Answered step by step

Verified Expert Solution

Question

1 Approved Answer

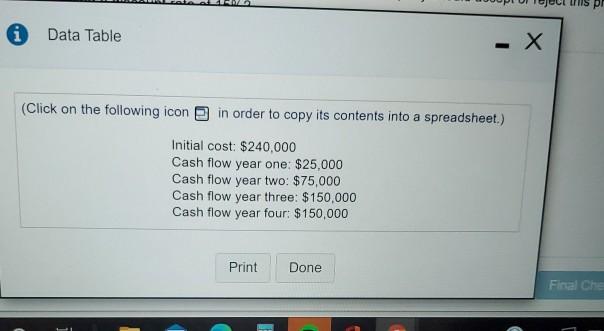

this pi i Data Table - X (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cost: $240,000 Cash

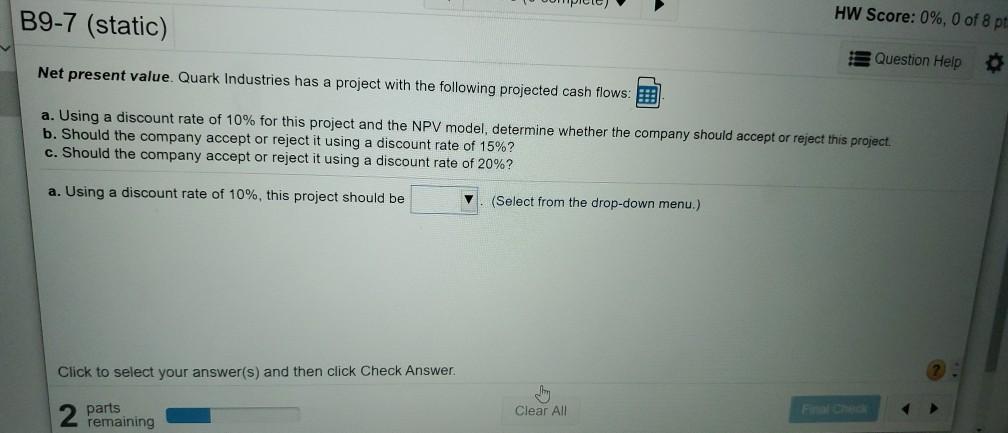

this pi i Data Table - X (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cost: $240,000 Cash flow year one: $25,000 Cash flow year two: $75,000 Cash flow year three: $150,000 Cash flow year four: $150,000 Print Done Final Che B9-7 (static) HW Score: 0%, 0 of 8 pt B Question Help Net present value. Quark Industries has a project with the following projected cash flows: a. Using a discount rate of 10% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 15%? c. Should the company accept or reject it using a discount rate of 20%? a. Using a discount rate of 10%, this project should be (Select from the drop-down menu.) Click to select your answer(s) and then click Check Answer 2 Pemaining Clear All

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started