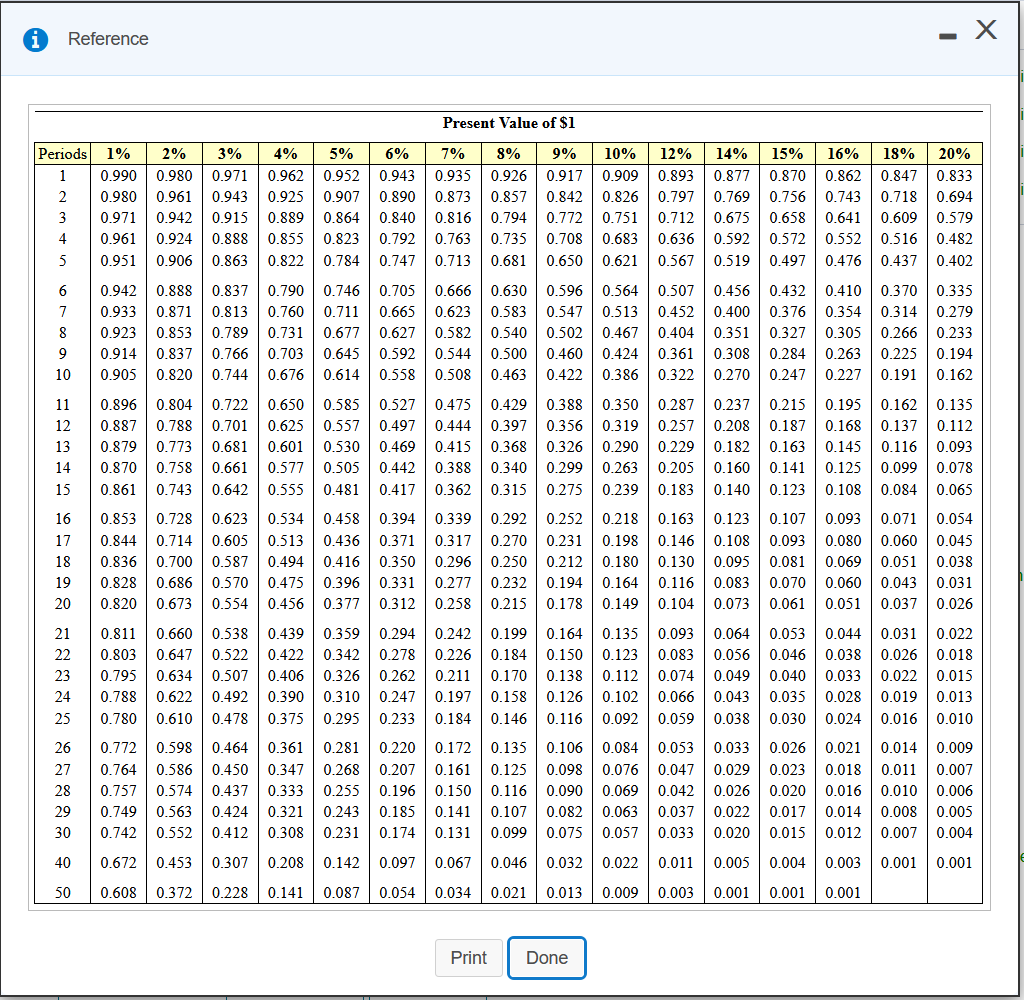

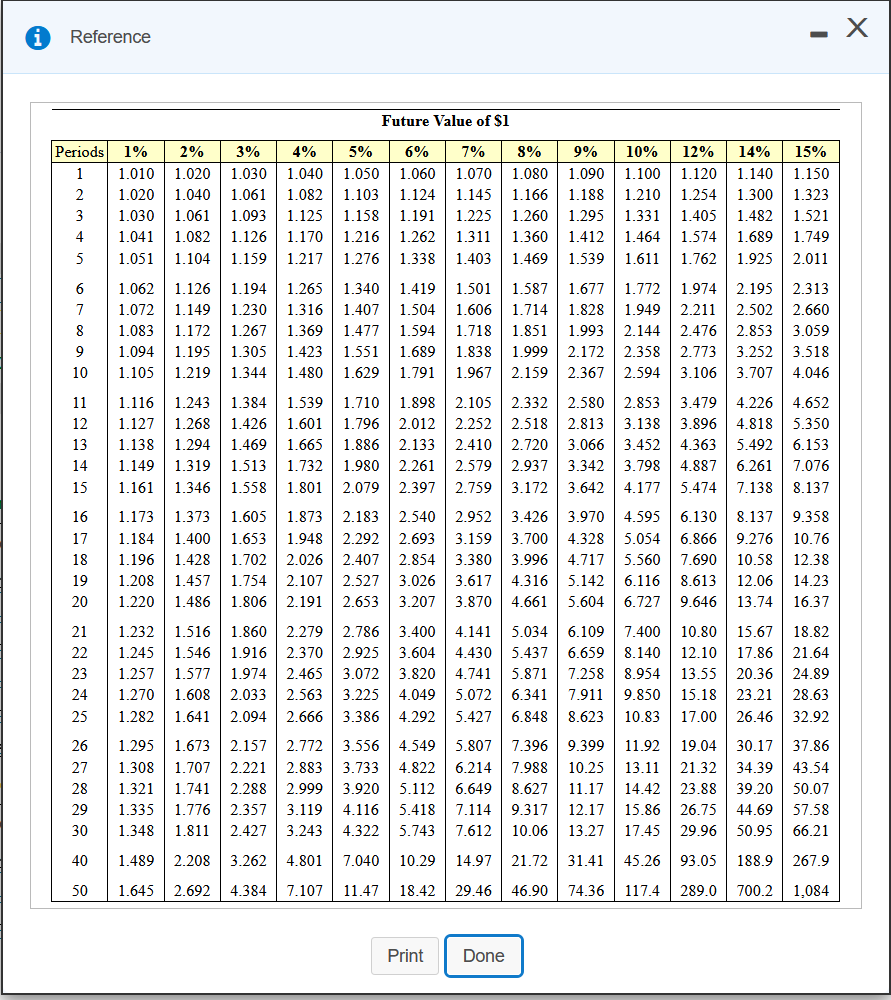

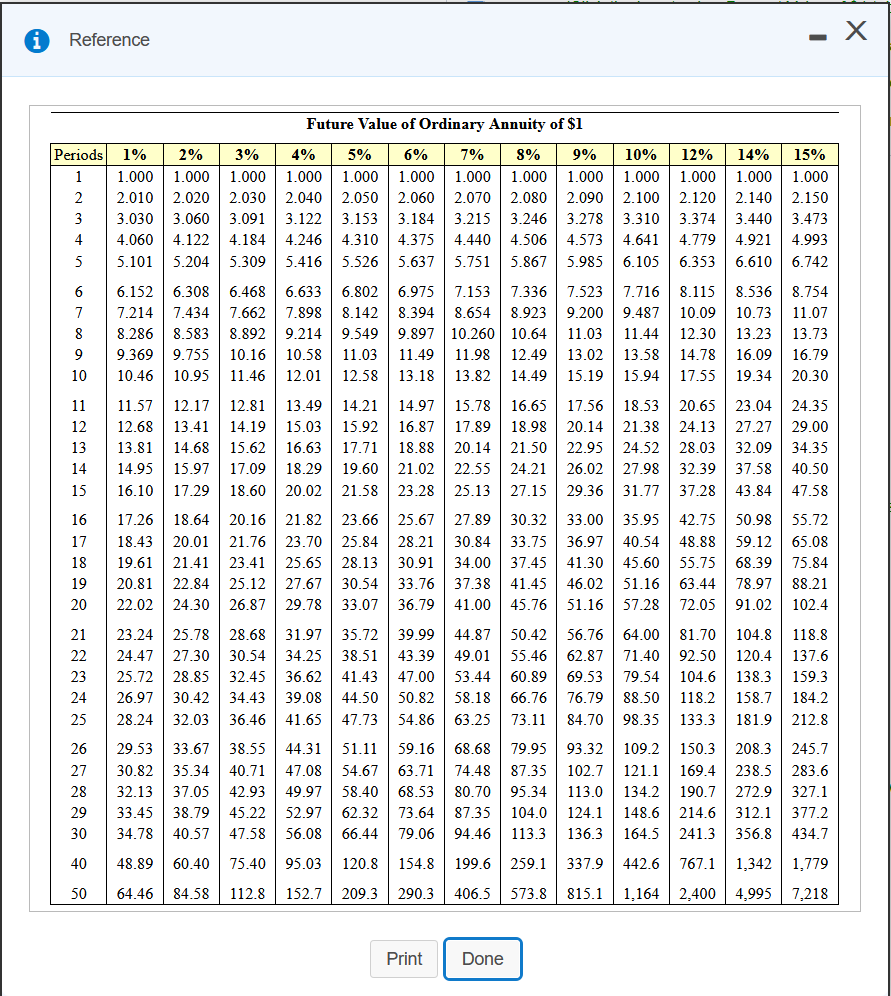

VIII WIERCURESTRES p ar WAWA 200 ved be DE WORD WWW.WORE wwwGUTEL WWW. SE WWW norme raposogeanges r Never meg e wa C W WWW ube GUJOON HO N ORR.. BANS Pent PV PU C PA Complew boa t NPY (pretowate Degin by calculating the N Cucu Y ou are ! umy C . W INDS ) ICO More Info - X The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,400,000. Expected annual net cash inflows are $1,500,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Lemons Company would open three larger shops at a cost of $8,100,000. This plan is expected to generate net cash inflows of $1,080,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $980,000. Lemons Company uses straight-line depreciation and requires an annual return of 7%. Print Done A Reference - X 0745 Periods 1% 2% 0.990 0.980 0.9800.961 | 0.971 0.942 0.961 0.924 0.951 0.906 0.942 0.888 0.933 0.871 0.923 0.853 0.914 0.837 0.905 0.820 0.896 0.804 0.887 0.788 0.879 0.773 0.870 0.758 0.861 0.853 0.728 0.844 0.714 0.836 0.700 0.828 0.686 0.820 0.673 0.811 0.660 0.803 0.647 0.795 0.634 0.788 0.622 0.780 0.610 0.772 0.598 0.764 0.586 0.757 0.574 0.749 0.563 0.742 0.552 0.672 0.453 0.608 0.372 Present Value of $1 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 0.971 0.962 0.952 0.9430.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.943 0.925 0.907 0.890 0.873 0.8570.842 0.826 0.797 0.769 0.756 0.7430.7180.694 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.813 0.760 0.711 0.665 0.623 0.583 0.583 0.547 0.513 0.452 0.400 0.314 0.279 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.4040.351 0.327 0.305 0.266 0.233 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.225 0.194 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.195 0.162 0.135 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.1370.112 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.183 0.140 0.123 0.108 0.084 0.065 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 0.587 