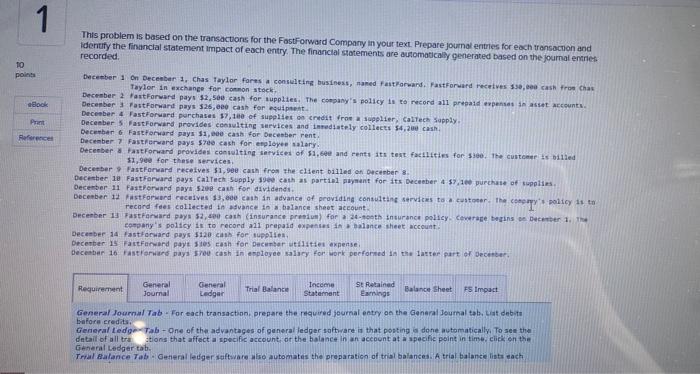

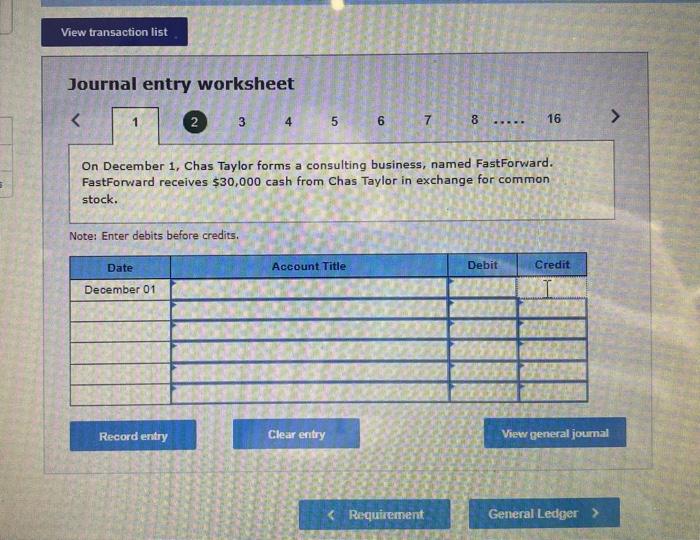

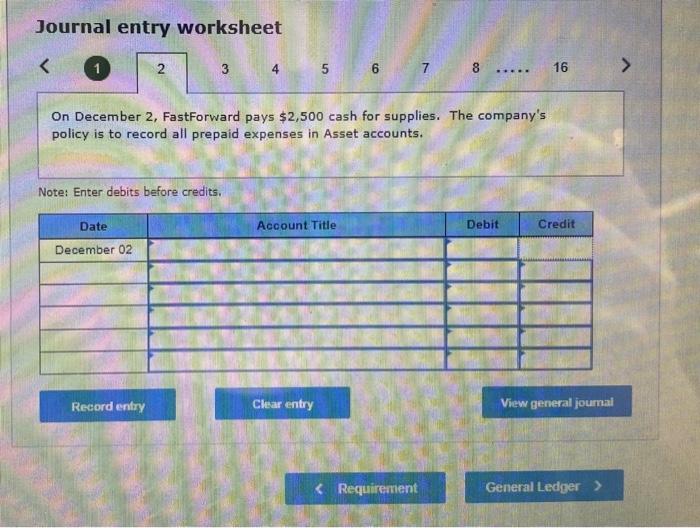

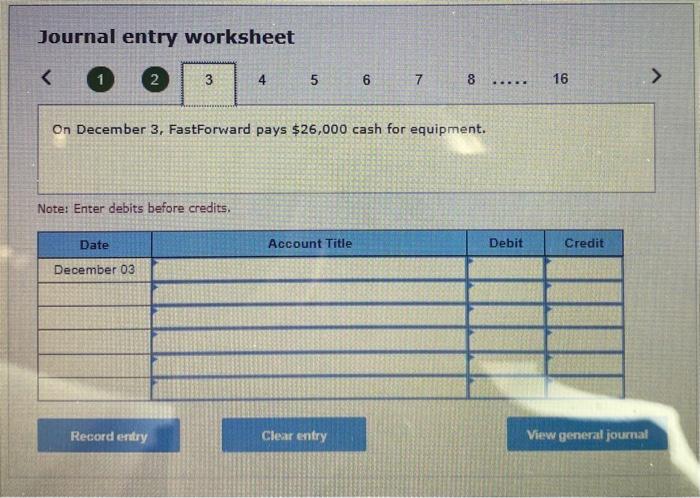

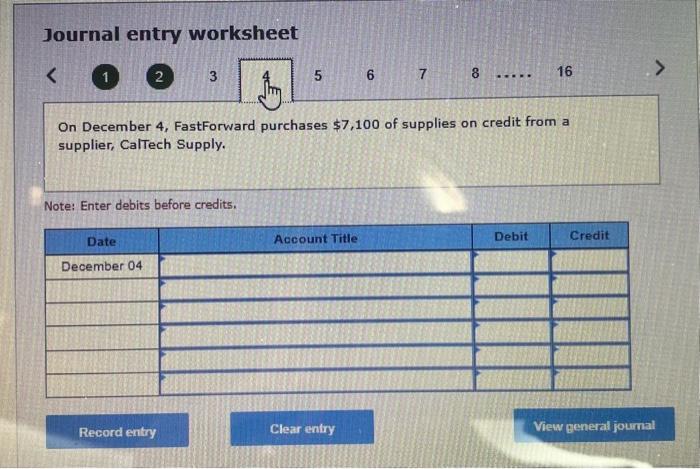

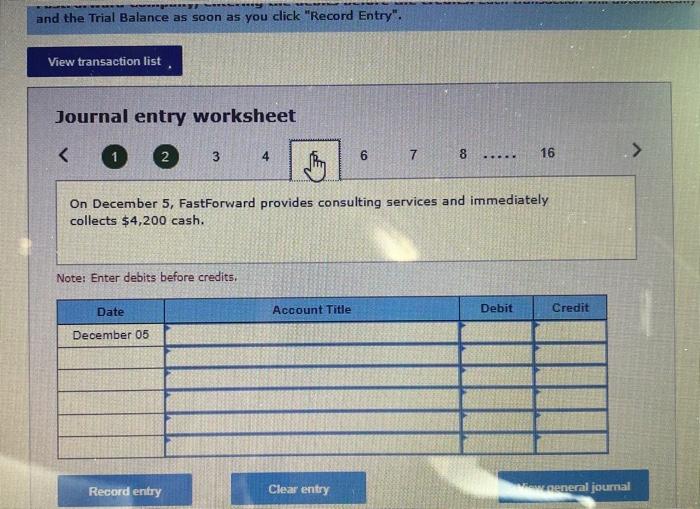

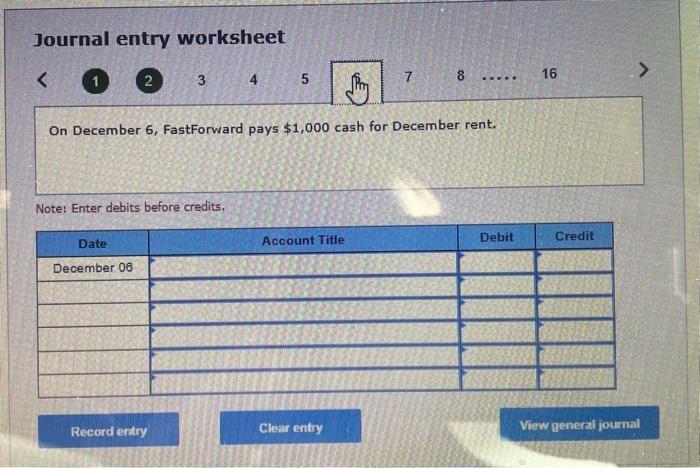

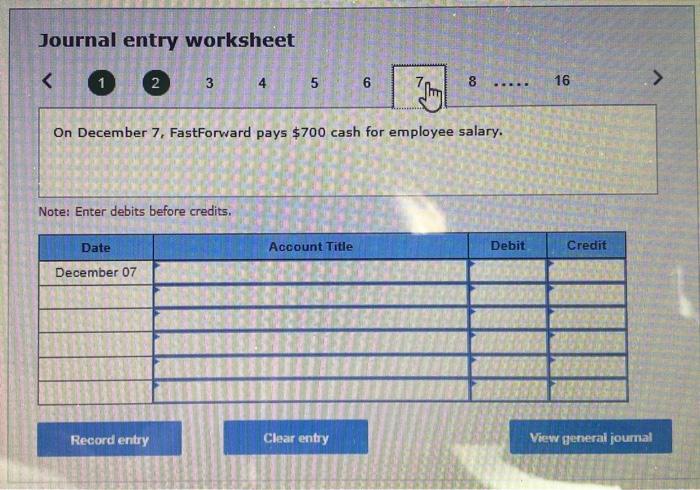

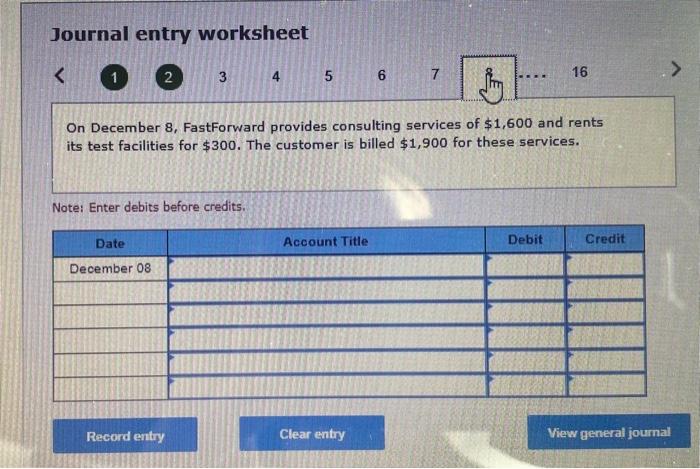

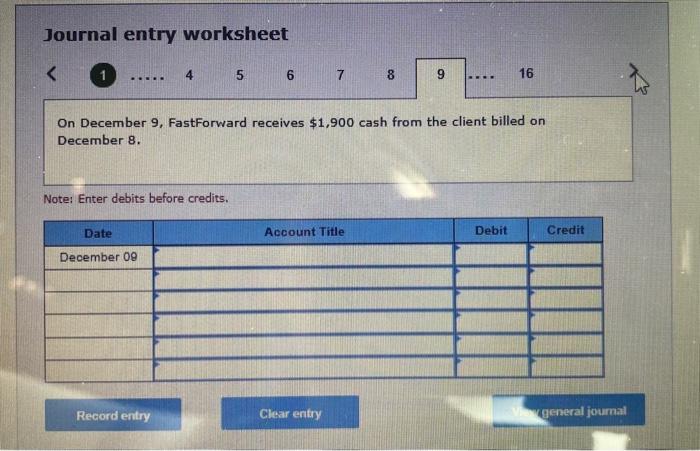

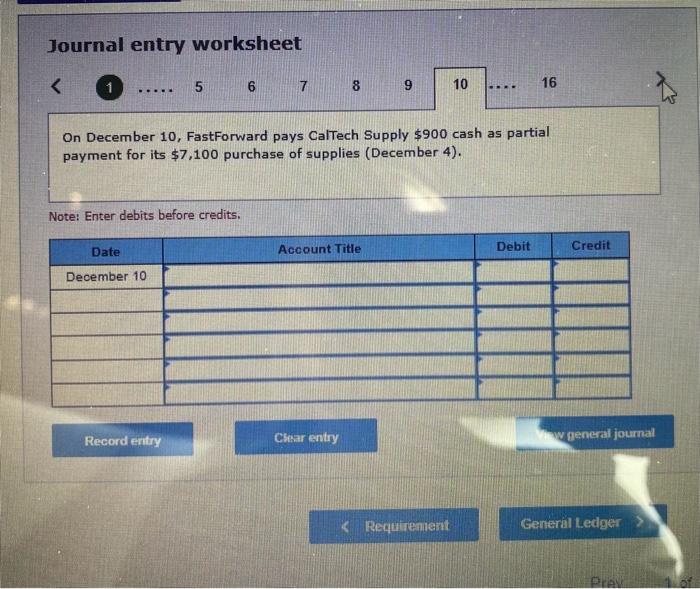

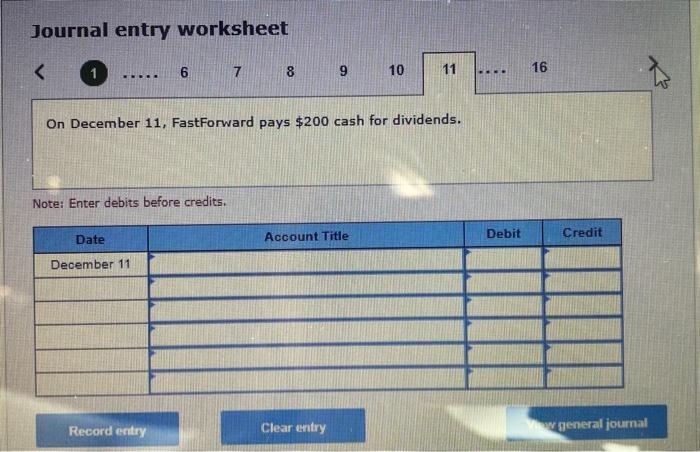

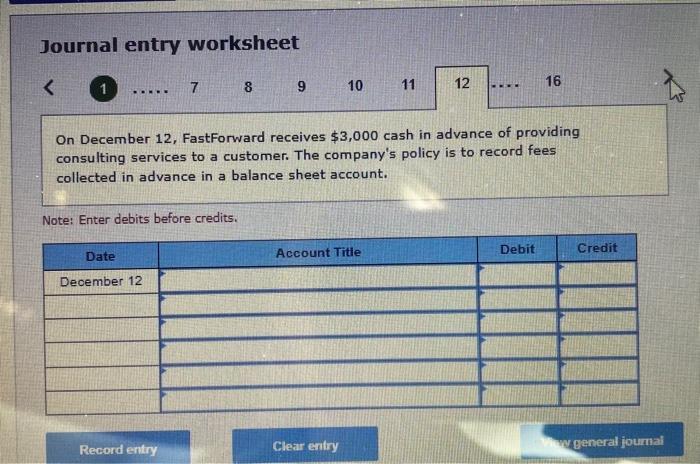

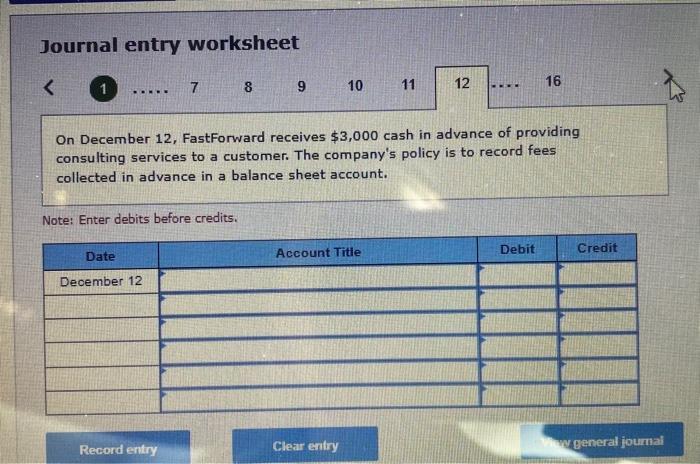

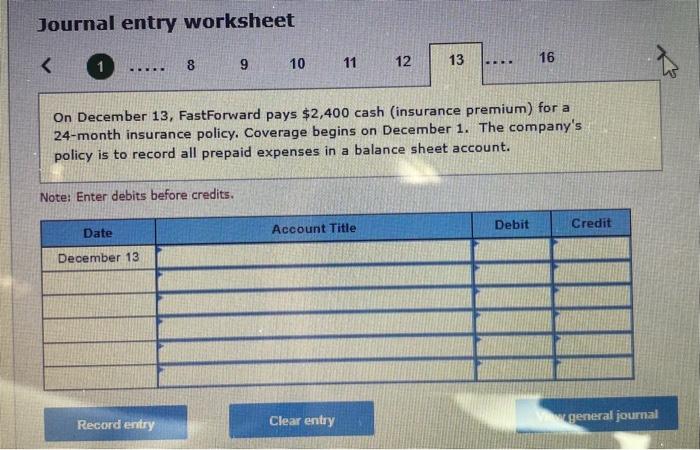

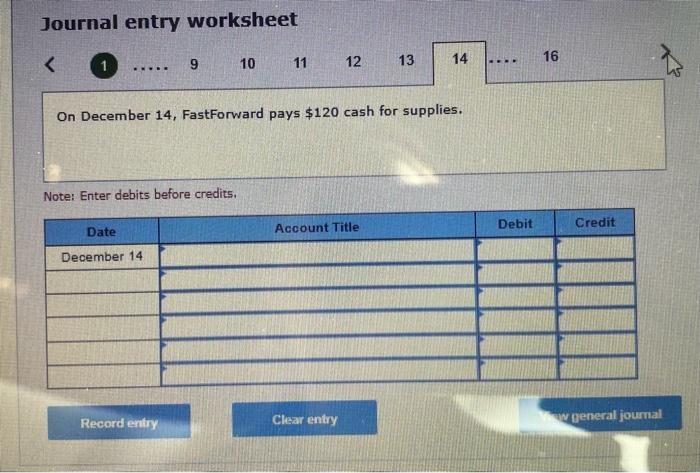

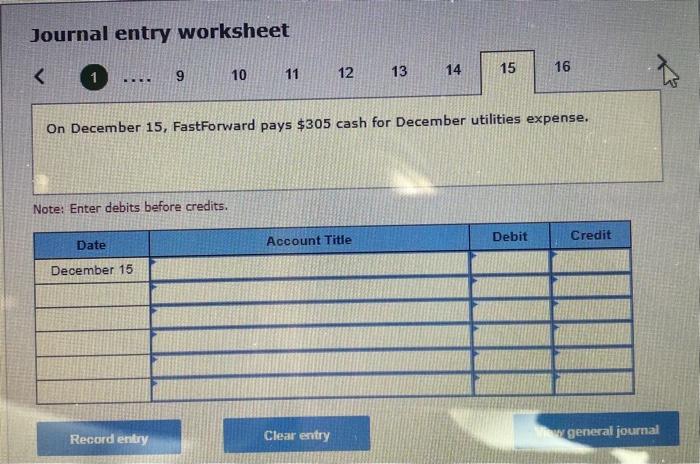

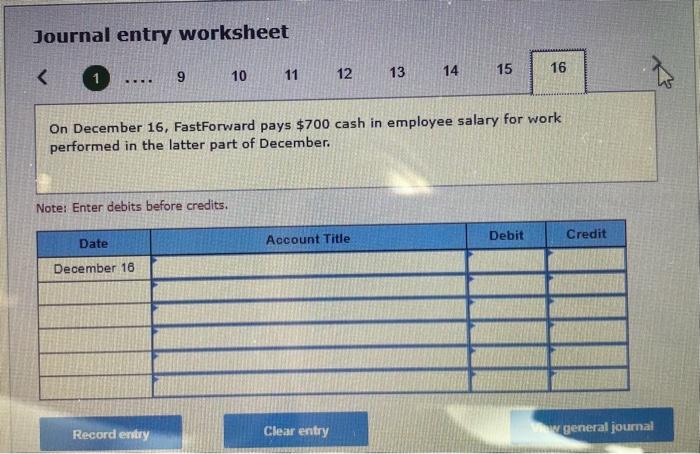

This problem is based on the transactons for the Fostforward Company in your text. Prepare joumal entres for each transacnion and lderify the financlal statement impact of each entry. The financial statements are ausomatically generated based on the journal entres recorded. Decepber 1. On Decenberi. 