this next part is attached as well

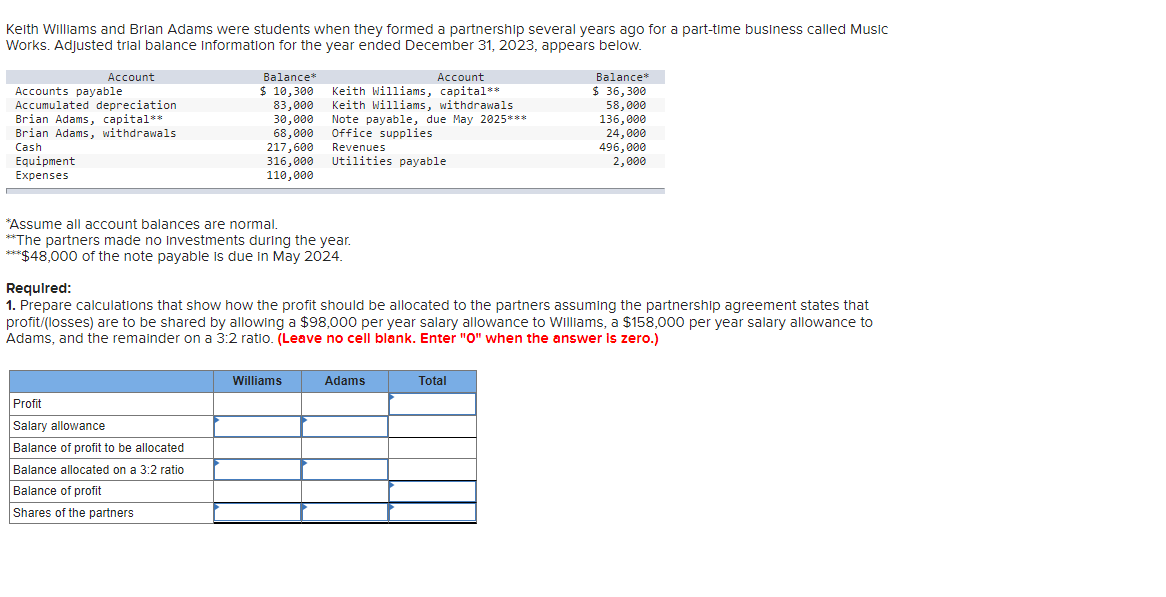

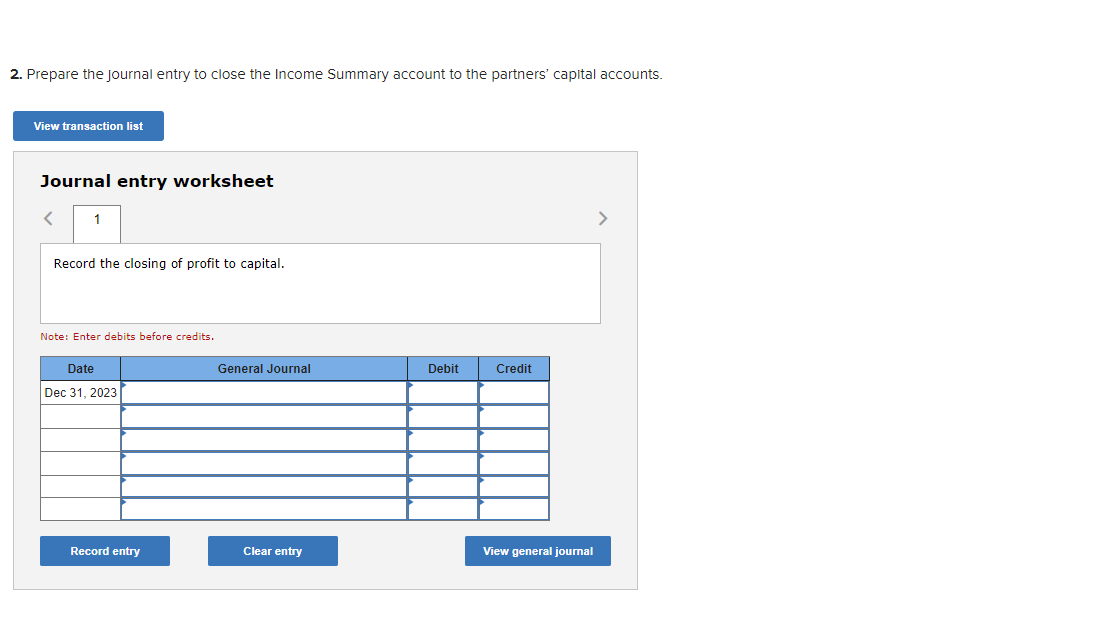

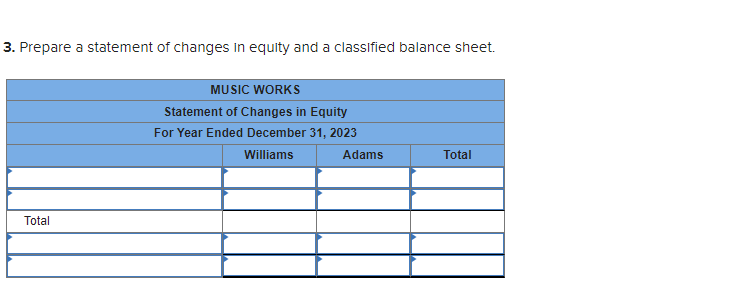

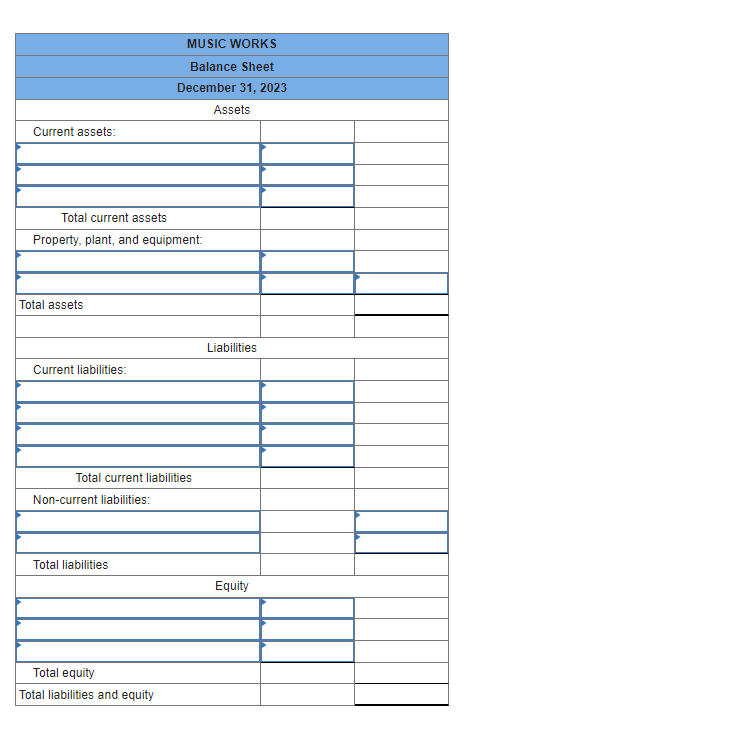

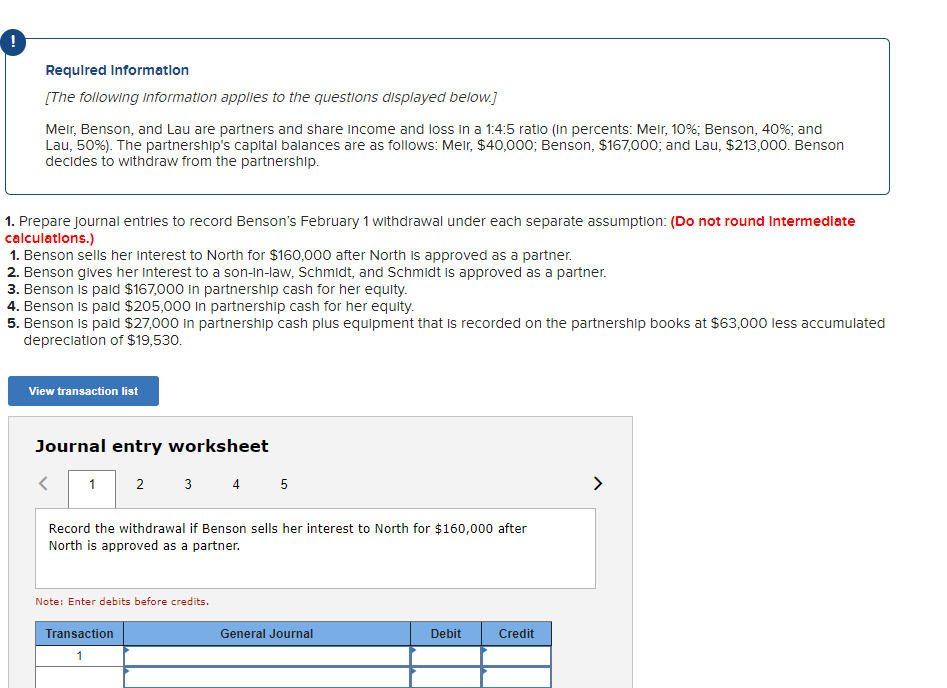

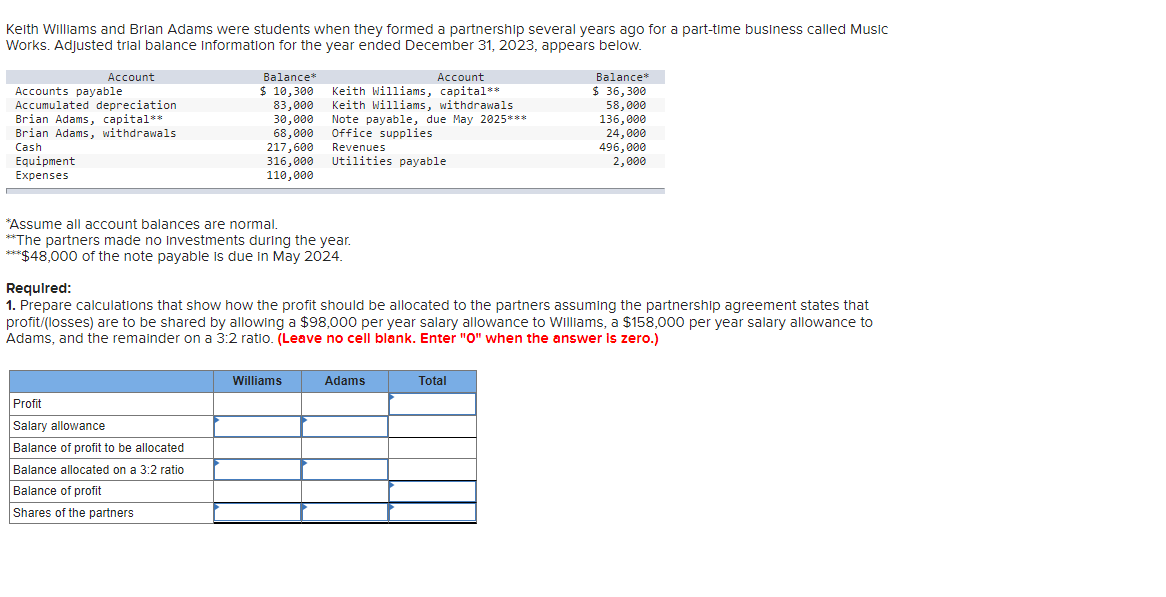

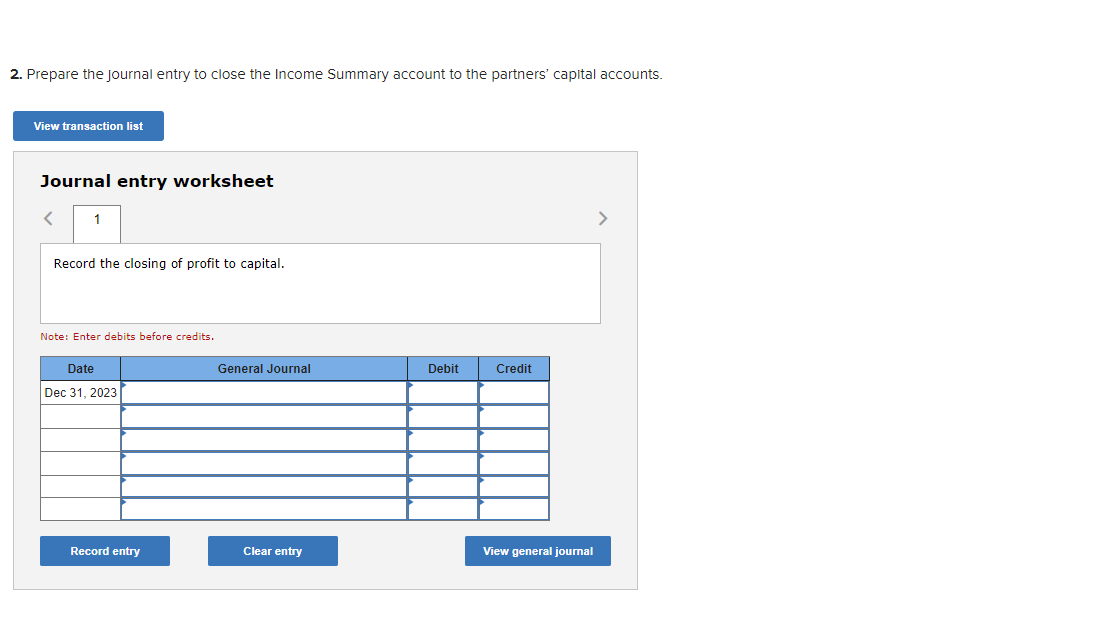

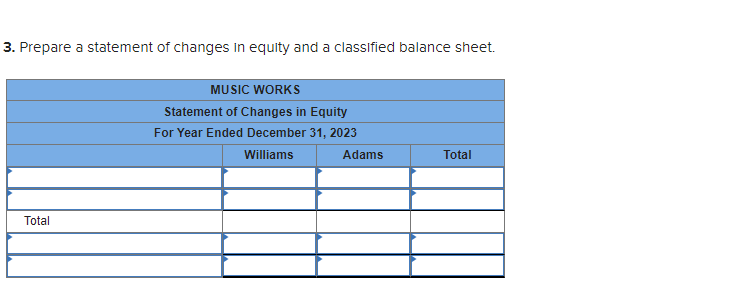

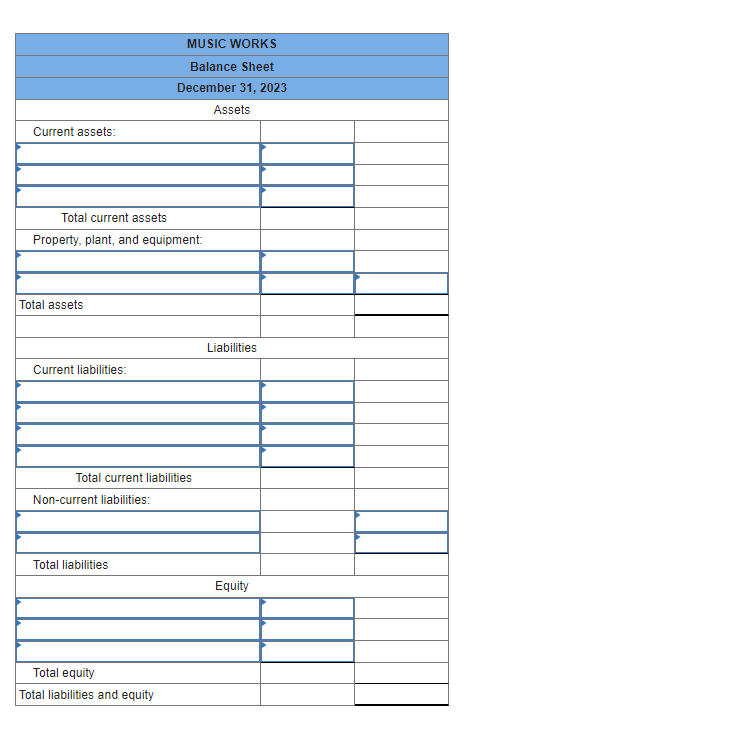

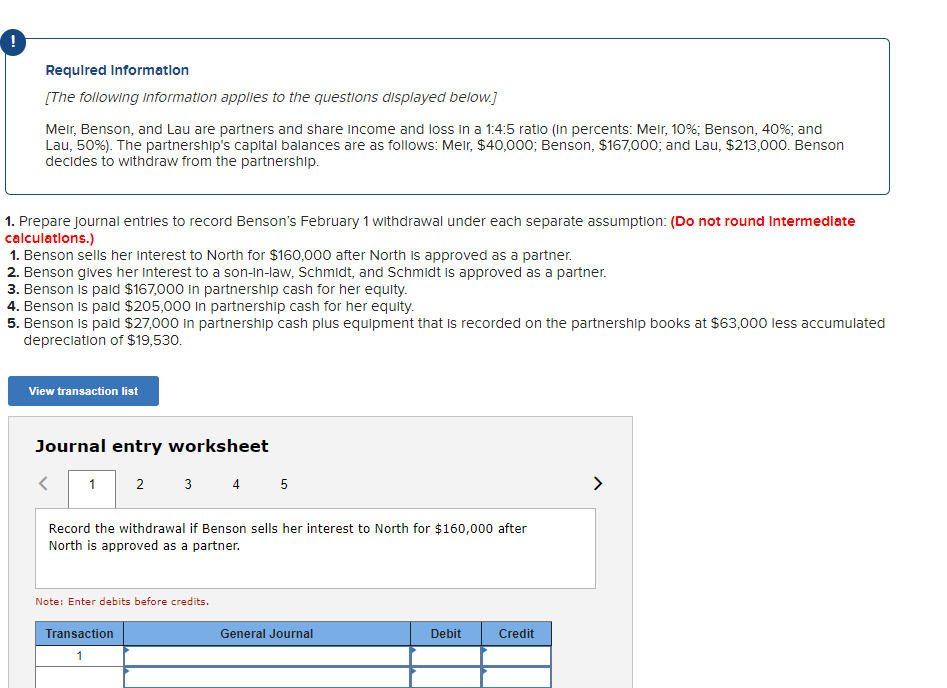