0.494 0.296 0.250 0.212 0.1800.130 0.095 0.081 0.069 0.051 0.038 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 0.538 0.439 0.359 0.2940.242 0.1990.164 0.135 0.093 0.064 0.053 0.031 0.022 0.522 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 0.507 0.406 0.326 0.262 0.211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.066 0.043 0.035 0.028 0.019 0.013 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.059 0.038 0.030 0.024 0.0160.010 0.464 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0.009 0.450 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.047 | 0.029 | 0.023 0.018 0.011 0.007 0.437 0.333 0.255 0.196 0.150 0.116 0.090 0.069 0.042 0.026 0.020 0.016 0.010 0.006 0.424 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.037 0.022 0.017 0.014 0.008 0.005 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.033 0.020 0.015 0.012 0.007 0.004 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.011 0.005 0.003 0.001 0.001 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.003 0.001 0.001 0.001 0.350 0.412 Print Done A Reference - X 5.417 4.767 3.889 6.463 8.9838.530 8.1 4.533 5.847 Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 0.990 0.9800.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 1.970 1.942 | 1.913 1.886 | 1.859 | 1.833 1.808 1.783 1.759 1.736 1.6901.647 1.626 1.605 1.566 | 1.528 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 2.174 2.106 3.902 3.808 3.717 3.630 3.546 3.465 | 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 5.795 5.601 5.242 5.076 4.917 4.623 4.486 4.355 4.111 3.784 3.685 3.498 3.326 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 4.039 3.812 3.605 7.652 7.325 7.0206.733 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 | 4.078 3.837 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 4.607 4.303 4.031 9.471 7.722 7.360 7.0246.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192 10.368 9.7879.2538.