THIS MUST BE IN C# AND WORK AS INTENDED, PLEASE INCLUDE A SCREENSHOT OF THE DESIRED OUTPUT THAT IS REQUESTED TO SHOW THAT THE PROGRAM WORKS.

Furthermore, please ensure that the getter and setters are not combined into single sections, there should be individual getter and setter functions for each variable

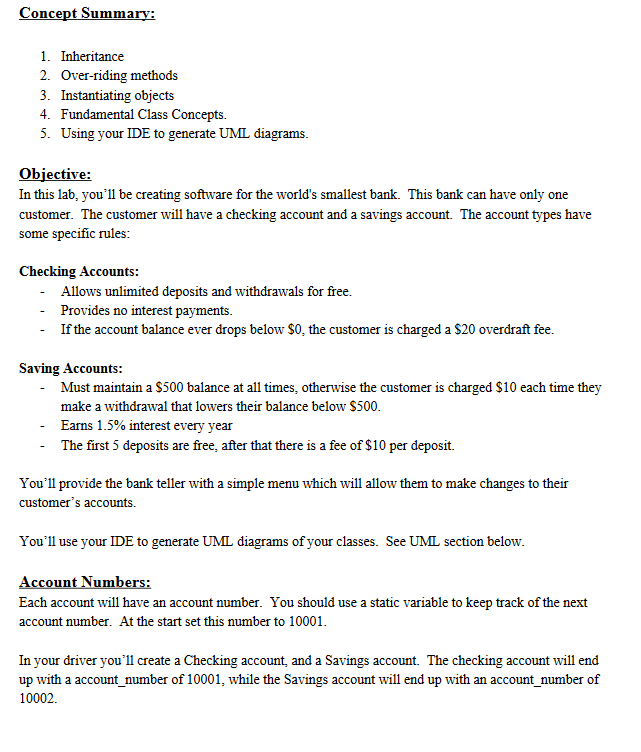

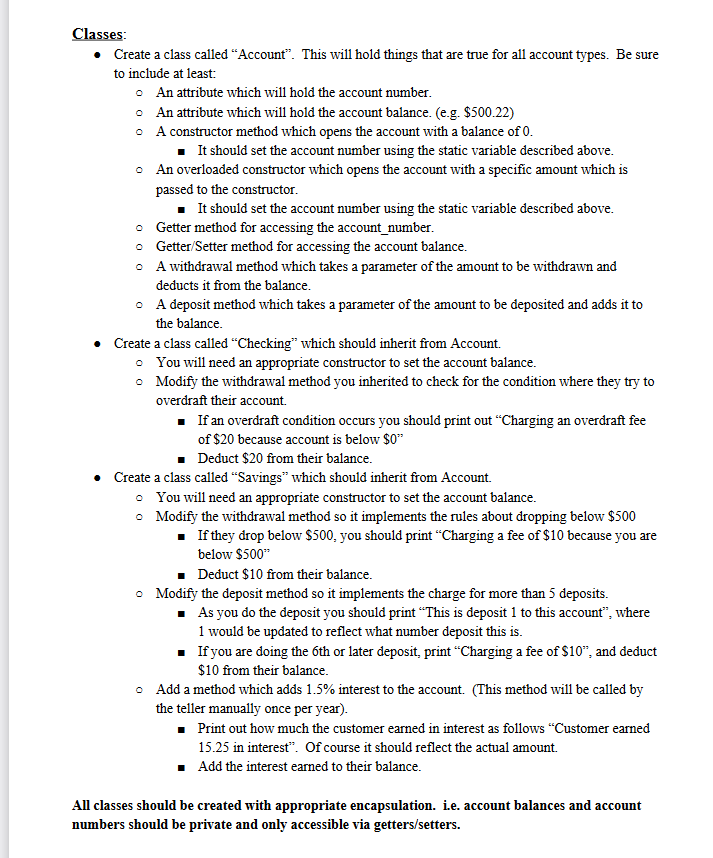

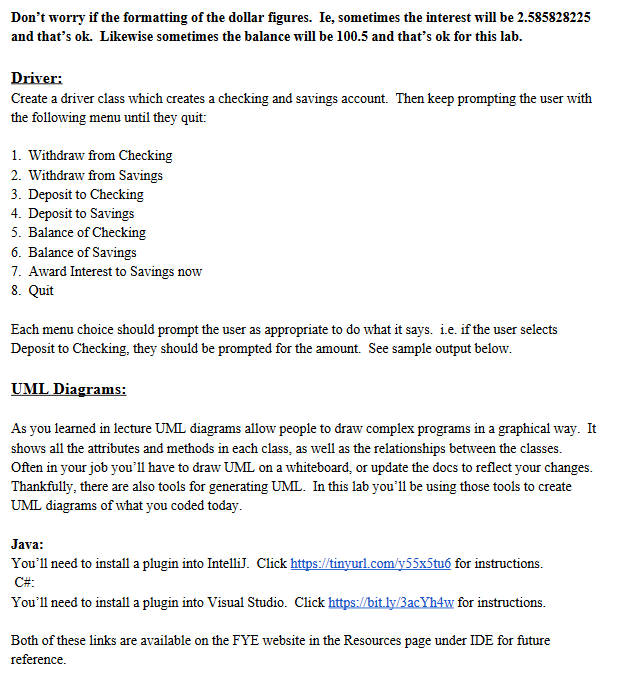

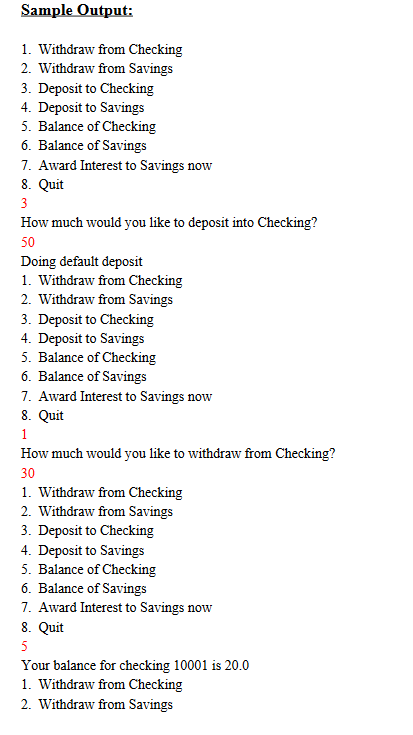

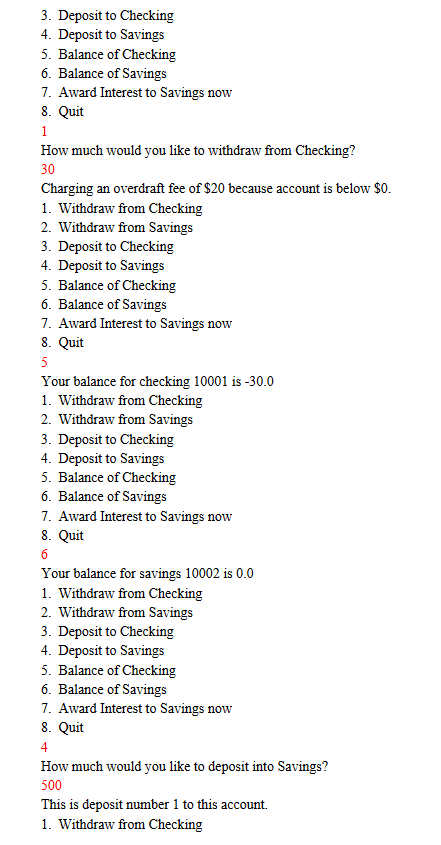

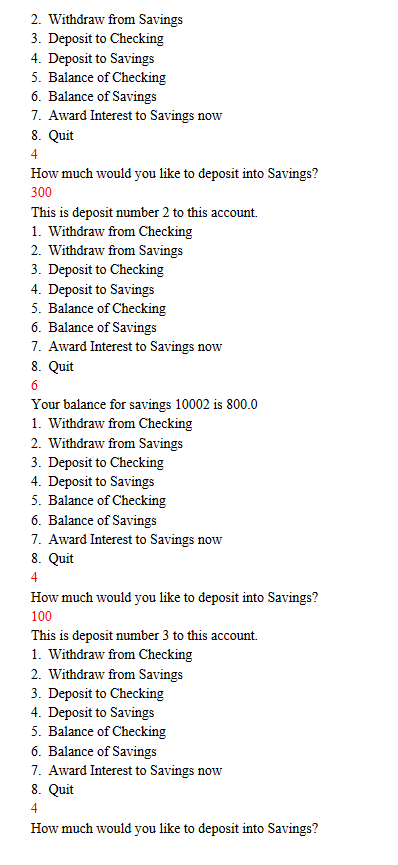

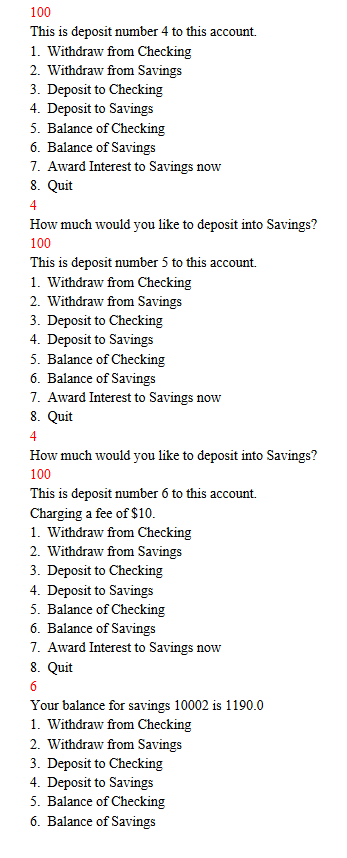

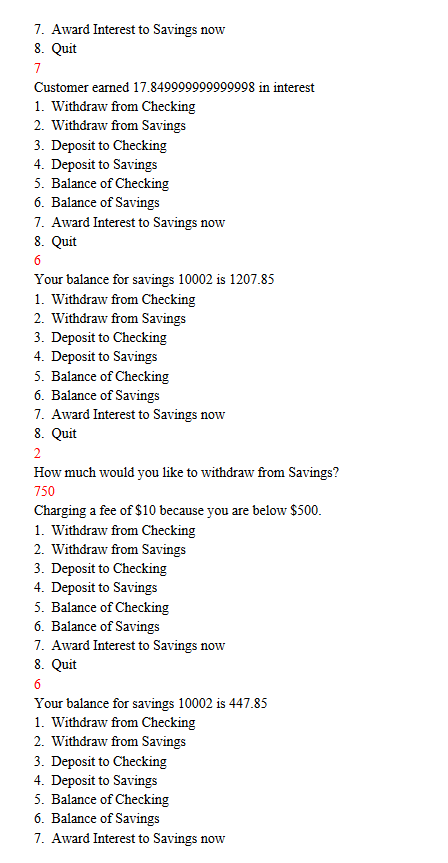

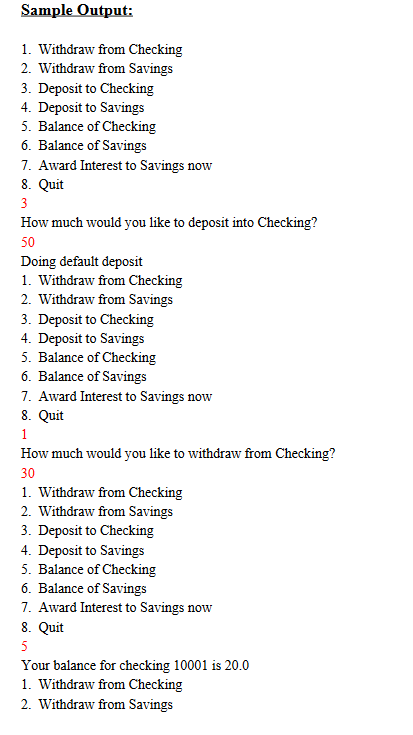

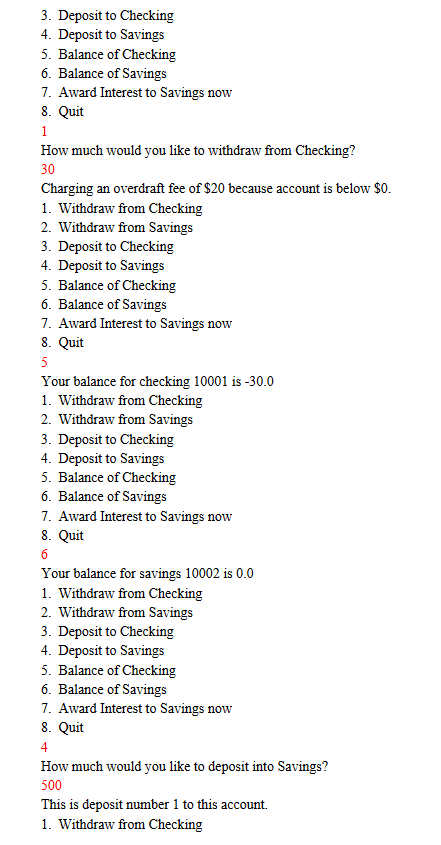

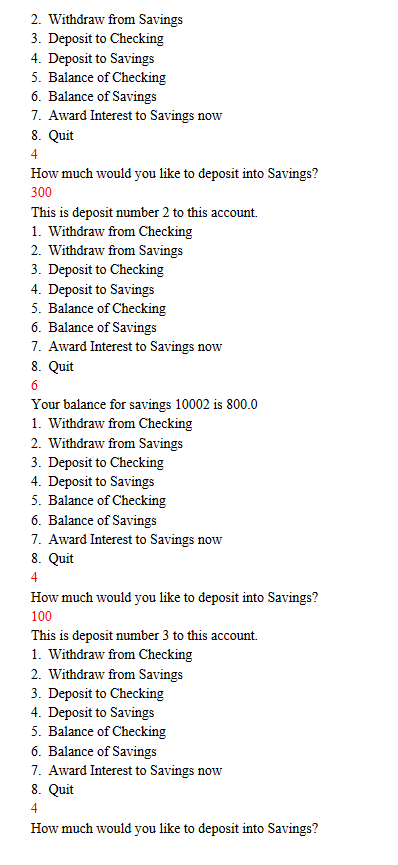

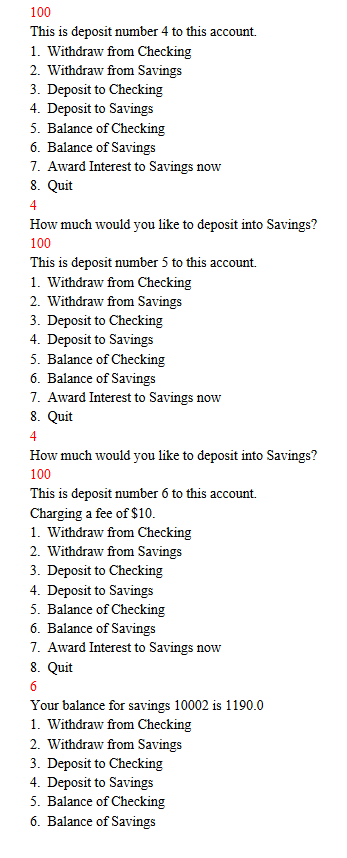

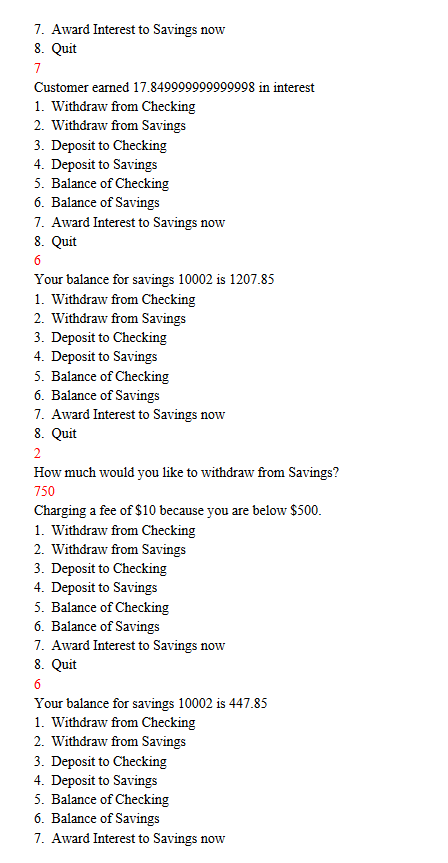

Concept Summary: 1. Inheritance 2. Over-riding methods 3. Instantiating objects 4. Fundamental Class Concepts. 5. Using your IDE to generate UML diagrams. Objective: In this lab, you'll be creating software for the world's smallest bank. This bank can have only one customer. The customer will have a checking account and a savings account. The account types have some specific rules: Checking Accounts: - Allows unlimited deposits and withdrawals for free. - Provides no interest payments. - If the account balance ever drops below $0, the customer is charged a $20 overdraft fee. Saving Accounts: Must maintain a $500 balance at all times, otherwise the customer is charged $10 each time they make a withdrawal that lowers their balance below $500. Earns 1.5% interest every year - The first 5 deposits are free, after that there is a fee of $10 per