Answered step by step

Verified Expert Solution

Question

1 Approved Answer

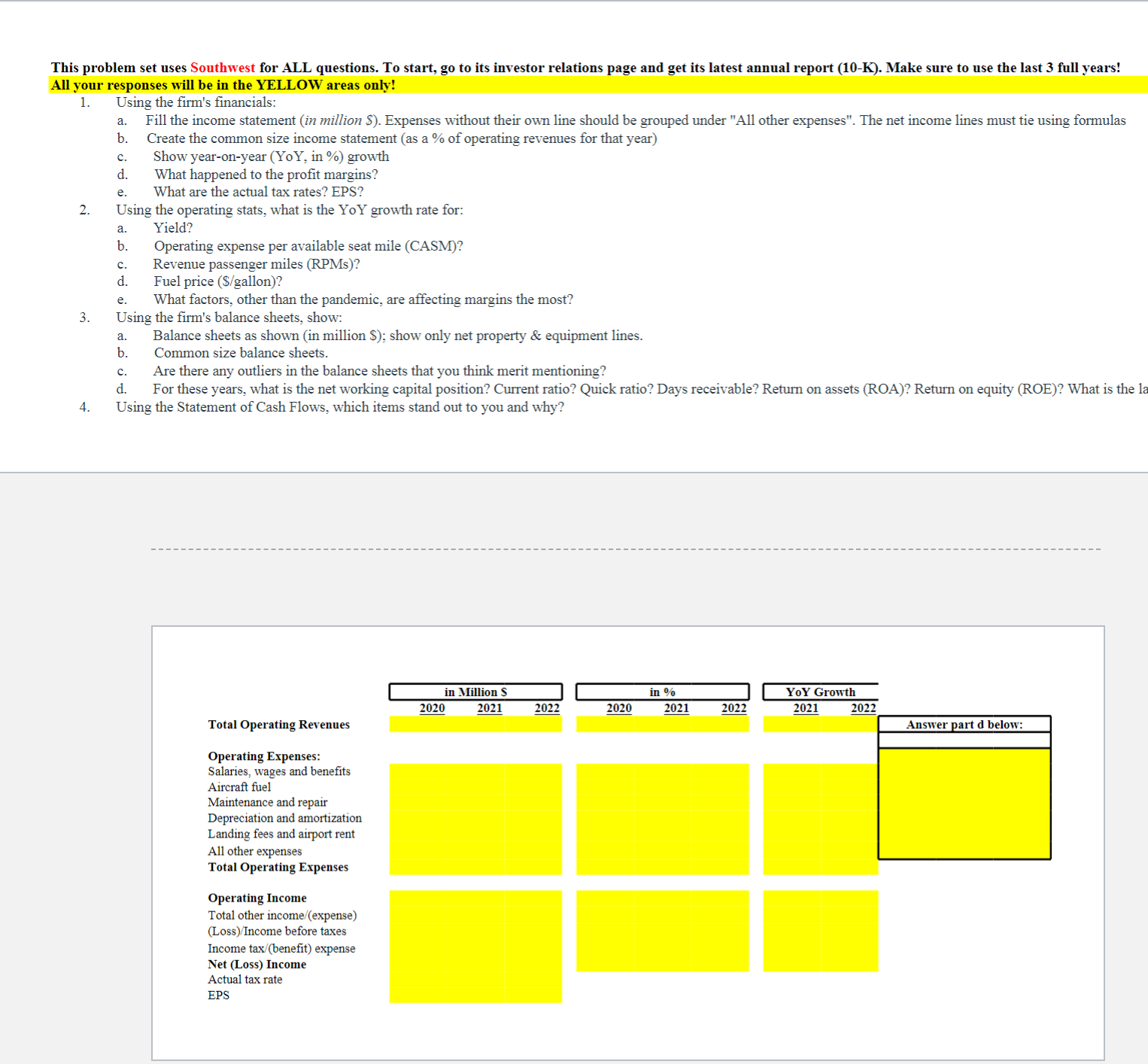

This problem set uses Southwest for ALL questions. To start, go to its investor relations page and get its latest annual report (10-K). Make

