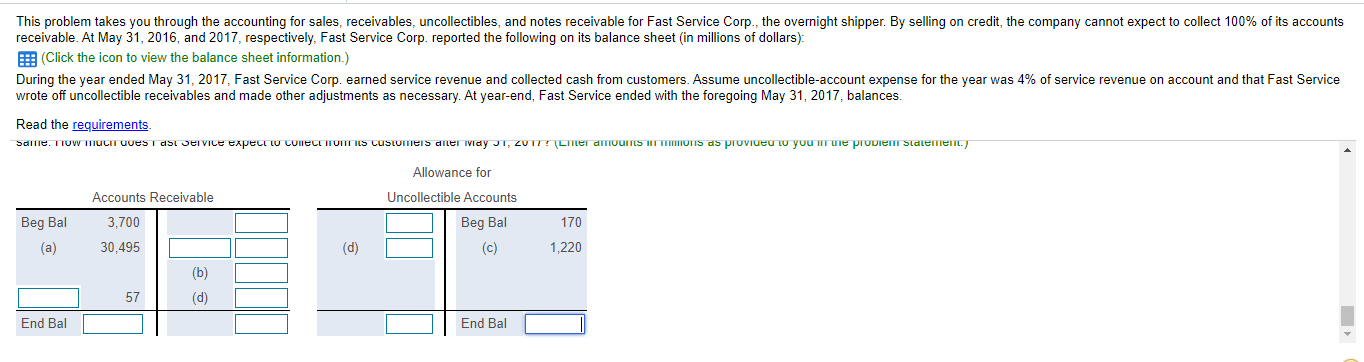

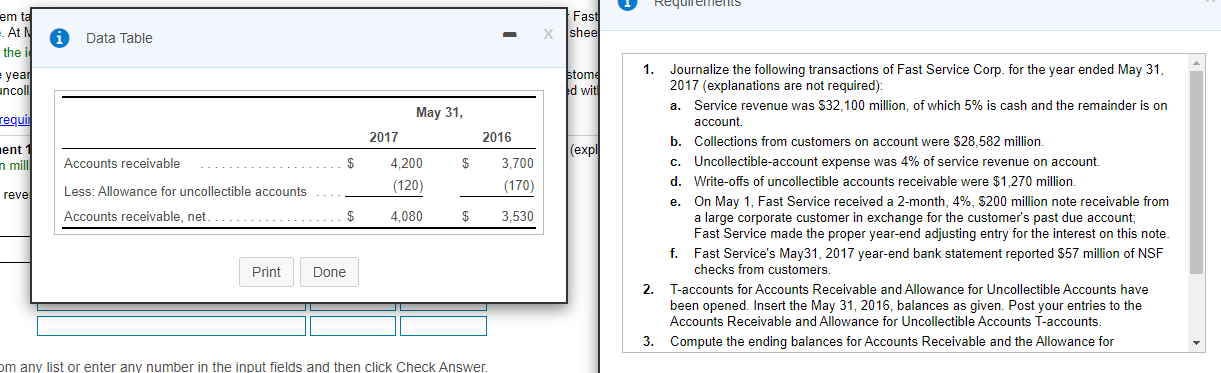

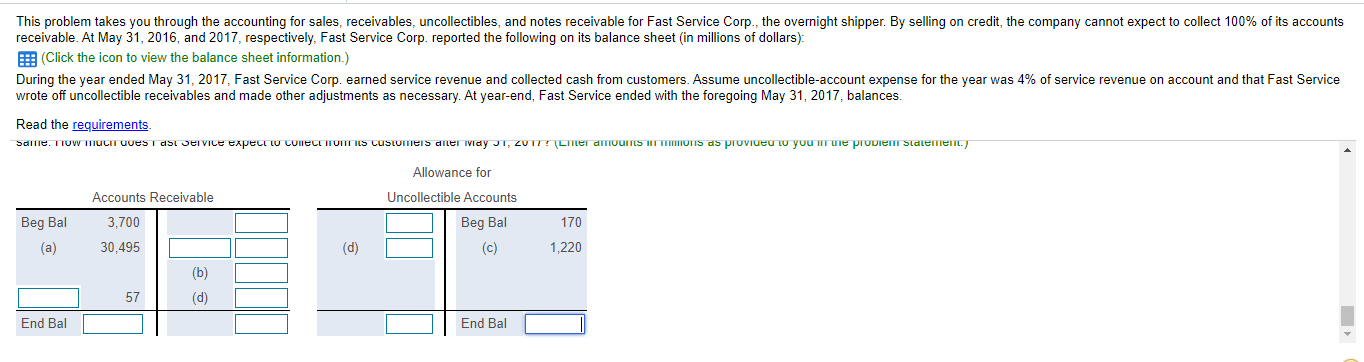

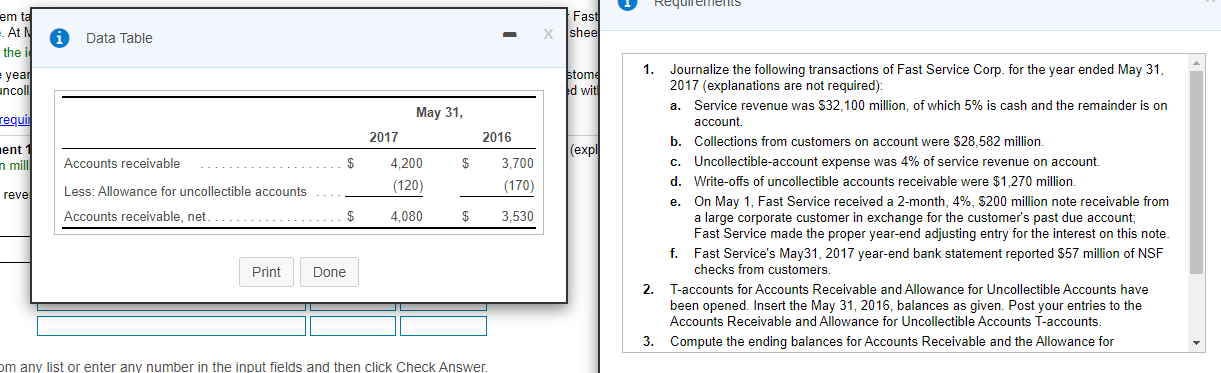

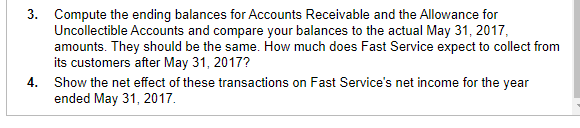

This problem takes you through the accounting for sales, receivables, uncollectibles, and notes receivable for Fast Service Corp., the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its accounts receivable. At May 31, 2016, and 2017, respectively, Fast Service Corp. reported the following on its balance sheet (in millions of dollars): (Click the icon to view the balance sheet information.) During the year ended May 31, 2017, Fast Service Corp. earned service revenue and collected cash from customers. Assume uncollectible-account expense for the year was 4% of service revenue on account and that Fast Service wrote off uncollectible receivables and made other adjustments as necessary. At year-end, Fast Service ended with the foregoing May 31, 2017, balances. Read the requirements. Same. TIU TULIT West asi Dervice expect to CONECI TUTTI ILS Customers allei vay J1, ZUTI? (mel amouTLS III TIMOns as provideu w you we provien Statement.) Allowance for Accounts Receivable Uncollectible Accounts 3,700 170 Beg Bal (a) Beg Bal (c) 30,495 (d) 1,220 (b) 57 (d) End Bal End Bal Requirements Fast em tal At N the i Data Table shee year ancoll stom d wit requit May 31, 2017 2016 (expl nent n mill Accounts receivable $ 4.200 $ 3,700 (170) Less: Allowance for uncollectible accounts (120) reve 1. Journalize the following transactions of Fast