Answered step by step

Verified Expert Solution

Question

1 Approved Answer

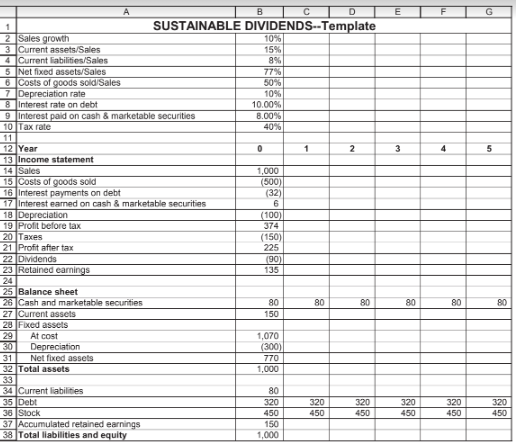

This problem introduces the concept of sustainable dividends: The firm whose financials are illustrated below wishes to maintain cash balances of 80 over the next

This problem introduces the concept of sustainable dividends: The firm whose financials are illustrated below wishes to maintain cash balances of 80 over the next 5 years. It also desires to issue neither additional stock nor make any changes in its current level of debt. This means that dividends are the plug in the balance sheet. Model this situation (note that for some parameter levels you may get negative dividends, indicating that there is no sustainable level of dividends).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started