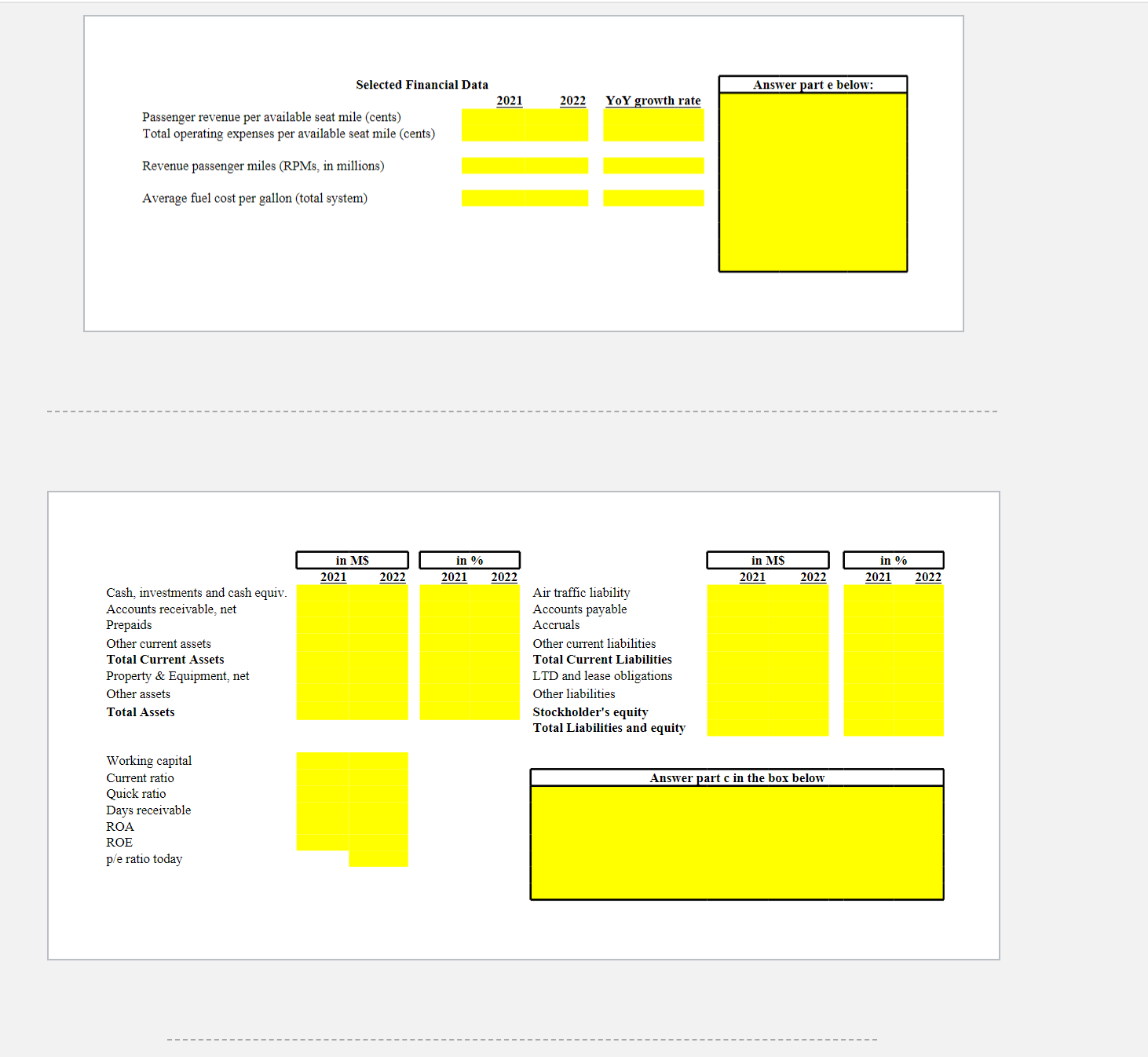

This problem set uses Southwest for ALL questions. To start, go to its investor relations page and get its latest annual report (10-K). Make sure to use the last 3 full years! All your responses will be in the YELLOW areas only! 1. Using the firm's financials: a. b. Fill the income statement (in million $). Expenses without their own line should be grouped under "All other expenses". The net income lines must tie using formulas Create the common size income statement (as a % of operating revenues for that year) c. Show year-on-year (YoY, in %) growth d. What happened to the profit margins? What are the actual tax rates? EPS? 2. 3. 4. e. Using the operating stats, what is the YoY growth rate for: a. b. C. d. e. Yield? Operating expense per available seat mile (CASM)? Revenue passenger miles (RPMs)? Fuel price ($/gallon)? What factors, other than the pandemic, are affecting margins the most? Using the firm's balance sheets, show: a. b. C. d. Balance sheets as shown (in million $); show only net property & equipment lines. Common size balance sheets. Are there any outliers in the balance sheets that you think merit mentioning? For these years, what is the net working capital position? Current ratio? Quick ratio? Days receivable? Return on assets (ROA)? Return on equity (ROE)? What is the la Using the Statement of Cash Flows, which items stand out to you and why? Total Operating Revenues Salaries, wages and benefits Operating Expenses: Aircraft fuel Maintenance and repair Depreciation and amortization Landing fees and airport rent All other expenses Total Operating Expenses Operating Income Total other income/(expense) (Loss) Income before taxes Income tax/(benefit) expense Net (Loss) Income Actual tax rate EPS 2020 in Million S 2021 in % 2022 2020 2021 2022 YoY Growth 2021 2022 Answer part d below: Selected Financial Data Answer part e below: 2021 2022 YoY growth rate Passenger revenue per available seat mile (cents). Total operating expenses per available seat mile (cents) Revenue passenger miles (RPMs, in millions) Average fuel cost per gallon (total system) Cash, investments and cash equiv. Accounts receivable, net Prepaids Other current assets Total Current Assets Property & Equipment, net Other assets Total Assets Working capital Current ratio Quick ratio Days receivable ROA ROE p/e ratio today in MS in % 2021 2022 2021 2022 Air traffic liability Accounts payable Accruals Other current liabilities Total Current Liabilities LTD and lease obligations Other liabilities Stockholder's equity Total Liabilities and equity in MS 2021 2022 Answer part c in the box below in % 2021 2022 Put your text answer in the yellow box.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started