Kelth Williams and Brlan Adams were students when they formed a partnership several years ago for a part-time business called Music Works. Adjusted trial balance Information for the year ended December 31, 2023, appears below. *Assume all account balances are normal. The partners made no investments during the year. ** $8,000 of the note payable is due in May 2024. Required: 1. Prepare calculations that show how the profit should be allocated to the partners assuming the partnership agreement states that profit/(losses) are to be shared by allowing a $98,000 per year salary allowance to Williams, a $158,000 per year salary allowance to Adams, and the remainder on a 3:2 ratio. (Leave no cell blank. Enter "0" when the answer is zero.) 2. Prepare the Journal entry to close the Income Summary account to the partners' capital accounts. Journal entry worksheet Record the closing of profit to capital. Note: Enter debits before credits. 3. Prepare a statement of changes in equity and a classified balance sheet. Required Information [The following information applles to the questions displayed below.] Meir, Benson, and Lau are partners and share income and loss in a 1:4:5 ratio (In percents: Melr, 10\%; Benson, 40\%; and Lau, 50\%). The partnership's capital balances are as follows: Melr, $40,000; Benson, $167,000; and Lau, $213,000. Benson decides to withdraw from the partnership. 1. Prepare journal entries to record Benson's February 1 withdrawal under each separate assumption: (Do not round Intermedlate calculations.) 1. Benson sells her interest to North for $160,000 after North is approved as a partner. 2. Benson gives her interest to a son-In-law, Schmidt, and Schmidt Is approved as a partner. 3. Benson is paid $167,000 in partnership cash for her equity. 4. Benson is pald $205,000 in partnership cash for her equity. 5. Benson is paid $27,000 in partnership cash plus equipment that is recorded on the partnership books at $63,000 less accumulated depreciation of $19,530. Journal entry worksheet 5 Record the withdrawal if Benson sells her interest to North for $160,000 after North is approved as a partner. Note: Enter debits before credits