Answered step by step

Verified Expert Solution

Question

1 Approved Answer

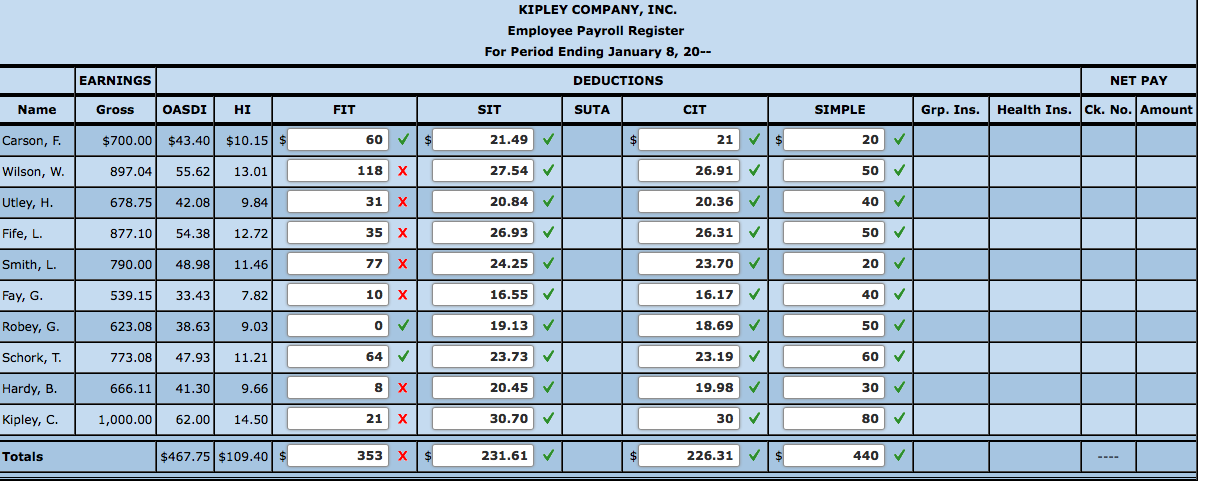

This problem continues the process of preparing the Kipley Company's Employee Payroll Register for the pay period ending January 8th, 20--. In previous chapters, gross

This problem continues the process of preparing the Kipley Company's Employee Payroll Register for the pay period ending January 8th, 20--. In previous chapters, gross wages were computed for each employee and using this data, FICA withholding and employer FICA liability was computed.

Requirements:

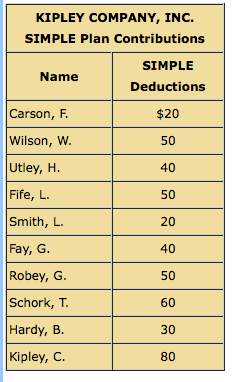

- Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction.

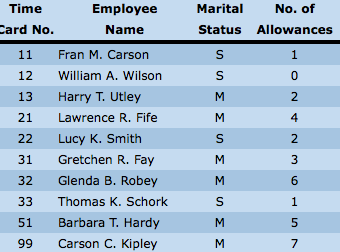

- Determine and record the federal income taxes for each employee.

- Determine and record the state income taxes for each employee.

- Determine and record the city income taxes for the city of Pittsburgh.

- Total each input column.

KIPLEY COMPANY, INC. SIMPLE Plan Contributions Name SIMPLE Deductions Carson, F. $20 Wilson, W. 50 Utley, H. 40 Fife, L. 50 Smith, L. 20 Fay, G. 40 Robey, G. 50 60 Schork, T. Hardy, B. 30 Kipley, C. 80 Marital Status No. of Allowances S 1 S M M Time Employee Card No. Name 11 Fran M. Carson 12 William A. Wilson 13 Harry T. Utley 21 Lawrence R. Fife 22 Lucy K. Smith 31 Gretchen R. Fay Glenda B. Robey 33 Thomas K. Schork 51 Barbara T. Hardy 99 Carson C. Kipley wNNO S M 32 M 6 S 1 M 5 M 7 KIPLEY COMPANY, INC. Employee Payroll Register For Period Ending January 8, 20-- EARNINGS DEDUCTIONS NET PAY Name Gross OASDI HI FIT SIT SUTA CIT SIMPLE Grp. Ins. Health Ins. Ck. No. Amount Carson, F. $700.00 $43.40 $10.15 $ 60 21.49 $ 21 $ 20 Wilson, W. 897.04 55.62 13.01 118 x 27.54 26.91 50 Utley, H. 678.75 42.08 9.84 31 X 20.84 20.36 40 Fife, L. 877.10 54.38 12.72 35 X 26.93 26.31 50 Smith, L. 790.00 48.98 11.46 77 X 24.25 23.70 20 Fay, G. 539.15 33.43 7.82 10 X 16.55 16.17 40 Robey, G. 623.08 38.63 9.03 o 19.13 18.69 50 Schork, T. 773.08 47.93 11.21 64 23.73 23.19 60 15 . Hardy, B. 666.11 41.30 9.66 8 x 20.45 19.98 30 Kipley, C. 1,000.00 62.00 14.50 21 X 30.70 30 80 Totals $467.75 $109.40 $ 353 231.61 $ 226.31 440

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started