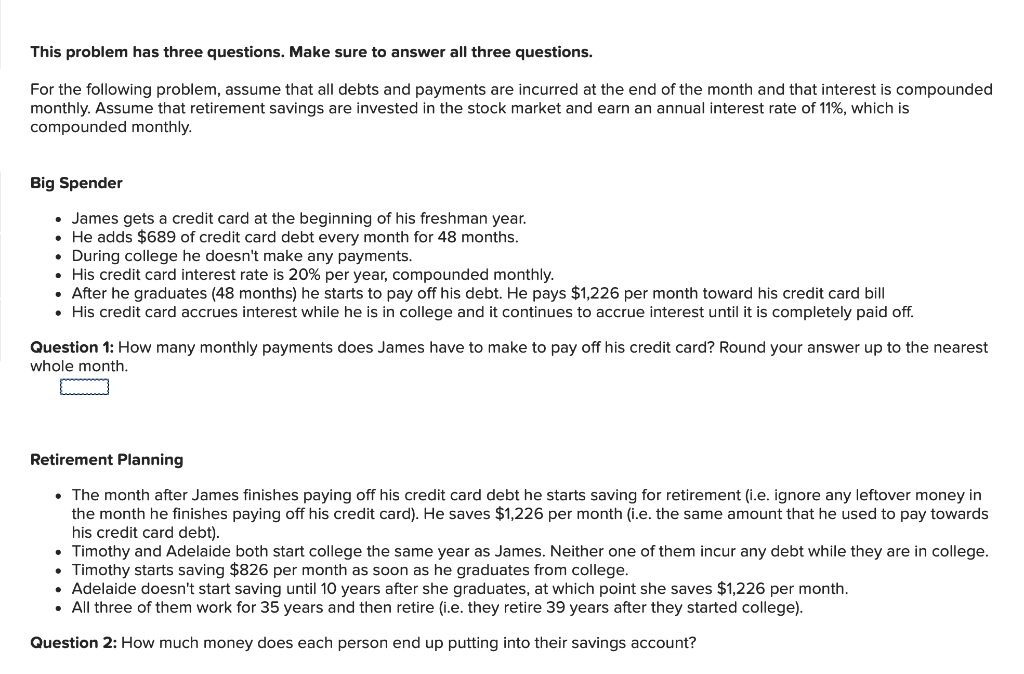

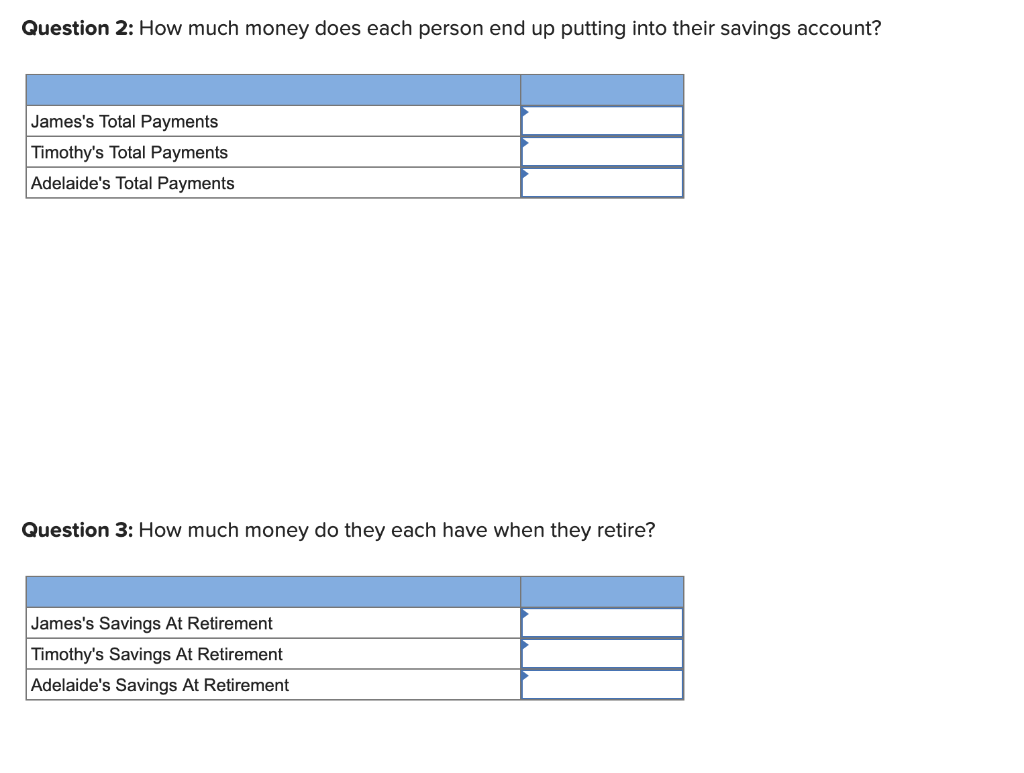

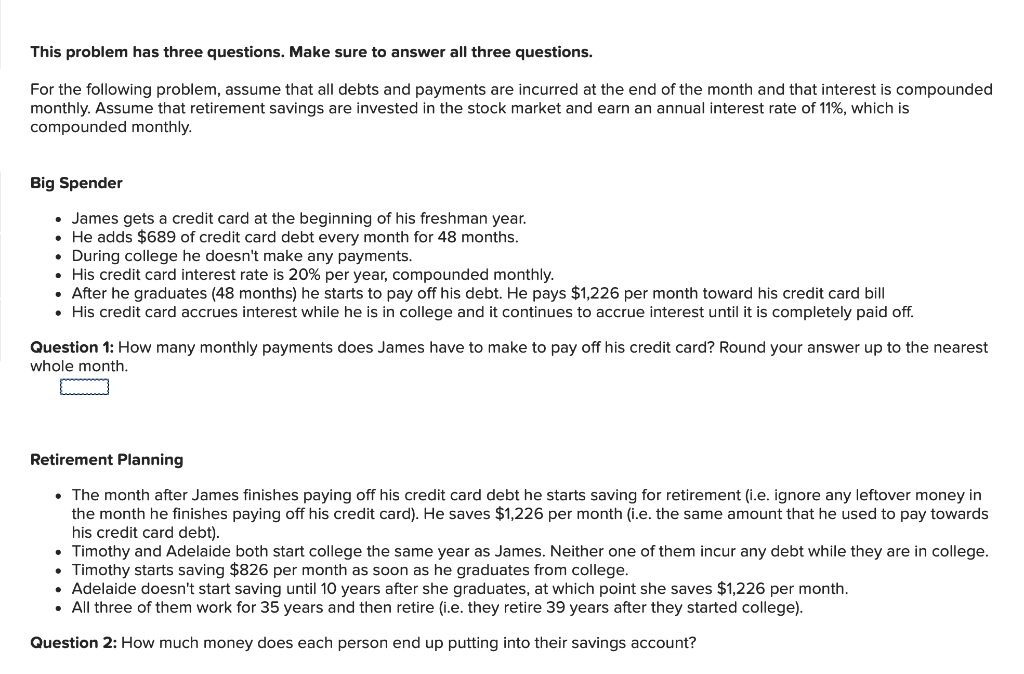

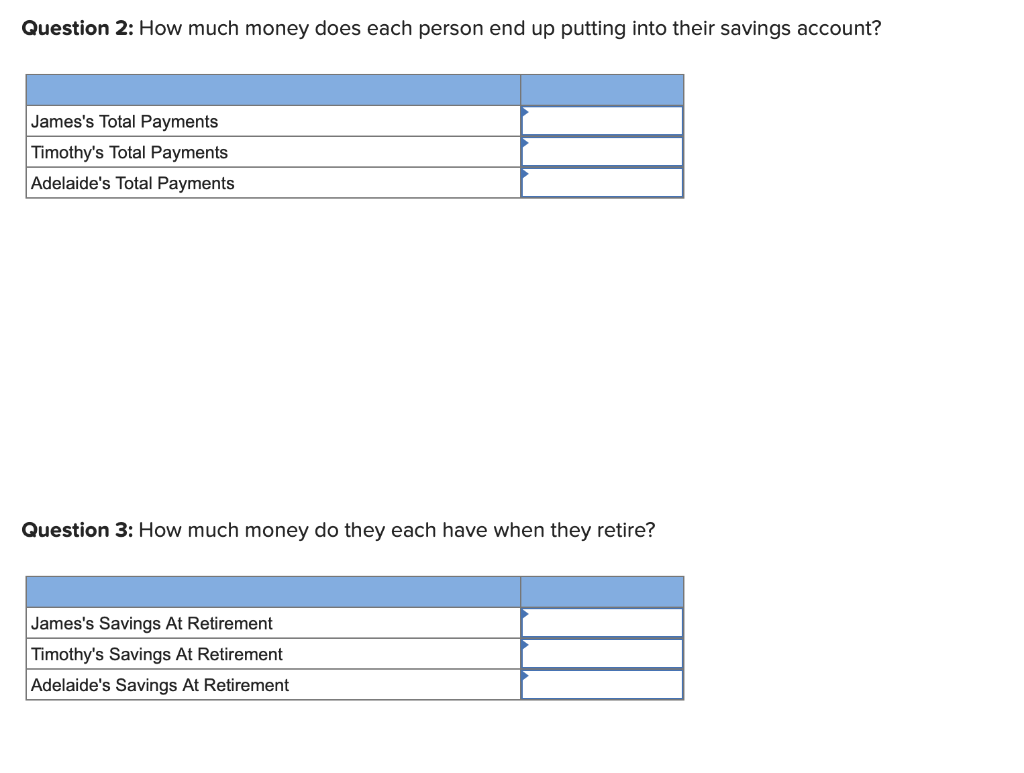

This problem has three questions. Make sure to answer all three questions. For the following problem, assume that all debts and payments are incurred at the end of the month and that interest is compounded monthly. Assume that retirement savings are invested in the stock market and earn an annual interest rate of 11%, which is compounded monthly. Big Spender James gets a credit card at the beginning of his freshman year. He adds $689 of credit card debt every month for 48 months. . During college he doesn't make any payments. His credit card interest rate is 20% per year, compounded monthly. After he graduates (48 months) he starts to pay off his debt. He pays $1,226 per month toward his credit card bill His credit card accrues interest while he is in college and it continues to accrue interest until it is completely paid off. Question 1: How many monthly payments does James have to make to pay off his credit card? Round your answer up to the nearest whole month. Retirement Planning The month after James finishes paying off his credit card debt he starts saving for retirement (.e. ignore any leftover money in the month he finishes paying off his credit card). He saves $1,226 per month (i.e. the same amount that he used to pay towards his credit card debt). Timothy and