1. Chas faylor. forts a consulting business, named fattroreard, FastForuard receives sae, eee cash froe Chas Taylor in exchange fier comon atock? Decenber 3 fastforwart pays 525 , ees cash for equapiest. Decenber. 4 FastForward porchasas 37, 1le of supplites on crade fron a scipplier, Galfech fopply, Deceeber, 5 FastForward provides conaulting wervices and inredately collecti 54,200 cash. Decerbar \& Fastioriard pays \$1, bee cash for Decenber rent. Decenber. 7 Fastferward pays s7ed cash fon efployee salary. \$1, 9 eve for these services, Decerber 8 Fastforward receives $1,908 cash from the client billed on Qecerber 8. Decenber 11 fastofrard pays 520 cash for dividends. eorpiry's policy. ix to record all peepaid expenses in a balance aheet account: Deceeber: a4: fast Fruard pays $120 cass for suppliea, Decenter 15 : Fattfarfard gayt. 1 les cash for Decerter wit1itiet expense. deceabar 16. fastlarnars pays shee cash in enployee salacy for work pecforned in the latter part pr decipber; General Journal Tab. For each transaction. prepare the requied jeurnal entry on the General Jeumal tab, Lat debits Eefora credits, General tedgex Tab - Qne of the adyantages of general ledger sof ofrare it that posting ia done automatically. To see the detail of all tre ations that affect a specific account or the balance in an account at a apecific point in time. cievi on athe General Ledger tab. Trial Aalance Tab. Getieral letgeridefwa re Miso automates the preparation of trial balancea. A trial balancie lists tach Journal entry worksheet 4567816 On December 1 , Chas Taylor forms a consulting business, named FastForward. FastForward receives $30,000 cash from Chas. Taylor in exchange for common stock. Note: Enter debits before credits. Journal entry worksheet 67816 