Service Corp. for the year ended May 31, 2017 (explanations are not required): a. Service revenue was $32,100 million, of which 5% is cash and the remainder is on account. b. Collections from customers on account were $28,582 million. c. Uncollectible-account expense was 4% of service revenue on account d. Write-offs of uncollectible accounts receivable were $1,270 million. e. On May 1, Fast Service received a 2-month, 4%, $200 million note receivable from a large corporate customer in exchange for the customer's past due account; Fast Service made the proper year-end adjusting entry for the interest on this note. f. Fast Service's May 31, 2017 year-end bank statement reported $57 million of NSF checks from customers. 2. T-accounts for Accounts Receivable and Allowance for Uncollectible Accounts have been opened. Insert the May 31, 2016, balances as given. Post your entries to the Accounts Receivable and Allowance for Uncollectible Accounts T-accounts. 3. Compute the ending balances for Accounts Receivable and the Allowance for Accounts receivable, net $ 4,080 $ 3,530 Print Done om any list or enter any number in the input fields and then click Check Answer. 3. Compute the ending balances for Accounts Receivable and the Allowance for Uncollectible Accounts and compare your balances to the actual May 31, 2017, amounts. They should be the same. How much does Fast Service expect to collect from its customers after May 31, 2017? 4. Show the net effect of these transactions on Fast Service's net income for the year ended May 31, 2017