this one

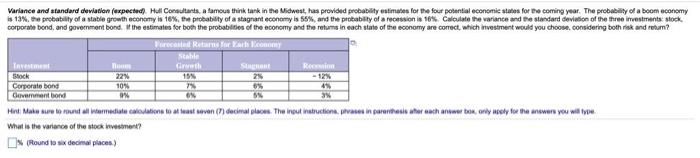

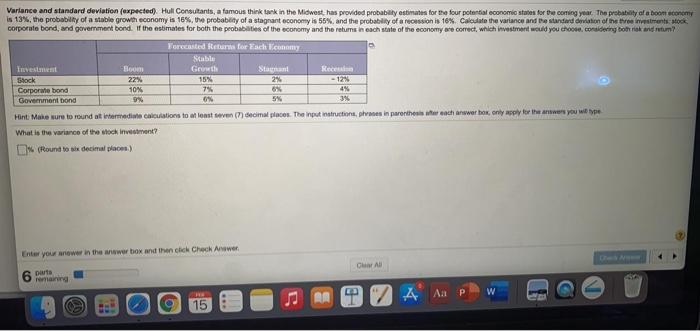

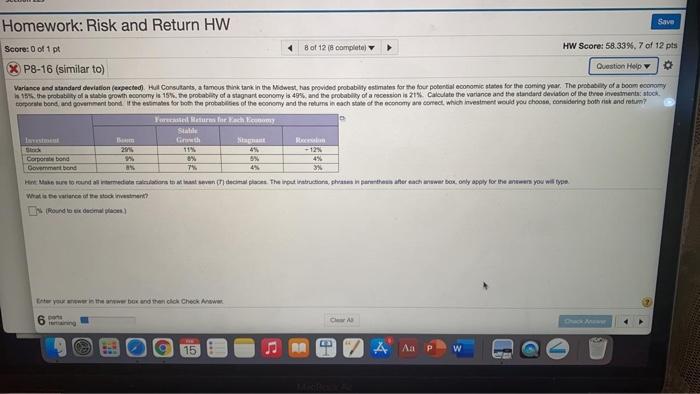

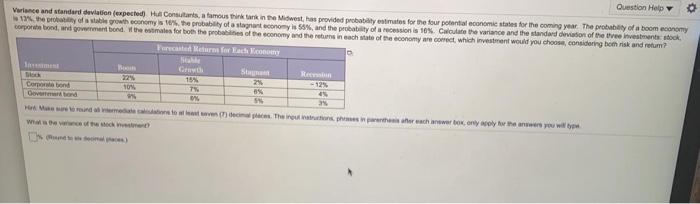

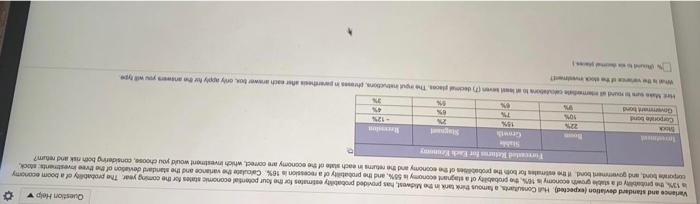

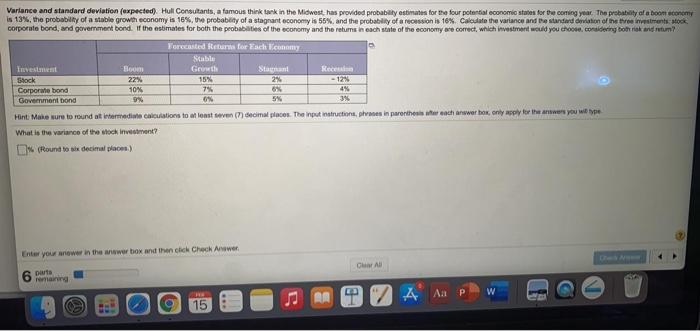

Save Homework: Risk and Return HW Score: 0 of 1 pt 8 of 12 complete HW Score: 58.33%, 7 of 12 pts X P8-16 (similar to) Question Help $ Variance and standard deviation (expected)Ha Constants, a tamous think tank in the Midwes. Tas provided probability estimates for the four potential economic states for the coming year. The probability of a boom economy 156. the probably of a growth economy is 15%, the probability of a stagnant economy is 40%, and the probability of a recession is 21% Calculate the variance and the standard deviation of the three investments to le bord and government bond the evident for both the probabilities of the conomy and the return in each of the economy recomect which investment would you choose, considering both risk and return Yerel Melumbach im al La Growth Ntagant R Corporate bond 0% 8 45 Government bond 7% 3% Here to our media is to taste decimal places. The routirruction, she is parthen after each www box only apply for the wes you wiltype What is incident Round to comples For your wwwwwww box and then chok Check 6 CA ng 5 15 RA & P w Question Help Variance and standard deviation (expected Hull Consultants, a famous think tank in the Midwest, has provided probability estimates for the four potential economie states for the coming year. The probability of a boom economy the royable growth economy is 10%. the probability of a stagnant economy is 50%, and the probability of a recession is 10% Cote the variance and the standard deviation of the three investment stock corpore bond, und government to the estimates for both the probabies of economy and the return neach state of the economy are correct, which investment would you choose, considering bom risk and retum? Forecast Metre for Each G 15% Re 22 10% Como bond Oood St 25 85 45 Question Help Varience and standard deviation (expected. Hul Constanta famous think tank in Midwest, has provided probability estimates for the four potential economies for the coming year. The probability of a boom con 19. the probly of a ble growth economy is 10% te probability of a stagnant economy is 50%, and the probability of a cession is 10% Calculate the variance and the standard deviation of the the investment stock componebord, and government to the for to the proces of the conomy and the return ach state of the economy are correct, which investment would you choose, considering both risk and retum? 22% 309 19% 2 ON 4 wah Variance and standard deviation (expected) Hull Consultants, a famous think tank in the Midwest has provided probably estimates for the four potential economic states for the coming year. The probability at a boom com is 13%, the probability of a stable growth economy is 15%. the probablity of a stagnant economy is 55% and the probability of a recession is 18% Calodate the variance and the standard Amaton of the tre moment stock corporate bond, and government bond. If the estimates for both the probabilities of the economy and the returns in each state of the economy are correct, which investment would you choose.comdering both nikad nun? Forecasted Returns for Each onem Stable Investment Boom Growth Stagnant Rece Stock 22 155 2 - 128 Corporate bond 10% 75 Government bond 5% 6% 5% 3% Hint Make sure to round at hermediate calculations to at least seven (7) decimal places. The input instruction, presin parenthesis whereach answer box, only by lorenes you will What is the variance of the clock investment? I Round to decimal place) Enter your newer in the www box and then click Check owe OLA Duuta P A Aa ANT 15 Variance and standard deviation (expected). Hull Consultants a famous think tank in the Midwest, has provided probability estimates for the four potential economie states for the coming year. The probability of a boom economy * 13%, the probability of a stable growth economy is 18%, the probability of a stagnant economy is 55%, and the probability of a recession is 16% Calculate the variance and the standard deviation of the three investment stock corporate bond, and goverment bond. It the estimates for bon the probabilities of the economy and the retums in each state of the economy are correct, which investment would you choose, considering both risk and retum? recented Retame for Stahl Growth SOM R 15% Corporate bond 10% 6% 49 Gervamentbord 0 Hint Make sure to found at tommediate calculations to a beast seven (7) decimal places. The inout natructions, please in parentes aturaach anwer box, only used for the answers you will you What is the variance of the stock investment? (Round to six decimal places)

this one

this one