Question

This problem provides a simple example of how alternative investments bases affect the calculation of ROI (and therefore, affects performance evaluation). Basic Information: The T

This problem provides a simple example of how alternative investments bases affect the calculation of ROI (and therefore, affects performance evaluation).

Basic Information:

The T Division of A.T. Enterprises has depreciable assets costing $2 million. The cash flows from these assets for 3 years follow: Year Cash Flow 1 $600,000 2 $700,000 3 $600,000

Depreciation of these assets is 10% per year; the assets have no salvage value.

Assumptions:

A.T. calculates Return on Investment as follows:

ROI = NOI / Investment

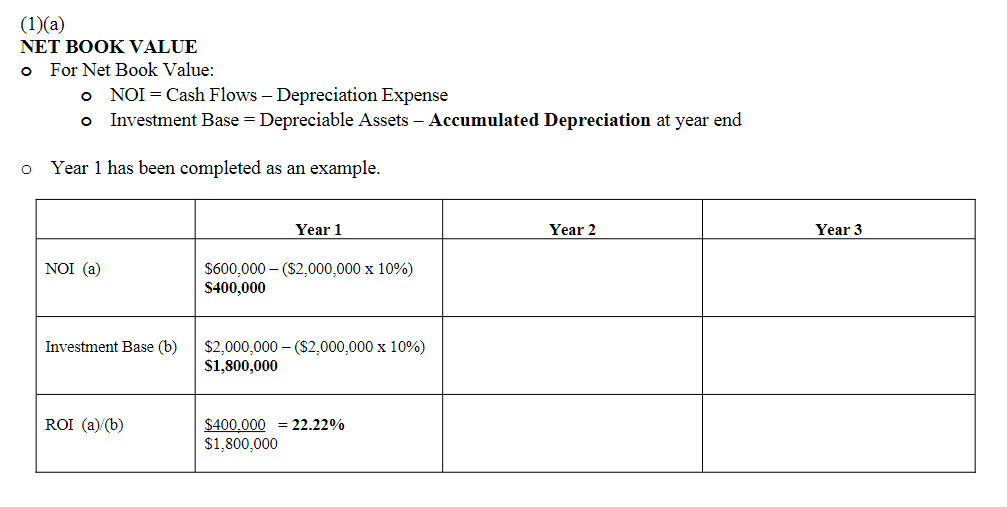

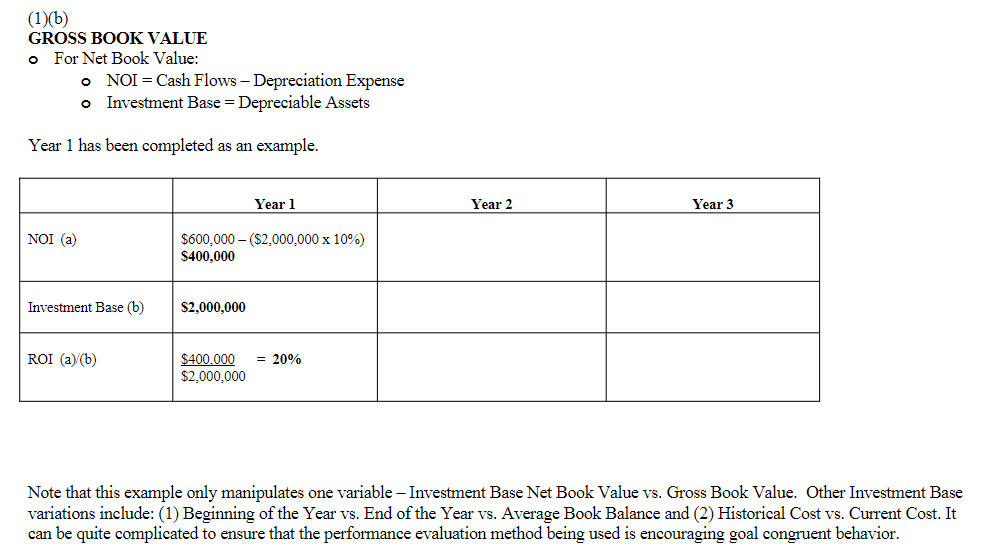

Required: (1) Fill in the tables on the following pages to compute ROI for years 2 and 3 assuming that investment is calculated using: (a) Net book value (b) Gross book value

(2) Visually compare each method separately across the three years. Based on your visual comparison, which method is better for evaluating performance? Why?

(1)(a) NET BOOK VALUE - For Net Book Value: - NOI= Cash Flows - Depreciation Expense - Investment Base = Depreciable Assets - Accumulated Depreciation at year end - Year 1 has been completed as an example. (1)(b) GROSS BOOK VALUE - For Net Book Value: - NOI= Cash Flows - Depreciation Expense - Investment Base = Depreciable Assets Year 1 has been completed as an example. Note that this example only manipulates one variable - Investment Base Net Book Value vs. Gross Book Value. Other Investment Base variations include: (1) Beginning of the Year vs. End of the Year vs. Average Book Balance and (2) Historical Cost vs. Current Cost. It can be quite complicated to ensure that the performance evaluation method being used is encouraging goal congruent behavior

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started