On December 2, FastForward pays $2,500 cash for supplies. The company's policy is to record all prepaid expenses in Asset accounts. Note: Enter debits before credits. Journal entry worksheet 4 56 7 8 On December 3 , FastForward pays $26,000 cash for equipment. Note: Enter debits before credits. Journal entry worksheet 1 8 16 On December 4, FastForward purchases $7,100 of supplies on credit from a supplier, CalTech Supply. Note: Enter debits before credits. and the Trial Balance as soon as you click "Record Entry". Journal entry worksheet 1 816 On December 5, FastForward provides consulting services and immediately collects $4,200 cash. Note: Enter debits before credits. Journal entry worksheet On December 6 , FastForward pays $1,000 cash for December rent. Note: Enter debits before credits. Journal entry worksheet 1 On December 7, FastForward pays $700 cash for employee salary. Note: Enter debits before credits. Journal entry worksheet 1 On December 8, FastForward provides consulting services of $1,600 and rents its test facilities for $300. The customer is billed $1,900 for these services. Note: Enter debits before credits. Journal entry worksheet On December 9 , FastForward receives $1,900 cash from the client billed on December 8 . Note: Enter debits before credits. Journal entry worksheet 16 On December 10, FastForward pays CalTech Supply $900 cash as partial payment for its $7,100 purchase of supplies (December 4 ). Note: Enter debits before credits. Journal entry worksheet 1 6. 9 On December 11 , FastForward pays $200 cash for dividends. Note: Enter debits before credits. Journal entry worksheet 16 On December 12, FastForward receives $3,000 cash in advance of providing consulting services to a customer. The company's policy is to record fees collected in advance in a balance sheet account. Note: Enter debits before credits. Journal entry worksheet 16 On December 12, FastForward receives $3,000 cash in advance of providing consulting services to a customer. The company's policy is to record fees collected in advance in a balance sheet account. Note: Enter debits before credits. Journal entry worksheet 1 8 16 On December 13 , FastForward pays $2,400 cash (insurance premium) for a 24-month insurance policy. Coverage begins on December 1 . The company's policy is to record all prepaid expenses in a balance sheet account. Note: Enter debits before credits. Journal entry worksheet 1 12 On December 14 , FastForward pays $120 cash for supplies. Note: Enter debits before credits. Journal entry worksheet On December 15, FastForward pays $305 cash for December utilities expense. Note: Enter debits before credits. Journal entry worksheet 1 14 On December 16 , FastForward pays $700 cash in employee salary for work performed in the latter part of December. Note: Enter debits before credits