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 5.029 4.656 4.327 11.255 10.575 9.954 9.3858.8638.384 7.943 7.5367.161 6.814 6.194 5.660 5.421 5.197 4.793 4.439 13 12.134 11.348 10.635 9.986 9.3948.8538.358 | 7.487 7.103 6.424 5.842 5.583 5.342 4.910 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 | 7.367 6.628 6.002 5.724 5.468 5.008 4.611 15 13.865 12.849 11.938 11.118 10.380 9.712 | 9.108 8.559 8.061 7.606 6.811 6.142 5.575 5.092 4.675 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 6.265 5.954 5.669 5.162 4.730 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.120 6.373 6.047 5.749 5.222 4.775 18 16.398 14.992 | 13.754 | 12.65911.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 6.128 5.818 5.273 4.812 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 6.198 5.877 5.316 4.844 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.469 6.623 6.259 5.929 5.353 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.6497.562 6.687 6.312 5.973 5.384 4.891 22 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 7.645 6.743 6.359 6.011 5.410 4.909 20.45618.292 | 16.444 14.857 13.489 | 12.303 | 11.272 10.371 9.580 8.8837.718 6.792 6.399 6.044 5.432 4.925 24 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 7.784 6.835 6.434 6.073 5.451 4.937 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.8239.077 7.843 6.464 6.097 5.467 4.948 22.795 | 20.12117.877 15.983 14.375 13.003 | 11.826 10.810 9.929 9.161 7.896 6.906 6.491 6.118 5.480 4.956 27 23.560 20.707 | 18.327 | 16.33014.643 13.211 | 11.987 10.935 10.027 9.237 7.943 6.935 6.514 6.136 5.492 4.964 28 24.316.21.281 | 18.764 16.663 14.898 13.406 12.137 | 11.051 | 10.1161 9.307 7.984 6.961 6.534 6.152 5.502 4.970 29 25.066 121.844 | 19.188 | 16.984 15.141 13.591 | 12.278 11.158 10.198 | 9.370 | 8.022 6.983 6.551 6.166 5.510 4.975 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.566 6.177 5.517 4.979 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 6.233 5.548 4.997 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9915 8.304 7.133 6.661 6.246 5.554 4.999 4.870 6.873 Print Done a Reference - X Future Value of $1 Periods 12% 14% 1.120 1.140 1.254 | 1.300 1.405 