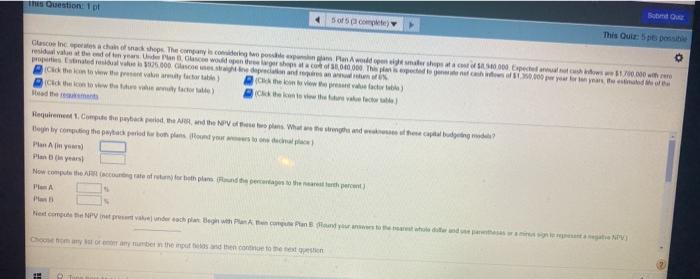

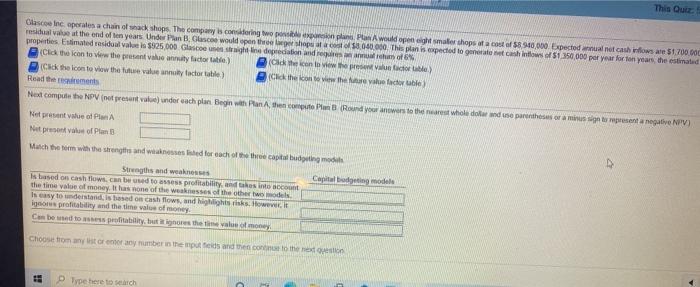

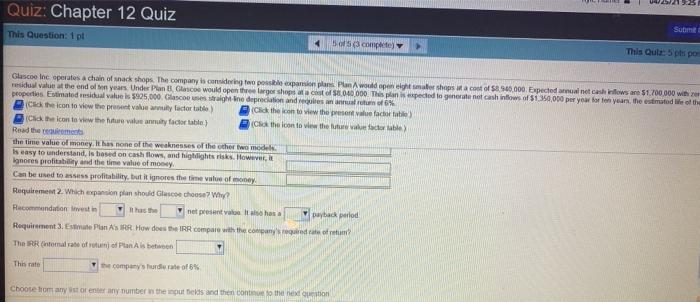

This Ouestion of Sot of complete This Oute: 5ps De Glasconce chance the The commis coming Plan Awesome shots of 0.000 peces www.170.000 wire residual of ten years old. The characted ProsEstates 905.000 de w the who Requirement Commented on the verples. What is the who have captal budgeten? by coming the period and you can place) Plan Ali ya PA Pax This Outz Glascone operates a chain of sackshops. The company is considering plans Plans would open eight smalershops at a cost of $ 10.000. Expected annual net cash flows are $1.700.000 residuale at the end of ten years Under Plan B Glace would open the shape of 860,000. This plan is expected to generation can inflows of 51.350,000 per year for ten years, the estimated properties Estimated residual value is 5925000 Gascogne depreciation of Click the icon to view the presente annuity factor tale (old the view the value factore) Click the icon to view the future value aty factor Click the one the factor ble Read the Next compute the NOV (net presentando cachplan Begin Pan Athen compte Plan B Round your answers to the whole doar de parentheses or a minus in present a negative PV) Netprent value of PA Net present of Plan 13 Maich them with the strong and wanted for each of the the capital big mo Strengths and weaknesses Capital Bating modele Is used on cash flows can be used to assess profitability and has no con the time value of money is one of the weaknesses of the other models Is easy to understand is based on cash flows, and his risks. However, profitability and the time value of money Can bewed to profitability, but ignore the time of my Choose from any story number the putted and then chother Type here to search 4225 Quiz: Chapter 12 Quiz Suome This Question: 1pl 553 competes This Quiz: 5 pts po Glasco Inc operates a chain of snack shops. The company is considering to possible examion plans Plan A would open marshops at a cost of 8960.000. Expected naine casinows are 51.700.000 with sidual value at the end of years. Under Plan Blascoe would open the larger shops at a cost of 8040.000 This plans peded to generate net cashindows of 51.350.000 per year for ten years, the estimated life of the properties Estimated residual values 5905,000. Glasco se straine depreciation and regis annual return of Click the icon to view the present vooruity factor tale Click the icon to view the present value facere (Click the icon to view the future valeant factor table) Cd the contove the wale actor Read the momenti the time value of money. It has none of the weaknesses of the other two models is easy to understand, is based on cash flows, and highlights risks. However, it Ignores profitability and the time value of money Can be used to profitability, but it lores the time value of money Requirement. Which expansion plan should Glasco choose? Why? Recommendation Westin has the net present valot has a Dayback period Requirement 3. Estate Plan ASIRR How does the IRR compare with the company's required to rem! The Internal rate of roof Plan Als between This rate the company's hurdurate of 8% Choose from any store any number in the inputs and then continue to the next to This Ouestion of Sot of complete This Oute: 5ps De Glasconce chance the The commis coming Plan Awesome shots of 0.000 peces www.170.000 wire residual of ten years old. The characted ProsEstates 905.000 de w the who Requirement Commented on the verples. What is the who have captal budgeten? by coming the period and you can place) Plan Ali ya PA Pax This Outz Glascone operates a chain of sackshops. The company is considering plans Plans would open eight smalershops at a cost of $ 10.000. Expected annual net cash flows are $1.700.000 residuale at the end of ten years Under Plan B Glace would open the shape of 860,000. This plan is expected to generation can inflows of 51.350,000 per year for ten years, the estimated properties Estimated residual value is 5925000 Gascogne depreciation of Click the icon to view the presente annuity factor tale (old the view the value factore) Click the icon to view the future value aty factor Click the one the factor ble Read the Next compute the NOV (net presentando cachplan Begin Pan Athen compte Plan B Round your answers to the whole doar de parentheses or a minus in present a negative PV) Netprent value of PA Net present of Plan 13 Maich them with the strong and wanted for each of the the capital big mo Strengths and weaknesses Capital Bating modele Is used on cash flows can be used to assess profitability and has no con the time value of money is one of the weaknesses of the other models Is easy to understand is based on cash flows, and his risks. However, profitability and the time value of money Can bewed to profitability, but ignore the time of my Choose from any story number the putted and then chother Type here to search 4225 Quiz: Chapter 12 Quiz Suome This Question: 1pl 553 competes This Quiz: 5 pts po Glasco Inc operates a chain of snack shops. The company is considering to possible examion plans Plan A would open marshops at a cost of 8960.000. Expected naine casinows are 51.700.000 with sidual value at the end of years. Under Plan Blascoe would open the larger shops at a cost of 8040.000 This plans peded to generate net cashindows of 51.350.000 per year for ten years, the estimated life of the properties Estimated residual values 5905,000. Glasco se straine depreciation and regis annual return of Click the icon to view the present vooruity factor tale Click the icon to view the present value facere (Click the icon to view the future valeant factor table) Cd the contove the wale actor Read the momenti the time value of money. It has none of the weaknesses of the other two models is easy to understand, is based on cash flows, and highlights risks. However, it Ignores profitability and the time value of money Can be used to profitability, but it lores the time value of money Requirement. Which expansion plan should Glasco choose? Why? Recommendation Westin has the net present valot has a Dayback period Requirement 3. Estate Plan ASIRR How does the IRR compare with the company's required to rem! The Internal rate of roof Plan Als between This rate the company's hurdurate of 8% Choose from any store any number in the inputs and then continue to the next to