Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this one: b. Bad Debt Exp. $30,600 Journalize transactions related to uncollectibles Excel Instructions a. What amount of bad debt expense will Morgane Company report

this one:

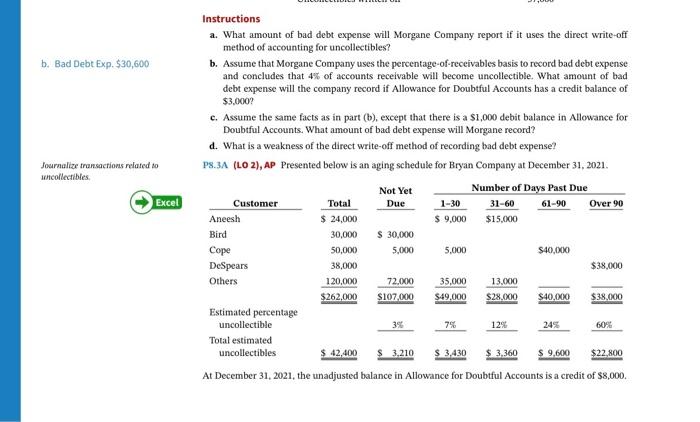

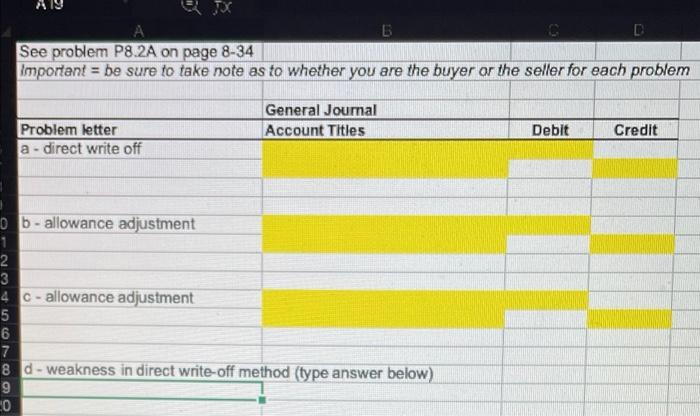

b. Bad Debt Exp. $30,600 Journalize transactions related to uncollectibles Excel Instructions a. What amount of bad debt expense will Morgane Company report if it uses the direct write-off method of accounting for uncollectibles? b. Assume that Morgane Company uses the percentage-of-receivables basis to record bad debt expense and concludes that 4% of accounts receivable will become uncollectible. What amount of bad debt expense will the company record if Allowance for Doubtful Accounts has a credit balance of $3.000? c. Assume the same facts as in part (b), except that there is a $1,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Morgane record? d. What is a weakness of the direct write-off method of recording bad debt expense? P8.3A (LO 2), AP Presented below is an aging schedule for Bryan Company at December 31, 2021 Not Yet Number of Days Past Due Customer Total Due 1-30 31-60 61-90 Over 90 Aneesh $ 24,000 $ 9,000 $15.000 Bird 30,000 $ 30,000 Cope 50,000 5,000 5.000 $40.000 DeSpears 38,000 $38.000 Others 120,000 72.00 35,000 13.000 $262,000 $107.000 $28.000 $40.000 $38.000 Estimated percentage uncollectible 39 7% 12% 245 60% Total estimated uncollectibles $ 42,400 3.210 $ 3,430 $ 9,600 $22,800 At December 31, 2021, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $8,000. $49,000 $ 3,360 Aly A 6 D See problem P8.2A on page 8-34 Important = be sure to take note as to whether you are the buyer or the seller for each problem General Journal Account Titles Debit Credit Problem letter a - direct write off ob - allowance adjustment 1 2 3 4 C - allowance adjustment 5 6 7 8 d - weakness in direct write-off method (type answer below) 9 CO OO b. Bad Debt Exp. $30,600 Instructions a. What amount of bad debt expense will Morgane Company report if it uses the direct write-off method of accounting for uncollectibles? b. Assume that Morgane Company uses the percentage-of-receivables basis to record bad debt expense and concludes that 45 of accounts receivable will become uncollectible. What amount of bad debt expense will the company record if Allowance for Doubtful Accounts has a credit balance of $3.00 c. Assume the same facts as in part (b), except that there is a $1,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Morgane record? d. What is a weakness of the direct write-off method of recording bad debt expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started