1.482 1.574 1.689 1.762 1.925 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.020 1.040 1.061 1.082 1.103 | 1.124 1.145 1.166 1.1881.210 1.030 1.061 1.093 1.125 1.158 1.191 | 1.225 1.260 | 1.295 1.331 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.360 1.412 1.464 1.051 1.104 1.159 | 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.062 | 1.126 1.194 | 1.265 1.340 1.419 1.501 1.587 1.677 1.772 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.714 1.828 1.949 1.083 1.172 1.267 | 1.369 1.477 1.594 1.718 1.851 1.993 2.144 1.094 | 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 1.116 | 1.243 | 1.384 | 1.539 1.710 1.898 2.105 2.332 2.580 2.853 1.127 1.268 1.426 1.601 | 1.796 2.012 2.252 2.518 2.813 3.138 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 1.149 1.319 | 1.513 | 1.732 1.980 2.261 2.579 2.937 3.342 3.798 1.161 | 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 1.184 1.400 1.653 | 1.948 2.292 2.693 3.159 3.700 4.328 5.054 1.196 | 1.428 1.702 2.026 2.407 2.854 3.996 4.717 5.560 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 5.142 6.116 1.220 1.486 | 1.806 2.191 2.653 3.207 3.870 4.661 5.604 6.727 1.232 1.516 | 1.860 2.279 2.786 3.400 4.141 5.034 6.109 7.400 1.245 1.546 1.916 2.925 3.604 4.430 5.437 6.659 8.140 1.257 1.577 1.974 2.465 3.072 3.820 4.741 5.871 7.258 8.954 1.270 1.608 2.033 2.563 3.225 4.049 6.341 7.911 9.850 1.282 1.641 2.094 2.666 4.292 5.427 6.848 8.623 10.83 1.295 1.673 2.157 2.772 | 3.556 4.549 5.807 7.396 9.399 11.92 1.308 1.707 2.221 2.883 | 3.733 4.822 6.214 7.988 10.25 13.11 1.321 1.741 2.288 2.999 3.920 5.112 6.649 8.627 11.17 14.42 1.335 1.776 2.357 3.119 4.116 5.418 7.114 9.317 12.17 15.86 1.348 1.811 2.427 3.243 4.322 5.743 7.612 10.06 13.27 17.45 1.489 2.208 3.262 4.801 | 7.040 10.29 14.97 21.72 31.41 45.26 1.645 2.692 4.384 7.107 11.47 18.42 29.46 46.90 74.36 117.4 1.974 2.211 2.476 2.773 3.106 3.479 3.896 4.363 4.887 5.474 6.130 6.866 7.690 8.613 9.646 10.80 12.10 13.55 15.18 17.00 19.04 21.32 23.88 26.75 29.96 93.05 289.0 3.380 15% 1.150 1.323 1.521 