Adelaide both start college the same year as James. Neither one of them incur any debt while they are in college. Timothy starts saving $826 per month as soon as he graduates from college. Adelaide doesn't start saving until 10 years after she graduates, at which point she saves $1,226 per month. All three of them work for 35 years and then retire (i.e. they retire 39 years after they started college). Question 2: How much money does each person end up putting into their savings account? Question 2: How much money does each person end up putting into their savings account? James's Total Payments Timothy's Total Payments Adelaide's Total Payments Question 3: How much money do they each have when they retire? James's Savings At Retirement Timothy's Savings At Retirement Adelaide's Savings At Retirement This problem has three questions. Make sure to answer all three questions. For the following problem, assume that all debts and payments are incurred at the end of the month and that interest is compounded monthly. Assume that retirement savings are invested in the stock market and earn an annual interest rate of 11%, which is compounded monthly. Big Spender James gets a credit card at the beginning of his freshman year. He adds $689 of credit card debt every month for 48 months. . During college he doesn't make any payments. His credit card interest rate is 20% per year, compounded monthly. After he graduates (48 months) he starts to pay off his debt. He pays $1,226 per month toward his credit card bill His credit card accrues interest while he is in college and it continues to accrue interest until it is completely paid off. Question 1: How many monthly payments does James have to make to pay off his credit card? Round your answer up to the nearest whole month. Retirement Planning The month after James finishes paying off his credit card debt he starts saving for retirement (.e. ignore any leftover money in the month he finishes paying off his credit card). He saves $1,226 per month (i.e. the same amount that he used to pay towards his credit card debt). Timothy and Adelaide both start college the same year as James. Neither one of them incur any debt while they are in college. Timothy starts saving $826 per month as soon as he graduates from college. Adelaide doesn't start saving until 10 years after she graduates, at which point she saves $1,226 per month. All three of them work for 35 years and then retire (i.e. they retire 39 years after they started college). Question 2: How much money does each person end up putting into their savings account? Question 2: How much money does each person end up putting into their savings account? James's Total Payments Timothy's Total Payments Adelaide's Total Payments Question 3: How much money do they each have when they retire? James's Savings At Retirement Timothy's Savings At Retirement Adelaide's Savings At Retirement