deposit. You'll provide the bank teller with a simple menu which will allow them to make changes to their customer's accounts. You'll use your IDE to generate UML diagrams of your classes. See UML section below. Account Numbers: Each account will have an account number. You should use a static variable to keep track of the next account number. At the start set this number to 10001. In your driver you'll create a Checking account, and a Savings account. The checking account will end up with a account_number of 10001, while the Savings account will end up with an account_number of 10002. Classes: Create a class called "Account. This will hold things that are true for all account types. Be sure to include at least: An attribute which will hold the account number. An attribute which will hold the account balance. (e.g. $500.22) A constructor method which opens the account with a balance of 0. It should set the account number using the static variable described above. An overloaded constructor which opens the account with a specific amount which is passed to the constructor. It should set the account number using the static variable described above. o Getter method for accessing the account_number. Getter/Setter method for accessing the account balance. A withdrawal method which takes a parameter of the amount to be withdrawn and deducts it from the balance. A deposit method which takes a parameter of the amount to be deposited and adds it to the balance. Create a class called Checking which should inherit from Account. You will need an appropriate constructor to set the account balance. Modify the withdrawal method you inherited to check for the condition where they try to overdraft their account. If an overdraft condition occurs you should print out "Charging an overdraft fee of $20 because account is below $0" Deduct $20 from their balance. Create a class called "Savings which should inherit from Account You will need an appropriate constructor to set the account balance. Modify the withdrawal method so it implements the rules about dropping below $500 If they drop below $500, you should print Charging a fee of $10 because you are below $500" Deduct $10 from their balance. Modify the deposit method so it implements the charge for more than 5 deposits. As you do the deposit you should print This is deposit 1 to this account, where 1 would be updated to reflect what number deposit this is. If you are doing the 6th or later deposit, print "Charging a fee of $10", and deduct $10 from their balance. Add a method which adds 1.5% interest to the account. (This method will be called by the teller manually once per year). Print out how much the customer earned in interest as follows "Customer earned 15.25 in interest". Of course it should reflect the actual amount. Add the interest earned to their balance. All classes should be created with appropriate encapsulation. i.e. account balances and account numbers should be private and only accessible via getters/setters. Don't worry if the formatting of the dollar figures. Ie, sometimes the interest will be 2.585828225 and that's ok. Likewise sometimes the balance will be 100.5 and that's ok for this lab. Driver: Create a driver class which creates a checking and savings account. Then keep prompting the user with the following menu until they quit: 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit Each menu choice should