1.749 2.011 2.313 2.660 3.059 3.518 4.046 4.652 5.350 6.153 7.076 8.137 9.358 10.76 12.38 14.23 16.37 18.82 21.64 24.89 28.63 32.92 37.86 43.54 50.07 57.58 66.21 267.9 2.195 2.502 2.853 3.252 3.707 4.226 4.818 5.492 6.261 7.138 8.137 9.276 10.58 12.06 13.74 15.67 17.86 20.36 23.21 26.46 30.17 34.39 39.20 44.69 50.95 188.9 700.2 2.370 5.072 3.386 1,084 Print Done i Reference - X Periods 15% 1.000 2.150 3.473 4.993 Future Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 3.030 3.060 3.091 3.122 3.153 3.1843.215 3.246 3.278 4.060 4.122 4.1844.246 4.310 4.375 4.440 4.506 4.573 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 | 7.523 7.214 7.434 7.662 7.898 8.142 8.394 | 8.654 8.923 | 9.200 8.286 8.583 8.8929.214 9.549 9.897 10.260 10.64 11.03 9.369 9.755 10.16 10.58 11.03 | 11.49 | 11.98 12.49 13.02 10.46 10.95 11.46 12.01 12.58 13.18 13.82 14.49 15.19 11.57 12.17 12.81 13.49 14.21 14.97 15.78 16.65 17.56 12.68 13.41 | 14.19 15.03 15.92 16.87 17.89 18.98 20.14 13.81 14.68 15.62 16.63 17.71 18.88 20.14 21.50 22.95 14.95 | 15.97 17.09 18.29 19.60 21.02 22.55 24.21 26.02 16.10 17.29 18.60 20.02 21.58 23.28 25.13 27.15 29.36 17.26 18.64 20.16 21.82 23.66 25.67 27.89 30.32 33.00 18.43 20.01 21.76 23.70 25.84 28.21 30.84 33.75 36.97 19.61 21.41 23.41 25.65 28.13 30.91 34.00 37.45 41.30 20.81 22.84 25.12 27.67 30.54 33.76 37.38 41.45 46.02 22.02 24.30 26.87 29.78 33.07 36.79 41.00 45.76 51.16 23.24 25.78 28.68 31.97 35.72 39.99 44.87 50.42 56.76 24.47 27.30 30.54 34.25 38.51 43.39 49.01 55.46 62.87 25.72 28.85 | 32.45 36.62 41.43 47.00 53.44 60.89 69.53 26.97 30.42 34.43 39.08 44.50 50.82 58.18 66.76 76.79 28.24 32.03 36.46 41.65 47.73 54.86 63.25 73.11 84.70 29.53 33.67 38.55 44.31 51.11 59.16 68.68 79.95 | 93.32 30.82 35.34 40.71 47.08 54.67 63.71 74.48 87.35 102.7 32.13 37.05 42.93 49.97 58.40 68.53 80.70 95.34 113.0 33.45 38.79 45.22 52.97 62.32 73.64 87.35 104.0 124.1 34.78 40.57 47.58 56.08 66.44 79.06 94.46 113.3 136.3 48.89 60.40 75.40 95.03 120.8 154.8 199.6 259.1 337.9 64.46 84.58 112.8 152.7 209.3 290.3 406.5 573.8 815.1 10% 1.000 2.100 3.310 4.641 6.105 7.716 9.487 11.44 13.58 15.94 18.53 21.38 24.52 27.98 31.77 35.95 40.54 45.60 51.16 57.28 64.00 71.40 79.54 88.50 98.35 109.2 121.1 134.2 148.6 164.5 442.6 1.164 12% 14% 1.000 1.000 2.120 2.140 3.374 3.440 4.779 4.921 6.353 6.610 8.115 8.536 10.09 10.73 12.30 13.23 14.78 17.55 19.34 20.65 23.04 24.13 27.27 28.03 32.09 32.39 37.58 37.28 43.84 42.75 50.98 48.88 59.12 55.75 68.39 63.44 78.97 72.05 91.02 81.70 104.8 92.50 120.4 104.6 138.3 118.2 158.7 133.3 181.9 150.3 208.3 169.4 190.7 272.9 214.6 312.1 241.3 356.8 767.1 | 1,342 2,400 4.995 6.742 8.754 11.07 13.73 16.79 20.30 24.35 29.00 34.35 40.50 47.58 55.72 65.08 75.84 88.21 102.4 118.8 137.6 159.3 184.2 238.5 212.8 245.7 283.6 327.1 377.2 434.7 1,779 7,218 Print Done Requirement 2. What are the strengths and weaknesses of these capital budgeting methods? Match the term with the strengths and weaknesses listed for each of the four capital budgeting models. Capital Budgeting Method ARR Net present value Strengths/Weaknesses of Capital Budgeting Method is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other models. Is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money. Can be used to assess profitability, but it ignores the time value of money v It allows us to compare alternative investments in present value terms and it also Payback method Profitability index accounts for differences in the investments initial cost. It has none of the weaknesses of the other models. Requirement 3. Which expansion plan should Lemons Company choose? Why? Lemons Company should invest in Plan A because it has a longer payback period, a higher ARR, a higher net present value, and a higher profitability index. Requirement 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? The IRR (internal rate of return) of Plan A is between 10%-12% This rate does not exceed the company's hurdle rate of 7% Choose from any list or enter any number in the input fields and then continue to the nextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started