prompt the user as appropriate to do what it says. i.e. if the user selects Deposit to Checking, they should be prompted for the amount. See sample output below. UML Diagrams: As you learned in lecture UML diagrams allow people to draw complex programs in a graphical way. It shows all the attributes and methods in each class, as well as the relationships between the classes. Often in your job you'll have to draw UML on a whiteboard, or update the docs to reflect your changes. Thankfully, there are also tools for generating UML. In this lab you'll be using those tools to create UML diagrams of what you coded today. Java: You'll need to install a plugin into Intelli). Click https://tinyurl.com/y55x5tu for instructions. C#: You'll need to install a plugin into Visual Studio. Click https://bit.ly/3ac Yh4w for instructions. Both of these links are available on the FYE website in the Resources page under IDE for future reference. Sample Output: 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 3 How much would you like to deposit into Checking? 50 Doing default deposit 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 1 How much would you like to withdraw from Checking? 30 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit Your balance for checking 10001 is 20.0 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 1 How much would you like to withdraw from Checking? 30 Charging an overdraft fee of $20 because account is below $0. 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 5 Your balance for checking 10001 is -30.0 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 6 Your balance for savings 10002 is 0.0 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 4 How much would you like to deposit into Savings? 500 This is deposit number 1 to this account. 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 4 How much would you like to deposit into Savings? 300 This is deposit number 2 to this account. 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 6 Your balance for savings 10002 is 800.0 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 4 How much would you like to deposit into Savings? 100 This is deposit number 3 to this account. 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 4 How much would you like to deposit into Savings? 100 This is deposit number 4 to this account. 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 4 How much would you like to deposit into Savings? 100 This is deposit number 5 to this account. 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 4 How much would you like to deposit into Savings? 100 This is deposit number 6 to this account. Charging a fee of $10. 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 6 Your balance for savings 10002 is 1190.0 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 7 Customer earned 17.849999999999998 in interest 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 6 Your balance for savings 10002 is 1207.85 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 2 How much would you like to withdraw from Savings? 750 Charging a fee of $10 because you are below $500. 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now 8. Quit 6 Your balance for savings 10002 is 447.85 1. Withdraw from Checking 2. Withdraw from Savings 3. Deposit to Checking 4. Deposit to Savings 5. Balance of Checking 6. Balance of Savings 7. Award Interest to Savings now